Author: Climber, Golden Finance

On August 5, the global financial market suffered a "Black Monday", and the crypto market fell as much as "312". The recently approved Ethereum ETF also failed to reduce the damage to ETH. Instead, it fell to as low as $2,100 under the influence of continuous selling by market maker Jump Crypto. Many communities and analysts even regarded this behavior as one of the reasons for the plunge in the entire crypto market.

In fact, Jump Crypto's selling behavior has already occurred, and it is almost "clearing out". On-chain data shows that the cumulative value of ETH sold in the past 10 days has exceeded US$300 million. The ETH collection behavior includes unstaking ETH from Lido and transferring it from other wallets many times. At present, the proportion of its marked positions in stablecoins has exceeded 96%.

There are various speculations about Jump Crypto's selling behavior. Some suspect that it is a liquidation caused by the CFTC investigation, and some believe that the company converted assets into stablecoins to cope with economic risks. Given Jump Trading's tradition of high confidentiality, after combing through past data, the author is more inclined to infer that Jump Trading cut off the Jump Crypto department in advance to prevent involvement in the Terra case's $4.47 billion settlement dispute.

Jump Crypto's "clearance-style" sell-off has led to speculation from all sides

The earliest abnormal transfer record of the on-chain wallet address marked as Jump Trading occurred on July 17, when a certain address starting with 0x401c transferred 9,998 ETH to the Jump Trading address, worth approximately $34.4 million.

After comparing its token balance history on Arkham Intelligence, it was found that the company had been selling its Ethereum holdings since July 19, not just last weekend.

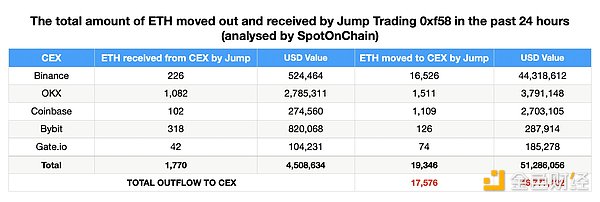

Spot On Chain data also shows that from July 25 to August 5, the wallet marked as Jump Crypto recharged a total of US$279 million worth of ETH to the CEX exchange.

According to public information, Jump Trading has previously released a large number of ETH pledges from Lido and transferred them in batches from other addresses.

On-chain analyst Yu Jin monitored that Jump Trading redeemed 83,000 wstETH for 97,500 ETH from July 25 to August 4, of which 66,000 ETH flowed into the exchange.

As of writing, there are still 37,600 wstETH in its wstETH storage address that have not been transferred out. 11,500 stETH in the redemption ETH address are being redeemed into ETH; 20,000 ETH in the ETH transfer to the exchange address are also entering the exchange in batches.

In addition, it has deposited nearly $300 million worth of ETH in different centralized exchanges, including top participants such as OKX, Binance, Coinbase and Gate.io.

Currently, Jump Trading's stablecoin positions account for more than 96%, with a total value of $324 million. Tracking agency data also shows that Jump Trading has been cashing out for days. Since Jump Trading began selling ETH on July 24, it has withdrawn 617.8 million USDC from Binance and deposited 558.2 million USDC into Coinbase. USDC deposited in Coinbase may be exchanged for US dollars at a ratio of 1:1.

There are different speculations about Jump Trading's selling and cashing out.

The CEO of crypto investment company Cake Group said that the massive sell-off in the crypto market in recent days may be due to Jump Trading, either because the traditional market was called for margin and needed liquidity, or because of regulatory reasons to withdraw from the cryptocurrency business.

Steno Research senior crypto analyst Mads Eberhardt believes that Jump Trading has been borrowing Japanese yen to fund its high-frequency trading business, perhaps to have sufficient liquidity or acquire crypto assets due to the surge in the yen-dollar exchange rate. The cost of repaying loans denominated in US dollars has increased significantly, and their potential collateral may have also been hit. Jump Trading may have received a margin call for loans.

It is worth mentioning that Arthur Hayes, co-founder of BitMEX, spoke out at this time. He said that he learned through news channels in the traditional financial field that a "big guy" fell and sold all crypto assets, and this "big guy" was speculated by the community to be Jump Crypto.

The $4.47 billion settlement in the Terra case may become the biggest burden

Jump Trading is a Chicago-based financial company known for high-frequency trading. It later established Jump Crypto to focus on cryptocurrency business. However, Jump made huge profits through secret transactions in its attempt to restore the fixed exchange rate of TerraUSD (UST), but ultimately failed to avoid the collapse of UST, which caused global investors to lose about $40 billion. Similarly, this incident also put Jump Trading in a reputation crisis.

As the Terra case progressed, the SEC began to investigate whether the president of Jump Crypto signed a secret agreement with Do Kwon during the collapse of UST, that is, Jump Crypto was accused of manipulating the price of the stablecoin TerraUSD to make a profit of $1.28 billion. At that time, Kanav Kariya refused to answer this question.

Although in April and June of this year, Jump Crypto was not found to have any evidence of wrongdoing under the investigation of the SEC and the U.S. Commodity Futures Trading Commission (CFTC), nor was it accused of any wrongdoing. However, Jump Crypto President Kanav Kariya quickly announced his resignation, ending his six-year career at Jump Trading.

Whether Jump Trading and Terraform Labs have other illegal secrets is unknown, but Jump Trading's whistleblower helped the US SEC file a case against Do Kwon, and the Montenegrin court recently ruled that Do Kwon would be extradited back to South Korea.

At the end of May this year, Terraform Labs and Do Kwon agreed to settle the securities fraud case for $4.47 billion.

Previously, FTX and the CFTC reached a $12.7 billion settlement agreement, and the settlement agreement between Binance and the CFTC included CZ paying $150 million to the CFTC and Binance paying $2.7 billion to the CFTC. But it is clear that the current Terraform Labs and Do Kwon have difficulty paying the fine.

After the settlement agreement was reached, Terraform Labs CEO Chris Amani announced that the company plans to dissolve its business and ask the community to take charge of the business. In addition, the company is also considering selling its four businesses.

In view of this, we cannot rule out the possibility that the SEC will continue to hold other responsible persons for the Terra thunderstorm case accountable, and Terraform Labs and Do Kwon may not reveal more insider information about Jump Crypto in order to reduce their guilt, and Jump Trading has also reported the former.

In addition, the chairman of the CFTC also publicly stated in May this year that cryptocurrencies are facing an inevitable wave of enforcement actions, and there will be a "enforcement action cycle" in the next six months to two years.

Combined with previous speculations from all parties, perhaps the "big guy" Jump Crypto is really going to fall.

On the other hand, Jump Trading originally had a wide range of businesses and attached great importance to confidentiality. The Jump Crypto encryption department is only one of them. Losing the car early to save the driver can also stop the loss early and avoid greater reputation and financial losses.

According to the Chapter 7 liquidation case regulations of the U.S. Bankruptcy Code, after a company applies for Chapter 7 bankruptcy, the court appoints a bankruptcy administrator (trustee) in the liquidation case. All states in the United States allow debtors to retain their necessary property (i.e., exempt property). The bankruptcy administrator will collect the debtor's non-exempt property, sell it and distribute the proceeds to creditors. At the end of the Chapter 7 case, both exempt and outstanding debts will be wiped out.

Conclusion

Jump Crypto chose the most unreasonable period to sell off a large amount of ETH. The approval of the US Ethereum ETF, bull market expectations, interest rate cuts, and the downward trend of the crypto market all indicate that it is not suitable to liquidate at this time. For a business unit backed by Jump Trading, such a large-scale sell-off is most likely to be a "survival dilemma." If it is only for arbitrage, it is obviously not in line with the investment strategy it has always advocated.

The settlement of up to $4.47 billion is obviously unrealistic for Terraform Labs and Do Kwon at this time. With the help of various factors, US regulatory authorities such as the SEC and CFTC need to find the "second responsible person." If more guilt of Jump Crypto is really involved in the follow-up, it will undoubtedly be more troublesome for Jump Trading.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance YouQuan

YouQuan Davin

Davin TheBlock

TheBlock Coinlive

Coinlive  Others

Others Coindesk

Coindesk Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist