Specialized vs. General-Purpose ZK: Which is the Future?

ZK Stack, dedicated vs. general-purpose ZK: Which one is the future? Golden Finance, the line between dedicated and general-purpose ZK is blurring.

JinseFinance

JinseFinance

1. Project Introduction

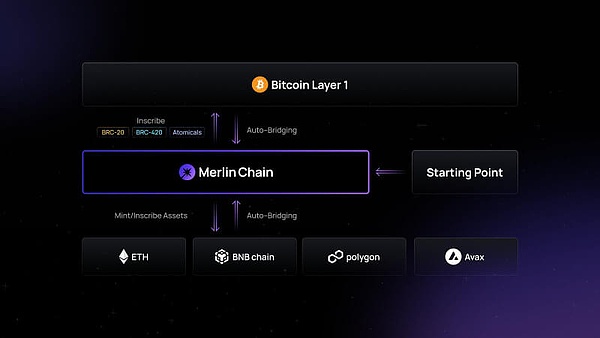

Merlin Chain is a new player in the Bitcoin Layer 2 ecosystem that uses a decentralized oracle network, an on-chain BTC fraud defense module, and zero-knowledge (ZK) convolutions to improve Bitcoin's scalability and efficiency.

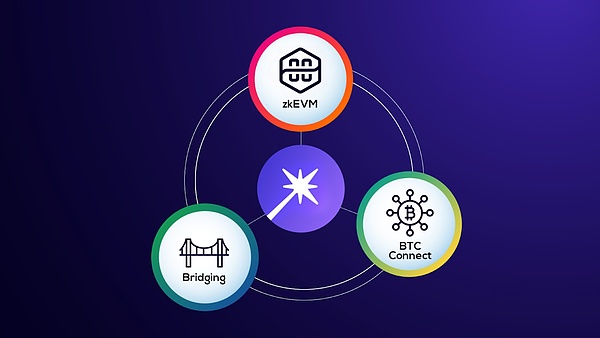

Merlin Chain achieves Bitcoin's expansion through ZKEVM, an EVM-compatible expansion solution, which uses zero-knowledge proofs to verify the validity of state changes. Merlin Chain also introduces an innovative second-layer solution in the Bitcoin ecosystem - Zero Knowledge Rollup (ZK Rollup) technology. This technology improves the scalability and practicality of Bitcoin and allows Merlin Chain to efficiently process large numbers of transactions.

The Merlin Chain platform also uses decentralized oracles and serialized nodes to manage data securely and transparently, maintain its decentralized spirit, and build trust. These features promote innovation in the Bitcoin ecosystem, compressing sufficient transaction proof batches to reduce congestion and increase transaction speed. Merlin Chain also uses bridging technology to facilitate asset transfers from L1 to L2, enabling access to external data sources and execution of smart contracts using decentralized oracle networks and on-chain fraud proofs.

In addition, Merlin Chain also introduced a BRC20 governance token called Merlin (MERL). The team plans to promote the Bitcoin-centric governance model by airdropping $MERL. As a BRC20 standard token, $MERL provides a variety of functions, including governance rights, staking functions to enhance network security, payment of transaction fees, participation in network operations and use as liquidity and collateral within the ecosystem.

2. How it works

Merlin Chain integrates second-layer technology solutions into the Bitcoin network to enhance functionality, reduce transaction costs and increase transaction speed.

While the Bitcoin (layer 1) blockchain is characterized by network congestion, slow processing time, high transaction fees, and the inability to build new products, the Merlin Chain layer 2 solution introduces the exact opposite. It has no transaction capacity restrictions, is cost-effective, has fast transaction speeds, and implements innovations from the first layer of Bitcoin.

Merlin Chain's functionality revolves around the ZK-Rollup network, decentralized oracle network, and on-chain fraud prevention. ZK-rollup works by compressing multiple transaction proofs into batches. This helps reduce network congestion, thereby increasing transaction speeds, reducing processing time, and improving efficiency.

In addition, Merlin Chain verifies uploaded transactions by interacting with the first layer of Bitcoin with the help of a decentralized oracle network and on-chain fraud proofs. The decentralized oracle network uses BTC as collateral while verifying transactions to prevent fraud cases. When the transaction is verified and successfully confirmed, the pledged BTC will be released. Thereby enhancing the security and credibility between the first layer of Bitcoin and the second layer of Merlin Chain.

3. Core Mechanism

3.1 ZK-Rollups Technology

Merlin Chain adopts zero-knowledge proof (ZK-Proofs) technology, namely ZK-Rollups, to ensure the security and privacy of transactions.

The core of ZK-Rollups is the use of zero-knowledge proof. Zero-knowledge proof is a cryptographic method that allows one party (the prover) to prove to another party (the verifier) that a statement is correct without revealing any information other than proving that the statement is correct. In ZK-Rollups, this allows transactions to be executed and verified without revealing the specific content of the transaction.

3.1.1 Main functions and operation flow

Transaction packaging: In ZK-Rollups, multiple transactions are grouped into a "roll". These transactions are processed and calculated off-chain to avoid the high fees and network congestion of the main chain.

Generate Proof: After processing these transactions, a zero-knowledge proof is generated, which proves that all transactions are valid and do not violate the rules of the network. This proof can be generated quickly and has a small amount of data, which is a key advantage of ZK-Rollups.

Submit to the main chain: Once the proof is generated, it will be submitted to the main chain. The main chain only needs to verify this single proof without processing each individual transaction. This greatly reduces the workload of the main chain.

Data Availability: Although transaction data is processed off-chain, the metadata of the transaction (such as the sender and receiver of the transaction) still needs to be stored on the main chain to ensure data availability and transparency.

3.1.2 Advantages

Scalability: By processing transactions off-chain and aggregating the results into a proof, ZK-Rollups can significantly increase the number of transactions per second (TPS).

Security: Zero-knowledge proofs ensure the correctness and integrity of transactions without exposing the details of transactions.

Privacy: Since the specific content of the transaction is not disclosed, the privacy of users is better protected.

Reduced transaction fees: Due to the reduced load on the main chain, transaction fees are relatively low.

3.1.3 Application of ZK-Rollups in Merlin Chain

In Merlin Chain, ZK-Rollups technology is particularly suitable for processing a large number of tiny transactions, such as micropayments, high-frequency trading DeFi applications, or in-game transactions. These application scenarios usually require fast and low-cost transactions, which the traditional Bitcoin network cannot effectively support due to the data limit of each block and the average block time of 10 minutes.

By introducing ZK-Rollups, Merlin Chain not only makes these operations feasible, but also maintains compatibility with the Bitcoin network while taking advantage of Bitcoin's security and decentralization. This approach effectively expands Bitcoin’s capabilities, enabling it to support more complex and diverse blockchain applications while maintaining its core decentralization and security properties

3.2 Decentralized Oracles

Merlin Chain’s decentralized oracles are a key component of the platform, providing a secure and reliable way to integrate real-world data onto the blockchain. Oracles are the bridge between the blockchain and the outside world, and they enable smart contracts to access and respond to data that is not stored on the blockchain itself.

3.2.1 Function of decentralized oracle

The main function of decentralized oracle in Merlin Chain is to provide a trusted way to obtain, verify and deliver external data (such as price feeds, weather updates, events of other chains, etc.) to the chain. The purpose of this is to reduce the risk of single point failure and improve the accuracy and security of data.

3.2.2 Workflow

Merlin Chain's decentralized oracle ensures the validity and security of data through the following steps:

Data source: The oracle collects information from multiple independent and trusted data sources. These sources may include APIs, professional data providers, public data feeds, etc.

Data Aggregation: Data collected from multiple sources is aggregated to form a more stable and reliable data point. Aggregation methods may include taking the average, median, removing extreme values, etc., all of which are intended to reduce the bias or error that any single data source may introduce.

Verification and Consensus: Before the aggregated data is uploaded to the blockchain, it needs to go through a series of verification processes to ensure the authenticity and accuracy of the data. This usually involves a consensus mechanism among multiple independent nodes.

On-chain Interaction: Once the data is verified and confirmed, it is sent to the blockchain, and smart contracts can access and execute predetermined logic based on this data.

3.2.3 Security and Decentralization

The decentralization of Merlin Chain Oracle is guaranteed by multiple aspects:

Multiple data sources: Using multiple data sources instead of a single source increases the robustness of the system and the reliability of the data.

Decentralized data processing: Data aggregation and verification are not completed by a single entity, but by multiple independent nodes in the network, reducing the possibility of manipulation.

Economic incentive and penalty mechanism: Nodes participating in data verification may need to pledge assets and be subject to economic penalties when providing incorrect data, which increases the motivation of participants to remain honest.

3.2.4 Application Scenarios

Merlin Chain's decentralized oracle can be used in a variety of application scenarios, such as:

Financial derivatives: provide accurate market price data for the execution of complex financial contracts.

Insurance contracts: automatically process claims based on real-time environmental or other external data.

Cross-chain interaction: enables Merlin Chain to receive and respond to events occurring in other blockchains.

In short, Merlin Chain's decentralized oracle greatly expands the application areas of blockchain technology and enhances the functionality and practicality of smart contracts by providing a reliable, secure and decentralized way to integrate external data. This not only enhances the attractiveness of the Merlin Chain platform, but also provides users with more possibilities and flexibility.

3.3 Compatible with Ethereum Virtual Machine (EVM)

Merlin Chain's compatibility with Ethereum Virtual Machine (EVM) means that it can execute smart contracts designed for Ethereum and allows developers to use Ethereum's development tools and languages (such as Solidity) to develop and deploy applications. This compatibility brings several important advantages to Merlin Chain, but also brings some challenges.

3.3.1 Advantages of EVM compatibility

Seamless migration and deployment: Developers can directly deploy smart contracts originally developed for Ethereum on Merlin Chain without major modifications. This reduces the learning cost and migration difficulty, allowing existing Ethereum developers to easily start working on Merlin Chain.

Utilize existing tools and libraries: Due to the popularity of EVM, there are a large number of tools and libraries developed around it, such as Truffle, Hardhat, OpenZeppelin, etc. Merlin Chain's EVM compatibility means that these tools and libraries can be used on its platform, further reducing development difficulty and improving efficiency.

Enhanced interoperability: EVM compatibility enables Merlin Chain to more easily integrate with other projects and services in the Ethereum ecosystem. This includes wallets, Oracle services, exchange interfaces, etc., which helps to improve user experience and application usability.

3.3.2 Technical Implementation

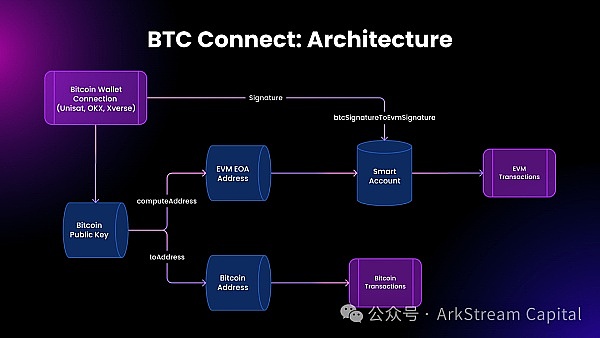

Merlin Chain achieves EVM compatibility mainly by embedding a complete EVM execution environment in its Layer 2 architecture. This means that in addition to processing Bitcoin-related operations, Merlin Chain can also run Ethereum bytecode and execute smart contracts that are exactly the same as Ethereum.

3.3.3 Application scenarios

DeFi applications: Because many popular decentralized finance (DeFi) projects were originally developed for Ethereum, Merlin Chain's EVM compatibility allows these applications to be quickly deployed on its platform, taking advantage of the higher efficiency and lower transaction costs provided by Merlin Chain.

NFT and games: Similarly, many NFT and blockchain games are also developed based on EVM. Merlin Chain can attract such application developers and provide a platform with more cost-effectiveness and better user experience.

3.3.4 Challenges and responses

Although EVM compatibility brings many benefits, there are also some challenges, such as performance optimization and security issues. Merlin Chain may need to implement specific optimization measures to improve efficiency while ensuring the security of the compatibility layer is not exploited by malicious smart contracts.

Overall, Merlin Chain’s Ethereum Virtual Machine-compatible strategy greatly enhances the attractiveness of its platform as a versatile blockchain solution that attracts developers and users. This strategy will not only help expand its ecosystem, but also promote the development of innovative applications.

4. Merlin Token

Merlin Chain introduces its native token $MERL, a key component designed to support the network’s governance, security, and overall ecosystem development.

The following is a detailed introduction to the $MERL token:

4.1 Overview of $MERL Token

Name and Standard: The name of the token is MERL, which complies with the BRC20 standard.

Total Supply: The total supply is 2.1 billion $MERL.

4.2 Functions of $MERL Tokens

Governance: $MERL holders can shape the future development of Merlin Chain by voting on major proposals.

Staking: Holders can stake $MERL to enhance the security of Merlin Chain and ensure the operational integrity and reliable performance of the network.

Paying network fees: $MERL can be used to pay transaction fees on Merlin Layer 3.

Token Holder Activity Participation: $MERL holders can actively participate in network operations by delegating to collectors or staking $MERL to run their own collectors.

Liquidity and Collateral: $MERL can be used as native liquidity and collateral within the ecosystem, supporting smooth trading and lending mechanisms.

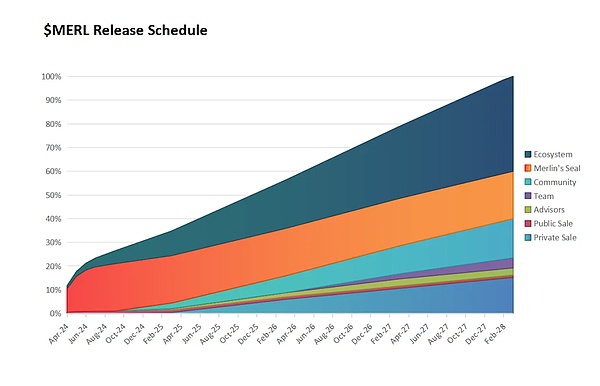

4.3 $MERL Token Distribution and Release Plan

Merlin's Seal: 20% of the $MERL supply will be airdropped to participants in the Merlin's Seal event.

Public Sale: 10% of the $MERL supply will be allocated through the public sale.

Private Sale: 15.23% of the supply will be allocated to private investors.

Advisors: 3% of the supply is allocated to advisors.

Team: 4.2% of the supply is allocated to the core team.

Community: 16.57% of the supply is used as rewards for supporting the community.

Ecosystem: 40% of the supply is allocated through ecosystem grants and incentives.

$MERL will be distributed over a four-year period according to the release schedule outlined below:

As of now, the token circulation is 245.7M MERL, accounting for 11.70% of the total circulation. 4.4 Listing plan of $MERL

$MERL plans to be listed on multiple exchanges, including OKX (deposit time: 10:00 UTC on April 17, 2024; trading time: 10:00 UTC on April 19, 2024; withdrawal time: 10:00 UTC on April 20, 2024), Hashkey Global (deposit time: 10:00 UTC on April 18, 2024; trading time: 10:00 UTC on April 19, 2024; withdrawal time: 10:00 UTC on April 20, 2024) UTC), Bybit, Bitget (trading time: April 19, 2024 10:00 UTC; withdrawal time: April 20, 2024 11:00 UTC), Gate.io, etc. The specific listing date and time have been clearly listed.

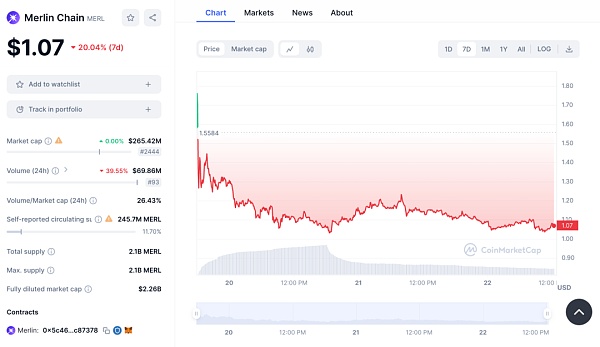

Token Performance

As of now, the price of $MERL token is $1.07, the token price has fallen by 20.04% in the past 7 days, the market value of the token is $265.42M, 24-hour trading volume: $69.86M, 24-hour trading volume/market value ratio: 26.43%.

The introduction of $MERL tokens provides Merlin Chain with a mechanism through which community members can directly participate in the governance and development of the network, while also providing an economic incentive to promote user and developer participation. These features and plans show that the Merlin Chain team is committed to building a healthy, active and decentralized ecosystem.

5. Ecosystem

The operating projects under its ecosystem include:

5.1 MerlinSwap

MerlinSwap is a decentralized exchange designed to support the ecosystem of Merlin chain. It uses discrete liquidity automated market makers to provide liquidity and swap services on Merlin chain cost-effectively and efficiently.

Discrete Liquidity Automated Market Maker (DL-AMM) is a technical model that allows liquidity providers to focus on specific price points and the most traded price ranges, ensuring that users benefit from lower slippage and accurate prices when exchanging tokens on MerlinSwap. DL-AMM also helps users input the specific number of tokens they want to exchange, thereby providing the services of an order book and an automated market maker (AMM).

5.2 MerlinStarter

MerlinStarter is the most important launch platform built on the Merlin chain ecosystem, supporting all Bitcoin second-layer projects. It provides technical support, marketing strategy, token economics consulting, human resources and startup funds.

In addition, MerlinStarter promotes fair launch on Merlin Chain. Fair launch is a token issuance model that takes into account inclusion and equal distribution when issuing tokens, so that everyone has an equal opportunity to purchase tokens on Merlin Chain.

Other features of MerlinStarter include the onboarding of multi-chain tokens to Merlin Chain, while issuing Merlin Chain native tokens to other chains. This supports the issuance of BRC-20, BRC-420, ERC-20, and ERC-404 assets.

5.3 Merlin Chain Testnet

The Merlin Chain Testnet is a trial interface for the platform. In order to browse the testnet, users will need to acquire assets such as BTC and BRC-20 tokens through Bitcoin faucets and connect their testnet wallets to Unisat or Bitget. Using the assets obtained from the faucet and connecting their wallets, they can switch from the BTC chain to Merlin Chain and transfer BRC-20 tokens equally between the and Bitcoin blockchains.

All assets used on the Merlin Chain Testnet are not real assets. They are strictly used to test the platform and therefore have no real value.

Merlin Chain plans to launch its mainnet by February 2024. Part of the plan includes launching its staking campaign and distributing governance tokens to participating users through a fair launch on the Particle network.

6. Team/Partners/Financing

6.1 Team

Merlin Chain is a subsidiary product line of Bitmap Tech (formerly RCSV), a top team with an overall market value of over US$500 million. The BRC-420 "Blue Box" series under Bitmap Tech has become one of the hottest Ordinals assets. The team has also previously developed BRC420 and Bitmap games.

6.2 Partners

Merlin Chain has partnered with Particles Network to use its account abstraction solution to enable easy switching between Bitcoin Layer 1 and Merlin Chain Layer 2.

Other platforms that Merlin Chain has partnered with include GeniiData, Bit Smiley, and Stakestone.

It is worth mentioning that Merlin Chain's recent partners are Tron Network and OKX.

Merlin Chain is working with the Tron network to enhance interoperability between Bitcoin and the Tron network. In addition, this will enable cross-chain accessibility and functionality, thereby expanding its use cases. The main goal of this collaboration is to initiate interaction between the Tron network and the Bitcoin ecosystem. It is also seen as a way to expand the utility of Tron on the Bitcoin blockchain while combining the strengths of the Tron network and Merlin Chain. In essence, interoperability between the two blockchains will allow users to explore a wide range of financial services in the blockchain space through seamless interaction with Merlin Chain.

MerlinChain and OKX have partnered to integrate the OKX wallet with MerlinChain. This is to facilitate easy connection to the protocol using the OKX Web extension. Users will need to download the OKX wallet web extension, create a new OKX wallet or add an existing wallet, and then use the web extension to connect their OKX wallet to Merlin Chain.

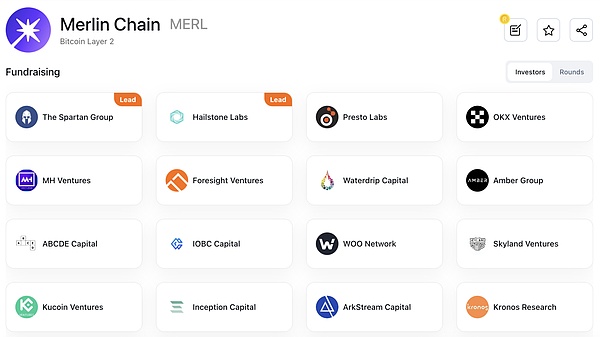

6.3 Financing

Merlin Chain has successfully obtained financing from 24 outstanding investors, including well-known investors such as OKX Ventures, ABCDE, Foresight Ventures and Arkstream Capital. Although the specific amount has not been disclosed, this financial support marks an important milestone for Merlin Chain on the road to enhancing the scalability and practicality of Bitcoin.

7. Project Evaluation

7.1 Track Analysis

Merlin Chain is mainly a blockchain Layer 2 solution project in the DeFi (decentralized finance) track, focusing on enhancing the functionality and efficiency of Bitcoin by building a second-layer platform on top of the Bitcoin network.

Projects similar to Merlin Chain include:

Lightning Network (Bitcoin's Layer 2 payment protocol; implements fast micropayment channels and reduces the load on the chain by establishing a payment channel network.)

Difference: Mainly used for payments and small transactions, without the smart contract function provided by Merlin Chain.

Liquid Network: (Bitcoin's sidechain solution, providing exchanges, brokers, and markets with fast and secure Bitcoin transaction channels.)

Difference: As a sidechain, Liquid Network supports the issuance and trading of assets, but it relies on the structure of the alliance chain, which is different from the decentralized characteristics of Merlin Chain.

7.2 Project Advantages

Improving Bitcoin's Functionality:Merlin Chain significantly expands Bitcoin's functionality by providing smart contract support and faster transaction confirmation times, allowing it to support complex financial products and services that the Bitcoin network itself does not have.

Low-cost and efficient transaction processing:Through ZK-Rollups technology, Merlin Chain achieves high-throughput transaction processing while significantly reducing transaction costs, which is particularly important for DeFi and other applications that require high-frequency transactions.

Cross-chain interoperability:Merlin Chain's oracle and EVM compatibility enable it to interoperate with other blockchain systems, such as Ethereum and other chains using EVM, which increases its applicability and flexibility in the entire blockchain ecosystem.

Security and decentralization:Although Merlin Chain achieves efficient transaction processing in its Layer 2 solution, it still maintains the decentralized and secure characteristics of the Bitcoin network, because all transactions will eventually be confirmed and stored on the Bitcoin main chain.

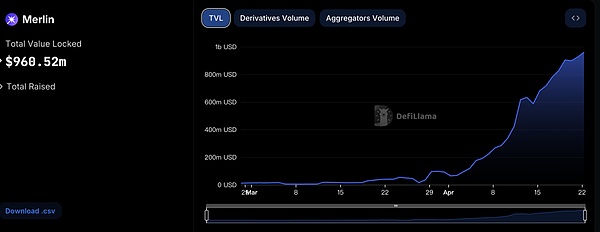

High total value locked (TVL):Currently, Merlin Chain's TVL is $960.52 million. TVL is an important indicator for measuring the liquidity of DeFi projects, indicating the total value of assets deposited in the project by all users. The TVL of the Merlin project is close to $100 million, which is a relatively healthy indicator, showing that the project is able to attract and retain a large amount of capital.

7.3 Project Disadvantages

Although Merlin Chain has brought many technological innovations and advantages, like all blockchain projects, it also faces some potential disadvantages and challenges. The following are some of the shortcomings that the Merlin Chain project may have:

Technical Complexity: Because Merlin Chain integrates multiple technologies (such as ZK-Rollups, decentralized oracles, EVM compatibility), the maintenance and upgrade of its system may be complex. This requires a high-level technical support team to ensure the stable operation and timely updates of the platform.

Security Risks:Although technologies such as ZK-Rollups can provide good security in theory, they may encounter unforeseen security issues in practical applications. In particular, the application of these technologies on Bitcoin is relatively new and may have vulnerabilities that have not yet been discovered.

User Adoption and Network Effects:Merlin Chain's current success depends largely on sufficient user and developer adoption. Due to fierce competition, users may choose other platforms for various reasons (such as better user experience, lower fees, and wider application support).

Competitive Pressure:Facing competition from other Layer 2 solutions: There are already multiple mature Layer 2 solutions on the market, such as Polygon, Optimism, Arbitrum, etc., which provide similar or more advanced functions and have established a strong market position and community support.

Legal and Regulatory Uncertainty:As an innovative blockchain project, Merlin Chain may face changing legal and regulatory environments in different countries and regions. Regulatory uncertainty may affect the development of the project, especially when it comes to cross-border transactions and smart contract applications.

Technical Dependency:Dependence on Ethereum Technology: Although Merlin Chain aims to add functionality to the Bitcoin network, many of its innovations (such as EVM compatibility) actually rely on Ethereum technology. This reliance may limit Merlin Chain's ability to innovate completely independently.

Despite these potential shortcomings and challenges, Merlin Chain's unique positioning and technological innovation provide it with an opportunity to win a place. The project team needs to continue to optimize the technical architecture and improve the user experience, while actively responding to legal and regulatory changes to promote the long-term development of the project.

8. Project Summary

In summary, Merlin Chain will redefine Bitcoin's ecosystem through its Layer 2 solution, paving the way for unprecedented usage and interaction with Bitcoin's Layer1 assets. With the implementation of ZK-Rollup technology and a firm commitment to Bitcoin's native principles, Merlin Chain is expanding Bitcoin's capabilities in scalability and utility. It is committed to supporting the core Bitcoin protocol and is expected to introduce a new era of efficiency, security, and innovation, making the Bitcoin network more versatile and user-friendly.

ZK Stack, dedicated vs. general-purpose ZK: Which one is the future? Golden Finance, the line between dedicated and general-purpose ZK is blurring.

JinseFinance

JinseFinanceMany people still confuse FHE with ZK and MPC encryption technologies, so this article will compare these three technologies in detail.

JinseFinance

JinseFinanceSolana’s “Actions and Blinks” simplify transactions and voting operations through browser extensions, while Farcaster on Ethereum enhances social network interoperability and user data privacy protection through decentralized protocols.

JinseFinance

JinseFinanceSymbiotic and Karak are making waves in the Ethereum restaking market, competing with pioneer EigenLayer.

JinseFinance

JinseFinance JinseFinance

JinseFinanceTesla CEO Elon Musk and Meta CEO Mark Zuckerberg have agreed to a cage fight- but their feud goes far beyond that.

Clement

ClementThe DeFi space continues to bring up disruptive innovations that cut across different industries and economies. The internet community has ...

Bitcoinist

BitcoinistWhen crypto bull market profits dry up, the best way to keep gains coming is by using leverage to open ...

Bitcoinist

BitcoinistOptimism and Arbitrum are two of the largest Layer 2 (L2) solutions utilizing Optimistic rollup technology to scale the Ethereum network. This article will make a comprehensive comparison.

Cointelegraph

CointelegraphAt least three blockchain projects have publicly announced that their teams have opened their arms and are ready to accept any former developers who leave after the collapse of the Terra ecosystem.

Cointelegraph

Cointelegraph