Source: Kucoin; Compiled by: Deng Tong, Golden Finance

In May 2024, the cryptocurrency market was active and significant progress was made, especially in the regulatory field and market dynamics. The approval of a spot Ethereum ETF significantly boosted market sentiment, setting a positive tone for the month, before the BTC ETF’s AUM rebounded to $60 billion. The stablecoin space has also been mixed, with issuance of traditional fiat-collateralized stablecoins such as USDC and FDUSD declining, while USDe issuance hitting new highs. This pattern reflects the broader evolution of the stablecoin market. Additionally, while public chain and Layer 2 solutions such as Base and Linea have seen significant inflows, overall investment in the crypto market has declined slightly from the previous month, but has maintained a positive growth trajectory year-over-year, highlighting the enduring interest and interest in the space. Growth potential.

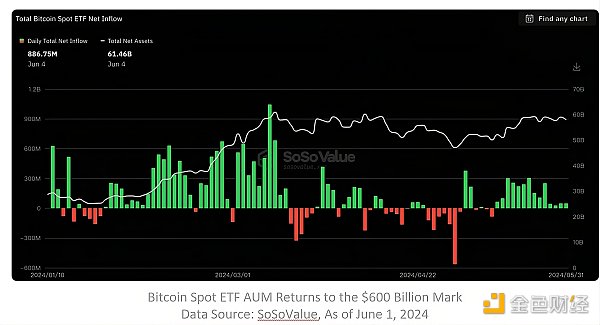

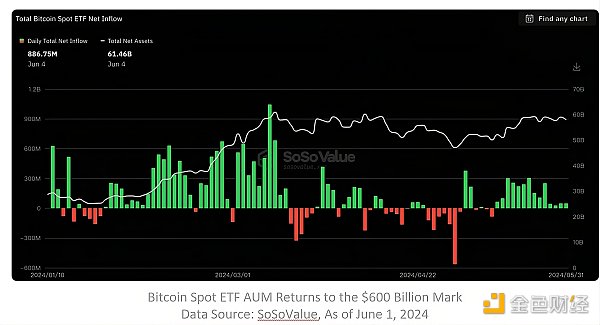

With the approval of the Ethereum spot ETF, market sentiment rebounded, and the asset management scale of the BTC ETF rebounded to US$60 billion

In mid-May 2024, global economic data and events reignited optimism about potential U.S. monetary policy. This newfound confidence, coupled with NVIDIA's strong earnings report, has boosted interest in technology stocks and the artificial intelligence sector. The broader cryptocurrency market also rebounded, driven in large part by the unexpected approval of a key Ethereum spot ETF filing. While the ETF has yet to see capital inflows, the news has had a positive impact on market sentiment, boosting confidence in Ethereum and its ecosystem.

Markets that have been sluggish have experienced a clear shift in sentiment. Total assets under management (AUM) of Bitcoin spot ETFs rebounded to the $60 billion mark, reflecting renewed investor interest. Additionally, BTC contract open interest surged, returning to highs seen earlier this year, while BTC options open interest rose cautiously. Looking ahead, June will be an eventful month. The Federal Reserve is about to hold a Federal Open Market Committee meeting and may adjust its securities holding strategy, which will have a negative impact on the market. Liquidity has an impact.

Cryptocurrency Trends: Attention Assets Surge

Cryptocurrency Markets Increasingly Favor Characters and Celebrities Attention assets such as meme tokens because they have untapped growth potential. This trend reflects a shift away from projects with excessive initial valuations that limit price discovery and wealth creation. Notcoin is a prime example of this shift, resulting in a significant increase in its price and trading volume.

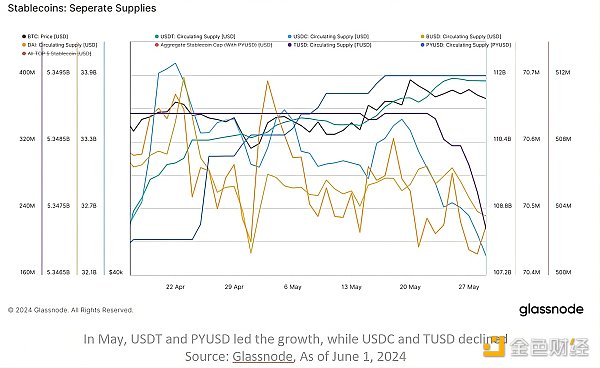

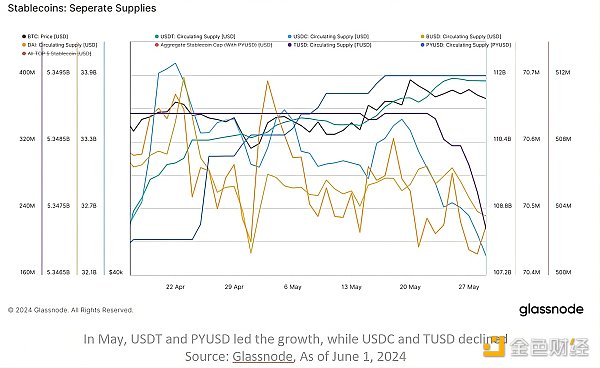

The issuance of fiat currency-backed stablecoins has mixed performance

In May 2024, fiat currency The overall issuance of pledged stablecoins decreased by US$840 million, mainly affected by the decline of USDC and FDUSD. USDT and PYUSD are trending upward, while USDC, DAI and TUSD are underweight, according to SosoValue and Glassnode data. PYUSD saw significant growth of 21.7% and the announcement of its issuance on Solana may have an impact on the Solana ecosystem. USDe issuance surged to $2.978 billion, surpassing FDUSD to become the fourth largest stablecoin. FDUSD issuance dropped from 4.25 billion on April 30 to 2.92 billion on May 31, 2024, a decrease of 31.29%. This significant reduction contrasts with the stability of USDT and USDC, which are more commonly used for trading and payments.

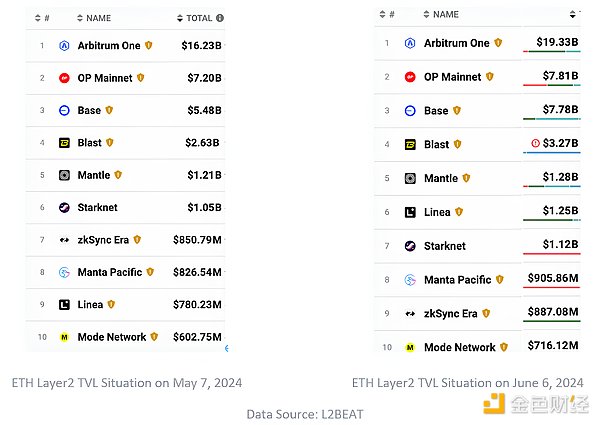

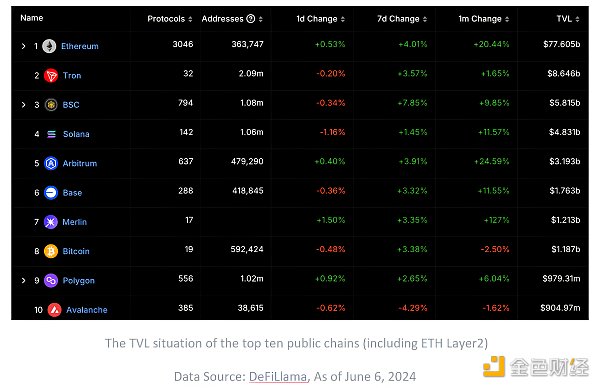

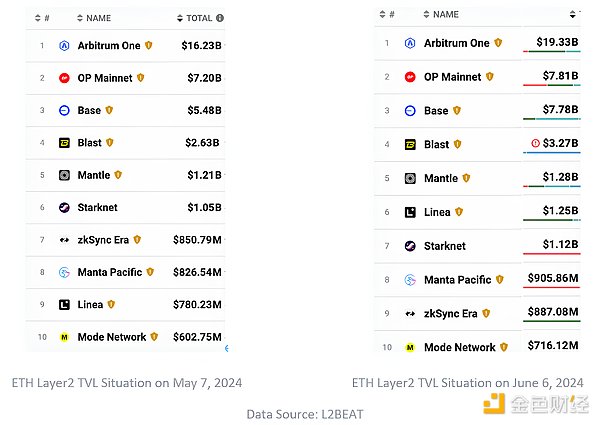

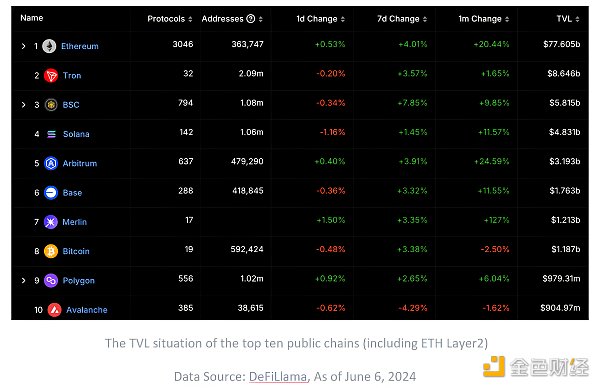

Despite the market recovery, But ETH Layer2 activity drops

Despite a 21% monthly increase in ETH prices, Layer2 TVL denominated in ETH fell increased by 4.4%, indicating stagnant activity levels within the Layer 2 ecosystem. However, USD-denominated TVL rose more than 20% as the overall market recovered. The surge in ETH price did not translate into an increase in funding in the ETH Layer2 ecosystem, which dropped slightly to 12.38 million ETH. Conversely, TVL in U.S. dollars reached approximately $47.81 billion due to market recovery.

The growth of Base and Linea amid pessimism in the Layer 2 industry

In response to ETH Layer 2 Amid the pessimistic outlook for the industry, Base and Linea bucked the trend and achieved significant growth. While the narrative of high-performance blockchains and low on-chain fees lost traction, meme coins and restaking gained traction. Base’s ecosystem is showing increased activity, with the native token attracting a lot of attention. Linea is seeing significant capital inflows driven by memecoins and the Restaking narrative, with FOXY and Renzo Protocol leading the ecosystem.

ETH-based zone Merlin performs strongly for blockchain and BTC ecosystem

As Ethereum price rebounds, ETH-based blocks Chains such as Arbitrum and Base have shown strong USD-denominated TVL performance. ETH price recovery has led to increased activity on Ethereum in meme assets related to the U.S. presidential election. Meanwhile, within the BTC ecosystem, Merlin’s TVL has grown by more than 100% in the past month, driven by Solv Funds’ Bitcoin-wide underlying yield dividend protocol. However, Merlin’s native token lacked significant volume and price growth due to limited practical applications and positive incentives.

LayerZero's powerful Sybil screening measures inspire the crypto community

In early May 2024, LayerZero Labs launched a 14-day self-reporting Sybil activity program, encouraging users to self-report or report Sybil activity to each other in exchange for rewards. This program, which provides self-reporters with 15% of expected allocations, strengthened anti-Sybil efforts and resulted in widespread mutual reporting driven by financial incentives.

Notcoin’s popularity boosts TON ecosystem

Mini on the TON blockchain The game Notcoin quickly became popular with impressive transaction volumes and a growing user base, reaching 6 million daily active users and a market capitalization of $2.2 billion in three months. Its success highlights the potential of the “Tap to Earn” model, leveraging the openness of Web3 and integrating with Telegram to reduce customer acquisition costs and grow its user community. In addition, Catizen, another TON ecosystem game, has also achieved explosive growth, with more than 6 million users and 8.1 million transactions, further enhancing the activity and liquidity of the TON ecosystem.

Runes lead BTC trading amid BRC20 weakness

May 2024, < strong>The Bitcoin derivative asset market will shift its focus to RUNES and BTC Layer2, BTC staking/re-hypothecation and shared security areas, while BRC20 Ordinals have struggled to maintain significant flow and growth. The rise of new technologies and narratives from developers is challenging the dominance of Ordinals/BRC20 in the BTC native asset space, requiring more innovation to regain market recognition.

DOG (Runes) has risen strongly, challenging ORDI’s market position

Driven by positive market trends, The market value of DOG assets in the Runes ecosystem surged, approaching $800 million by the end of the month. Meanwhile, ORDI experienced volatility but managed to recover to a market cap of $1 billion on May 31, 2024, maintaining its lead over DOG. Despite ORDI's resurgence, overall user, developer, and traffic momentum continues to shift away from Ordinals/BRC20 and towards the rapidly growing RUNES ecosystem.

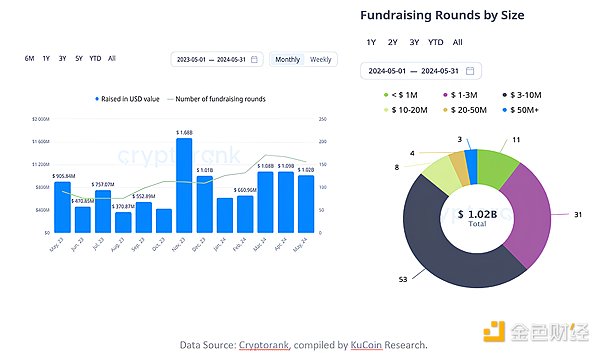

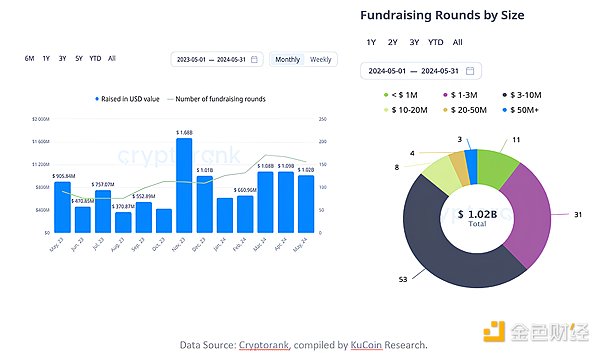

Cryptocurrency investment dynamics Trends

In the past month, the cryptocurrency market disclosed 156 investment and financing projects totaling $1.02 billion. While that's down slightly from April 2024, it's up from the same period last year, with more than 50% of projects receiving funding between $1 million and $10 million.

Investment The focus shifts and strategic round financing increases

In May 2024, the proportion of Series A investments in the cryptocurrency market dropped from 10% to 7.77%, while the proportion of strategic round financing projects increased from 15.73% to 18.45%. IndicatingThere is an increasing tendency for projects to exit through public listings. The proportion of seed round investment has remained basically unchanged.

EVM-based blockchain leads the financing boom

Ethereum, EVM-compatible chains and Layer 2 solutions are the public chains with the largest number of projects dominate the ecosystem. Among non-EVM chains, Solana maintains its position in the top five, Fantom enters the top ten, and TON improves its ranking, highlighting their increasing prominence in the market.

Turkey plans to enact new cryptocurrency regulatory law

Turkey is preparing to submit a new law to regulate cryptocurrency assets, consistent with international regulatory standards, while also imposing restrictions on cryptocurrency transactions. tax. The move is aimed at reducing the risks associated with cryptocurrency trading. The Capital Markets Commission will impose strict regulations on the licensing and operation of cryptocurrency trading platforms. This move has the strong support of Turkish Finance Minister Mehmet Şimşek.

JinseFinance

JinseFinance