Source: Liu Jiaolian

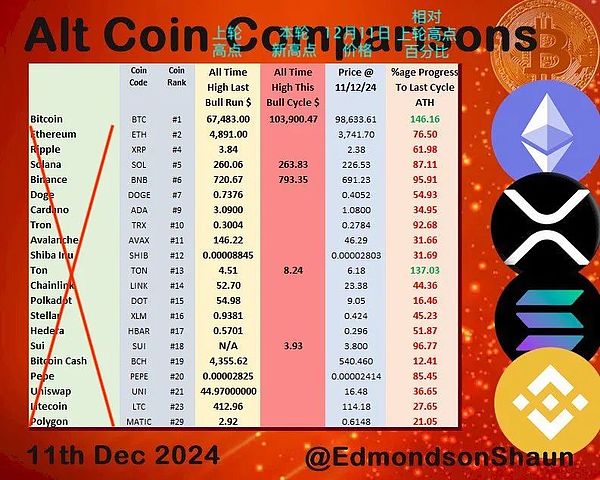

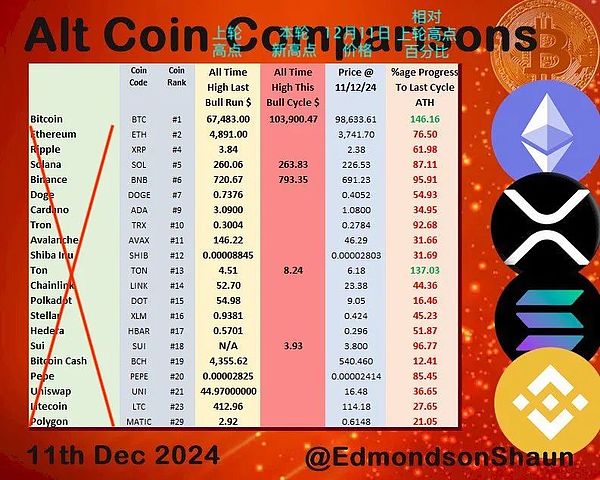

Overnight, BTC made another effort and reached $100,000 again. Some netizens found that the top 50 altcoins and meme coins that hit new highs in the last bull market, that is, in 2021-2022, did not outperform BTC in terms of market value.

If calculated based on BTC's $100,000, ETH should rise to more than $7,000 and UNI should rise to $70, but they are currently only advancing to around $3,800 and $17.

Therefore, the yield rate of Jiaolian's various positions exposed the "overdoing" of the last round of layout of altcoins: BTC 495.6%, UNI 55%, ETH 48.6%.

If calculated based on the increase of BTC relative to the previous high, the yields of UNI and ETH should reach 538% and 174% respectively.

Ideals are full, but reality is skinny.

In each round, countless newbies enter the market, all of them are fearless, eager to try, always thinking that they can easily beat the market and outperform BTC. Take out real money and play around, and you will know how much you are worth.

You think it is worthless. Can you do it continuously? It is worth a thousand gold.

Secondary market investment often hones an important quality of a person: honesty.

Be honest with yourself. Know your own weight. Honestly admit that your level is average.

Know what you know, and know what you don’t know. This is knowledge. In English, it is called intellectual honesty.

The rate of return on a position is often proportional to your honesty.

The more honest you are, the higher the rate of return.

The more arrogant you are, the faster you lose your position.

Jiaolian has seen many arrogant and conceited people, but none of them can survive the bull and bear markets.

Only by being honest can one be cautious. Only by being cautious at the beginning can one be cautious at the end.

It is often only in retrospect that we realize the importance of "risk control" beforehand. Jiaolian's risk control at the beginning had the following points:

First, hoard BTC first. Only when the BTC position building target is achieved can the excess funds be allocated to other products.

Second, the BTC position is the ballast stone, and it is not allowed to sell BTC in exchange for other assets under any circumstances.

Third, the proportion of a single altcoin position should be controlled within 10% of the BTC position.

The opposite of risk control is of course that the contribution of altcoin revenue to the overall rate of return is reduced. So that even if you encounter a good market, it is just a drop in the bucket for the whole plate.

This tells us a truth of life: there is no corresponding price for any profitable thing.

Many times, when you see a good thing, don't rush to jump into the pit. Please think about what the price is first.

A good thing without a price must be a trap.

If you can't bear the cost of risk, you are powerless. And if you don't know the cost of risk, you are stupid.

Whether it is powerlessness or stupidity, it is a stumbling block that hinders our success.

The solution to powerlessness is hard work. The solution to stupidity is learning.

Work hard to make money, study hard, guard against arrogance and impetuosity, and don't be greedy or lazy, then everyone can succeed.

Kikyo

Kikyo