Microsoft said in a filing with the U.S. Securities and Exchange Commission that its global finance team regularly evaluates multiple investment assets, including cryptocurrencies, for diversification and risk management.

Although Bitcoin has been considered in the past, the board has not made any further investment decisions due to factors such as volatility.

If the proposal is passed, Microsoft will become the largest publicly traded crypto investment company, surpassing MicroStrategy and Tesla.

Getting in

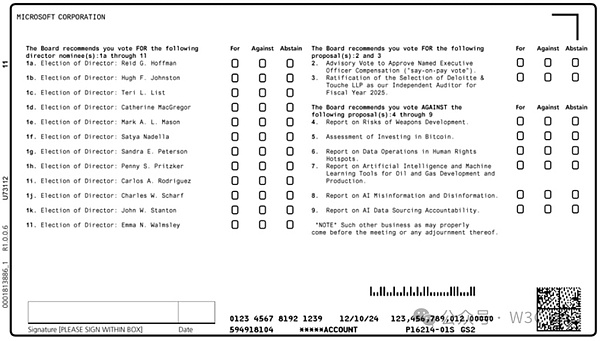

In a filing on October 24, Microsoft disclosed that it had proposed an "evaluation of investing in Bitcoin" to certain shareholders, who will vote at a meeting on December 10.

In response, MicroStrategy founder Michael Saylor posted on the X platform that if Microsoft CEO Satya Nadella wants to make another trillion dollars for Microsoft shareholders, please contact me.

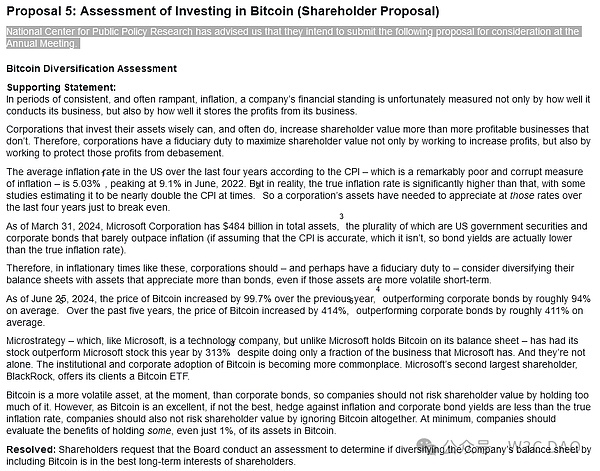

In addition, the National Center for Public Policy Research (NCPPR) promoted the proposal, which highlighted the Bitcoin investment strategy of business intelligence company MicroStrategy, noting that although the company's business accounts for only a small part of Microsoft, it has outperformed Microsoft by more than 300% this year.

The center also said that institutional and corporate adoption of Bitcoin is becoming more and more "common" through spot Bitcoin exchange-traded funds.

The research center noted that Bitcoin remains volatile but can serve as a hedge against inflation and corporate bond yields.

"At a minimum, companies should evaluate the benefits of holding a portion of their assets, even as little as 1%, in Bitcoin," it said.

Layout

While Microsoft's investment in Bitcoin is unlikely, it accepted Bitcoin payments in its Xbox online store between 2014 and 2018.

In addition, Microsoft has made extensive layouts in the field of blockchain:

Cloud Supply Chain: Microsoft's cloud supply chain blockchain project aims to improve the transparency, traceability and predictability of the supply chain through blockchain technology. The application of blockchain technology in the supply chain can ensure that the production and transportation records of each product are tamper-proof and traceable, thereby greatly reducing fraud and errors and improving the efficiency and reliability of the supply chain.

Project Bletchley: Microsoft launched an enterprise blockchain architecture called "Bletchley", which defines blockchain middleware and encryption technology (Cryptlets). The goal of the Bletchley project is to provide an open, modular blockchain platform for enterprises, governments and individuals.

Azure Blockchain Service: Microsoft's Azure Blockchain Service is a fully managed blockchain service designed to simplify blockchain development and management. Enterprises can use Azure Blockchain Service to quickly build, manage and scale blockchain networks without worrying about infrastructure and operation and maintenance issues.

Summary

In the future, Microsoft's entry into Bitcoin will have a far-reaching impact. On the one hand, it will greatly enhance the status of Bitcoin and other cryptocurrencies in the mainstream financial market, enhance market confidence, and attract more attention from large enterprises and institutional investors. Microsoft's entry as a technology giant will further promote the development of blockchain technology and its application in various industries.

In general, Microsoft's entry into Bitcoin will not only redefine the landscape of the cryptocurrency market, but also drive continuous innovation and development in the global technology and financial fields, opening up a future full of infinite possibilities.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance CryptoSlate

CryptoSlate Beincrypto

Beincrypto cryptopotato

cryptopotato Coindesk

Coindesk cryptopotato

cryptopotato Beincrypto

Beincrypto Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph