If you observe carefully, you can find that there are many crypto exchange shops scattered on the streets of Hong Kong.

In the store, users can freely exchange between cash and cryptocurrency without KYC - no questions asked, according to According to on-site visits, last year a single exchange shop could exchange up to 1 million Hong Kong dollars at a time, and the exchange party only needed to reserve a phone number or email address. Compared with the high handling fees of Hong Kong Digital Exchange, the exchange rate of exchange shops is undoubtedly more cost-effective and convenient. From a certain perspective, this reflects the characteristics of Hong Kong’s financial freedom, but it also triggers concerns among some industry insiders about anti-money laundering.

Just recently, the good times have been short-lived and freedom has been curbed. Hong Kong announced that it plans to promulgate new rules to ban over-the-counter OTC exchanges, and the above-mentioned companies are very likely to face the challenge of business restrictions or even liquidation due to imminent supervision.

The concept of OTC is not unfamiliar to people in the industry. As the name suggests, any place that independently matches transactions outside of conventional exchanges can be regarded as an over-the-counter exchange. . Generally speaking, encrypted OTC mainly covers three major carriers, namely online platforms focusing on social media matching, offline physical exchange shops and encrypted ATM machines.

According to preliminary on-site observation estimates by Hong Kong law enforcement agencies, there are approximately 200 physical virtual asset over-the-counter trading shops (including those operated by automated teller machines) in Hong Kong. Over-the-counter trading shops) are operating, and there are approximately 250 active virtual asset trading service providers on the Internet. According to a Chainalysis investigation, change shops are an important part of over-the-counter cryptocurrency trading, accounting for the majority of the $64 billion in digital assets flowing through Hong Kong as of June.

Looking closely at the reasons, OTC’s own anti-money laundering deficiencies, market disorder and lack of effective investor protection are the main reasons for this regulation, especially last year. In the intense JPEX and Hounax incidents, some cryptocurrency exchange shops became the promoters, and the false promotion platform has obtained a compliance license. Data shows that in the JPEX incident, investors lost US$180 million, while in the Hounax scam, 145 victims lost a total of US$18.9 million. As of now, most investors' funds have not been recovered.

(OTC) will be included in the supervision and will launch a consultation on the proposed regulatory framework in the short term. We hope that citizens and stakeholders will actively express their opinions. In the following days, on February 8, the Hong Kong government launched a public consultation on the legislative proposal to establish a licensing system for virtual asset over-the-counter trading service (OTC) providers. The consultation period ended on April 12.

According to the legislative proposal, Hong Kong plans to establish a licensing system under the customs department for online platforms and offline entities including ATM machines. Anyone who To engage in business related to any virtual asset spot trading services in Hong Kong, one must apply for a license from the Commissioner of Customs and Excise. Licensed virtual asset over-the-counter trading operators must comply with the anti-money laundering and counter-terrorist financing requirements and other regulations stipulated in the Anti-Money Laundering Ordinance. tube requirements. In short, cryptocurrency over-the-counter trading providers need to collect customer records and add staff to monitor improper trading behavior, and the previous KYC-free era has officially come to an end.

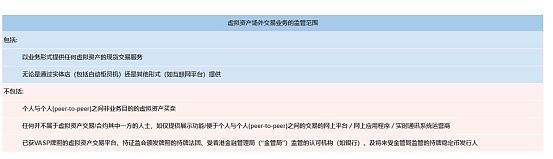

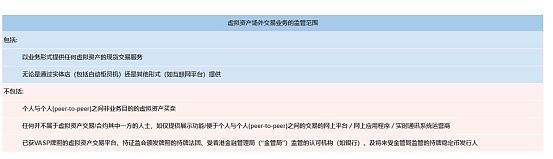

Supervision scope of virtual asset OTC trading business, source: Junhe

Secondly, the currencies that users can trade are also restricted. It is recommended that the services provided by virtual asset over-the-counter trading licensees can only cover transactions for retail investors on at least one virtual asset trading platform licensed by the China Securities Regulatory Commission. Tokens, as well as stablecoins issued by issuers licensed by the Hong Kong Monetary Authority (HKMA) following the implementation of the proposed stablecoin issuer licensing regime.

The proposal also clarifies the penalties for violating relevant regulations. Anyone who does not hold a license and engages in regulated over-the-counter virtual asset trading services will be subject to Once convicted through public prosecution procedures, the person may be fined NT$1 million and imprisoned for two years. In addition, if the licensee commits misconduct (such as breaching other regulatory requirements), administrative penalties may be imposed, including suspension or revocation of the license, reprimand, order to make corrections, and/or a fine (not exceeding $500,000).

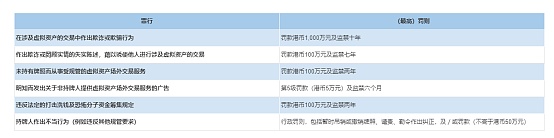

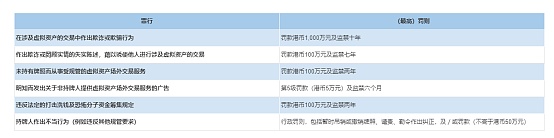

Proposed crimes and (maximum) penalties proposed under the "Virtual Assets OTC Consultation Document", source: Junhe

From a macro perspective, with the introduction of OTC virtual asset trading into the regulatory framework, coupled with the existing VATP license and securities-based virtual asset trading license system (No. 1 license upgrade ), a license to provide advice on securities-based virtual assets (upgraded to No. 4), a license to manage investment portfolios containing virtual assets (upgraded to No. 9), the China Securities Regulatory Commission’s guidance on tokenized securities business, and the upcoming stablecoin issuance The personal license system undoubtedly means that Hong Kong’s governance framework for the encryption field has gradually matured, forming a relatively complete regulatory mechanism that takes licenses as the starting point and covers both on-site and off-site.

On the other hand, the application deadline for licensed entity exchanges is also approaching, according to the Securities and Futures Commission’s mid-2023 According to the rulebook, licensed exchanges have until February 29 to obtain or apply for a license.

But when it comes to individuals, considering the differences in the impact of regulations, different subjects have different opinions.

Chengyi Ong, head of Asia-Pacific policy at Chainalysis, which tracks digital asset transactions, said the legislation comes as providers must manage crime, cybersecurity and other operational risks. The over-the-counter trading framework in the proposal "will lead to the integration and reorganization of existing institutions, the head effect will be enhanced, and the frequency of use of OTC platforms as an entrance to cryptocurrency will be greatly reduced."

Jason Chan, a Hong Kong-based partner at Howse Williams Law Firm, which specializes in providing financial regulatory consulting services, said that this legislation proposes to bring the Hong Kong Customs Department together with other agencies Inclusion may give the public the impression that supervision is “too fragmented”.

In response, a spokesman for the Financial Services and Treasury Bureau responded that in view of the customs’ own business functions, the customs department is responsible for supervising cryptocurrency OTC service providers. the most suitable institution. The spokesperson added that the proposal's rulebook provides necessary risk controls and maximum investor protection.

For exchange shops that are trapped in the regulatory whirlpool, the sudden rise in compliance costs is an inevitable trend.

One Satoshi is one of the chain OTC companies in Hong Kong. According to its co-founder Roger Li, the company's business mainly serves retail investors. Usually small transactions of HK$10,000 or less are carried out.

Li said that while the company already conducts certain anti-money laundering and KYC checks, new requirements related to compliance personnel and record keeping may increase costs. In this case, OTC trading companies "either have to stop cryptocurrency business or apply for a new license." He is also waiting to wait for clearer policy guidance.

This regulation does not affect the application for licensing of crypto exchanges. Currently, there are only two licensed digital asset exchanges in Hong Kong, namely HashKey Exchange and OSL Group. Judging from the disclosure on the official website, as of February 27, a total of 19 institutions, including OKX, Bybit, Crypto.com and HKVAX related to Binance, have submitted license applications. It is worth pondering that HTX under the guidance of Sun Yuchen submitted applications three times. The queen withdrew her application and the reason for the withdrawal was not announced.

List of institutions that have applied for licenses, source: Hong Kong Securities and Futures Commission official website

Looking around the world, although the United States has taken the lead, Hong Kong is still facing a battle for dominance in the crypto asset business with regions such as Singapore and Dubai. Therefore, Hong Kong has always insisted on being inclusive and innovative. policy formulation and be at the forefront of policy formulation. Previously, the Hong Kong Securities and Futures Commission allowed exchange-traded funds to directly invest in cryptocurrencies; before the Bitcoin spot ETF was approved in the United States, the Hong Kong Securities and Futures Commission had stated that it was “ready to accept applications for recognition of virtual asset spot ETFs”; Recently, Hong Kong’s monetary authorities announced that they are formulating rules for stablecoins.

From a regulatory perspective, industry insiders generally believe that this move is not unforeseen. Cryptocurrency exchange consultant Vince Turcotte said: “Incorporating OTC trading into the regulatory structure is a natural extension of the system and can further legalize the Hong Kong crypto market.”

However, considering the numerous offshore cryptocurrency platforms around the world and difficult-to-trace P2P transactions, Hong Kong’s process-based supervision of the industry and OTC transactions is by no means easy. Carlton Lai, head of blockchain research at Daiwa Capital Markets, said: “The decentralization of cryptocurrencies has brought huge regulatory challenges, and users can easily access offshore cryptocurrency exchanges and applications, even while avoiding the government. Under the supervision of the government."

The facts are exactly the same. Hong Kong’s cryptocurrency crime rate has tripled in the past three years, with the number of cryptocurrency crimes recorded in 2023 The case involves nearly 4.4 billion yuan (approximately 611 million U.S. dollars). Hong Kong’s Securities and Futures Commission (SFC) recorded 1,397 and 2,336 cryptocurrency crime cases in 2021 and 2022 respectively.

This number will rise to 3,415 in 2023. Of course, the rise in numbers also means that the popularity of encryption in Hong Kong is rising from a certain perspective.

In the final analysis, for Hong Kong, the encrypted boat is far from reaching the point of crossing the Ten Thousand Mountains. In addition to public cognitive prejudice and the need to improve The regulatory framework and the most important "fund flow" have only just begun to take effect. But fortunately, every step of Hong Kong's progress is still on the road, and with the current surge in mainstream currencies, Hong Kong's positioning as a wealth management center is also expected to bloom new vitality.

JinseFinance

JinseFinance