Author: Shenchao TechFlow

Entering the interest rate cut cycle, the market collapse and restart seem to only take a moment What are the hidden market factors?

With the Federal Reserve officially cutting interest rates by 50 basis points this morning, the last shoe on the macro level of the crypto market this year has finally landed.

Looking back now, among the three clear positives that the market is most looking forward to in 2024 - spot Bitcoin ETF, Bitcoin halving, Fed interest rate cut, ETF promotion Bitcoin exceeded US$70,000, setting a record high; the halving did not bring significant market fluctuations as expected.

While the correlation of macro conditions to Bitcoin is often debated, macro cycles, specifically USD liquidity (as a function of monetary policy/interest rates, risk appetite, etc. Function) is still the main driver of medium- and long-term asset prices, and now regarding the beginning of the Fed's interest rate cut cycle, the market consensus seems to be mostly bullish, and it is generally believed that this is a tradable event, but is this really the case?

The interest rate cut cycle begins, and the market rebounds overnight?

Since the beginning of 2022, the U.S. federal funds rate has entered an upward cycle. Until the third quarter of 2023, the Federal Reserve has intensively raised interest rates to combat the U.S. Inflation -Between January 2022 and August 2023, the effective interest rate increased from 0.08% to a target rate between 5.25% and 5.5%.

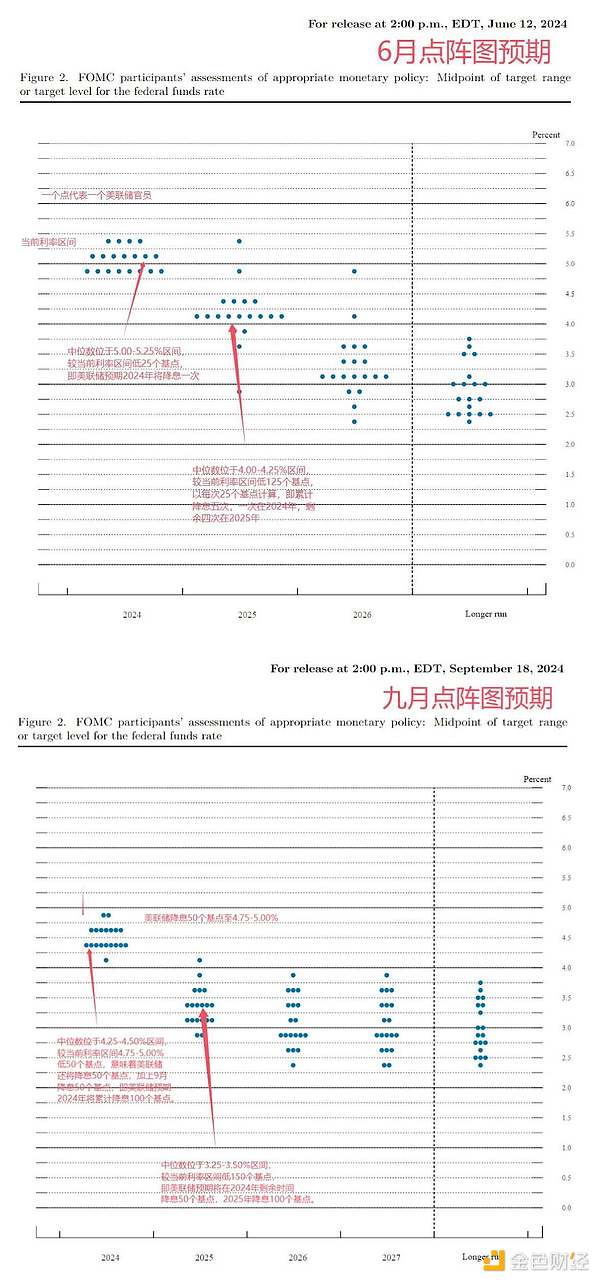

Now, with the Federal Reserve announcing a 50 basis point interest rate cut on September 18, it has lowered the target range of the federal funds rate to between 4.75% and 5.00%. , meaning that this round of tightening cycle has officially ended, and the publisheddot plot also shows that interest rates are expected to continue to be cut by 50 basis points during the year.

Bitmap analysis|Golden Ten Data

Although the first interest rate cut has been delayed compared to market expectations 4 months, but driven by this, market positivity in the cryptocurrency industry has strengthened significantly, and people are beginning to tend to invest their funds in Bitcoin and other crypto assets.

The reason is also very simple. Previously, the U.S. currency and bond markets, as the largest pools in the financial market, were full of liquidity. Nowonce interest rates enter the During a down cycle, currency and bond markets will become less attractive, and people will begin to be more inclined to invest their funds in assets that offer higher risks and returns.

Therefore, after the news was announced this morning, market sentiment was instantly ignited. Bitcoin continuously exceeded the integer mark of 61,000 US dollars and 32,000 US dollars, reaching a maximum of 62,589 US dollars. With this At the same time, in the past 12 hours, the entire network liquidated more than 114 million U.S. dollars, of which long orders liquidated more than 97 million U.S. dollars. The entire encryption market directly staged a bloody massacre against short sellers, especially Bitcoin short sellers.

Coinglass data

However, it is worth noting that interest rate cuts are usually beneficial to risk assets, but for price trends, what is important is often not the factors that have been priced in, but the degree of deviation from market expectations, Jean, head of marketing at OSL -David Pequignot said:

"Bitcoin and the broader cryptocurrency space rebounded after the Federal Reserve announced a 50 basis point interest rate cut, but the committee's statement Still wary of further rate cuts, Governor Bowman advocates for a modest cut, while Chairman Powell expresses concern about too aggressive policy easing,The U.S. election is in full swing and markets will be keeping a close eye on economic indicators in the coming months to determine The direction of the federal funds rate"

In addition, some fermenting events hidden in the market in the past few months may also become ignored. Positive/negative factors, then we will look forward to the main storyline that may be the mainstay in the second half of the year.

US spot ETFs continue to flow in

According to SoSoValue data, Bitcoin spot ETFs have shown a new wave of capital inflows since July. Although there was another sharp weekly decline at the beginning of this month, the overall situation has been significantly reversed from April to May.

As of the time of publication, the total net asset value of Bitcoin spot ETFs is US$54.85 billion, and the ETF net asset ratio (market value as a percentage of the total market value of Bitcoin) reaches 4.61% , the historical cumulative net inflow reached US$17.44 billion.

Hong Kong digital asset ETF gradually increases in volume

The market always likes to overestimate the short-term effects of new things and underestimate their Long-term impact. In addition to U.S. ETFs, the Hong Kong virtual asset spot ETF, which has been launched for nearly half a year, has a recent signal that is worthy of attention:

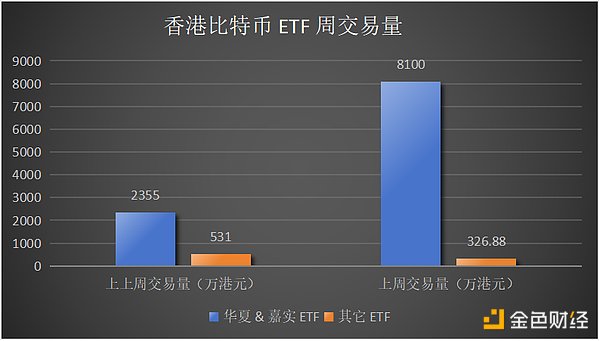

According to data from the Hong Kong Exchange, The total trading volume of Hong Kong's three Bitcoin spot ETFs last week was approximately HK$84 million, a significant increase of over 191% from last week's HK$28.86 million.

Among them,the weekly trading volume of China Asset Management and Harvest International's two Bitcoin ETFs managed by OSL exceeded HK$81 million, accounting for 96.1%, a significant increase of 244% from last week's HK$23.55 million ; The weekly trading volume of another spot Bitcoin ETF was approximately HK$3.2688 million, accounting for approximately 3.9%, a drop of more than 38% from last week's HK$5.31 million.

The wheel of encryption regulation is turning

The wind is rising from Qingping At the end of the year, in the context of the 2024 election year, the macro environment has obviously improved recently, both at the regulatory and financial levels, and a new round of catalysts is brewing.

First, on May 22, the Financial Innovation and Technology Act for the 21st Century (FIT21 Act) was passed by the House of Representatives with an overwhelming vote of 279 to 136. , then the U.S. Securities and Exchange Commission (SEC) quickly passed the Ethereum spot ETF, which means that the stance of U.S. regulators changed from tough to soft.

U.S. SEC official website

Especially in the American political circles, they have also begun to frequently try: 4 years ago, if someone told you that here In this round of U.S. presidential election, candidates from both parties will actively promote their recognition and support for cryptocurrency, even to the extent of "comparison". Do you believe it?

You will definitely think that person is crazy.

But the reality is so dramatic. For the encryption industry, the 2024 U.S. presidential election has become a politician's show that is completely different from the 2020 and 2016 elections. ——Whether it is the issue setting throughout the election cycle or the public statements of the presidential candidates of both parties, cryptocurrencies have begun to be involved as never before, and the candidates of both parties are even "comparing" their own open attitudes.

Overall, the election year is definitely a key factor. For the United States, the number of people who directly or indirectly hold cryptocurrency is already a critical factor. It is a force that cannot be ignored, especially when the poll data is tight. The "critical minority" are the most important ones. This can be seen from the passage of the FIT21 bill at this time.

Summary

History will not simply repeat itself, but it will always It rhymes with the same rhyme.

Generally speaking, in this environment where the market is suddenly cold and then warm, there are still quite a lot of positive factors slowly fermenting. As long as you observe carefully, This will make people still have confidence in the market outlook. With the start of a new round of interest rate cuts, and after the dust settles on the 2024 US election, Web3 and the encryption industry may really enter a new cycle.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Dante

Dante JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk TheBlock

TheBlock decrypt

decrypt Others

Others Future

Future