Source: PentaLab

Since the release of the first in-depth research report on Gains Network on February 1, the price of GNS has risen from US$4.64 to US$6.2 within two weeks, achieving an astonishing increase.

The following content is excerpted from the "Project Introduction, Product Revenue, Agent Please refer to the full report for content such as "coin economics, data verification, valuation, risk analysis", "track analysis, code evaluation, competition comparison, media community, team background, financing situation and route planning".

Project Introduction

Gains Network is a decentralized synthetic asset leverage trading protocol created on Ethereum. Its flagship product is gTrade, which uses synthetic asset trading. , supporting high-leverage perpetual contract trading platforms including cryptocurrencies, foreign exchange, stocks, stock indices and commodities. The platform supports 150x leverage on cryptocurrencies and stocks, and up to 1000x leverage on Forex. gTrade is special because its structure allows it to offer a large amount of leverage on a wide range of assets. It does this by using a synthetic asset system, which means users can trade any asset that is compatible with gTrade oracles. The project binds users to its ecosystem through the $GNS token, which allows users to earn APY by staking $GNS, which not only enhances community participation but also increases the utility of the token. When initially launched on Ethereum, Gains Network was not an immediate hit with the market, but business gradually grew after migrating to the Polygon chain, and the market really exploded after integrating the Arbitrum chain.

Product income

Breakdown of fee income

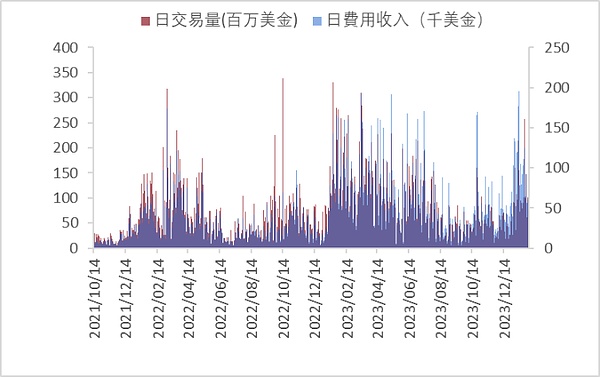

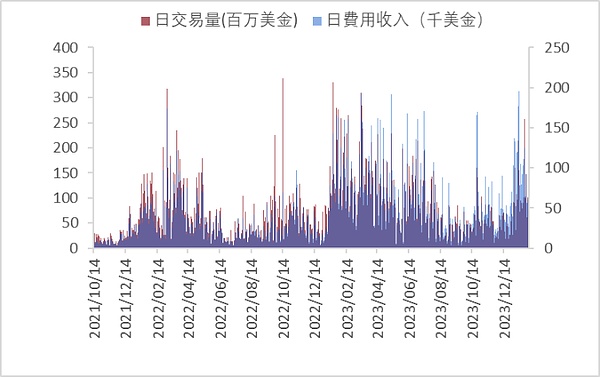

According to Token Terminal data, Gains Network’s 30-day fee amount is in the derivatives competition Tao ranks 3/50, belonging to the first echelon. From January 2022 to January 31, 2024, the total transaction volume processed by the decentralized leverage trading platform gTrade in the past 2 years was approximately US$54.9 billion, and the fee income was approximately US$34 million. The fee income increased smoothly with the transaction volume. . Daily trading volume and fee income fluctuate greatly. Among them, on February 17, 2023, Binance announced that it would list GNS in the Innovation Zone and open spot trading pairs GNS/BTC and GNS/USDT. The news attracted more users to the gTrade platform to participate in transactions, pledges, etc., forming a The peak and continuation of daily transaction volume and fee amount were reached.

Chart 2: Cumulative transaction fees increase with transaction volume

Source: Token Terminal, Penta Lab

Chart 3: Listing on Binance in February 2023 will cause an increase in trading volume

Data source: Token Terminal, Penta Lab

User roles and growth

Currently, the users of the gTrade platform are except for the most basic traders In addition to the role, you can also participate in the construction of the platform through other 4 roles and obtain benefits:

Trader: By doing long , Earn investment income by shorting asset pairs;

Vault Liquidity Provider (LP): Obtain DAI rewards by providing liquidity to the DAI vault

< /li>Token holders: obtain DAI rewards by staking GNS;

Liquidity providers: by providing GNS/DAI pools Liquidity gets GNS rewards;

Referrals: Participate in the recommendation program and get GNS rewards.

Rewards for recommenders and liquidity providers are paid in minted GNS tokens, and at the same time, an equal amount of DAI will enter the vault to support staking.

According to Token Terminal data, as of January 31, in the derivatives track, Gains Nertwork had 6121 monthly active users, ranking 4/30, ranking at the forefront. Recently, Gains Network participated in the Arbitrum STIP program and provided 3.825 million and 675,000 ARB tokens to traders and liquidity providers of GNS and gDAI respectively from December 29, 2023 to March 29, 2024, attracting There are a large number of users, and the number of active users has tripled in one month.

Chart 4: The number of monthly active users tripled in one month

Source: Token Terminal, Penta Lab

Product iteration, innovation and market adaptability

Gains Network has never stopped repeatedly calculating the trading platform and expanding trading pairs since its launch. By constantly adjusting the trading model, filling loopholes, adopting new oracle mechanisms, and constantly adjusting product positioning, expanding from cryptocurrencies to stocks, foreign exchange, and commodities, the current main form of Gains Network has been stabilized. Gains Network uses a single liquidity pool and DAI treasury to execute transactions on all asset pairs. It has extremely high liquidity efficiency and can provide the widest range of trading pairs and leverage options, including cryptocurrencies, foreign exchange, stocks, and commodities. A total of 187 trading pairs are included, which reflects the strong ability of repeated calculations and adaptability.

In October 2021, the team changed the name from gains.farm to Gains Network to rebrand the derivatives exchange.

Updated the version to V6 on January 27, 2022, and continued to perform small iteration optimizations. After the LUNA thunderstorm, GNS was no longer used as collateral, but was changed to DAI.

On May 3, 2022, Gains Network launched three blue-chip stocks AAPL, FB and GOOGL on the Polygon mainnet, and 6 days after the successful test, the other 20 stocks. For the first time, it is possible to trade stock prices on-chain using leverage (trading synthetics using the median aggregate price of selected stocks).

In September 2023, Gains Network listed 18 new FX pairs. In addition to this, Gains Network submitted an application for $7 million in ARB tokens and a grant matching offer of $100,000 in GNS as part of Arbitrum’s short-term incentive program.

On October 1, 2023, gTrade v6.4.1 went online. This update involves a number of changes, including the depreciation of GNS NFTs (in exchange for GNS tokens) and the transfer of income from Development funds were reallocated to $GNS stakers, increasing GNS stakers' income by approximately 70%, and total GNS fees rising from 30%-60%.

On January 27, 2024, Gains Network announced the launch of a new version of gTrade V7, introducing gETH, gUSDC and adding a multi-collateral deposit function. Multi-collateral means that traders can Choose from a range of cryptocurrencies as collateral for your position. Currently, you can choose USDC, ETH or DAI. The new version of V7 will also introduce the liquidity yield tokens gUSDC and gETH.

Token Economy

GNS Token

Total Token Supply Overview

The initial token of Gains Network is GFARM2 allocated on Ethereum, and the Development Fund and Governance Fund each account for 5% of the token allocation ( 10% in total), and after being bridged to the Polygon chain, it was split into GNS tokens at a ratio of 1:1000. GNS is currently distributed on the Polygon chain and the Arbitrum chain, with an initial supply of 38.5 million and a maximum supply of 100 million. The maximum supply is only used as a fail-safe mechanism and cannot theoretically be reached. According to Dune data, as of January 31, the total supply of GNS was 33,942,395, which is lower than the initial supply and is in a deflationary state, with the number of tokens minted being lower than the number burned.

The casting and destruction of GNS

GNS is an application token. Its casting and destruction are inseparable from the gToken vaults (Vaults), which can maintain the vault mortgage. Dynamic balance of rates. The treasury is the counterparty to all transactions on the platform, receiving assets pledged by liquidity providers, transaction fees incurred, losses incurred by traders, and paying income to profitable traders. gToken represents the ownership share of the underlying mortgage assets in the vault. Currently, Gains Network has introduced three types of collateral: DAI, WETH and USDC, forming three gTokens and treasury: gDAI, gETH and gUSDC. The portion of the vault that exceeds the pledged assets (corresponding to 100% mortgage) constitutes the over-collateralization layer (Over-collateralization Layer), which serves as a buffer between traders and lenders, and the opposite is under-collateralization (Under-collateralization).

If the vault is over-collateralized, a portion of the trader’s losses (represented by collateral, such as DAI, which is revenue for the vault) will be transferred to a pool for over-the-counter (OTC) trading, Users can sell GNS at the 1-hour weighted average price (Time weighted price) in exchange for assets, and the sold GNS will be destroyed. The advantage of OTC trading is that there is no price slippage and it does not affect the GNS price on the exchange. When the price of GNS falls rapidly and TWAP is higher than the market price on the exchange, holders will tend to sell GNS in the OTC market in exchange for DAI and buy back GNS with DAI at the market price, forming a price balance mechanism to a certain extent. If the vault falls below collateral, GNS are minted and sold via OTC in exchange for assets, which are used to replenish the vault. No more than 0.05% of the total supply can be minted per 24 hours of GNS, which would result in an annual inflation rate of up to 18.25% without burning.

It can be seen that the actual supply of GNS changes dynamically. When the gTrade trading platform has sufficient fee income and traders' total losses are greater than profits, the vault is in an over-collateralized state, GNS will be sold and destroyed in the OTC market, and the decline in supply will increase the currency price, achieving a certain sense of holding the token. Someone's income distribution. It can be found that Treasury is the short-term counterparty to all trades on gTrade, while GNS is the long-term counterparty through this mechanism.

Gains Network is improving and developing the governance framework of the platform. GNS has now become the governance token of the platform. One GNS token is equal to one vote. After the proposal reaches consensus and is improved in the Discord forum, it can be transferred to the Snapshot platform and voted on by holders.

GNS NFTs

Before V6.4.1, NFT Bots were responsible for executing all stop-profit, stop-loss and limit orders on gTtrade. Only Only NFT holders can operate NFT robots and receive platform fee distribution and GNS rewards. Gains Network distributes NFT points to liquidity providers that provide at least 1% of total liquidity, which are used to mint NFTs. Different levels of NFT (divided into brass, silver, gold, platinum and diamond levels) require different points, and accordingly, the levels of benefits available to holders are also different. After NFT holders pledge it, they can receive a fixed spread discount of up to 25% and an increase in GNS staking income of up to 10%.

Due to the version upgrade, the functions of NFT robots are now assumed by the chainlink oracle network, and NFT has been abandoned in V6.4.1. Holders can exchange NFTs for GNS tokens, and the amounts exchanged for different levels of NFTs are different. There are two options for redemption: one is to obtain $GNS linearly within 6 months starting from the date of redemption (staking throughout the minting period); the other is to obtain $GNS immediately, but must pay a 25% penalty (the penalty will be For governance funds, for strategic use or destruction at the discretion of the community).

Income distribution and token value capture

Taking DAI as an example, the fees collected by the platform are allocated to the Governance Fund, DAI pledge (DAI Staking), GNS stakers, recommenders, and an oracle network that executes limit orders in a decentralized manner.

From the perspective of allocation of specific fees:

1. All loan fees will go into the DAI treasury;

2. Limited 18.75% of the opening and closing fees for price orders is allocated to the governance fund, 62.5% is allocated to GNS pledgers, and 18.75% is allocated to DAI pledgers;

3. Opening and closing of market orders 18.75% of the fee is allocated to the governance fund, 57.5% is allocated to GNS stakers, 18.75% is allocated to DAI stakers, and 5% is allocated to the oracle network;

4. Rollover fees, fixed spreads and dynamic spreads It is collected by directly or indirectly (opening price) affecting the trader's P&L, and enters the DAI vault in the form of the trader's P&L.

From the perspective of user roles:

1. The rewards obtained by staking GNS tokens are paid with the transaction’s collateral (DAI, WETH and USDC) . According to the official information of Gains Network, since about 70% of the transactions on the platform are market orders, on average, 61% of the transaction fees of all orders will be allocated to GNS pledge;

2. 18.75 of all orders % of the transaction fees will be allocated to DAI stakers;

3. 18.75% of the transaction fees of all orders will be allocated to the governance fund;

4. Referrer rewards (Refferal Reward) is extracted from the "Governance Fund" fee. According to the official statement of Gains Network, it accounts for approximately 22.5% to 30% of the position opening fee. The specific proportion depends on the amount of position opening brought by the ambassador to the platform.

Data verification

According to DefiLlama data, as of January 28, 2024, Gains Network has been deployed on the Arbitrum and Polygon chains, with TVL accounting for 88% and 12% respectively.

As of January 30, 2024, Gains Network’s circulating market capitalization/TVL (Market Cap/TVl) was 3.62, which is relatively low compared to the historical average of 4.84 in the past 24 months.

Chart 5: Gains Network circulation market value/TVL is at a historical low

Source: DefiLlama, Penta Lab

Valuation

Although GNS's TVL volume is less than 7% of GMX, the ratio of market value to TVL is already three times that of GMX, implying that the market Recognition of its lending efficiency, growth potential and safety. In the six-month dimension, we believe that with the inclusion of gETH and eUSDC and the expansion of new functions, TVL has the opportunity to exceed the US$100 million mark. Based on the historical average market capitalization/TVL ratio in the past two years of 4.84, the estimated six-month market capitalization is 4.84 One hundred million U.S. dollars.

Main risks

Fund pool management risk, run risk, and attack risk.

JinseFinance

JinseFinance