Source: Blockchain Knight

MicroStrategy purchased another 850 BTC in January, with a total value of approximately US$37.2 million.

Currently, the company has 190,000 BTC, with a total spend of $5.93 billion. Despite this, the company's total revenue fell 6% year over year.

A recent report highlighted that MicroStrategy’s success last year was due to its focus on the use of artificial intelligence in business intelligence strategies.

p>

The company said: “2023 is an extraordinary year for MicroStrategy. We have strategically raised funds, significantly increased our BTC holdings, and continued to innovate, including developing and launching MicroStrategy. Artificial Intelligence, this is our first AI-based business intelligence tool to market.”

In addition, MicroStrategy also claimed thatSince the end of September 2023, they have acquired a large number of BTC, while taking advantage of market fluctuations, keeping the average acquisition price lower than BTC’s current price.

“Since the end of the third quarter, 31,755 BTC have been acquired for $1.25 billion, or $39,411 per BTC.”

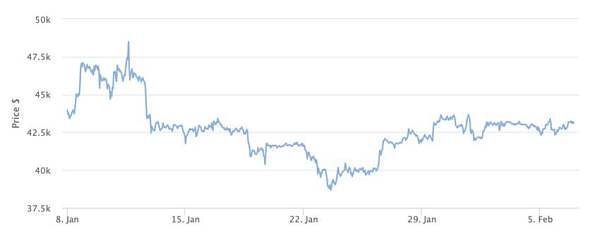

Meanwhile, as of press time, the price of BTC to $43,081. The average BTC price recorded by MicroStrategy is approximately 9% lower than today’s price.

p>

In December 2023, Saylor claimed that the spot BTC ETF recently approved by the SEC (U.S. Securities and Exchange Commission) surpassed most traditional financial developments in the past few decades.

“This may be the biggest development on Wall Street in the past 30 years, and there is truth to this statement.”

Recent reports indicate that Saylor has been exploring selling shares of MicroStrategy.

According to previous reports, on January 3, Saylor contacted regulators to exercise MicroStrategy’s stock options. Documents show he holds 315,000 shares worth about $216 million.

However, during the fourth quarter conference call, Saylor explained that he received 400,000 stock options in 2014.

Edmund

Edmund