What is AOVM?

AOVM is an AI layer protocol built on top of @aoTheComputer, combining AO's hyper-parallelism with AI large models.

JinseFinance

JinseFinance

Source: Web3 Insights

DePIN is a decentralized application designed to use tokens Rewards to incentivize individual collaborative efforts in building connected, real-world physical infrastructure. DePIN, which stands for “Decentralized Physical Infrastructure Network,” uses blockchain technology to unite millions of participants to create and oversee trustless and permissionless infrastructure driven by programming.

The comprehensive ecosystem covers various fields, including cloud networks such as VPN, CDN, file storage, and databases, as well as wireless technologies such as 5G, IoT, sensor networks, and energy networks.

DePIN has a simple yet compelling selling point. By providing Web3 incentives, these networks effectively facilitate the collaborative development and management of critical infrastructure. As such, they are expected to outperform centralized infrastructure in terms of efficiency, resiliency, and performance. At its core, DePIN holds the potential to bring significant and positive shifts to the real-world infrastructure landscape.

In order to systematically organize a comprehensive DePIN ecosystem, we propose to divide the entire market into 6 different market segments.

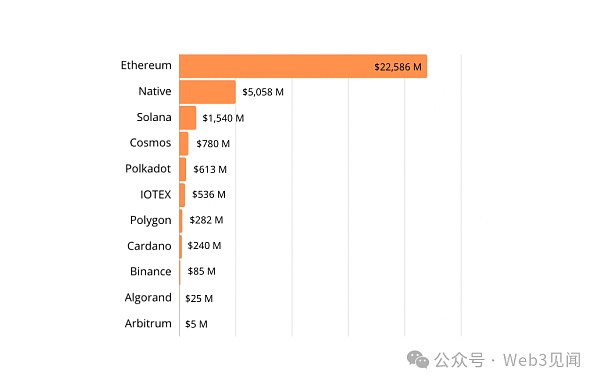

The market accommodates more than 675 DePINs, with a total market value of more than $35 billion. Total revenue exceeded $19 million, according to on-chain annual recurring revenue (ARR).

The majority of DePIN’s share is built on the Ethereum blockchain. Considering the rapid development of the entire Ethereum ecosystem, it is expected that new DePIN projects will emerge in 2024. Proprietary native platforms make up the second largest market capitalization, including Bittensor, IOTA, Sia, and others, as expected in this context.

Computing Market:

A physical infrastructure network involving nodes and the individuals who manage those nodes contribute computing resources, such as storage or processing power, and are responsible for their contributions and receive compensation.

The computing market represents the most mature and successful DePIN business model. The storage network needs increased demand, the compute network needs additional provision, and the retrieval network needs increased density to compete effectively with web2.

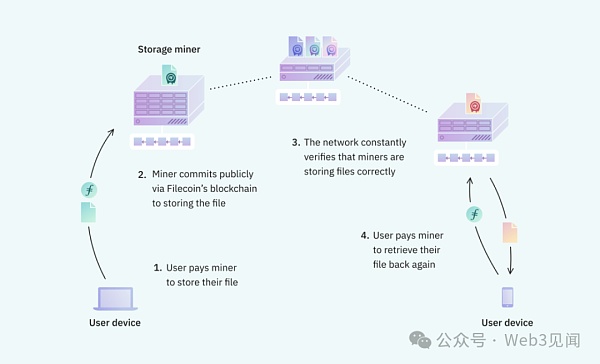

Filecoin

Filecoin is an early and well-known decentralized peer-to-peer infrastructure network (DePIN) protocol that pioneered an ICO in 2017. As a decentralized file storage network, it enables users to share their unused computer storage and earn $FIL. Storage providers receive $FIL for users storing files in their available space. The decentralized nature ensures market-driven pricing.

Filecoin has already found use cases including data backup for the Internet Archive and support for multiple formats in applications such as Audius and Huddle01. It is worth noting that major decentralized exchange SushiSwap has integrated with Filecoin, which may affect the data management of decentralized exchanges.

Operational metrics include: TVL — $1.02 million, Core Developers (30-day average) — 44, Revenue (30-day) — $228,450.

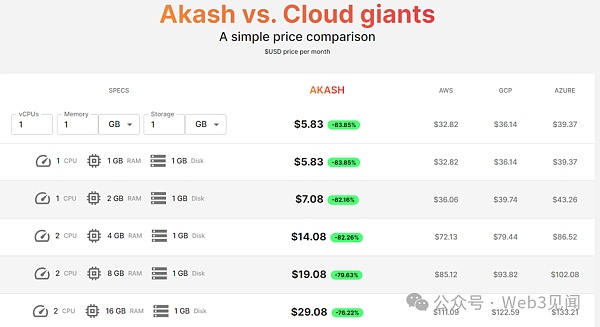

Akash Network

Introducing Akash Network, a decentralized cloud computing marketplace connecting providers and customers. Widely recognized but often misunderstood, cloud computing solves the problem of excess computing resources at major Web2 companies like Google and Amazon. These technology giants began to sell excess capacity and dominate the cloud market.

Developers purchase fixed hosting space, leaving a large portion unused. Akash steps in to leverage underutilized global data centers to deliver cost-effective cloud computing without the need for new infrastructure.

Akash’s efficiency has attracted blockchain validators, with platforms such as Osmosis and Avalanche using its services. Users can choose from a variety of providers, reducing dependence on tech giants and reducing the risk of single points of failure.

Operational metrics include: Trading Volume — Over $11M, Bond Tokens — 60.7% / $137.16M, AKASH Community Pool — Over $9.5M.

Wireless coverage: Initiatives in this area provide wireless network services using protocols such as 5G, Wi-Fi, Bluetooth or LoRa. Each sector in decentralized wireless (DeWi) operates according to different economic principles. While the mobile industry dominates in terms of monetary value, fixed internet and WiFi lead in terms of usage (measured in gigabytes and number of users).

Crypto mobile virtual network operators (MVNOs) leverage tokens to revolutionize the traditional wireless economic model. MVNOs acquire and manage customer relationships and provide compensation to traditional telecommunications companies (MNOs) for wholesale network access.

Helium

As a leading protocol in the DePIN space, Helium focuses on IoT device connectivity. Initially centered around decentralized IoT connectivity, Helium expanded in 2019 with the introduction of the Helium hotspot cellular network. Users can contribute to citywide wireless connectivity and earn the native token $HNT by installing a device in their home or office.

Helium’s diverse expansion includes moving from networking IoT devices to cellular networks and now building 5G networks. This expansion provides individuals with the opportunity to mine $MOBILE tokens by operating 5G nodes and contributing to the Helium 5G mobile network.

Operational metrics include: Active Hotspots — over 8,500, Onboarding Fees — over $220,000.

WiFi Map

WiFi, a popular global connection protocol with billions of daily active users (DAU), is experiencing In a notable event, WiFi Map distributed $WIFI tokens to 225,000 contributors in 190 countries.

The platform has over 2 million monthly active contributors and 5 million monthly active users, generating $1 million in annual on-chain revenue through products such as eSIM packages and VPNs Recurring Revenue (ARR).

AI Wholesale Data:

The convergence of AI and cryptocurrencies provides an alternative exit strategy for the DePIN sensor/data network. These networks can now leverage valuable data sets through intelligence mining or participation in data computing markets, rather than competing directly with upstreams.

Council: https://www.chainml.net/

Council is an open source framework for working with agent teams in Python (soon Quickly develop custom generative AI applications in Rust. It extends the ecosystem of large language model (LLM) tools to provide advanced control for AI agents. Users can create complex agents with predictable behavior through the Council's features such as controllers, filters, evaluators, and budgets.

The framework connects seamlessly to a variety of large language models (LLMs) and integrates with popular libraries such as LangChain and LlamaIndex. Council’s goal is to simplify packaging and deployment of agents at scale across multiple platforms, with future releases focusing on enterprise-grade monitoring and advanced quality control.

Bittensor: https://bittensor.com/

Bittensor is a decentralized network connecting global machine learning models. Each "neuron" represents a model owned by individuals around the world, collaboratively processing information, similar to the cooperative nature of neurons in the human brain.

The network uses a unique blockchain architecture built on the Substrate framework, the same technology that powers Polkadot. Substrate’s modular design enables Bittensor to tailor its blockchain for decentralized machine learning.

Bittensor utilizes a Proof-of-Stake (PoS) consensus mechanism, unlike traditional Proof-of-Work (PoW) networks such as Bitcoin. PoS selects validators based on the tokens they hold and the tokens used as collateral, providing a more energy-efficient alternative.

Operational metrics include: total accounts - over 82,000, staked supply - 89.52%, active validators - over 45, active miners - over 1,000.

Service Marketplace

Horizontal services marketplace leverages cryptocurrency incentives to acquire top global talent. These marketplaces, whether relying on human or agent-based services, excel in two key areas: 1) attracting and retaining great talent, and 2) effectively aligning supply with demand.

Vertical service markets are reshaping the gig economy built on web2 platforms like Uber and Doordash. Unlike its predecessors, which permanently captured economic value from the local economy, the web3 platform empowers local operators by restoring ownership and control.

In 24-25, on-chain security services are expected to be the clear winner. During the last crypto cycle, Certik set the precedent for what could be achieved in an on-chain security services market of $10 billion or more.

Sensor networks play a key role in restoring user ownership and control of data. We are surrounded by devices that are constantly generating data. Sensor networks collect a variety of data from nodes (machines that can collect and process information), from traffic conditions to weather and local street imagery.

dimo:https://dimo.zone/

DIMO is a project that collects telemetry data from hardware devices connected to vehicles. Any node with the necessary hardware and software can join the network and collect information such as fuel consumption and vehicle speed. This data can then be purchased by industries such as automakers and insurance companies. For example, mobility data can provide insights into vehicle diagnostics, battery health and maintenance. Drivers who transmit data will be rewarded with $DIMO, the network’s native token.

Operational metrics include: Connected vehicles — more than 39,000; value of all vehicles on DIMO — more than $1 billion.

Hivemapper

Hivemapper aims to create a decentralized map network, similar to a decentralized Google Maps. Users purchase dash cams to map streets while driving, and the uploaded images are converted into map data on the Solana blockchain. Drivers will be rewarded with $HONEY tokens. While $HONEY has the potential to appreciate given Solana's performance, the $299 cost of the dash cam may limit global adoption, especially in developing economies.

Operational indicators include : Total mapped kilometers – over 116 million, total transactions – over 13 million, total contributors – over 41,000, regions – over 2,100.

Energy Networks

DePIN is expected to have a significant impact on traditional industries such as telecommunications and energy that are characterized by oligopolistic market structures. In the energy sector, the dominant model involves centralized power plants, often relying on fossil fuels. Energy DePIN disrupts this status quo by decentralizing the energy production process, incentivizing individuals to contribute resources to the network. Incorporating smart contracts into network governance eliminates intermediaries and creates a direct connection between producers and consumers in the energy market.

Entheos: https://www.entheos.network/

Entheos enables solar and wind energy operators to fully utilize their untapped battery capacity. A key component of our go-to-market strategy is a proprietary battery management system that significantly extends battery life by more than two times through efficient utilization of individual cells.

Glowgreen: https://glowlabs.org/

Glowgreen is an on-chain permanent capital tool designed to incentivize green energy production. The solar farm allocates 100% of its electricity revenue to the Glow Treasury, actively participating in the mining of $GLW. Miners compete to fix GLW emissions, with computing power tied to the generation of carbon credits. This structure creates a self-reinforcing incentive to generate carbon credits where solar projects might not be practical.

Venture capital and investment are key drivers in most markets, driving the exponential growth of mature startups and facilitating the emergence of innovative ideas and developments within the market.

Right DePIn's examination of the venture capital market shows that the largest projects have accumulated around $1 billion in funding. The average total investment size of a single project in this data set is $81.6 million. By comparison, during the last market cycle focused on DeFi, the corresponding metric was $174.7 million. This discrepancy could mean that DePIn is currently viewed by investors as a less compelling narrative, or that its time has not yet come.

By The VCs who have made multiple investments in DePIN projects but have always supported the DePin initiative are easily identifiable, indicating a clear trend. Notable among these active funds are industry leaders such as HashKey, Coinbase Ventures, a16z and others.

The grant program can be a great incentive for co-founders, developers and funders of emerging projects to enhance existing products or develop new ones. The DePin Marketplace has followed suit, launching a number of substantive initiatives specifically dedicated to promoting the growth of the DePin product ecosystem.

IoTeX offers a diverse range of development grants, including funding for the dePIN incubator of up to 20,000 USDT. This specialized layer supports innovative projects leveraging real-world data and meets the needs of mature teams launching DePIN projects or integrating data into existing products. The incubator provides IoTeX’s financial support and technical expertise to realize breakthrough ideas. Individual developers can also receive 2,000 USDT in funding to conduct a simple dePIN proof-of-concept.

Peaq recently (November 2023) launched the dePIN Grants Program through the Peaq Foundation’s Peaq Ecosystem Grants Program. The program is backed by entities such as Cypher Capital and HashKey Capital, which provide financial support for research and development within the Peak ecosystem. In the near future, the community will participate in voting to select funding recipients. Eligible projects include DePIN, dApps, Layer-2 applications, and plans to support dApp builders, users, and Layer-2 applications on the Peak Network.

The DIMO Ignite Grants Program serves as a catalyst for the DIMO ecosystem, promoting dePIN research through open funding programs. Evaluation criteria include:

Transparent use of funds: Grantees must provide clear execution plans and exit criteria.

Ability to Execute: Grantees are required to demonstrate their qualifications and a feasible plan for project completion.

Impact: Projects should have a measurable impact on the DIMO protocol and ecosystem, providing lasting value beyond the funding period.

The DePin market is actively developing and is characterized by new developers, projects and subsequent emerging interests. A massive influx in the basic market. We recommend researching various potential niches that have the potential to take a leading position in the DePin market.

Ator Network leverages the $ATOR token and plans to fork Tor in 2024 by introducing hardware relays and providing token incentives to node operators . As the number of nodes on the network continues to increase, developers have the opportunity to create high-performance privacy-focused applications (onion services) on the ATOR platform. Mining $ATOR has the potential to become a compelling consumer use case for DePIN: users can secure their home internet traffic by purchasing a WiFi router, and earn tokens in the process. Other notable privacy DePins making significant progress include 0KnowledgeNetwork, Hopr, Session, AeroNyx, and NYM.

Web3 provides an advantage against Web2 vampire attacks as developers create user-aligned versions of popular web2 applications on enhanced ZK infrastructure. Lucrative opportunity. In these attacks, protocols offer token incentives to attract rival user bases. Unlike traditional attacks that are limited to on-chain data, ZK TLS enables verifiable off-chain data for the first time with the support of advanced cryptography. This introduces a new primitive, since in addition to capital and labor, DePIN can also be bootstrapped by reputation.

ZK-verifiable GPU clouds are expected to be launched within the next 1-2 years, ushering in an on-chain inference economy that centralized providers will find difficult to adapt to. The high cost of inferring large language models (LLMs) drives hosting providers to prefer smaller, more economical models. This creates challenges for smart contract developers looking to integrate artificial intelligence into on-chain logic. While ZK verification can confirm whether a specific model is used for inference, the current implementation increases transaction costs by 75x. Reducing these overheads is critical to unlocking the potential of on-chain AI.

To learn more about the implementation of zero-knowledge (ZK) technology in machine learning, please see our previous article: "Data Transfer and the revolution of verification: ZK + ML”

The DePIN market is promising, with a continued number of projects, developers, investors and emerging initiatives increase.

2023, DePIN has seen the growth of more than 600,000 nodes across wireless, computing and sensor networks. In addition to the nodes highlighted in this diagram, many emerging DePINs contained 100 to 500 nodes throughout the year, demonstrating rapid scaling as they transitioned into 2024.

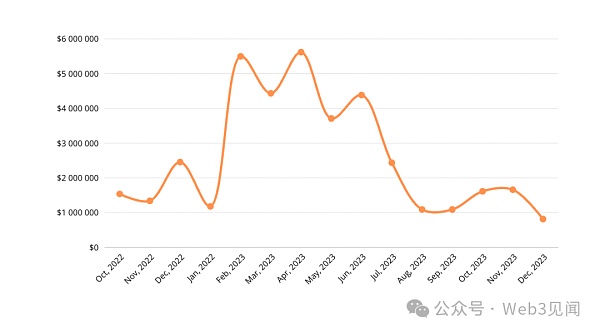

However, when examining the progress of DePIN on-chain revenue in 2023 to gauge market dynamics, it is clear that after the peak of activity and popularity in March and April 2023, revenue subsequently decline.

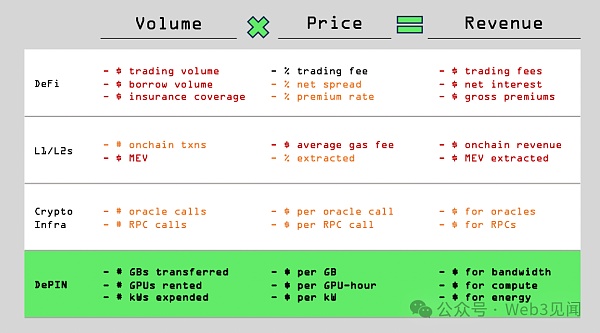

On-chain income Refers to users purchasing and securing/burning tokens in exchange for products, services or goods. Revenue declines may result from lower volumes or lower prices. But it's worth noting that this decline relies less on market speculation. This is because the revenue generation mechanisms for most DePINs are different from those in the DeFi, L1/L2 and Infra space.

Red represents components that are directly affected by the cryptocurrency speculation cycle, yellow represents components that are less correlated with the cryptocurrency speculation cycle, and black represents components that are uncorrelated.

Assuming that there is no significant correlation with DePIN’s revenue in the cryptocurrency speculation cycle, we can assume that the main challenge in DePin’s narrative is mass adoption and the emergence of new groundbreaking projects looking to integrate, thus driving the overall market development.

AOVM is an AI layer protocol built on top of @aoTheComputer, combining AO's hyper-parallelism with AI large models.

JinseFinance

JinseFinanceIn the core mechanism of Arweave, there is a very important concept and component, which is the storage fund Endowment.

JinseFinance

JinseFinanceAs a decentralized physical infrastructure, DePin makes it easier to obtain funds and growth through the token economy model, but most DePin projects are not very "decentralized." Investors may end up finding that what they invest in looks more like Internet companies.

JinseFinance

JinseFinanceAs a product of its times, Dogecoin has its own set of problems. DogeLayer is here to fix just that.

Max Ng

Max NgNothing quite as scary as as innocent NFT holders unknowingly acquiring "money laundering tools.", and Tte platform's forensics data-driven approach protects holders from exactly that.

Brian

Brian JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Cointelegraph

Cointelegraph