Author: BREAD, Translation: Golden Finance xiaozou

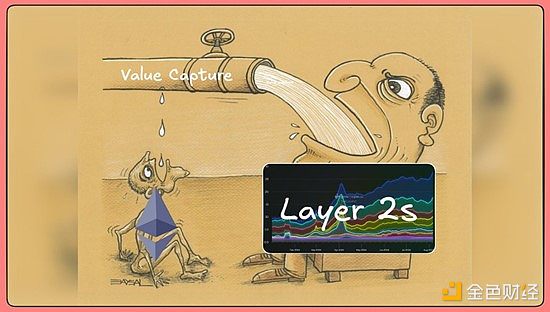

It is crucial that Ethereum abandons its ultra-robust money narrative - I'm not sure if this is a good thing or a bad thing.

Why do I say this? Because now that users have migrated from the mainnet, it is unlikely that we will see L2 regain the ETH burning levels before the Dencun upgrade (March 24).

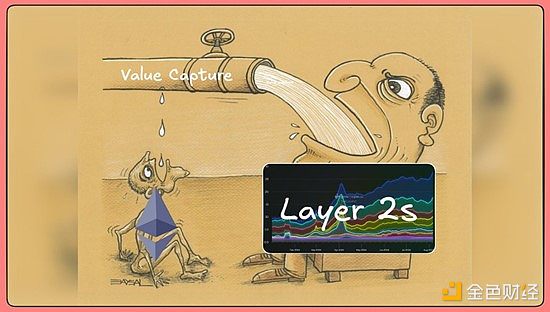

L2 is:

Getting execution rewards

Owning user relationships

Scaling throughput while keeping relatively fixed Ethereum costs (in the case of Alt-DA)

1、The world we envision

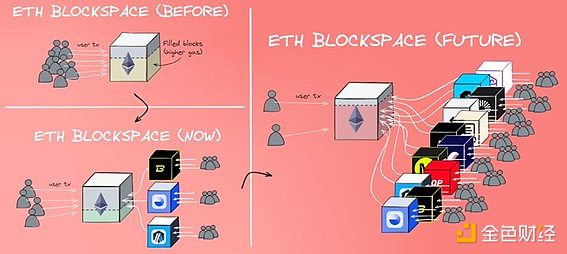

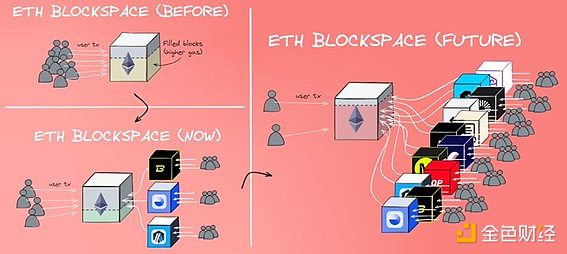

The modular roadmap has always had a major problem with user migration, and when on-chain participants migrate to one or a few of their favorite L2 solutions, activity on the mainnet will drop. This is expected.

Over time, the user flow will basically look like this:

Activity will decline, with a small number of users scattered across several early L2s, mainnet, and Alt-L1s.

Then a large number of L2s will stimulate a surge in activity, and these L2s will be extremely active and actively compete for block space.

Demand for ETH block space (from users who are less cost-sensitive, i.e. L2s), burn levels are restored, and the Ethereum ecosystem has both maintained its ultrasonic currency narrative (ETH deflation) and attracted large-scale users through scalable L2s. Great!

However, things are different after the Dencun upgrade.

2What we are seeing

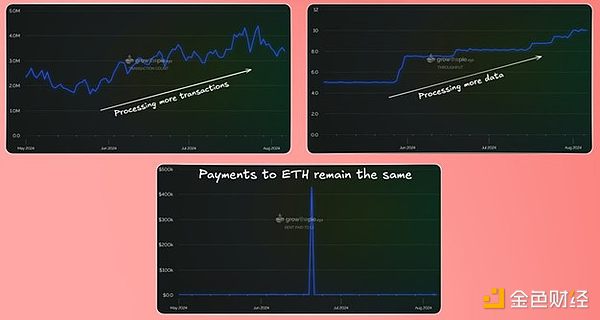

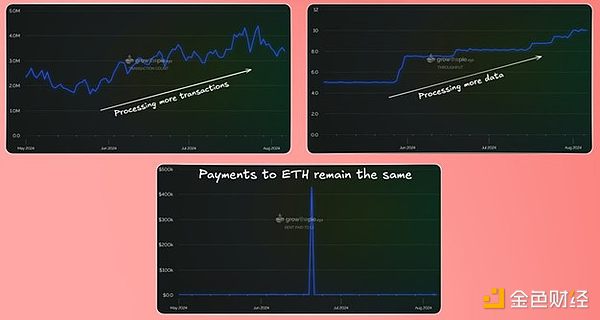

Since the introduction of the blobspace mechanism, L2 can significantly reduce transaction costs, we are witnessing the formation of another trend: L2s are swallowing more and more transactions and throughput, while keeping Ethereum costs relatively stable.

Here are the Base metrics for the past 90 days:

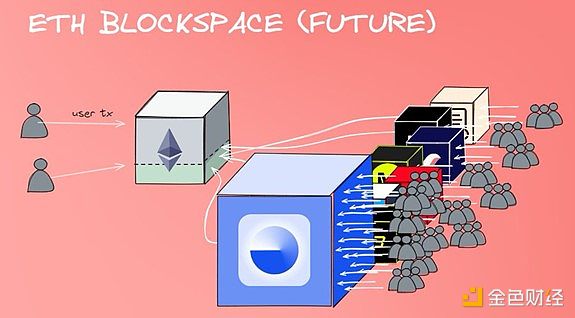

What happens when the L2 ecosystem grows infinitely without additional ETH overhead? They devour other L2 users, and no additional ETH is burned. They are like black holes, absorbing users within the Ethereum ecosystem.

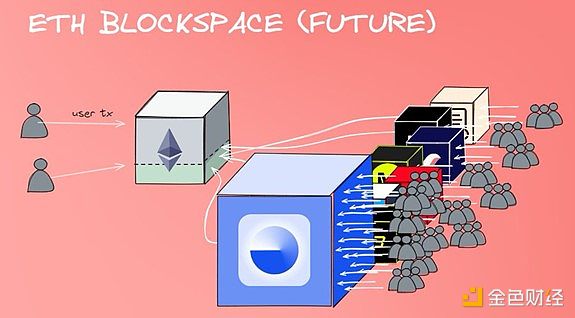

This means you will (most likely) end up with something like this:

Exponential laws take effect, the dominant L2 absorbs a disproportionate amount of users, and Ethereum remains underutilized because the cost of paying into Ethereum remains relatively constant despite user growth.

This is why I think it’s time to abandon the ultra-sound money narrative: because it probably won’t be a determining factor for a very, very long time (especially measured in crypto timescales).

I don’t think it’s a bad thing either. If you want ETH to be money, then now that it’s a settlement and security chain, not a user chain, inflation is not a bad thing, it will help spread quickly across all these ecosystems.

Making it (artificially) scarce will compromise some of those properties (see Bitcoin). It's a great narrative and it really matters.

3Other Thoughts

Note that these are all about the ultra-robust narrative, not the outlook for the asset itself, and I'm still bullish on the Ethereum asset.

I think the core devs would be better off continuing to push the modularity roadmap rather than going back to L1 scaling entirely. They should have tried scaling L1 earlier before giving in to L2, but now user education and the further benefits the L2 economy gets from it outweigh the benefits of L1 scaling.

Make some optimizations (e.g. block times) to reduce unnecessary complexity like pre-confirmations, but be sure to stick to it.

The importance of ETFs to ETH cannot be overstated. They are structural game changers, and all the current conversations will be irrelevant to them in the next few years.

Ironically, the abuse of L2 for ETH is bullish? If I were a corporate entity looking to make money from my user base, Coinbase has laid out the perfect blueprint for me. So that means I am still in the Ethereum ecosystem, continuing to expand the narrative, but not buying into it. Not sure which side of the pendulum is more important.

JinseFinance

JinseFinance