Author: Stanley, Kernel Ventures; Translation: 0xxz@金财经

1. Rollup track background

1.1 Track introduction

Rollup is Layer2 One solution is to expand the performance of Ethereum by transferring the calculation and storage of transactions on the Ethereum main network (i.e. Layer 1) to Layer 2 for processing and compression, and then uploading the compressed data to the Ethereum main network. The emergence of Rollup makes the Gas fee of Layer 2 much lower than that of the main network, saving Gas consumption, faster TPS, etc., making transactions and interactions smoother. Some mainstream Rollup chains that have been launched such as Arbitrum, Optimism, and Base, as well as ZK Rollup chains such as Starknet and zkSync are all commonly used chains on the market.

1.2 Data Overview

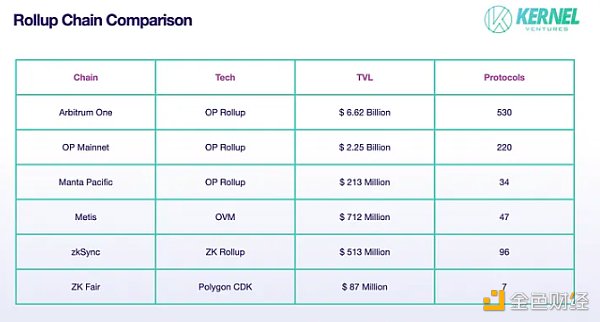

Rollup chain data comparison, picture source: Kernel Ventures< /span>

It can be seen from the data that OP and ARB still dominate the current Rollup chain, but rising stars such as Manta & ZK Fair can accumulate a certain amount of TVL in the short term, but in the protocol In terms of quantity, it will take some time to grow. The mainstream Rollup protocol has been fully developed and the infrastructure has been improved. Other emerging chains still need to develop.

2. Analysis of the Rollup track

This article will classify each chain and introduce some of the more popular Rollup chains as well as the old Rollup chains.

2.1 Old Rollup Chain

ARB: Arbitrum is an Ethereum Layer 2 expansion solution created by the Offchain Labs team based on Optimistic Rollup technology. While Arbitrum transactions are still settled on Ethereum, Arbitrum only submits raw transaction data to Ethereum, and execution and contract storage occur off-chain, so the gas fees required by Arbitrum are very small compared to mainnet.

OP: Optimism is based on Optimistic Rollup and uses a single round of interactive fraud proof to ensure that the data synchronized to Layer1 is valid.

Polygon zkEVM:Polygon zkEVM is an Ethereum Layer 2 zkEVM expansion solution based on ZK Rollup. This solution uses ZK proof to reduce transaction fees and improve throughput. Keep Ethereum L1 secure.

2.2 Emerging Rollup Chain

ZK Fair

The main features of ZK Fair as a Rollup are:

Built based on Polygon CDK, the DA layer will use Celestia (currently maintained by the self-operated data committee), EVM compatible

-

Using USDC as Gas fee

Rollup token ZKF is 100% distributed to the community. 75% of the tokens will be distributed in four installments to participants of Gas consumption activities within 48 hours. Essentially, participants participate in the primary market sale of tokens by paying Gas to the official sorter. The corresponding The financing valuation in the primary market is only US$4 million.

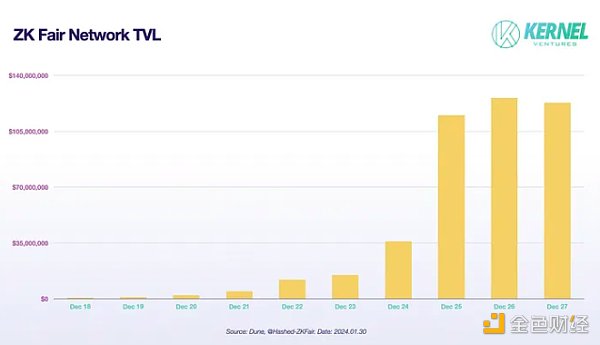

ZK Fair TVL growth trend, image source: Kernel Ventures

ZK Fair’s rapid rise in short-term TVL is partly due to its decentralized “ownerless” nature. We learned from the community that current mainstream exchanges such as Bitget & Kucoin & The listing of Gate etc. is done by the community and users to establish contact with the exchange, and then invite the official team for technical docking. They are all voluntary actions of the community, including izumi Finance on the chain, which is a model led by the community and supplemented by the project side. Make connections and strengthen community cohesion.

We learned from ZK Fair development team Lumoz (formerly Opside) that the team plans to launch new Rollup chains with different themes in the future, such as the currently hot Bitcoin-based Rollup chain, as well as social, Financial derivatives, etc. In the future, new chains may be launched in the form of cooperation with project parties, similar to the popular Layer 3 concept, that is, one Dapp and one chain. Through discussions with the team, we learned that some subsequent chains will also There is a Fair mode, where the team will distribute a portion of the original chips to participants on the chain.

Blast

Blast is a second-layer network based on Optimistic Rollups technology and compatible with Ethereum. It only takes 6 days to complete the TVL on the chain. It has exceeded 500 million US dollars, approaching 600 million US dollars, and has directly doubled the price of Blur tokens.

Blast began when founder Pacman believed that hundreds of millions of dollars in funds in the Blur bid pool had been passively sleeping, failing to earn any income, and this situation existed in almost every application in every chain. , meaning these funds are suffering passive depreciation due to inflation. Specifically, when a user deposits funds into Blast, Blast will then use the corresponding ETH locked on the Layer 1 network for native pledge of the network, and automatically return the obtained ETH pledge income to the users on Blast. Simply put, if a user holds 1 ETH in an account on Blast, it will likely grow automatically over time.

Manta

Manta Network is a gateway for modular ZK applications. It uses modular blockchain and zkEVM to establish a new L2 smart contract platform. Example, a modular ecosystem built for the next generation of dApps, currently provides two networks:

This article mainly introduces Manta Pacific, a modular L2 ecosystem built on Ethereum. Through modularization The infrastructure design addresses availability issues and allows seamless integration of modular DA and zkEVM. Since Manta became the first Ethereum L2 integrated into Celestia, Manta Pacific has helped users save more than $750,000 in gas fees.

Metis

Metis has been in operation for 2 years, but its recent decentralized sequencer (Sequencer) has attracted attention again. Metis is a Layer 2 based on the Ethereum chain. It is the first innovative use of decentralized sequence pool (PoS Sequencer Pool), mixed OP and ZK Rollup to improve the security, sustainable operation and decentralization of the network.

In Metis's design, the initial orderer nodes are created by whitelisted users, and there is a parallel staking mechanism. Users can become new sequencer nodes by staking the native token METIS, while allowing network participants to supervise the sequencer nodes, improving the transparency and credibility of the entire system.

3. Technology core analysis

3.1 Polygon CDK

Polygon Chain Development Kit (CDK) is a modular open source software toolkit for blockchain Developers launch new L2 chain on Ethereum.

Polygon CDK leverages zero-knowledge proofs to compress transactions and enhance scalability. It also prioritizes modularity and promotes flexibility in designing application-specific chains. This enables developers to choose virtual machines, sequencer types, gas tokens, and data availability solutions. It has the following features:

High modularity: Polygon CDK allows developers to customize L2 chains according to specific requirements. Can meet the unique needs of various applications.

Data availability: Chains built using CDK will have a dedicated Data Availability Committee (DAC) to ensure reliable off-chain data access.

3.2 Celestia DA

Celestia first proposed the concept of modular blockchain, decoupling the blockchain into three layers: data, consensus and execution. , these three layers of work in a single blockchain are all completed by a network. Celestia focuses on the data and consensus layer, and L2 allows Celestia to be responsible for the data availability layer (DA) to reduce interaction gas fees. For example, Manta Pacific has adopted Celestia as the data availability layer. According to Manta Pacific official news, DA fees were reduced by 99.81% after migrating from Ethereum to Celestia.

For specific technical details, please refer to Kernel Ventures’ previous article "Kernel Ventures: An article discussion DA and Historical Data Layer Design”.

3.3 Comparison of OP and ARB

Optimism is not the only existing Rollup solution. Arbitrum offers a similar solution. Arbitrum is the closest alternative to Optimism in terms of features and popularity. Arbitrum allows developers to run unmodified EVM contracts and Ethereum transactions on layer 2 protocols while still enjoying the security of Ethereum’s layer 1 network. In these respects, it offers very similar characteristics to Optimism.

The main difference between Optimism and Arbitrum is that the former uses a single round of fraud proofs, while Arbitrum uses multiple rounds of fraud proofs. Optimism's single-round fraud prevention (FP) relies on L1 to perform all L2 transactions. This ensures that FP verification is instantaneous.

Since its launch, ARB has been significantly better than OP in various L2 business data, but this began to gradually change after OP began to promote OP stack. Although OP still cannot reach the size of ARB , but there is already a rising trend, and the increase in this round of OP tokens is huge, nearly doubling in three months. Op stack is an open source L2 technology stack, which means that other projects that want to run L2 can use it for free to quickly deploy their own L2, greatly reducing the cost of development and testing. L2s that adopt OP stack can achieve safety and efficiency among themselves due to the consistency in technical architecture. After OP stack was launched, it was first adopted by Coinbase, which used L2 Base built by OP stack, which had a demonstration effect of Coinbase. Then Op stack was adopted by more and more projects, such as Binance's opBNB, NFT project Zora, etc.

4. Future Outlook of the Track

4.1 Fair Launch

The Fair Launch mode of this round of Inscription Track has a wide audience, allowing retail investors to directly obtain the original chips. This is why inscriptions are still popular today. ZK Fair uses the essence of this model, that is, public launch. In the future, more chains may follow this model, resulting in a rapid increase in TVL.

4.2 Rollup annexes L1 market share

In terms of experience, there is no real difference between Rollup and L1. Even its efficient transactions and low handling fees are often more attractive to users, because large Some users don't care so much about technical details and only make decisions based on experience. Some fast-growing rollups have excellent experience, extremely fast transaction speeds, and generous incentives for users & developers. With the precedent of ZK Fair, future chains may follow this method and further annex L1 .

4.3 Clear plan & ecological health

In this round of Rollup narrative, ZK Fair & Blast and other chains, project owners generously provide incentives, making the ecology healthier and reducing Many flamboyant and meaningless TVLs, such as zkSync, have not issued coins for many years after being online. They rely on high financing and technology to continue to be "PUA" participants. Although their TVL is very high, new projects on the chain, especially new narratives and new themes projects rarely come out.

4.4 Public Goods

In the new round of Rollup, many chains have proposed the concept of fee sharing. ZK Fair is 75% of the fee sharing to all pledgers of ZKF tokens. , 25% of the handling fee is shared with Dapp deployers. Blast also shares the handling fee with Dapp deployers. Therefore, many developers are not limited to the income of the project, nor are they limited to the income of ecological fund Grants. With the income of Gas , more free public products can be developed.

4.5 Decentralized Sequencer

The fee collection of L2 and the cost payment of L1 are both executed by the Sequencer of L2, and the profit also belongs to the Sequencer. Currently, OP and ARB's sequencers are all officially run, and profits go to the official treasury.

The mechanism of decentralized sorters is likely to operate on a POS mechanism, that is, decentralized sorters need to pledge L2’s native tokens such as ARB or OP as a credit deposit when they fail to perform their duties. The deposit will be slashed. Ordinary users can pledge themselves as a sorter, or they can use a pledge service similar to that provided by Lido. Users provide mortgage tokens, and professional and decentralized sorter operators perform sorting and uploading services, and pledge users can get most of it. The sorter receives L2 fees and MEV rewards (90% under Lido’s mechanism). This model can make Rollup more transparent, more decentralized, and more trustworthy.

4.6 The business model is broken

Almost all Layer 2 companies make profits through the "second landlord" model. The so-called second landlord means renting the house directly from the landlord and then re-renting it to others. Tenants, the same is true in the blockchain world. The Layer2 chain collects gas fees from users (tenants) and then pays them to Layer1 (landlord). Therefore, in theory, the scale effect is very important. As long as there are enough people using Layer2, in fact, the The fees paid to Layer1 will not change much (unless the volume is huge, such as OP, ARB). Therefore, if the transaction volume of a chain cannot reach expectations within a certain period of time, it may be in a state of loss in the long term. This is also the previous article The reason why chains like zkSync like mentioned above like PUA users is that with enough TVL, there is no need to worry about no users to trade.

However, this business model cannot be sustained in the past. Take a look at zkSync. It is a chain with excellent financing situation, but for some smaller chains, it may not be very useful for PUA users. . Therefore, some of the things mentioned above about the "grassroots" rise of ZK Fair are worth learning from other chains. When blindly paying attention to TVL, we must also think about the long-term continuation of TVL. And as more and more L2s are born, the handling fees of L1 will decrease, thereby reducing the biggest advantage of L2. This is also one of the problems faced by L2, how to acquire users not only from the perspective of low price.

5. Summary

The article takes ZK Fair’s TVL reaching US$120 million in a short period of time as the starting point. The Rollup track was discussed, including old ones such as Arbitrum and Optimism and new ones such as ZK Fair, Blast, Manta, and Metis.

At the technical level, the modular toolkit of Polygon CDK and the modular concept of Celestia DA were explained. Comparing the differences between Optimism and Arbitrum, it was mentioned that the decentralized sorter may adopt a POS mechanism to make Rollup more transparent and decentralized.

In the future outlook, the broad audience of the fair launch model is emphasized, and Rollup may annex L1 market share. It is pointed out that there is no substantial difference between Rollup and L1 in terms of experience, and efficient transactions and low fees attract users. Emphasizing the importance of public products, as well as the concept of fee sharing proposed by the new round of Rollup. Finally, we mentioned the disruption of the business model and focused on the long-term continuation of TVL.

To put it simply, the characteristics of this new round of Rollup are: new projects, tokens, modularity, generous incentives, making the project’s initial business and currency price flywheel turn faster .

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Hui Xin

Hui Xin cryptopotato

cryptopotato Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist