With its natural geographical proximity to the mainland and its advantages as an international financial center, Hong Kong has become the preferred investment platform for mainland private equity management institutions. As more and more mainland private equity management institutions pour into the Hong Kong market, it is particularly important to plan the compliance work in the process in advance.

With a "green card" in the international capital market, you can not only directly participate in overseas investments, but also manage and use the funds of these overseas investors in accordance with the relevant laws of Hong Kong. In this article, Liu Lei’s legal team will analyze the application conditions and procedures for the Hong Kong Asset Management License No. 9 from multiple perspectives, aiming to provide compliance guidance for relevant parties interested in developing businesses in Hong Kong.

1. The difference between private equity fund license and virtual asset license

(1) Application License conditions

Although both private equity fund licenses and virtual asset management licenses require Hong Kong Financial No. 9 license application, there are big differences in the application requirements. . First of all, to engage in private equity fund business, you only need to apply for a No. 9 license. However, if you want to engage in virtual asset management business, you not only need a No. 9 license, but you also need to apply for a sub-license that can engage in virtual asset business (also known as the "No. 9 license"). upgrade"). In addition, in the license applications for private equity business and virtual asset business, there are also different requirements for the company's registered capital, company structure, personnel, office space, etc.

(2) Requirements for licensed representatives

In the case of licensed representatives (RO) In terms of headcount requirements, a private equity fund license generally only requires 2 people; however, since the virtual asset market operates 24 hours a day, 7 days a day, which is different from the traditional fund or stock market, it generally requires at least 3 persons in charge. Three shifts.” Moreover, the two have different qualification requirements for ROs such as academic qualifications and years of experience. This will be introduced in detail in the third point below, "Preliminary preparations for applying for the No. 9 plate".

(3) Functional scope of the license

Meet the requirements for private equity funds introduced in this article , after applying for the corresponding license according to the process, you can engage in private equity fund-related business, but the product scope generally must not involve virtual assets. If you want to conduct private placement business of virtual asset products, you also need to apply for the No. 9 virtual asset sub-license mentioned above. Otherwise, you may be deemed as "operating without a license" and be held accountable by the China Securities Regulatory Commission.

2. Positioning and development of private equity fund licenses Apply

According to the regulatory requirements of the Hong Kong Securities Regulatory Commission, there are currently ten types of financial licenses. After being approved, financial institutions can carry out stocks and financial derivatives at the same time. , foreign exchange, gold and other types of transactions. Among them, establishing a private equity fund in Hong Kong requires obtaining a Type 9 license, which is a Type 9 "Regulated Business Qualification License" under the Securities and Futures Ordinance.

(1) Positioning: No. 9 license plate is the 9th category of regulated products stipulated in the Securities and Futures Ordinance promulgated and implemented by the Hong Kong Securities and Futures Commission (SFC) Management business qualification license, that is, asset management license. Financial entities holding a No. 9 license can manage the assets of others in accordance with relevant laws and regulations.

(2) Function: Hong Kong No. 9 license is currently one of the mainstream ways for large-scale domestic private equity to go overseas, and it is also the "passport" for the domestic capital market. Having this license , which means that you can directly participate in overseas investment and manage and use the funds of overseas investors. Moreover, since the scope of "securities" under Hong Kong's Securities and Futures Ordinance is much larger than securities in the general sense, it includes shares, stocks, and debentures issued by companies or non-corporate groups or government entities. , bonds, loan stocks, funds, notes and their rights, options, interests, or equity certificates, participation certificates, interim certificates, interim certificates, receipts, or subscription or purchase of such projects warrants, and other interests or property that generally become securities. Therefore, after obtaining the Hong Kong No. 9 license, the company will be qualified to provide investment portfolio management services such as stocks, funds, bonds, etc. to overseas institutions.

(3) Business scope: The business types covered by Hong Kong’s No. 9 license are equivalent to the mainland’s private equity fund license, but compared with the mainland’s private equity manager registration For registration, Hong Kong does not have so many restrictions on investment groups.

(4) Two ways to obtain No. 9 plate:

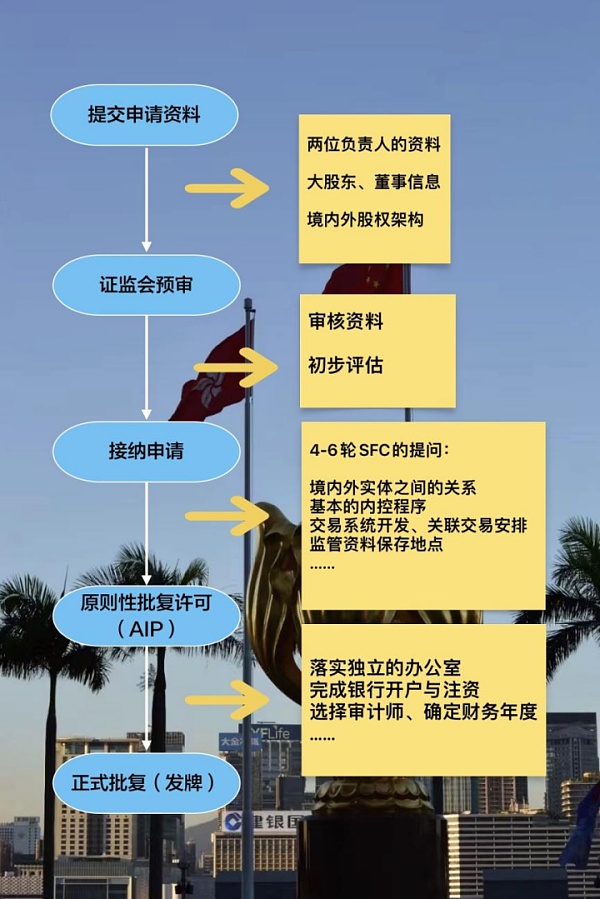

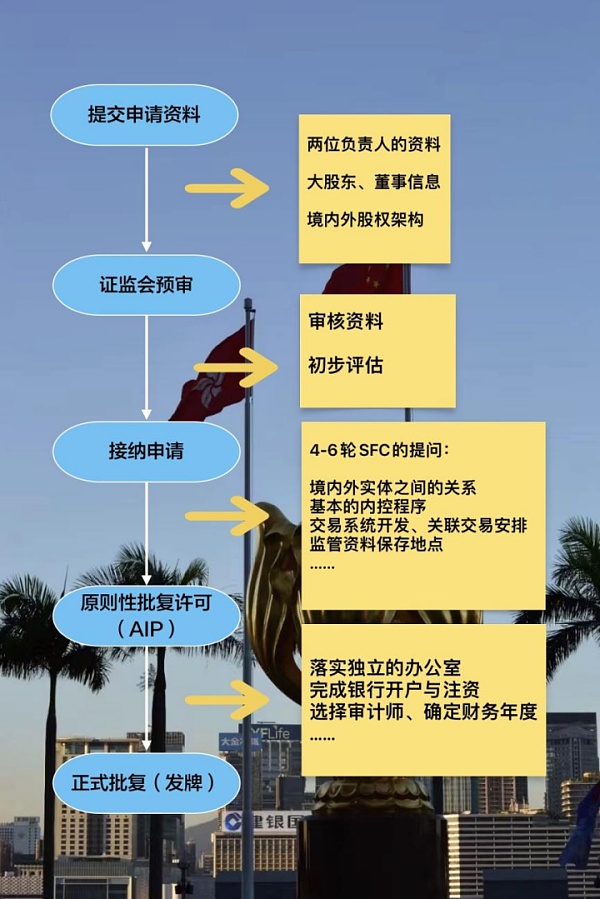

Currently, in There are two main ways to obtain the No. 9 license in Hong Kong: first, set up a company in Hong Kong and apply for the No. 9 license from the SFC; second, directly acquire a Hong Kong company holding the No. 9 license. As for the second method of acquiring licenses, all parties can submit an application and go through the normal acquisition process. This article will not do too much analysis; the following will mainly focus on the first method of obtaining a license.

3. Preparation for applying for No. 9 plate< /h2>

(1) Establish a company with a suitable personnel structure

This requirement is mainly to ensure The applicant must have real "business" operations in Hong Kong to avoid falsely establishing a company in Hong Kong. In addition, the company also needs to open at least one Hong Kong bank account for transferring accounts and counting income and expenses.

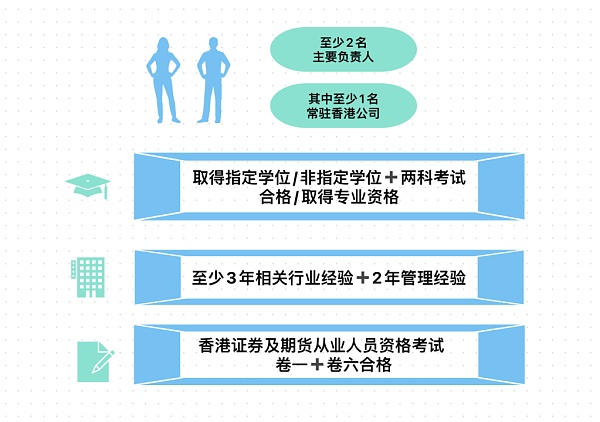

(2) Qualified licensed representatives (RO)

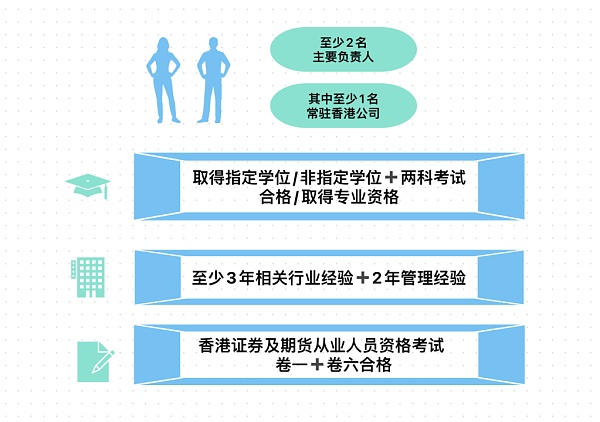

1. Number of people : Nominally, 2 people are required, and at least 1 main person in charge is resident in the Hong Kong company to conduct necessary business communication. In addition, licensed institutions are also required to have emergency contact persons for handling complaints and emergencies.

2. Qualification requirements for licensed representatives (RO)

(1) Mainly responsible Requirements for personnel

①Industry qualifications: Hold a designated university degree, such as accounting, business administration, economics, finance, law, etc.), or hold other university degrees degree, and have passed at least 2 designated subject examinations, or obtained professional qualifications, such as Chartered Financial Analyst, Certified Financial Planner, etc.

②Industry experience: at least 3 years of relevant industry experience, and more than 2 years of management experience. (In the regulations of the Securities Regulatory Commission, the meaning of "above" is different from its mathematical meaning, both of which refer to the current number)

③Examination: Take the Hong Kong Securities and Futures Practitioner Personnel Qualification Examination, and Papers 1 and 6 must be passed.

(2) Requirements for licensed representatives

Compared with the main responsible persons, for ordinary The requirements for licensed representatives are relatively low. There are no requirements for the above-mentioned industry qualifications and industry experience, and passing Paper 1 of the Hong Kong Securities and Futures Practitioners Examination is enough.

(3), office space

1. There must be a physical office. There is no requirement for the specific area, but there must be a lease contract or "owner consent letter" with the property or other office building lessor. ”, thereby proving that the financial entity does have a physical location to operate offline.

2. The company must have an independent office space and be equipped with basic office facilities that can only be used by employees of the company, and cannot be confused with other companies. In Hong Kong, the monthly rent for leasing an independent office is approximately HK$50,000 to HK$100,000. In addition, Hong Kong properties will also charge a certain management fee.

3. If the company uses a "shared office" for office work, it must fully explain why the "shared office" can meet its office needs and ensure that representatives from the China Securities Regulatory Commission can When visiting this shared office, the China Securities Regulatory Commission may send inspectors from time to time to conduct on-site spot inspections.

4. Quantity: Applications that do not hold the No. 9 license plate must have more than 1 office, and applications that hold the No. 9 license must have more than 4 offices, and each All offices must meet the requirements of the first three points.

We suggest that when domestic private equity funds first come to Hong Kong, they may consider renting independent office space in serviced offices or smaller offices until their business scale grows. , and then consider moving to a larger office space to meet industry compliance and cost control requirements at the same time.

(4) Sufficient assets

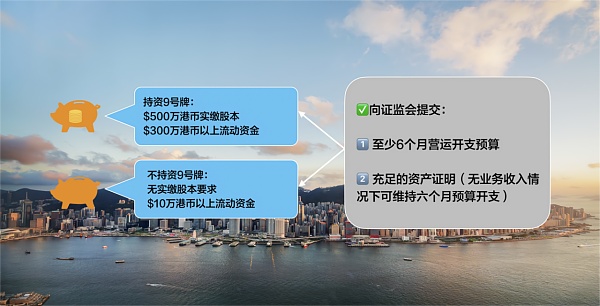

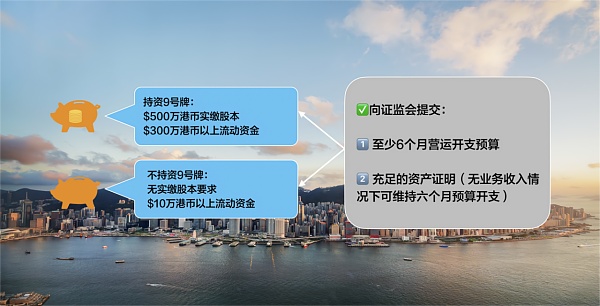

1. Registered capital requirements

(1) No. 9 license plates that do not hold client assets: no paid-in capital requirements, but must maintain liquidity of more than 100,000 Hong Kong dollars.

(2) No. 9 license plate holding client assets: must meet the paid-in capital of HKD 5 million, and must maintain liquidity of more than HKD 3 million.

2. Submit materials to the Securities Regulatory Commission

The company founder must submit at least A 6-month operating and expense budget table shows that you have the ability to continue to make profits. In addition, sufficient proof of assets must be submitted to ensure that the company still has financial resources sufficient to meet financial indicators and meet the expenditure budget for at least 6 months of operation even if there is no business income.

4. Compliance operations after obtaining the license< /h2>

(1) Notification of changes in the company’s basic situation

After obtaining a license to operate, the company must The SFC will be notified in a timely manner of any changes in information related to the license application, such as license application status, usage status, basic information of major shareholders and directors, and contact entities, and the relevant information will be updated in a timely manner.

(2) Finance

The company must conduct financial audits on an annual basis and report to SFC Submit financial audit report. From a practical level, you can find an accounting firm to calculate corporate profits after deducting operating costs (such as employee wages, office expenses, etc.). Generally speaking, the tax rate is 8.25% for the portion of profit less than HK$2 million, and the tax rate of 16.5% for the portion exceeding HK$2 million. In addition, it is necessary to calculate the corresponding valuation of the company's profits in the financial year and submit it to a specialized audit firm to review and issue an audit report before completing the financial tax return. The financial year in Hong Kong is generally at the end of December or the end of March. Applicants can choose a time period from the two to file based on their own business conditions and time period.

In addition to the above requirements, the company's minimum paid-in share capital and liquidity must be maintained throughout the licensing period. Companies are required to submit financial resource returns or annual returns to the SFC monthly or semi-annually.

(3) Personnel

The company must provide continuous training to its management personnel. And it must be ensured that each licensed person has actually received continuous training and maintained a high degree of mastery of laws, policies, industry regulations, etc. in relevant fields. For ordinary employees, although SFC does not explicitly require it, licensed operating entities should try their best to provide employees with basic training on relevant industry knowledge, so as to promote the company's overall compliance and sustainable operations.

(IV), Others

1. The annual fee must be paid on time. If not If you pay on time, you may be subject to corresponding penalties from the Securities Regulatory Commission, such as paying a certain fine.

2. The company must submit an annual report to the Hong Kong Securities Regulatory Commission every year, clearly showing all aspects of the company's operation and management this year, including the company's actual income, profit margins, and dividends situation, changes in assets, etc.

5. The lawyer has something to say

Although the application requirements for a Hong Kong private equity fund license are very similar to the virtual asset No. 9 license, there are still some differences between the two: such as registered capital, office space, holding licensing personnel, etc. Since Hong Kong's customs clearance, the economies of Hong Kong and the mainland have been in a state of close exchanges. Hong Kong's freedom and convenience in information, capital flow, entry and exit, and employment opportunities as an international financial center are very attractive to mainlanders. Hong Kong is the best choice for private equity investors who want to go overseas. At the same time, lawyers also remind you: you must complete the compliance work for the private equity fund license application and operation processes in advance. If necessary, you can consult a professional lawyer to avoid relevant legal risks as much as possible.

JinseFinance

JinseFinance