Source: Lawyer Liu Honglin

If individual currency holdings are considered trivial, then some companies can be described as "coin-buying maniacs." According to CoinGecko data, the listed company holding the largest number of Bitcoins in the world is MicroStrategy. As of February 22, 2024, the company held 174,530 Bitcoins, worth approximately $9.1 billion.

Another company that holds a large amount of currency is the famous Tesla. Currently, Tesla holds more than $500 million in Bitcoin value. In addition, Tesla also supports customers to use cryptocurrency to purchase its products.

Not only US listed companies will deploy crypto assets, but Chinese Internet companies will also Follow up step by step.

Boya Interactive, a Hong Kong-listed company, announced on the Hong Kong Stock Exchange on March 8, 2024 that in order to further promote the group’s business development and layout in the Web3 field, the board of directors seeks approval from shareholders at the general meeting of shareholders to further grant potential cryptocurrency. The purchase authorization authorizes the board of directors to continue to purchase cryptocurrencies in a total amount not exceeding $100 million. It is understood that at the end of last year, the company's board of directors was authorized to purchase no more than $100 million in cryptocurrency, including 1,110 Bitcoins, with an average price of approximately $41,790. There are 14,855 Ethereum coins in total, with an average price of approximately US$2,777. There are approximately 8 million Tether coins. Based on this calculation, as of March 8, Boyaa Interactive’s floating profit on its books was approximately US$45.8553 million (approximately 330 million yuan).

As cryptocurrencies strengthen, Boyaa Interactive’s stock price is also rising. As of the close of trading on March 8, the stock rose 30.08% to HK$1.73 per share, with a total market value of HK$1.228 billion. The stock rose 43.01% the previous trading day, and the increase in the past two trading days has been close to 90%. In less than a month, Boyaa Interactive’s growth has exceeded 200%.

Such an operation will definitely make many Hong Kong listed companies jealous. After all, it is difficult to start a new business, but it is easy to buy virtual currency.

On March 27, 2024, the interactive social platform Yingshi Universe announced yesterday that its board of directors has approved a budget of US$100 million for the group to operate in any regulated and licensed company in the next five years. Cryptocurrencies purchased on the exchange will be funded from their existing cash reserves.

With the trend of more and more overseas companies holding large amounts of currency, many Mainland bosses are also interested, but before entering the game, it is worth understanding the relevant legal knowledge and legal risks.

01 Legal Analysis of Currency Holding by Companies in Mainland China

On December 5, 2013, the People's Bank of China, the Ministry of Industry and Information Technology, the China Banking Regulatory Commission, the China Securities Regulatory Commission, and the China Insurance Regulatory Commission issued the "Notice on Preventing Bitcoin Risks", emphasizing that Bitcoin is not legally compensable or mandatory. Monetary attributes are not money in the true sense.

On September 4, 2017, the People's Bank of China, the Cyberspace Administration of China, the Ministry of Industry and Information Technology, the State Administration for Industry and Commerce, the China Securities Regulatory Commission, the China Banking Regulatory Commission, and the China Insurance Regulatory Commission seven ministries and commissions issued the "On Preventing Token Issuance Financing" "Risk Announcement" clearly states that no individual or organization shall illegally participate in token issuance financing activities, and any token financing trading platform shall not engage in the exchange business between legal currency, tokens, and "virtual currencies", and shall not provide tokens or Virtual currency provides pricing, information intermediary and other services.

On August 24, 2018, the China Banking Regulatory Commission, the China Insurance Regulatory Commission, the Ministry of Public Security, the Cyberspace Administration of China, the People's Bank of China, and the State Administration for Market Regulation issued the "On Preventing Illegal Fund-raising in the Name of "Virtual Currency" and "Blockchain" Risk Warning".

On September 24, 2021, the People’s Bank of China, the Central Cyberspace Administration of China, the Supreme People’s Court, the Supreme People’s Procuratorate, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange Jointly issued the "Notice on Further Preventing and Dealing with the Risks of Speculation in Virtual Currency Transactions".

It is not difficult to see from the above context that at the regulatory level, our country has always maintained a focus on virtual currencies and continues to make adjustments and clarifications.

A brief summary: Bitcoin and other virtual currencies are not legal tender and cannot be circulated as currency; ICO (Initial Coin Offering) is clearly defined as illegal behavior; virtual currency exchange, buying and selling of virtual currencies, and matchmaking of virtual currency transactions Services, token issuance financing, virtual currency derivatives trading, etc.are all illegal financial activitiesand are strictly prohibited and will be resolutely banned in accordance with the law. Overseas virtual currency exchanges that provide services to Chinese residents are also illegal financial activities.

Although the "Notice on Preventing Bitcoin Risks" denies the currency attribute of Bitcoin, itindirectly affirms the "virtual commodity" attribute of Bitcoin. Currently, policies and laws allow individuals to hold virtual currencies represented by Bitcoin, but what about companies’ holding of currencies?

From a legal point of view, for civil subjects, "anything can be done unless prohibited by law." Article 127 of the Civil Code clearly stipulates the protection of online virtual property. As a specific virtual commodity, Bitcoin is a virtual property legally held by natural persons and legal persons. The "Notice on Preventing Bitcoin Risks" issued in 2013 stipulates that Bitcoin trading is a commodity buying and selling behavior on the Internet, and ordinary people have the right to participate at their own risk. As a company that is also a subject of civil law, it seems thatthe act of purchasing and holding virtual currencies itself can hardly be regarded as a violation of current laws and regulatory policies.

02 Legal risks of the company’s currency purchase behavior

(1) Policy red line: illegal financial activities

Whether it is from the policy interpretation or the practical cases that Lawyer Mankiw has come into contact with, the speculation and behavior related to virtual currencies are Financial risk prevention has been the focus of supervision by relevant departments in recent years.

On May 18, 2021, the China Internet Finance Association, the China Banking Association, and the China Payment and Clearing Association jointly issued the "Announcement on Preventing the Risks of Speculation in Virtual Currency Transactions", making it clear that financial institutions, payment institutions, etc. Relevant institutions are not allowed to carry out businesses related to virtual currencies, and consumers are reminded of the risks of speculation in virtual currency transactions.

Following this, on September 24, 2021, the People’s Bank of China, the Central Cyberspace Administration of China, the Supreme People’s Court, the Supreme People’s Procuratorate, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange Ten ministries and commissions jointly issued the "Notice on Further Preventing and Dealing with the Risks of Speculation in Virtual Currency Transactions". Compared with the previous policy issuing bodies, the 924 Notice has attracted the Supreme People's Court, the Supreme People's Procuratorate, and the Ministry of Public Security. The addition of , shows that in terms of supervision, more attention is paid to the connection with the judicial chain, which can be described as a "one-stop" service.

At the same time, Notice 924 also clarified: “Carry out exchange business between legal currency and virtual currency, exchange business between virtual currencies, act as a central counterparty to buy and sell virtual currency, and provide information intermediary and pricing for virtual currency transactions. Virtual currency-related business activities such as services, token issuance and financing, and virtual currency derivatives trading are suspected of illegal sales of tokens, unauthorized public issuance of securities, illegal futures business, illegal fund-raising and other illegal financial activities, which are strictly prohibited and resolutely banned in accordance with the law. !”

If a company is involved in the above-mentioned behaviors in the purchase and sale of virtual currencies, it can easily be suspected of illegal business crimes or other crimes and be investigated.

(2) Own investment risk

Notice 924 also clarified the validity of virtual currency investment behavior. "Any legal person, unincorporated organization or natural person who invests in virtual currencies and related derivatives that violates public order and good customs will have the relevant civil legal actions invalid, and the resulting losses shall be borne by them themselves; those suspected of undermining financial order and endangering financial security will be prosecuted by the relevant departments. Investigate and deal with them in accordance with the law.”

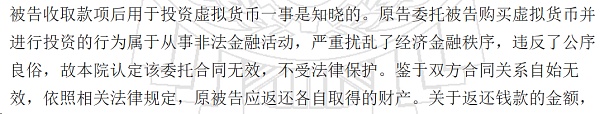

In current judicial practice, there are many currency-related disputes, and the court has indeed determined that virtual currency investment behavior is invalid as “violating public order and good customs”. On June 28, 2022, the Shanghai Baoshan District Court made a judgment on the private lending dispute case between Pan and Huang, and determined that the plaintiff entrusted the defendant to purchase virtual currencies and invest in them, which was an illegal act and the entrustment contract was invalid. Return of propertys.

(Screenshot of part of the judgment in the private loan dispute case between Pan and Huang)

But not all courts will rule that both parties return their property. In many cases, after the investment behavior is deemed invalid, the court will determine the responsibilities of both parties based on the specific circumstances of the case, and make a judgment to return the investment in full, in part, or not. There is no uniformly applicable standard across the country.

Therefore, this is also a risk that bosses need to face directly when disputes arise over investment activities.

(3) Some discussions

The presentation and development of new things are always novel and even bizarre. Some companies pay employees salaries in the form of virtual currencies, but this is not supported by the court (Case No.: (2022) Beijing 03 Min Zhong No. 12380); some companies let employees hold Bitcoin on their behalf, and the employees ran away; there are also "technology companies" "Specializes in the legal processing business of virtual currencies, etc.

This raises many interesting questions that are worth thinking about.

For example, tax issues. Some people jokingly say that the two most forbidden things in the world are tax evasion in the United States and drug trafficking in China. Taxation is an important part of the government responsibilities of every country, and our country is no exception, and our country will not be an exception to virtual currencies.

Since the beginning of 2022, large companies in the currency circle have been subject to tax audits, which reflects the country’s emphasis on people in the currency circle at the personal tax level. Theoretically speaking, both companies and individuals who make profits through property transfer should pay taxes. However, the purchase and withdrawal of coins by companies involves not only corporate financial information, but also smart contracts, encryption algorithms, distributed How to collect taxes on underlying technologies such as ledgers is not an easy task.

As for how to reflect the company’s purchase of virtual currency on its financial statements, Lawyer Honglin had previously consulted tax professional friends.

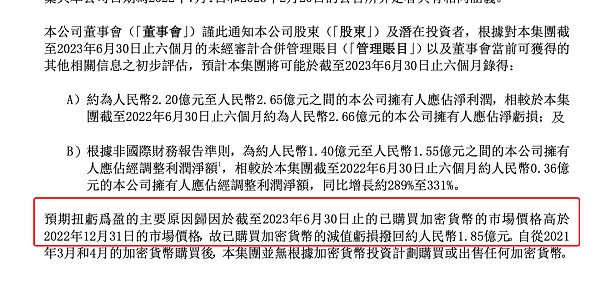

Take Meitu, a Hong Kong-listed company, as an example. The BTC and ETH it holds are accounted for as intangible assets with indefinite useful lives. It is recorded at market price when acquired, and impairment is accrued later when the value is lower than the recorded cost (purchase price).

There are two types of cryptocurrencies held by U.S. listed companies such as Coinbase/Bitdeer. The USDC stable currency is accounted for as a financial asset, and price fluctuations are recorded in current profits and losses. Like Meitu, other cryptocurrencies are calculated as intangible assets.

Of course, when companies encounter virtual currencies, there are many similar compliance and Practical issues are worth discussing, such as asset custody, asset realization, etc. Everyone is welcome to communicate.

03 Mankiw Lawyer Suggestions

The company is an economic field The most active "cells" are now not only cutting-edge technology companies, but even many traditional companies have come up with the idea of laying out Web3 and configuring virtual currencies. However, in view of my country’s current regulatory attitude towards the currency circle, compliance issues must be taken seriously. Not to mention criminal risks, even if the company's account is frozen if the company's account is frozen, it is not a small matter for the company's operations.

Therefore, before a company purchases virtual currency, it must conduct sufficient compliance work, the most basic of which include selecting purchase channels, controlling the source and security of funds of both parties to the transaction, and currency-related transaction accounts and other risk isolation measures. Of course, if you have deeper and more detailed compliance needs, you are welcome to communicate with Mankiw lawyers. You may wish to witness the legal occurrence of Web3 in China!

Xu Lin

Xu Lin

Xu Lin

Xu Lin Joy

Joy Xu Lin

Xu Lin Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance Xu Lin

Xu Lin fx168news

fx168news Cointelegraph

Cointelegraph Ftftx

Ftftx Ftftx

Ftftx