In the past few months, I have talked to dozens of startup teams. I found that some teams did not think about users from the first principles, had unclear user needs, assumed what users wanted, or made too many assumptions about user adoption.

Technological innovation is fascinating. But the ultimate audience of all this is the user. As Steve Jobs said: "You've got to start with the customer experience and work back toward the technology – not the other way around." Entrepreneurs need to think more about user-centricity and learn the "work backwards" way of thinking.

Guys, it's time to focus on users again.

1. UI/UX

Source: Uniswap

Interfaces similar to Uniswap and Lido have in fact become the benchmark for Crypto. In terms of UI/UX design, it should be as simple and intuitive as possible, allowing users to easily understand and use it, reducing friction as much as possible, and making minimal assumptions about users.

1.1 UI

Websites are usually an important entry point for users to access a project. As a heavy product experiencer, I have two impressive moments of collapse:

When I open a website, the first thing I see is three or four entry buttons. When I intuitively click these buttons, they take me to different pages, each of which contains a lot of information and complex design elements. I suddenly feel anxious. Where should I start?

The project does not provide any documentation. For many users, documentation is a portal to quickly understand project information, and it is a faster and more efficient way to understand a project than white papers and blogs. Some "buzzwords" on the homepage do not help users fully understand a project except for providing slogan-like publicity.

1.2 UX

I want to use two examples to illustrate - the user experience of Crypto at this stage needs more fine-grained optimization.

I have always believed that the importance of mobile has been overlooked. Currently, most dapps lack a smooth mobile experience and can only be used through a browser (built-in to the wallet), and need to switch back and forth between the browser and the wallet. Imagine that you are an avid memecoin trader. When you can't guarantee that you are always in front of the computer, you will feel anxious about your position, so a mobile Dexscreener will make you feel a lot more at ease.

By cooperating with Privy, friend.tech has taken a step towards a built-in wallet. But compared to the mobile version of CEX, DEX still has a long way to go in terms of user experience. For time-sensitive transactions (such as contract transactions), real-time notification push or price alerts are very useful. For social applications, the importance of sharing anytime, anywhere is even more important.

AI and LLM can help users understand a new project very well.

For example, when I visit a Layer2 Ecosystem page, I am usually confused. It shows common protocols such as Uniswap and Aave, a lot of wallets, tools, etc. I know these protocols, but I don’t know where to start. Imagine an Agent that can tell you what dapps everyone is playing on this Layer2 and what is the fastest growing protocol based on recent on-chain data. It can even analyze the behavior of each user address to provide targeted suggestions.

Things like this make me feel that Crypto still has a lot of room for improvement in UX. A few years ago, I would have thought that we didn't have a good enough Infra to support applications for mass adoption. Recently, we have a scalable underlying chain and an easy-to-integrate user onboarding process. Now it's time to spend more time on UX.

2. Stickness..Wat do?

Source: IOSG Ventures

In Crypto, it is relatively easy to get some short-term growth data - you can immediately launch a Campaign and give away some kind of Genesis NFT to achieve short-term goals. This has in fact been regarded as a kind of hint that users may have a certain expectation of potential benefits in the future. However, attracting real users and gaining their long-term adoption is a more difficult thing, and there are almost no shortcuts on this road. (It took Uniswap almost three years to make a good product before DeFi Summer arrived)

It is worth noting that Warpcast currently accounts for 90% of network activity, but there can be other clients that offer various unique propositions on this infrastructure. In addition, most people use it as a pure Web2 social media platform because users have not yet been trained to take advantage of everything it has to offer. The important growth signal will be individuals using Farcaster native solutions to make their user experience most like the expected different functions (decentralized social graph, framework, etc.), which may take time because the graph itself is not mature or powerful enough in its early stages.

2.1 Acquisition, wait..it’s all about airdrop?

Source: IOSG Ventures

Although I don’t want to confuse airdrops with customer acquisition, airdrops have in fact become a shortcut to customer acquisition.

Generally speaking, airdrops are now seen as a means of customer acquisition, and airdropped tokens are seen as customer acquisition costs.

I think the important thing is to think about the purpose of airdrops. What goals do you want to achieve through airdrops, and how do you manage expectations and formulate strategies based on these goals?

StarkNet recently issued rewards to the contributors of the top 5,000 repos in GitHub worldwide. It is obvious that this is to bring StarkNet and even Crypto into the field of vision of traditional developers. Other protocols have also proposed to issue airdrops to family pledgers or teams developing public products.

Source: IOSG Ventures

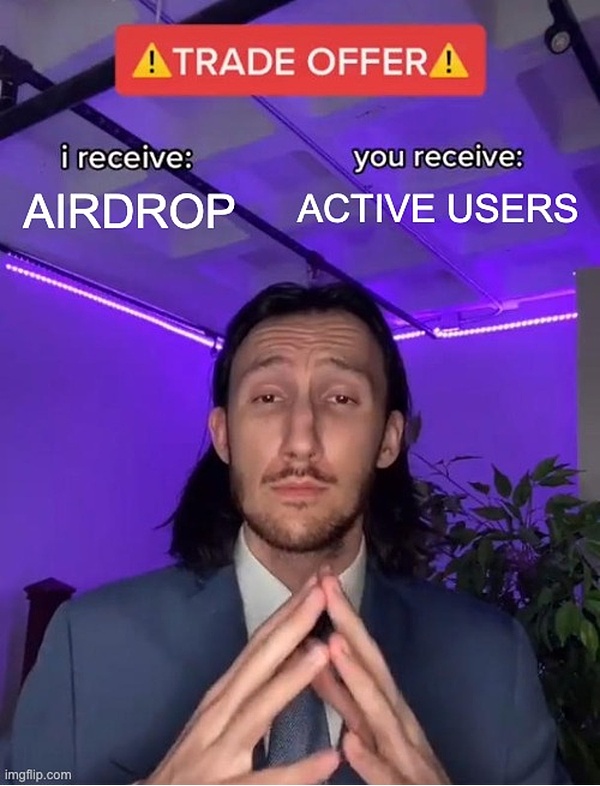

I agree with what Regan said: "Community means making money with your internet friends". We have to admit that many users use a pre-token protocol to get airdrops.

However, I have reservations about what Hayden said: "Don’t be stingy - give a significant amount away. If you don’t think the community deserves a significant amount, don’t release a token." The "Community" in Hayden's sentence is actually not the same as the "Community" in reality.

You know, in the airdrop season where witches are rampant, it is very difficult to distinguish between the real "Community" and the "witches", the latter of which has become an industry. To solve this problem, the protocol needs to spend more time identifying real contributors and consider long-term development.

Airdrops have actually become a bit toxic. Users often regard venture capital institutions and project parties as their absolute opposites. Project parties are in a dilemma in the design of airdrop rules. Airdrop farmers account for a considerable part of the community. If they feel that they are not rewarded well, they may fud your project on CT. However, if witch screening is not performed, tokens are often not rewarded to real users, and there will be greater selling pressure on them. This is quite tricky for the project.

Having said that, when you want to use airdrops to bootstrap, remember never to be vague, do not deceive users, and ensure that clear information and rules are delivered.

My opinion is that if you are a long-term builder, then try to return things to organic. Do not do excessive marketing to give users some unnecessary expectations, and focus on building good products.

In short, most projects conduct airdrops to attract users to use the product for a long time. This requires you to have a good enough product before releasing the airdrop expectations. If the user experience is bad, the airdrop may even have a counterproductive effect and leave a bad impression on users.

If you do not have a clear airdrop goal and strategy, as well as a good product, then focus on building, enjoy organic growth, and wait for a better time to come.

2.2 Retention

Different types of projects often have different user retention strategies: for DeFi, it is liquidity; for NFT, it may be more of a community.

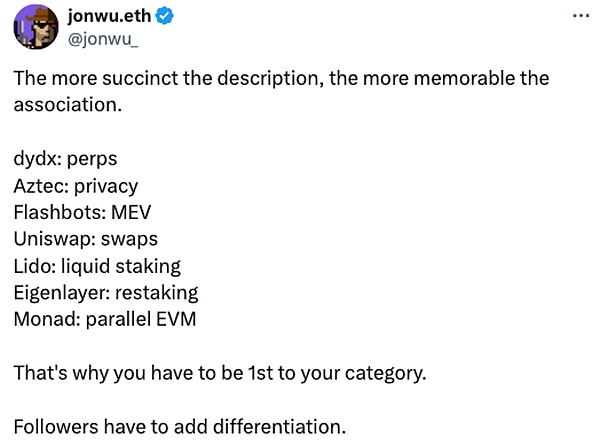

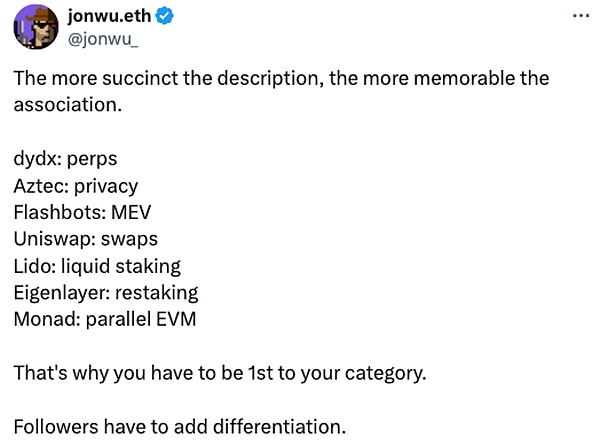

Source: jonwu.eth

Uniswap has accumulated indestructible liquidity and a strong brand over the past few years. When people want to swap a token, they often intuitively think of Uniswap first, and take it for granted that Uniswap will have the best liquidity and the lowest slippage, without having to go to DeFiLlama to find which pool has the best depth. The moat created by this brand effect based on people's intuition is quite solid.

In addition, the liquidity built by large funds is relatively stable, and the actions of large funds are often slower than those of small funds. Therefore, unless you can provide a strong incentive mechanism, it is extremely difficult to rebuild liquidity.

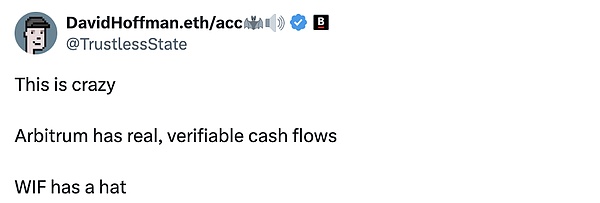

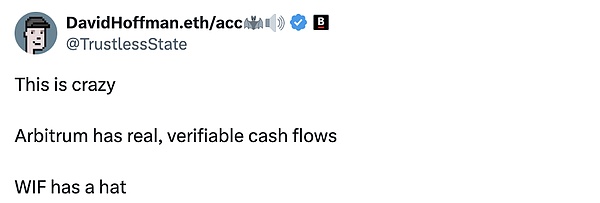

Source: David Hoffman

For application projects directly facing end users, the community may be the most important thing. Of course, the concept of community is difficult to be concretized. You can say that the essence of the community is a kind of culture, symbol, symbol, a group of maverick freaks gathered together for fun things.

When we judge whether the founder is Crypto-native, we usually communicate with the founder about their understanding of the community. This understanding is the intuition and mindset gained from long-term, at least one or two years of accumulation in the community. For such projects, founders need to try to understand the community, feel the culture, and listen to what users are saying.

3. Seeking Token-market-fit

Tokens reflect the market's consensus on projects to a certain extent. Take the above example, Arbitrum, as the L2 with the largest TVL, has a strong cash flow, which is a consensus; dogwifhat's hat consensus is also a consensus. What kind of token does the market want? What kind of token does the market buy in? I understand it from the perspective of utility and speculation.

Utility

Utility is also divided into several types:

One is the utility generated by the expectation of future returns. For example, you need to stake 32 ETH to become an Ethereum validator and earn about 4.5% APR.

One is similar to token-gated: you must hold a certain number of tokens or NFTs to be allowed to enter a community/or use a certain protocol.

The nature of some Infra projects determines that they cannot give tokens strong utility. For example, most L2 tokens currently only have governance utility or have a narrative "speculative" nature.

Speculation

Source: IOSG Ventures

Retail investors think that this token has the potential to rise. Regardless of the reason, direction, product, narrative, etc., the market will form a joint force to support the price of the token.

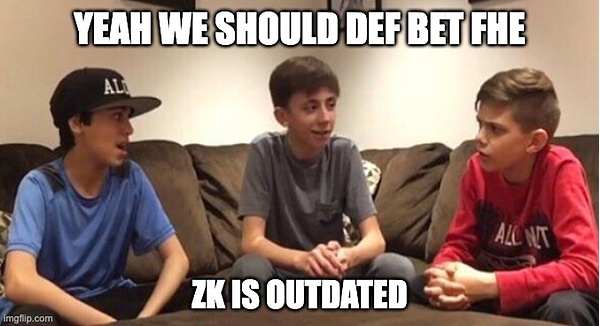

For users, narrative is often the most direct and easiest to understand. The problem faced by many Infra projects is that the concept of the project is too obscure and difficult to understand - it is difficult to expect every user to understand the principles of cryptography such as ZK, FHE, or things like developer tools, and the benefits they bring. But we can try to convey some simple information, such as abstracting these into a string of letters or phrases: ZK, FHE, Restaking, and so on.

Trace mentioned two good points in Unbundling Attention: "bigness" and "simplicity". For example, L1 is an enduring narrative in the Crypto world. It is large enough to accommodate a large number of dapps and users. For another example, memecoin is the simplest token. It has almost no learning curve. The only reason for users to buy it is the expectation of rising prices, so it can quickly occupy the user's mindshare.

I think another important point is how users perceive a project and how they interact with it. An intuitive example is that when users experience Solana, the most obvious feeling compared to Ethereum is fast and cheap, so users think Solana is better than Ethereum. This is a fairly simple thinking logic. I also observed that many EigenLayer restakers don't actually know what AVS is, but because EigenLayer has a stake interface and interaction process, it will give them a familiar feeling and make them accept the narrative of Restaking faster.

4. Closing

More projects and tokens are being rapidly introduced to the market, and users need to face rapidly changing narratives and dazzling projects. In this playground where everything is accelerated, attention is a scarce resource.

Crypto has been developing for nearly a decade, and users don't want just a good DEX like they did a few years ago. Today, it is more difficult to build a successful Crypto project than in previous years.

In any case, user-oriented is the final outcome. Put your focus back on users and think about user needs from the first principles. This is my sincere advice to all Crypto entrepreneurs.

JinseFinance

JinseFinance