Author: Mu Mu, Plain Language Blockchain

Recently, the crypto market has been unpredictable. Many people have begun to think that this is a strange bull market, and no one can make money. Many people even complain that this is the most difficult Bitcoin bull market in history to make money! So people who have always believed that "when the market is good, everything looks like the future, and when the market is bad, all projects look like crooked melons and cracked dates" have begun to doubt their lives and the value of the entire crypto industry, and think that the bull market is about to end...

01 It is difficult to make money in a bull market

Although this round of bull market is strange, after so many rounds of bull market, it should be nothing new. This is mentioned in the previous article "The logic of the Bitcoin bull market has quietly changed, and many people still can't make money? 》There has been a comparative analysis. In fact, it is not that this round of bull market is not profitable, but it is not easy to make money in every bull market. You should know that most of the people who made money in the past few rounds did not get on the train in the bull market. Those who smelled the "money-making" opportunity in the bull market will only know later that others made money from the money they provided.

In essence, those who can survive the bull and bear markets unscathed are the real winners. In the years of ups and downs in the Bitcoin and crypto markets, many famous gold diggers have come, including SBF, a genius trader on Wall Street, Do Kwon, known as the "Korean Musk", and others, who have all failed in the crypto market. The lessons learned from them are very simple. In addition to being eager for quick success and not fearing risks, the most important point is the error of "crypto values".

For a long time, many traders, including SBF, who claim to be "smart people", entered the crypto market. Perhaps they did not recognize the value of Bitcoin and crypto assets, but thought that there were "many fools who took over" here. The idea of buying "air" Bitcoin at a low price and reselling it to fools was very popular in this market. But what they could not imagine was that in this highly free market, they could never escape the fate of "big fish eating small fish". In any industry, anyone who does not pursue the correct values of the industry, does not recognize the value of the industry, and enters with the mentality of "cutting leeks" is destined to fail in this career. Even if they taste the sweetness at the beginning, they will soon be eaten back by the market.

Perhaps many people have forgotten what the original intention of Bitcoin and the crypto industry is, and the final result of distorted values may be serious misjudgment.

02 What's wrong with the value project?

In this round of bull market, the obvious feature is that many VCs' "value projects" and old crypto value projects that have been under construction in the crypto market before, including Ethereum, Layer2, Metaverse, DeFi, etc., which many people thought would soar in the bull market, do not seem to have been recognized by the market. Instead, people seem to be more willing to participate in inscriptions and Memes. This has to make people reflect on what went wrong with the "crypto value projects" that have been built for so many years?

In fact, it is not the market's fault for "not taking over" value projects, but the "value projects" really have problems! Recently, we have observed that the Ethereum GAS price has even dropped to 1. Some Layer2, Metaverse, DeFI projects with few daily active users, and newly listed VC projects have not yet started, but their market capitalizations are as high as hundreds of millions or billions. With such poor data and such a high market capitalization, people feel that there is an extremely overvalued bubble. Of course, no one would be willing to take over stupidly. It is better to directly rush to the Meme with a low market value and reject all kinds of PUA.

For a long time, many people have paid too much attention to the surface and ignored the underlying reasons. In fact, it is not that valuable projects have no value. The valuation of many valuable projects is not only measured by active users, because it carries billions and hundreds of billions of TVL, and these funds cannot be ignored.

Of course, the most important point is that the "wool-pulling" movement that has been popular in recent years has not only spawned a large number of fake users, but also made it difficult for new VC projects to be valued and difficult to calm down and do things, and then developed into a problem for the entire Web3 industry. A large amount of fake traffic and users have kidnapped these projects to some extent. There are even some organizations that use the bad market atmosphere for profit to make high-level customization: to deceive VCs to take over, create a superficial star team, and customize "value projects" for "wool-pulling" people. No one cares about technology, no one cares whether it solves real needs and problems. It is conceivable that such VC projects with deformed value orientation will be harvested as soon as they land and end in a dismal way.

So, people found that impurities were mixed into the new and old "value projects". A bad apple can spoil the whole pot of porridge, not to mention that this is a common phenomenon... Therefore, since it is unclear whether there is value, then not accepting it becomes the best strategy.

Of course, even so, we cannot completely deny most of the projects that maintain the original intention of encryption value. Bitcoin brings asset transparency and self-custody to realize the sanctity and inviolability of personal property. Ethereum, including Layer2 and other smart contract platforms, brings a "trusted" operating environment for Internet applications, pushing the Internet from online to onchain...After baptism, I believe they can still stand firm in the continuous self-correction of "purifying the source" in the encryption market.

03 The logic of the bull market has changed and it has not changed. For a long time, most cottages are just the undertakers of the overflow of value after Bitcoin surges. When the price of Bitcoin enters the high range, it is difficult to rush up. People find that many new narratives and small cottages with low market value seem to be "value depressions". Therefore, driven by FOMO emotions, some funds choose to rush to these surrounding cottage coins "small reservoirs". Because the pool is small, only a small amount of funds is needed to obtain several times or dozens of times of increase, so people slowly realize the logic of this bull market. However, this year, in addition to new and old cottages of various concepts, Meme projects are in full bloom. The market has found that the value of FOMO emotions can also be collected by containers. Since FOMO emotions can be directly loaded into Meme, why waste energy on those "cottage traps" that are full of various "rat shit" and prepared for retail investors everywhere? Therefore, Meme directly intercepted the funds that should have flowed to the cottage. The logic of the bull market has changed, but it has not changed. It's just that there is another circle of Meme pools next to the cottage pool to take over the overflow of Bitcoin. 04 Has the bull market gone? Most people may have lost their way

Many people are entangled and conflicted about whether the bull market is over and whether there are still fake bulls. But what I want to say is that since we already know that for most people, "a bull market does not necessarily mean making money, and a bear market does not necessarily mean losing money", why should we care so much about whether the bull market is over?

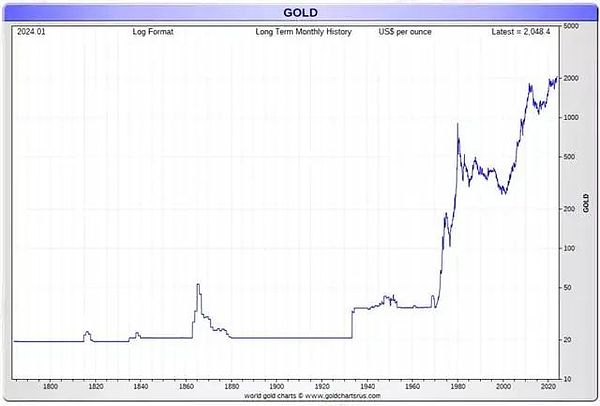

Learning from history, let's take a look at the trend chart of gold in the past 100 years. You will find that Bitcoin, the digital gold, has many similarities with gold in addition to some similar properties.

1) If the timeline is extended, the early price trend has almost become a straight line regardless of bull or bear markets.

2) Prices fluctuate in cycles and always maintain a long-term spiral upward channel.

It is simple to draw a conclusion with a high probability that Bitcoin, like gold, will always be the best long-term strategy on dips over the next 100 years.

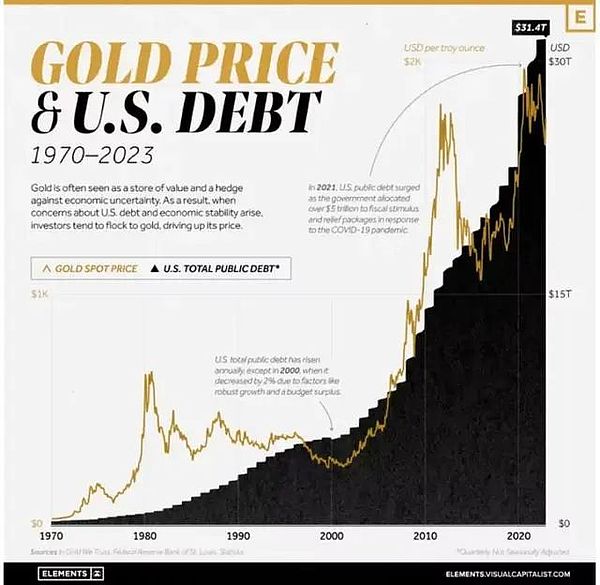

Gold is positively correlated with the size of U.S. Treasury bonds

Gold is positively correlated with the size of U.S. Treasury bonds

With the United States as a representative, the world has long entered the path of printing money to create huge debts, and the only way to resolve the ever-increasing debts is to start the printing press...

05 Summary

Recently, factors such as Mentougou debt liquidation and government selling have brought huge negative impacts to the market, but the good side is that these "Damos swords" hanging in the crypto market have also disappeared. If we extend the timeline, the "bull" will always be there, so there is no need to worry at all, just quietly hold the original intention of encryption and patiently welcome the new era.

cryptopotato

cryptopotato

cryptopotato

cryptopotato cryptopotato

cryptopotato Beincrypto

Beincrypto Coinlive

Coinlive  Catherine

Catherine Coindesk

Coindesk Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph