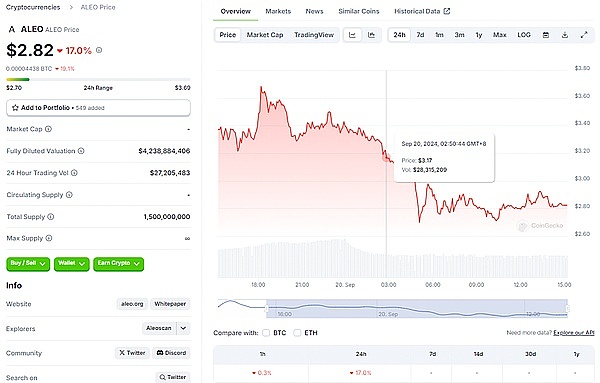

Aleo, a project once regarded as a rising star in the blockchain privacy computing track, is experiencing a rapid decline from its peak to obscurity. Whether it is the top financing background, the star team, or the high-profile technological innovation, none of them has prevented the sharp drop in the price of Aleo currency, which seems to be another signal of "the hottest must die".

So how did Aleo, which has many favorable factors such as solid academics, strong financing background, and support from miners, "ruin" itself?

01 Over-hype: The bubble burst behind the highlight moment

The Aleo project has its own halo since its debut. It is a future star with technologies such as zero-knowledge proof (ZKP) and privacy computing. With the halo of big-name VCs such as Andreessen Horowitz (a16z) and SoftBank Vision Fund, Aleo was once touted as the "savior" of blockchain. The overwhelming publicity in the market, the enthusiastic discussions on social media, and the background of the technical team from big companies such as Google and Amazon have all pushed Aleo to the altar.

Aleo's founding team has a strong background, and its main members include top experts in cryptography such as Howard Wu, Collin Chin and Raymond Chu. Howard Wu is the co-founder and CEO of Aleo. He graduated from the University of California, Berkeley, worked at Google, and made outstanding contributions in the fields of zero-knowledge proof and elliptic curve cryptography. His academic achievements Zexe and DIZK are adopted by top projects such as Ethereum and Zcash. Collin Chin is responsible for the development of Aleo's core programming language Leo and is a young cryptography genius. Raymond Chu has made great contributions to the development of snarkVM and snarkOS.

With the above advantages, Aleo has been highly expected by the market since its inception and is considered to be an important infrastructure for future privacy computing and decentralized applications. However, this strong team background has become a double-edged sword under the rendering of the market. Investors from all walks of life have flocked to Aleo, constantly pushing its valuation to new heights, but behind this high valuation is a huge bubble risk.

During the financing process, the project was valued at hundreds of millions of dollars, especially under the halo of large institutions such as a16z and SoftBank, which attracted a lot of speculative funds and investors chasing the rise, and also caused the project to be over-promoted. The frenzy of market speculation made Aleo lose itself, and all resources and backgrounds eventually became a burden under the high valuation, unable to provide long-term support for the currency price.

When the bubble burst, the market realized that these halos could not cover up the fact that the project itself was progressing slowly.

02 Lack of substantial progress: the technical gap that cannot be filled by financing

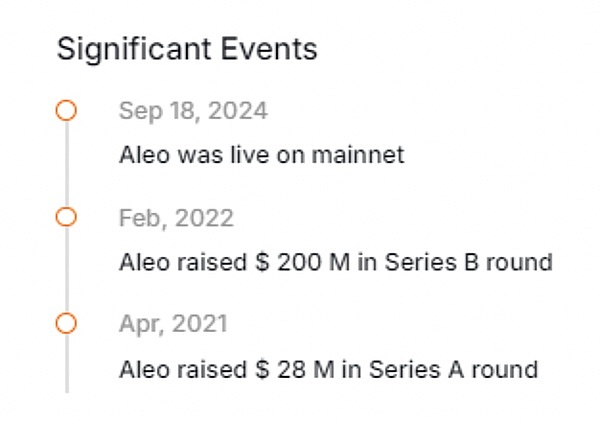

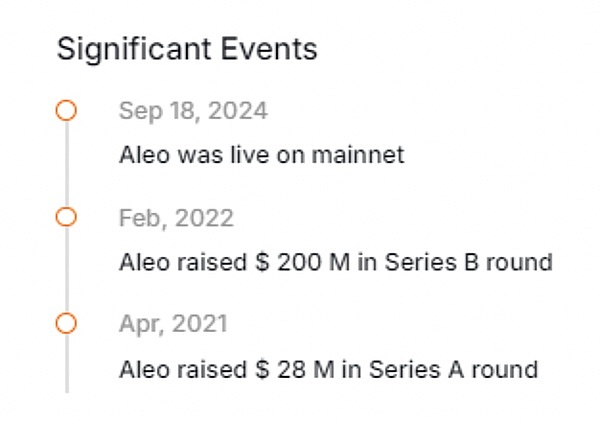

Speaking of Aleo's financing, it can be said to be infinitely glorious.

According to rootdata query, Aleo has completed a total of 298 million US dollars in financing, with a16z leading the A round, and Softbank and Kora leading the B and B+ rounds. It stands to reason that with such a strong financing background and financial support, Aleo should quickly achieve some substantial results to support its market value. However, this is not the case.

Although Aleo has launched a series of technical tools such as the Leo programming language, snarkVM, and snarkOS, the market has not seen the expected commercial application landing, and the ecological construction has also remained on the surface. Shouting the banner of privacy protection, the actual application has been slow to come into being, but Bitcoin and Ethereum have gradually completed the optimization of privacy functions in practice.

This lack of substantial progress is in stark contrast to the big promises made by the Aleo project, and investors are gradually losing patience while waiting. Look at the previous Bored Ape Otherside project, which was hyped up at the time, but what was the result? Two years have passed, and there has been no progress, and the price of the coin has fallen to a point where it is unbearable to look at. Aleo is also repeating the same mistake, and the gorgeous shell cannot cover up the lack of substantial progress.

03 Highly speculative: manipulation risk that cannot be covered up by the halo of stardom

The Aleo market is full of speculators who only want short-term arbitrage and do not care about the long-term development of the project itself. When Aleo was pushed to the altar under the halo of top VCs, these speculative funds swarmed in and pushed the price of the currency higher and higher. However, this highly speculative market environment is destined to make the price of Aleo extremely fragile.

Once the market sentiment changes, these speculators withdraw faster than anyone else, and the price of Aleo collapses instantly. Highly speculative projects cannot withstand market fluctuations at all. The continuous decline in the price of the currency has also defeated the confidence of investors.

In particular, the depth of Aleo's market is extremely poor, and any large order of the sell side can break through the support. Under such circumstances, who would have the confidence to hold for a long time? Look at those MEME coin imitations and dog projects, how many of them did not rise and fall overnight? Aleo does not have a solid market foundation and user stickiness, which will only allow speculators to use it to "cut leeks".

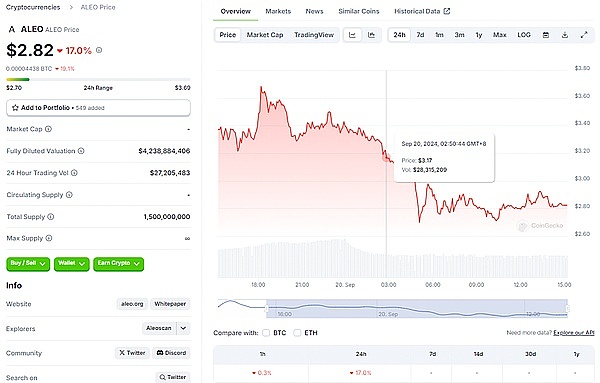

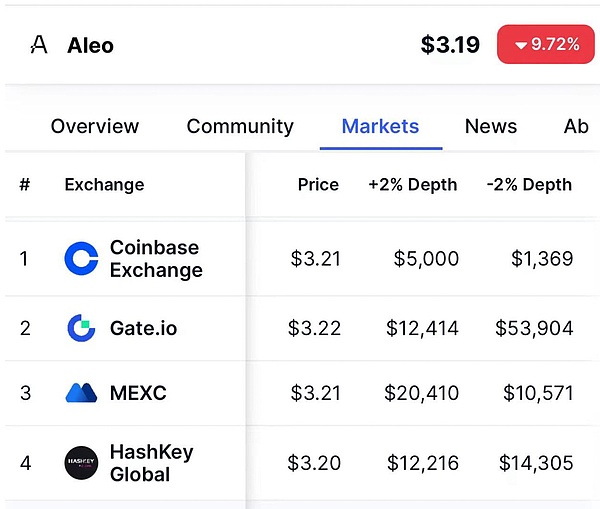

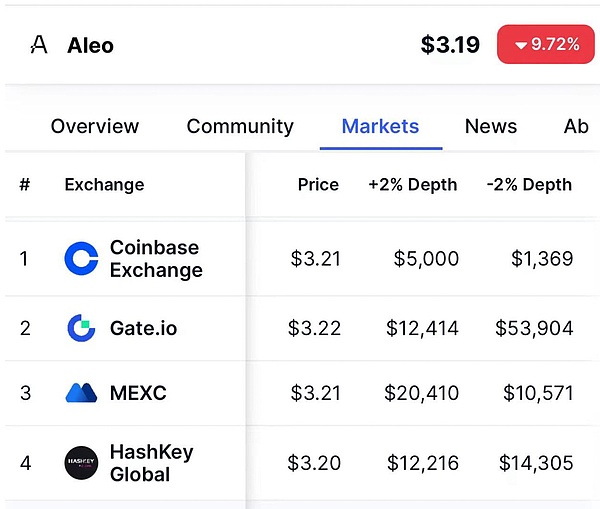

04 High price volatility: poor liquidity allows big players to play freely

From Aleo's market depth data, the buy and sell depth of major exchanges is very weak. Coinbase's +2% buy depth is only $5,000, and the sell depth is only $1,369. The same is true for Gate.io. The buy order cannot support the selling pressure of the sell order. With such low liquidity, the price volatility is naturally very high. Once a large buy and sell order enters the market, the price is like a roller coaster.

This kind of market with insufficient liquidity is a hotbed for manipulation by big investors. Aleon's market depth allows big investors to "play with it at their fingertips". A slight increase or drop in the market can induce retail investors to follow suit, push up the price of the currency in a short period of time, and then quickly sell it, leaving a mess. Such volatility not only excites speculators, but also discourages users who really want to invest, and ultimately further deteriorates the market environment.

05 Bandwagon effect and blind investment: the nightmare of high-level buyers

Aleon attracted a large number of followers in its heyday. These people only saw Aleo's popularity and top financing background, but ignored the actual implementation of the project itself.

When the price of the currency was soaring, these followers rushed to buy, fearing that they would miss the next "hundred-fold currency". But when the price of the currency began to fall, they became the "leeks" to be harvested.

After being trapped at high positions, investors who did not study and blindly followed the trend could only watch the price of the currency fall all the way without any chance to escape. In a market with insufficient liquidity and poor market depth, investors who took over at high positions became the last "takers" in the relay game. This phenomenon of passing the flower by beating the drum will eventually lead to a more serious stampede effect and a complete collapse of market confidence.

Written to the end

Aleo has gone from being a star blockchain project to the current plunge in currency prices. The four words "hot must die" perfectly interpret its ending.

Over-hype, lack of substantial progress, high speculation, poor liquidity, blindly following the trend... all these problems are dragging down Aleo.

The dark side behind the highlight must eventually face reality. The currency circle has never lacked "unicorns", but what is lacking is solid implementation and long-term accumulation. Aleo's failure once again sounded the alarm for the market. Investors should keep their eyes open and not be blinded by the "heat".

After the heat, there is often death. This is the tragedy of Aleo.

JinseFinance

JinseFinance