Source: BlocksBridge Consuling; Compiled by: Deng Tong, Golden Finance

So far, 13 U.S.-listed mining companies have reported their second-quarter earnings, revealing a common theme: the need for cash flow is not slowing down. According to calculations by TheMinerMag, The urgency is driven by the state of the Bitcoin hash price, which has not generated meaningful cash flow after the halving. To alleviate this situation, some companies have also turned to debt financing again.

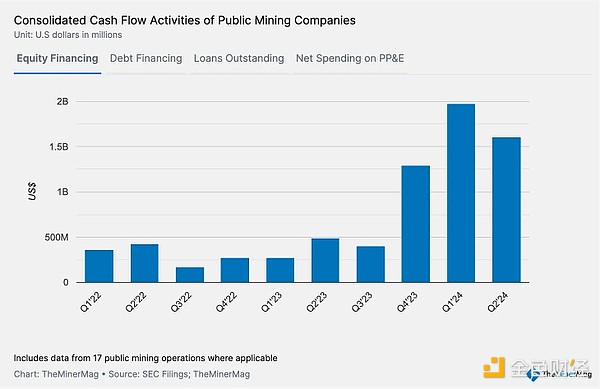

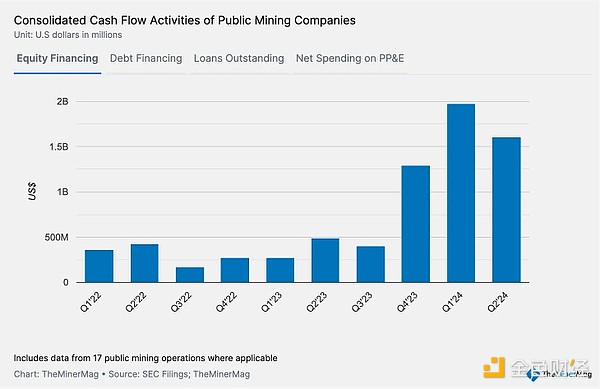

Nine of the 13 companies—Bitdeer, Bitfarms, Cipher, CleanSpark, Core, HIVE, Marathon, Riot, and Terawulf—raised a total of $1.25 billion in the second quarter through various equity offering programs. Iris Energy has not yet announced its earnings, but it reportedly raised $458 million in the second quarter through an at-the-market offering.

Based on this, TheMinerMag’s dashboard shows that in the first quarter since the halving, large mining companies raised more than $1.6 billion through equity financing, and so far in the third quarter, another $530 million has been raised.

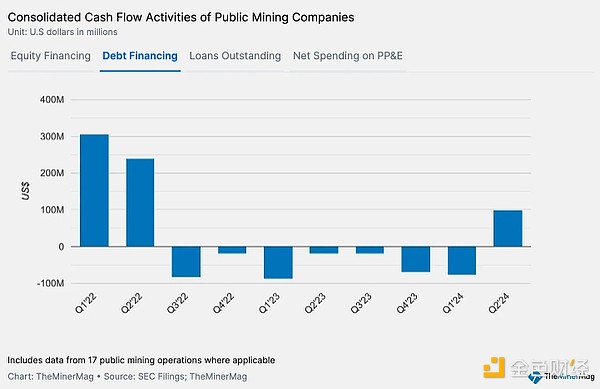

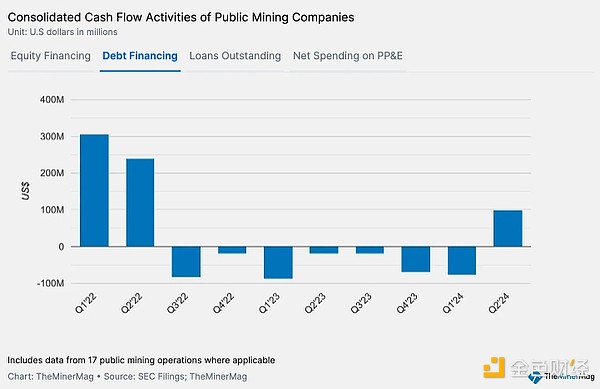

While this figure did not break the record of nearly $2 billion raised by mining listed companies through equity issuance in the first quarter, it is worth noting that convertible notes and asset-backed loans have increased again since the second quarter.

According to TheMinerMag’s dashboard, since the start of the 2022 bear market, during the Luna crash, total debt financing for public companies has been negative, indicating their efforts to deleverage over the past two years.

While many companies continued to deleverage in the second quarter, their total debt financing turned positive as Hut 8 did not raise any funds through equity issuance, but instead received $150 million in proceeds through Coatue notes.

In addition, in the past week, we saw Marathon and Core Scientific issue convertible notes totaling $700 million. In Core’s case, the new convertible notes were part of a debt restructuring effort, replacing existing debt with notes with lower interest rates. For Marathon, the convertible notes were primarily used to buy more Bitcoin from the market. CleanSpark disclosed in its second-quarter filing that it had entered into a credit agreement with Coinbase, using Bitcoin as collateral. Canaan said it committed 530 Bitcoins in the second quarter for an 18-month, $19.2 million term loan.

This is almost surprising, considering that Bitcoin’s hashrate is as low as $43/PH/s (that’s after today’s 4.2% difficulty adjustment).

YouQuan

YouQuan