The U.S. Federal Court in Seattle sentenced Binance founder Zhao Changpeng (CZ) on April 30 local time. Unlike the 36-month sentence sought by the U.S. Department of Justice (DOJ), the presiding judge Richard A. Jones set the sentence to 4 months in prison on the charge that CZ (or Binance) violated the relevant provisions of the U.S. Bank Secrecy Act against money laundering.

Later, CZ said on the social platform that he would serve his sentence and would focus on the field of education afterwards. At the same time, he said the importance of compliance for virtual currency exchanges, and the close attention Binance received and the guarantee of user funds security during the incident (being prosecuted by the U.S. Department of Justice) were crucial to (CZ's light sentence). Finally, CZ reiterated the need to protect users.

The last sentence “Protect users!” can’t help but remind people of the fact that on March 28 this year, the founder of FTX, SBF (Sam Bankman-Fried), was sentenced to 25 years in prison for fraud and embezzlement of customer funds, resulting in a loss of more than 8 billion US dollars.

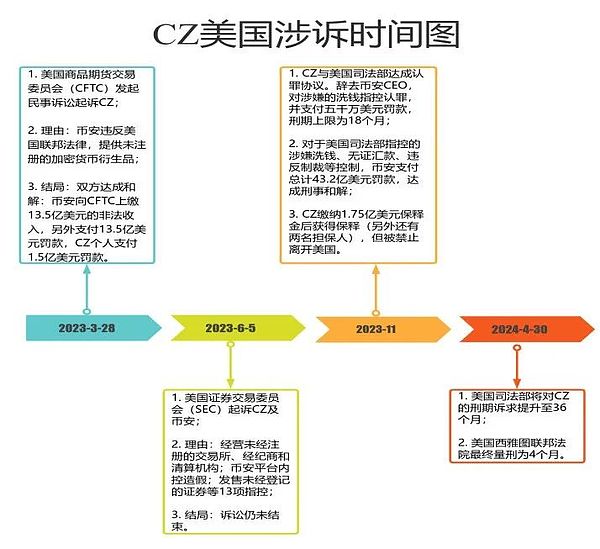

It seems that CZ's experience is not too bad, but the story is not over yet. Lawyer Liu sorted out the demands of different US law enforcement agencies on CZ or Binance, which may help us better understand the legal dilemma that virtual currency exchanges may face:

Some friends think that CZ's experience is quite like the "pig killing" in the United States, and some articles are even full of gloating between the lines. Lawyer Liu thinks that these views are superficial (of course, this does not mean that my views are necessarily profound). The experience of Binance or CZ is essentially a stress response of centralized government agencies to the application of decentralized technology in finance, especially in the field of currency.

Virtual currency exchanges have to compromise when facing conservative and powerful governments. But the embarrassing thing is that the virtual currency exchange itself is a typical centralized institution, which runs counter to the original intention of decentralization of virtual currency. Although its existence is reasonable at present, such as being able to provide great convenience for virtual currency transactions between users. But in essence, it is difficult to escape the rut of centralized drawbacks. CZ is not always spotless, and Binance is not the "flower protector" of the crypto circle. It's just that CZ did not touch too many red lines like SBF.

From the perspective of regulators, whether it is the DOJ, SEC, CFTC in the United States, or the territorial jurisdiction, personal jurisdiction, protective jurisdiction, and universal jurisdiction in the Chinese Criminal Law, the country's legislators and law enforcers can always find a basis to prove the legitimacy of their actions. In other words, at least in the eyes of many politicians, politics is the law of law, and law is a tool of politics (but Lawyer Liu still firmly believes in the law!).

The United States accused Binance of violating its Bank Secrecy Act anti-money laundering provisions, such as failing to inform U.S. authorities of nearly 100,000 transactions conducted using Binance by Hamas, ISIS, and the terrorist organization al-Qaeda; and failing to restrict $890 million in transactions between U.S. and Iranian users; in addition, Binance also earned huge fees from millions of transactions between users "including Cuba, Syria, and Crimea, Donetsk and Luhansk in Ukraine." (Quoted from "Trial of Zhao Changpeng | Prism", author Wen Shijun)

(Images of CZ's trial circulated on the Internet, please delete if infringement)

According to some American lawyers, the way the Bank Secrecy Act was applied in the CZ case is not common in American judicial systems. Therefore, it cannot be ruled out that the CZ case was concocted.

However, as mentioned above, the author's speculation is not to blame a certain government, because we cannot guarantee that CZ will be sentenced to less than 4 months in prison in other countries, and he may even be punished more severely. What the author wants to say is that it is still difficult for virtual currency exchanges and the decentralized virtual currencies behind them to be accepted by all governments in a short period of time. However, some people expressed optimism instead - the United States, as the global financial hegemon, does not seem to have taken any fatal actions against the "hegemon" in the virtual currency world, so does this mean that virtual currency is increasingly likely to be accepted by the "mainstream world"?

But for true believers in decentralization, what exactly does the "mainstream world" think - who cares?

Edmund

Edmund

Edmund

Edmund JinseFinance

JinseFinance Xu Lin

Xu Lin Xu Lin

Xu Lin Cheng Yuan

Cheng Yuan Kikyo

Kikyo Alex

Alex Alex

Alex Darren

Darren Coinlive

Coinlive