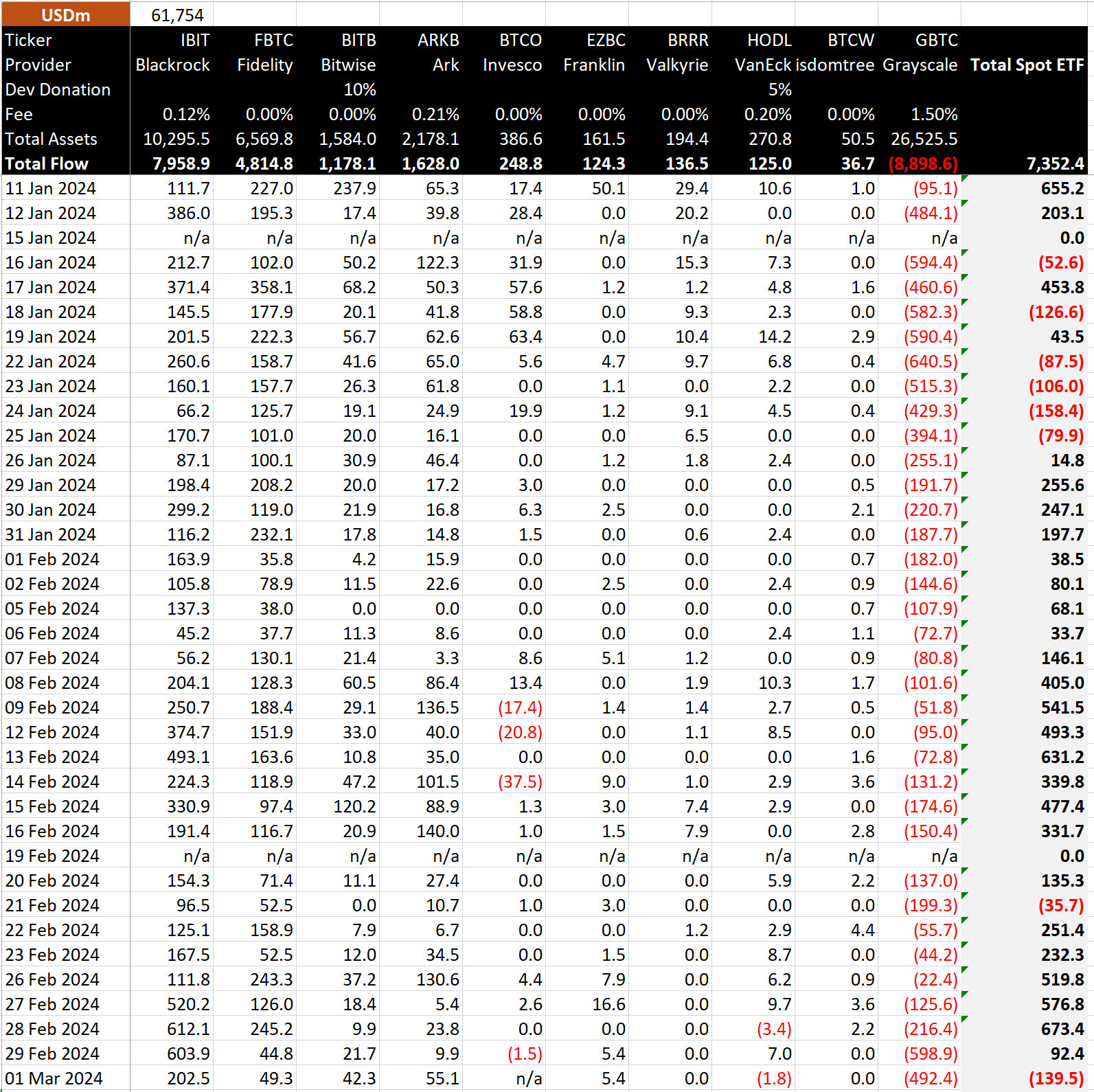

Ten spot Bitcoin ETFs are arguably among the most successful financial products in history, with trading volumes and inflows hitting new highs last week. Total net inflows reached $7.35 billion. BlackRock's IBIT hit the $10 billion asset mark in just seven weeks, the fastest an ETF has ever hit that figure and surpassing the largest silver ETF in size.

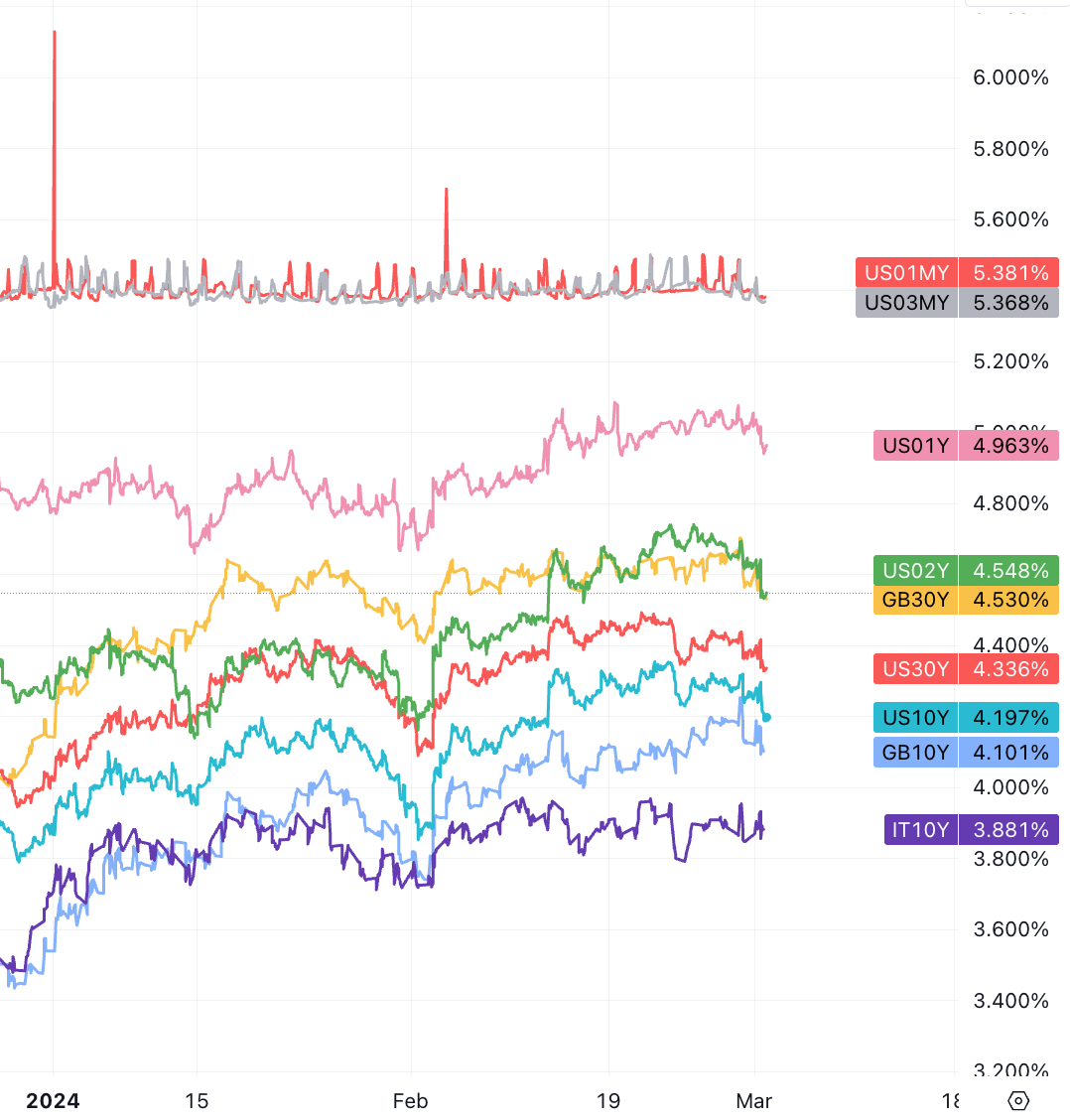

It can be seen in February that if the reason for the rise in bond market yields is positive factors (economic growth strong rather than a Fed rate hike), stocks would do well in this environment. Despite rising interest rates, the S&P and Nasdaq rose about 5% last month, and global stock markets also hit record highs, with many major global stock indexes hitting record highs, including Germany, France, and Japan. Chip stocks rose sharply, with NVIDIA rising another 30%, AMD rising 20%, Broadcom and TSMC rising 17%. The logic of chip stocks is that the closer they are to the upstream of the AI industry chain, the more they will rise. As for downstream software companies, especially big technology, their performance is average. For example, Google fell by 4% in the past month, Apple fell by 2.4%, Microsoft rose by 3%, and Meta rose by 500 Billions of repurchases rose 27%. Crude oil prices edged higher with WTI approaching $80. The U.S. dollar index rose first and then fell, basically flat. Bitcoin and Ethereum are up nearly 50%.

Unlike several periods last year when rising yields triggered corrections in stocks and cryptocurrencies, global stocks are There are three main reasons why both short-term and long-term interest rates can hold up and rise as interest rates rise again: 1) Strong fourth-quarter corporate earnings results; 2) NVIDIA's prospects fuel new enthusiasm for AI; 3) A strong economy increase.

Weak U.S. economic data released on Friday and speeches by Federal Reserve Board members increased the market's expectations for monetary easing, and U.S. bond yields plunged significantly. The U.S. ISM manufacturing index unexpectedly fell to a seven-month low of 47.8 in February, contracting for 16 consecutive months, with both new orders and employment shrinking.

Fed Governor Waller (a popular candidate for the next Fed Chairman) hinted that a reverse "reversal" will be implemented Operation" (QT), that is, the Fed should "buy short and sell long" on the balance sheet. He also hopes to see the Fed's holdings of agency MBS be reduced to zero and the proportion of short-term debt on the balance sheet increase. Waller's speech hinted that the Fed hopes to lower short-term bond yields, that is, lower interest rates that are closer to the money market. It is a dovish signal and can alleviate the inversion of the yield curve to a certain extent.

Before the global financial crisis, about one-third of the Fed's portfolio was in short-term Treasury bonds . Today, short-term Treasury bonds account for less than 5% of Treasury holdings.

At an event on the same day, Dallas Fed President Lori Logan once again emphasized that with the The number of bank reserves fell, and the Federal Reserve may start to slow down the pace of its balance sheet reduction. U.S. bonds and gold surged, and the U.S. stock index hit a record high.

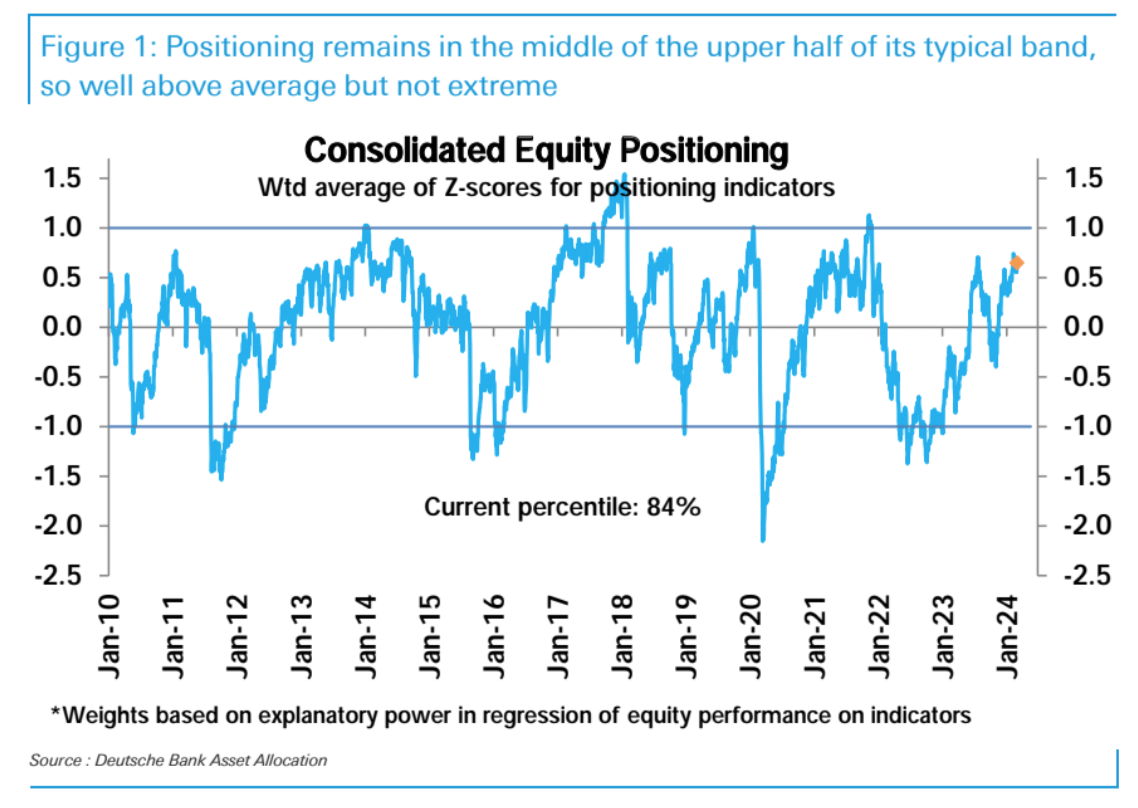

As for whether the recent rise is overheated, history shows that the market still has not entered an overheated state, but the growth rate may will slow down and volatility may increase.

The first 16 months of the current bull market compared to the past 12 bull markets (42%) Below average (50%). (This kind of statistics is not applicable in the currency circle)

If the Federal Reserve gradually relaxes its monetary policy in the future, there will be It is conducive to economic expansion and promotes further gains in risk assets. "The Fed's rate cuts are stirring up 'animal spirits' and driving risk assets," Bank of America wrote in a commentary last week.

However, the stock market will not rise forever. When investor sentiment becomes too optimistic, markets tend to become more volatile. Although investor sentiment has turned optimistic, it has not yet reached extreme levels. Investors should maintain reasonable expectations for returns and volatility, which historically has averaged three 5% corrections and one 10% correction per year.

All About Bitcoin

Ten spot Bitcoin ETFs are arguably among the most successful financial products in history, with trading volumes and inflows hitting new highs last week. Total net inflows reached $7.35 billion. BlackRock's IBIT hit the $10 billion asset mark in just seven weeks, the fastest an ETF has ever reached that figure and surpassing the largest silver ETF in size.

Friday saw the first net outflow in seven trading days, mainly due to the massive outflow of nearly $1.1 billion in GBTC for two consecutive days. The market speculated that the main reason behind the sell-off may be the repayment of the lender Genesis. Genesis received bankruptcy court approval on February 14 to sell 35 million GBTC shares (worth $1.3 billion then, about $1.9 billion now), but outflows from GBTC had been modest over the past two weeks until a spike on Thursday, However, most of this selling pressure seems to have been digested now.

Currently we can expect large institutions to "capitulate" one after another.

Bitwise Chief Investment Officer Matt Hougan said that current demand mainly comes from retail investors, hedge funds and independent financial consultant. He expects demand for spot Bitcoin ETFs to increase further as larger U.S. brokerages begin to participate. Some of the largest banks in the United States include Bank of America, Wells Fargo, Goldman Sachs, and JPMorgan Chase, but these banks have yet to offer BTC ETFs to their customers.

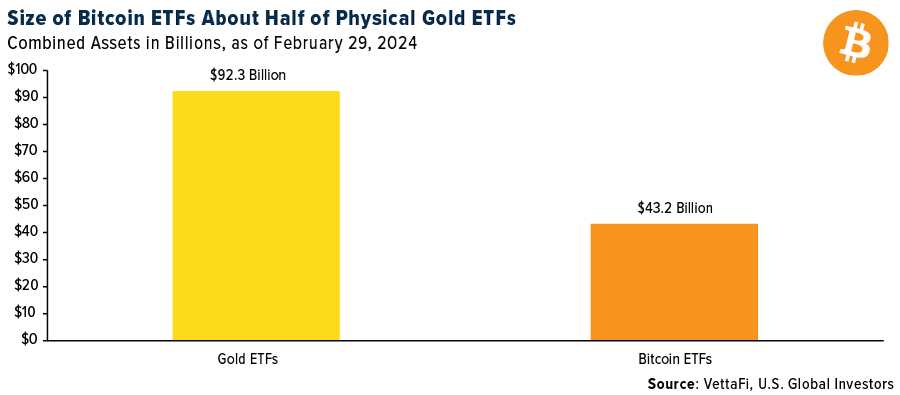

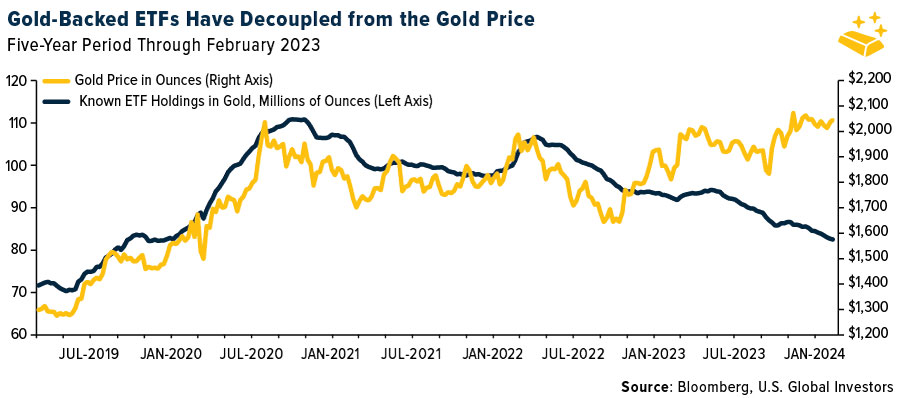

It’s unclear whether the excitement surrounding Bitcoin is sucking money away from gold, but there does appear to be some disconnect between gold’s price action and investment levels that have persisted for over a year. Historically, gold prices and gold-backed ETF holdings have traded in tandem, but starting in 2023, the two began to decouple, as shown below. This can be caused by a variety of factors, including changes in investor sentiment, monetary policy, portfolio balance, currency fluctuations, etc.

Bitcoin is the best choice for investors with long investment horizons or greater risk appetite, with its volatility roughly eight times that of its gold counterpart. The precious metal’s 10-day standard deviation is ±3%, while Bitcoin’s 10-day standard deviation is ±25%.

The drivers of gold prices appear to have changed in recent months. For decades, gold had an inverse relationship with real interest rates — rising as yields fell and vice versa — but since the onset of the pandemic in 2020, that pattern has been broken. In the 20 years before Covid, gold and real interest rates had a highly negative correlation coefficient. Since then, however, the correlation has turned positive, and the two assets now regularly move in the same direction.

It is currently generally believed that central bank purchasing activities are the new driving force for gold. Since 2010, financial institutions, primarily in emerging economies, have been net buyers of metals to support their currencies and de-dollarize.

Edward Snowden last week shared his prediction for 2024 that national governments will After being caught secretly buying Bitcoin, he said that Bitcoin is "a modern alternative to gold"

Currently Only the government of El Salvador has taken the initiative to purchase national Bitcoins and currently holds 2,381 Bitcoins in its treasury. The current profit may be 40% compared to the purchase cost.

According to intotheblock statistics, more than 97% of Bitcoin addresses are currently profitable, a record high in November 2021 highest level of profitability since.

The last time we observed such a large proportion of profitable addresses, Bitcoin was priced around 69,000 The U.S. dollar is near all-time highs.

But it is obviously meaningless to look at it this way. At the end of each bull market, the price often far exceeds the previous level. At the peak of a round, the profit ratio is definitely high. We should pay more attention to the changes in profit ratio at the beginning of each bull market

< p id="3750" data-selectable-paragraph="" style="text-align: left;">In January 2013, the BTC price was 14, the previous high was 23, and the profit ratio returned to above 90% for the first time in 17 months. , the increase will be 40 times by the next high point

BTC price in June 2016 was 716, the previous high was 1100 , the profit ratio returned to above 90% for the first time in 31 months, and the increase will be 28 times at the next high point

In August 2020, the BTC price was 11,500, with the previous high of 19,500. The profit ratio returned to more than 90% for the first time in 32 months, and the increase would be 4.5 times by the next high.

In February 2023, the BTC price was 51,000, with the previous high of 69,000. The profit ratio returned to more than 90% for the first time in 27 months. Will it increase by the next high? times

It can be seen that when the BTC price reaches about 60~70% of the previous high, profits will The proportion will rise to more than 90%. At this time, the selling pressure of users trying to recover their capital will no longer have a significant impact. Theoretically, the bull market will go smoother later.

And judging from the history of the past three times, after hitting the 90 profit threshold for the first time, the price will continue to rise. And touched this area many times.

However, the price increases after the past three hits have shown a decreasing trend, which is normal as the market matures. of.

According to the fitting of the exponential decay model, the maximum increase after hitting 90% this round was 390%. Taking 51,000 as the benchmark, the high price is around 250,000.

Pay attention to the April callback

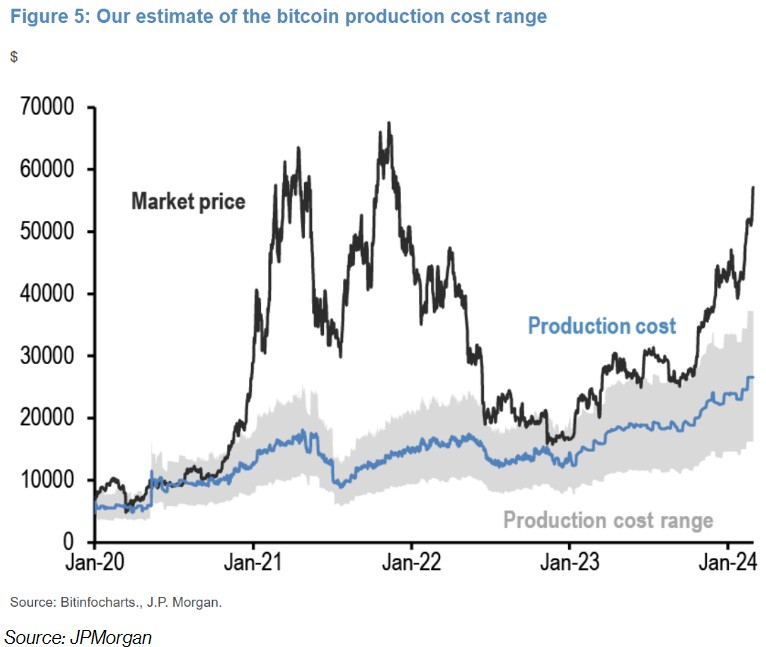

JPMorgan Chase analysts released a report last week predicting that the Bitcoin halving in April may lead to a decrease in miners' profitability, coupled with an increase in production costs, may have an impact on Bitcoin This puts downward pressure on currency prices.

Historically, Bitcoin’s production costs have been a key determinant of its price floor. The average production cost of Bitcoin is currently US$26,500 per coin, and will double to US$53,000 immediately after the halving. However, network computing power may drop by 20% after the halving, so the estimated production cost and price may be reduced to $42,000. This price is also the lowest point at which JPM predicts a possible correction for BTC.

Miners with higher production costs, in particular, are facing significant pressure due to an expected decline in profitability. The closer we get to the halving, the more gains in miner stocks may be restrained.

Meme Coin Riot and Copycat Season

Bitcoin has led the way for cryptocurrencies this year, but altcoins may soon start outperforming.

Dog-themed tokens DOGE and Shiba Inu (SHIB) rose by 50% last week ~ 100%, while the prices of new MEMEs such as PEPE, BONK and Dogwifhat (WIF) increased by 100~200% during this period.

Last week's "huge" MEME coin rally could be an "early sign" of the upcoming altseason . However, what is different in this round from the previous round is that the funds are mainly driven by institutions, and there is no guarantee that the funds flowing into Bitcoin will eventually flow into smaller assets. However, as the price of mainstream currencies rises, it may drive the risk preference of existing funds. This part of the money will most likely flow to assets with higher risks. This is due to human nature.

Some analysts pointed out that to confirm altseason, the key signal to look for is ETH's price breaking through $3,500 threshold.

Will VC return to cryptocurrency?

For the first time since March 2022, venture capital investment in crypto startups increased in 2023. Reached US$1.9 billion in the fourth quarter. That's up 2.5% from the third quarter, according to a recent PitchBook report.

Many start-up projects have announced financing in the past month, including Lava Protocol, Analog, Helika, Truflation and Omega etc. A16z announced a $100 million investment in EigenLayer, Ethereum’s restaking protocol. Binance Labs announced a total investment of $3.2 million in a seed round in January.

Avail announced a $27 million seed round led by Founders Fund and Dragonfly. Venture capital firm Hack VC raised $150 million to invest in early-stage cryptocurrency and AI startups.

Re-pledge rollups project AltLayer received US$14.4 million in strategic financing, co-led by Polychain Capital and Hack VC .

Digital asset trading platform Ouinex has raised more than $4 million from the community through seed and private placement rounds.

PredX, an artificial intelligence (AI)-powered prediction market, raises $500,000 in pre-seed funding< /p>

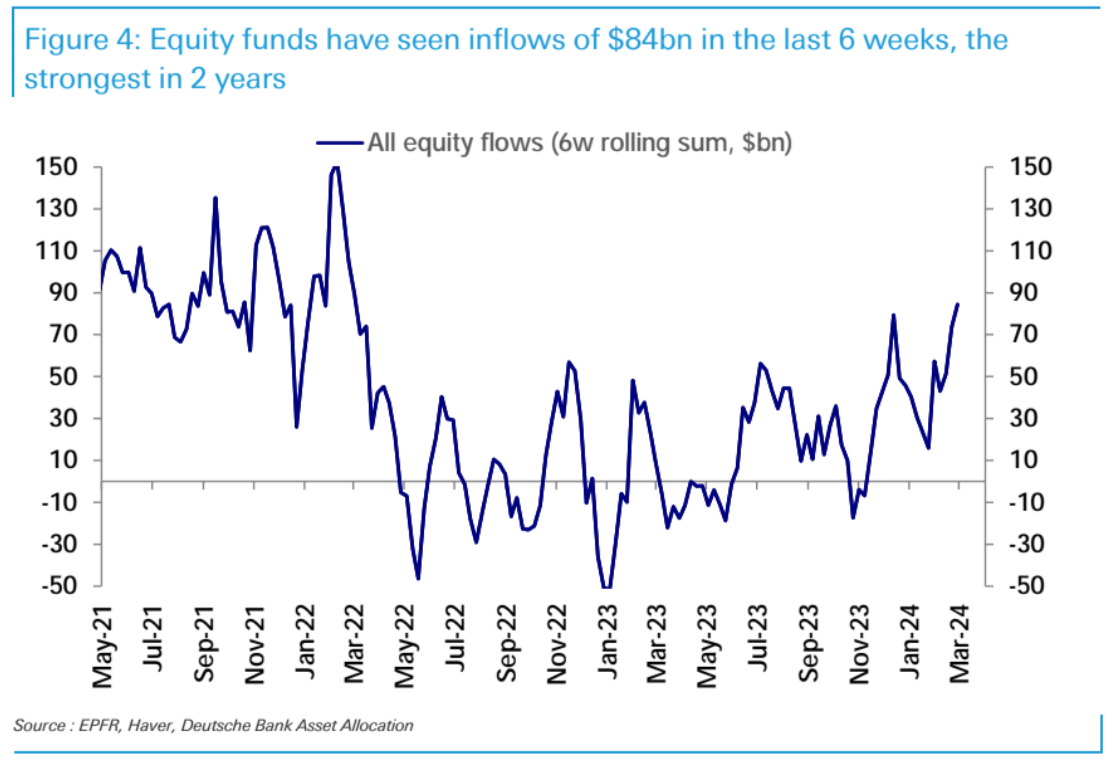

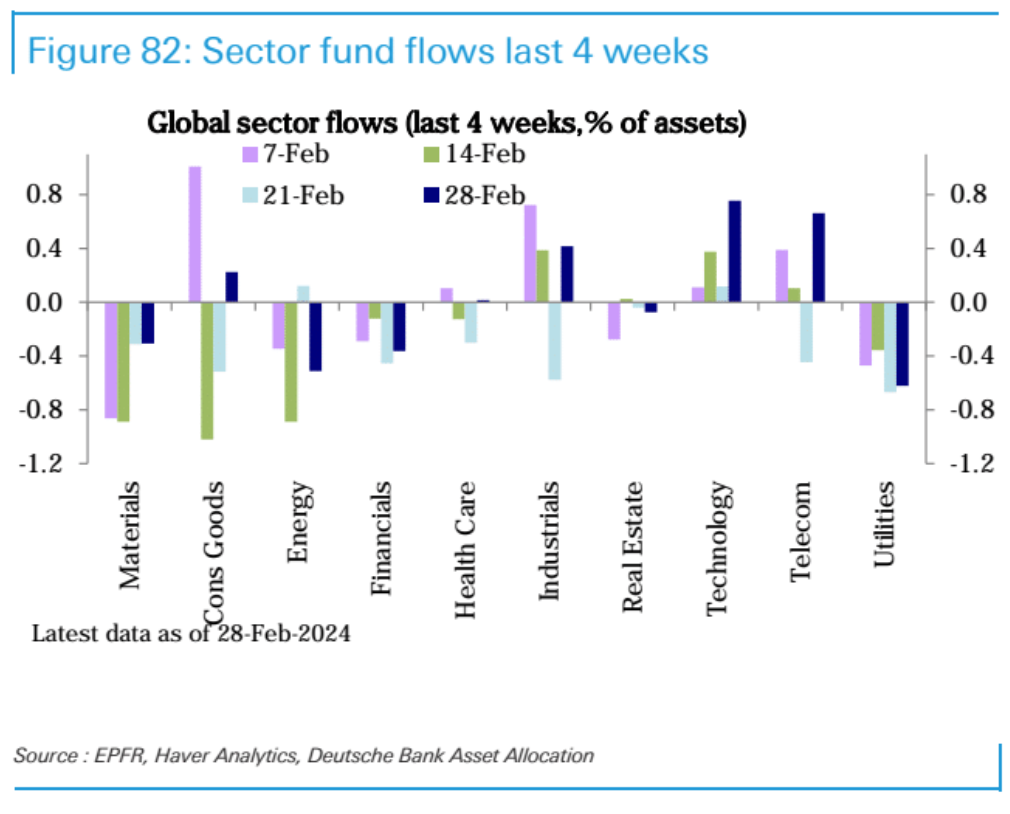

Fund flow

Stock funds saw strong inflows (US$10 billion) for the sixth consecutive week, and total inflows (US$84 billion) were the highest in two years. U.S. equity funds ($11.3 billion) were the main source of inflows. Technology fund inflows ($4.7 billion) also rose to a six-month high. Bonds ($13.8 billion) and money market funds ($38.7 billion) also recorded strong inflows. Inflows into technology stocks including major companies such as Apple and Nvidia hit $4.7 billion, the highest level since August and on track to hit an annual record of $98.8 billion.

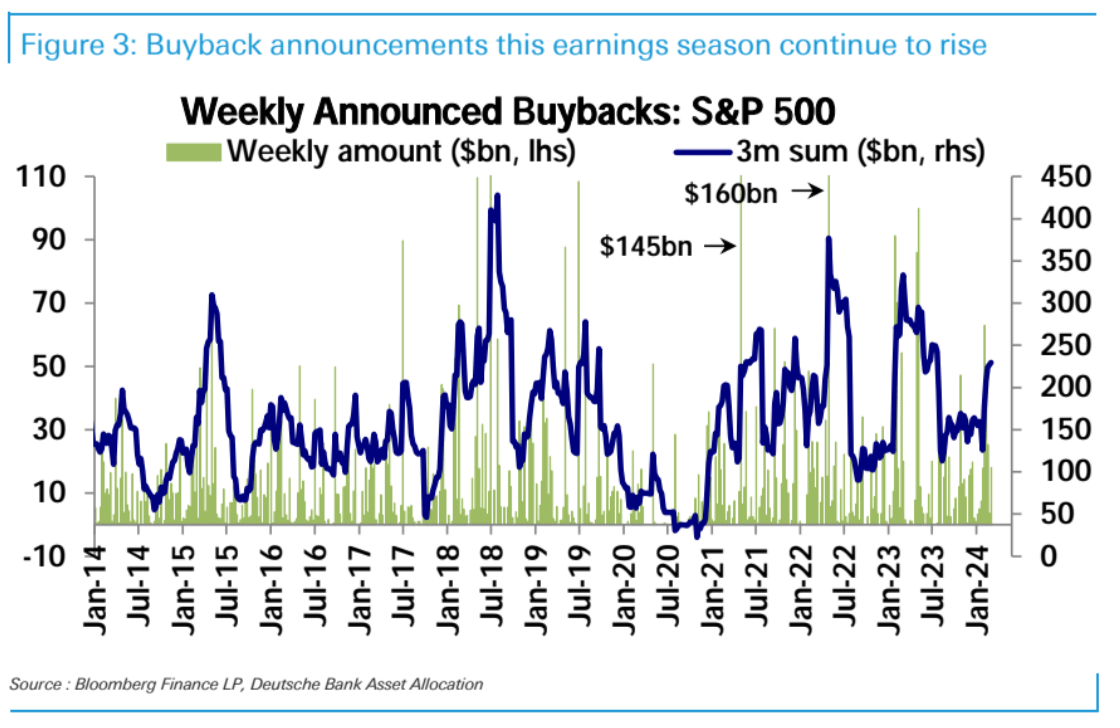

Buyback intensity increased from US$150 billion per quarter to US$225 billion

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance