Original author: RootData Research

Table of Contents

Overall Development Trend Characteristics of Web3 Industry

1.1. Bitcoin leads the global increase in major asset classes, and Bitcoin spot ETF will promote the long-term development of the industry

1.2. The total annual financing in 2023 is US$9.043 billion, boosted by the linkage of primary and secondary markets The industry is moving towards a new cycle

1.3. The primary and semi-level markets are becoming a new choice for investment or exit

1.4. Infrastructure and CeFi will dominate the development of the Web3 industry in 2023, with new unicorns 6 Home

1.5, The number of Web3 project failures in 2023 will decrease by 50%

Web3 asset development characteristics and sectors Trend analysis

2.1. The essence of the four waves of innovation in the Web3 industry is to find the native assets with the greatest consensus

2.2. The number of Web3 developers year-on-year Increased by 66% , the Ethereum ecosystem has an overwhelming advantage

2.3, Web3 popular sector rotation: L1/L2, DeFi, GameFi is still the track that the market pays most attention to

2.4, Stanford produces the most Web3 Practitioner, Google has the highest amount of project financing

Web3 capital flow characteristics and trend analysis

3.1. Analysis of the style and activity of Web3 investment institutions in 2023

3.2. Analysis of the rise and fall of the number of Web3 investment institutions in 2023

3.3. Annual financing amount of the infrastructure track Research and Analysis of the Top Ten Projects

3.4. Research and Analysis of the Top Ten Projects by Annual Financing Amount of DeFi Track

3.5. Research and Analysis of Top Ten Projects by Annual Financing Amount of CeFi Track

3.6. Annual Financing of GameFi Track Research analysis of the top ten projects

2023 ROOTDATA LIST List

4.1. Top 50 projects in the Web3 industry

4.2. Top 100 investment institutions in the Web3 industry

4.3. List of vertical tracks in the Web3 industry

CeFi Track Top 20 Projects

Layer 1 Track Top 20 Projects

GameFi Track Top 20 Projects

Top 20 projects in the DeFi track

Layer 2 Track Top 20 Projects

SocialFi Track Top 20 Projects

< p style="text-align: left;">The Web3 industry as a whole shows a strong recovery trend. Bitcoin's highest annual increase reached 160%. The return on investment leads the world's major asset classes. Bitcoin spot ETF has become a new entry channel for incremental funds.

The total financing amount of the Web3 industry will reach US$9.043 billion in 2023. The financing performance of different tracks is also different. The enterprise-level foundation Facilities and wallets are favored by capital. In the DeFi trend, DEX competition is fierce, and derivatives and RWA have attracted much attention. The total financing amount of the CeFi track has declined, but the Bitcoin ecological opportunities have attracted capital attention.

Finding native new assets with the greatest consensus has become an important law for the development of the Web3 industry. The number of developers increased by 66% year-on-year, and the Ethereum ecosystem leads the trend with its overwhelming advantages. Popular sectors are concentrated in traditional fields such as DeFi, L1/L2, and Game, but opportunities in compliance and social directions are becoming an important consensus in the market.

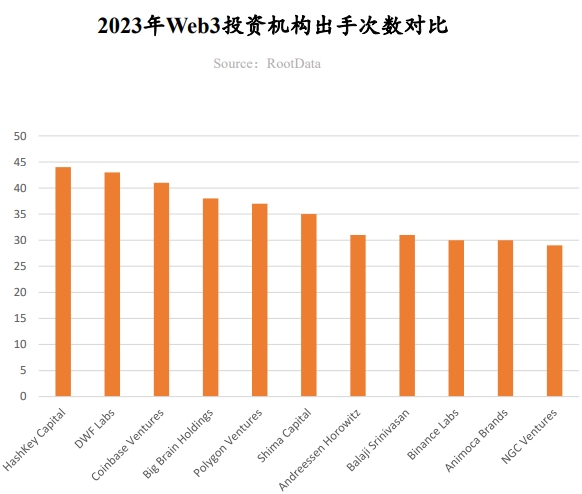

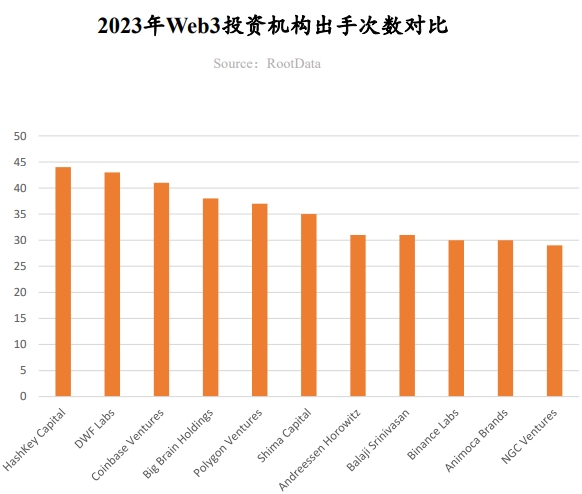

In 2023 more than 10 institutions will lead investment for at least 8 times. HashKey Capital ranked first in the number of annual investments for the first time, and has made extensive deployments in infrastructure, DeFi and other directions in the Asia-Pacific region. DWF Labs became the dark horse of the year, mainly investing in projects that have already issued coins and are not very popular in the market.

1. Overall trend characteristics of the Web3 industry

1.1. Secondary and macro analysis: Bit Coin leads the global increase in major asset classes, and spot ETF opens up a new dimension of market growth

1. Bitcoin: A highlight in the global asset sector

In 2023 Bitcoin will perform well as an asset class. According to NYDIG statistics, as of October 2023, Bitcoin has become the best-performing asset among 40 selected asset classes with an increase of 63.3% . This outpaced the 28.2% gain in U.S. large-cap growth stocks, as well as other major asset classes such as U.S. equities (12.2%), commodities (6%), cash (3.8%) and gold (1.1% ). In addition, Kaiko Research's analysis shows that despite facing tight macroeconomic conditions and headwinds in the crypto industry, Bitcoin still rose by more than 160% in 2023.

2. Bitcoin halving: new opportunities for market supply and demand

The Bitcoin halving event will occur in Q2 of 2024. Historically, Bitcoin’s price has risen significantly after each halving, but this has also been accompanied by increased volatility. In terms of demand, according to data from Glassnode, as of December 22, 2023, the number of non-zero balance Bitcoin addresses has exceeded 50 million. The increase in this figure reflects the growth of the user base. Together, these factors influence Bitcoin’s market value and trading activity.

3. Bitcoin Spot ETF: Leading the Growth Trend

Bitcoin spot ETF market performance is outstanding. On January 16 the trading volume exceeded 1.8 USD, surpassing 500 other ETF s on the same day. Three times the total amount. The trading volume in the first three days was nearly US$2 billion. Mainly includes funds managed by Grayscale, BlackRock and Fidelity. Standard Chartered Bank's head of foreign exchange research predicts that annual capital inflows may reach US$50 billion to US$100 billion in 2024. This reflects the high market interest and growth potential in these ETFs.

4. Monetary policy change: catalyzing the new bull market wave of Web3

The last bull market was related to the loose monetary policy of the United States, and the latest data shows that the Federal Reserve may cut interest rates in 2024. In this context, cryptocurrencies such as Bitcoin may become a diversification choice for investors due to their non-correlated and safe-haven properties. After the approval of Bitcoin spot ETF, Bitcoin has transformed from personal investment to institutional investment, reducing circulation and increasing scarcity. The Federal Reserve's interest rate cut expectations and inflation countermeasures may prompt more investors to allocate Bitcoin, heralding the beginning of a new bull market cycle in the Web3 industry.

1.2. The total annual investment and financing in 2023 will reach US$9.043 billion, and the linkage between the primary and secondary markets will promote the recovery and growth of the Web3 industry.

Spurred by the positive effects of Bitcoin spot ETF , BTC After testing the 3 mark for many times, the price ushered in a breakthrough. With the market's bullish sentiment prominent, as of December 31st, the total financing amount of the Web3 industry in 2023 reached 91.3 ; billion US dollars, of which the highest single-month financing amount was US$1.312 billion in November. The financing amount in Q4 was three quarters ahead. This is due to the short primary and secondary transmission paths of the Web3 industry. , showing that the primary market is gradually entering the track of recovery and growth.

Since entering the Q3 quarter of 2023, many funds have announced the completion of fundraising, and Web3 Fund Lightspeed Faction announced the completion of 285 U.S. dollar fundraising (over-raising 14% ), Standard Chartered Bank and Japanese financial giant SBI launched a US$110 million Web3 fund, and the Web3 fund CMCC Global supported by Li Zekai completed 1 billion in funding.

1.3. The primary and semi-level market is becoming a new choice for investment or exit. Fireblocks the off-site valuation has retreated the most, and EigenLayer the off-site valuation has increased the most.

As Web3 accelerates towards compliance , the high degree of linkage between the primary and secondary markets is more likely to cause investors' FOMO sentiment and high project valuations. More and more investors are considering the primary and semi-primary markets as important investment and exit paths.

Among the 45 projects listed on RootData primary and semi-market, Fireblocks OTC valuation Compared with the financing valuation, the retracement was the largest, with a decrease of approximately US$4 billion. Copper and Dune Analytics both have off-market valuation retracements of approximately several hundred million dollars. EigenLayer has performed strongly, and its current over-the-counter valuation of US$2.5 billion is 5 times the latest round of financing valuation of US$500 million. The off-site valuations of projects such as Aleo and LayerZero are relatively stable.

1.4, 2023 Infrastructure and CeFi dominated the development of the Web3 industry, adding new unicorns ;6 Home

According to RootData data, nearly Infrastructure, CeFi, games, NFT, DeFi, etc. are the tracks with the largest capital inflows in 3 years. The average financing amount in 2023 will be US$9.9 million, which will be reduced by about half compared to US$18.8 million in 2022. Even though the industry has gone through a two-year bear market, infrastructure has always been a hot topic.

Ending 2023 year 12 month 31 On that day, a total of 91 unicorn projects were born in the Web3 industry, of which CeFi accounted for 32, infrastructure accounted for 29, and NFT accounted for 8. However, the market has been sluggish in the past two years and the pace of investment in the primary market has slowed down. As a result, the number of Web3 unicorn projects (Andalusia Labs, Scroll, Flashbots, BitGo, Wormhole, Ramp) that will emerge in 2023 will only be in 2022. ;1/5 of the year.

1.5. The Web3 industry is maturing: The number of dead projects in 2023 will decrease by 50 year-on-year %

According to RootData data, about 120 Several projects declared bankruptcy or ceased operations in 2023, with the cumulative financing amount reaching US$940 million. Compared with the 239 projects that died in 2022, the total financing was US$4.033 billion, showing a significant decrease overall, reflecting that the industry is gradually maturing and stabilizing. These dead projects are distributed in various tracks, among which the DeFi track has the most dead projects (40), followed by CeFi (18) and infrastructure (16).

The top three financing projects among the bankrupt projects are Prime Trust (accumulated financing of 163 USD), Voice (accumulated financing of 1.5 ; US$100 million), Rally (accumulated financing of US$72 million). Insufficient funds are the main and most direct reason why projects cease operations. Other reasons include lack of market fit of products, stricter regulatory policies, hacker attacks, etc.

2. Web3 asset development characteristics and sector trend analysis

2.1. Four waves of the Web3 industry Wave of innovation: Looking for native new assets with the greatest consensus

Four waves of innovation in the Web3 industry The essence of Inspur is to find new native assets with the greatest consensus. New assets drive the influx of funds, so it is important to find the paths and scenarios for the birth of new assets in the Web3 industry, especially native assets, because compared with non-native assets, it has less resistance and The narrative space will be larger.

2.2. The number of Web3 developers increased by 66% year-on-year, and the Ethereum ecosystem has an overwhelming advantage

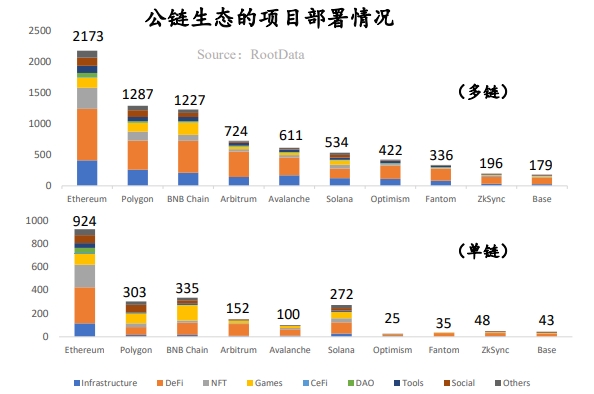

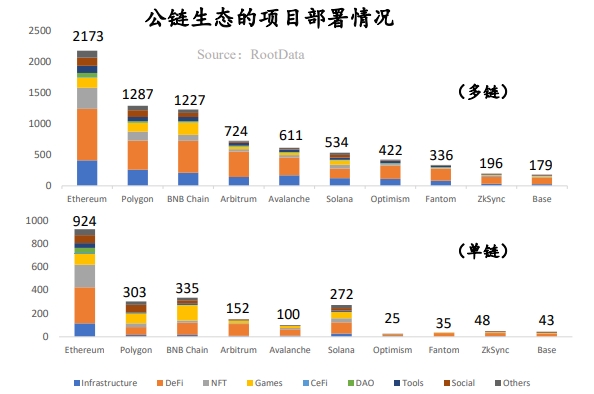

The Ethereum ecosystem has the greatest advantage: Whether it is a single chain or multiple chains, Ethereum Ecosystems all have overwhelming advantages, and the rest of the ecosystem mainly takes over the value overflow of Ethereum;

Solana becomes the performance of 2023 The most eye-catching public chain: SOL Tokens have increased by nearly 1000% , Solana Foundation announced that the number of monthly active developers has remained above 2500 , and ecological star projects have taken turns to enter the battle, whether it is veteran DeFi Projects such as Raydium, Orca, and Solend, as well as current star projects such as Jito, Jupiter, and Pyth Network, have gradually formed unique ecological advantages.

The number of developers has increased overall compared with the previous cycle: Compared with the last bear market, the number of developers has increased by 66% ;

Changes in developer types: Mature developers and builders are still strong in the Web3 industry, and speculative developers are leaving in batches; judging from the full-year data for 2023, this round of bear market The biggest change is among novice developers (the number decreased by 58%), while the number of experienced developers is increasing. The proportion of code submissions by developers with more than 1 year of experience is 75%.

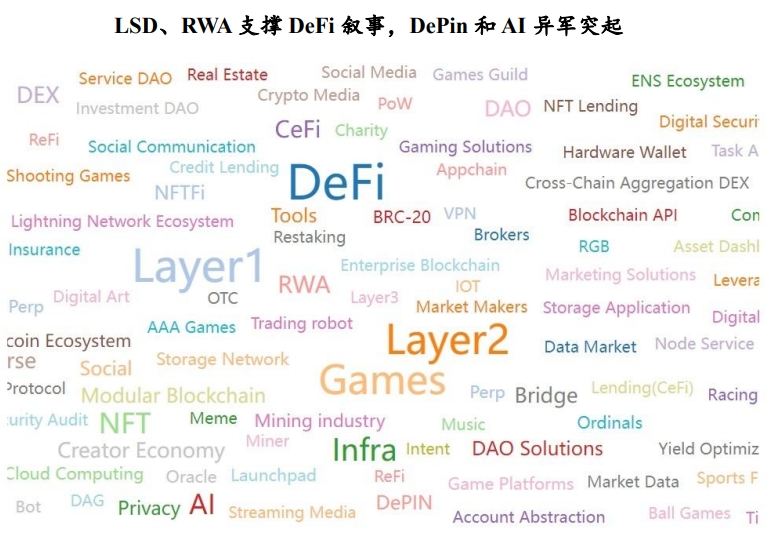

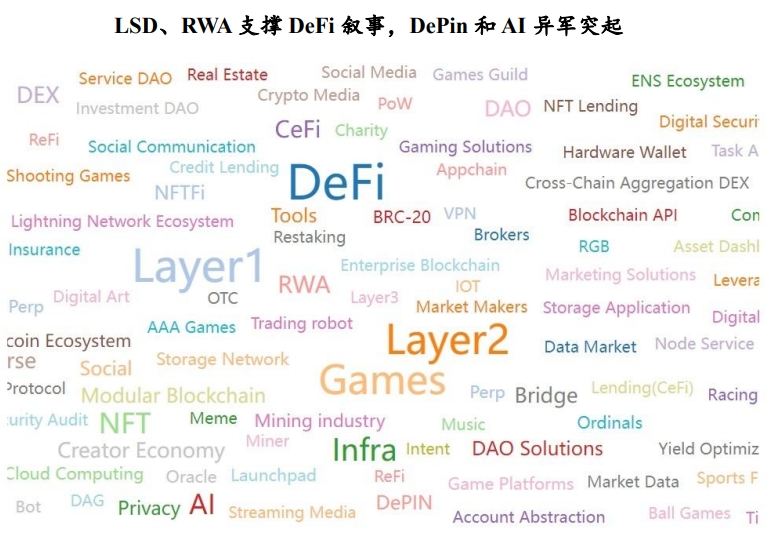

2.3, Web3 Rotation of popular sectors: L1/L2, DeFi, Game are still the tracks that the market pays most attention to , Layer 3, Restaking and other sectors are receiving market attention

Judging from the millions of tag clicks on RootData, DeFi, L1/L2, Games are the most popular tags. Lido, the leading staking service, and MakerDAO, the RWA concept pioneer, have brought the DeFi track back to life.

Layer 3, Intent and Restaking sectors are receiving market attention. EigenLayer Introducing Ethereum-level trust into middleware has created a new re-pledge ecosystem.

In 2023 Binance will list 26 new coins in total, covering infrastructure, Layer 1 and Meme etc. 20 There are many popular tags. The search popularity has dropped significantly for tags such as NFTFi, DAG, DOV and so on.

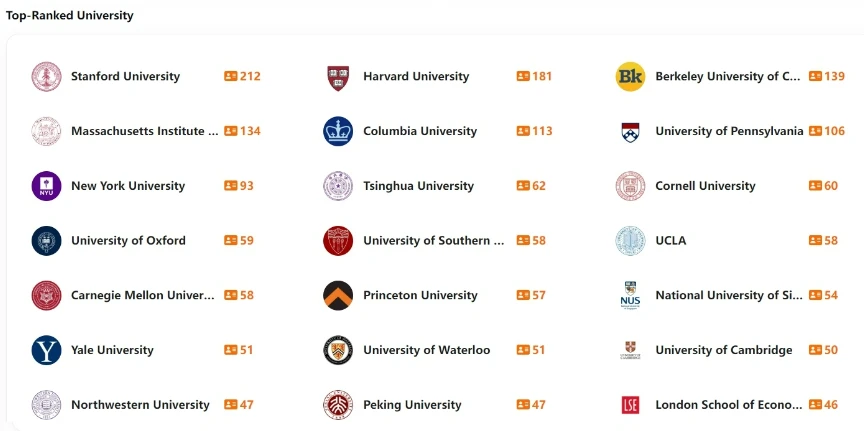

2.4. Stanford is the Web3 practitioner with the most output, and Google has the highest amount of project financing

From the perspective of education and work experience, the United States, China and Singapore are the most important countries where Web3 projects were born. , mainstream Web3 practitioners basically have both financial and technical capabilities and resources.

The Web3 entrepreneurship team of Harvard University and the entrepreneurship team of Google have the highest cumulative financing amount, and the Web3 entrepreneurship team of Peking University ranks the highest in cumulative financing amount Ranked 15th, Binance’s entrepreneurial team ranked 10th in cumulative financing amount. Among Chinese, Binance and HTX have the largest number of entrepreneurial teams. In addition, the number of entrepreneurial teams from OKX and Bitmain is increasing. Non-native Chinese practitioners mainly come from Alibaba and Tencent.

3. Web3 capital flow characteristics and trend analysis

3.1. Analysis of the style and activity of Web3 investment institutions in 2023: HashKey Capital is most willing to invest, and a16z Crypto prefers to lead the investment

Hashkey Capital becomes the institution with the most transactions in the year

HashKey Capital leaks to the top spot in the year for the first time Ranking first in the number of investments, it has made large-scale deployments in infrastructure, DeFi and other directions, with a special focus on projects in the Asia-Pacific region. In January 2023, it was announced that its third phase fund had completed US$500 million in fundraising, providing strong support for its high-frequency investments. Typical investment cases: MyShell, DappOS, Supra, SynFutures, PolyHedra.

DWF Labs becomes the dark horse of the year

DWF Labs major investment The style of projects that have already issued coins and are not very popular in the market has caused a lot of controversy. Typical investment cases: EOS, Conflux, Mask Network, Synthetix, Fetch.ai.

a16z Crypto prefers leading and large investments

a16z Crypto prefers leading and large investment styles, and maintains an active investment posture in areas such as infrastructure, games, and entertainment. Typical investment cases: Gensyn, Mythical Games, Proof of Play, Story Protocol, CCP Games.

In 2023 more than 10 institutions will lead at least 8 investments

Judging from the number of leading investments, 2023 Andreessen Horowitz, Polychain, Bitkraft Ventures, Dragonfly, 1kx, Hack VC, Shima Capital, Jump Crypto, and ABCDE Capital ranked Top 10, leading at least 8 times.

3.2. Analysis of the rise and fall of the number of Web3 investment institutions in 2023: Animoca Brands' number of transactions shrank the most, with 85 institutions investing throughout the year Over 10 times

Judging from the number of investments, a total of 85 investors made more than 10 times, and 9 investors made more than 30 times, which was a sharp decline compared with 2022. This reflects that the vast majority of investments Institutions have been affected by difficulties in raising funds, lack of confidence and other reasons, and have significantly reduced their investment frequency.

Among them, Animoca Brands, GSR, Coinbase Venture, Shima Capital, Spartan Group, a16z, Paradigm, Circle Ventures, Mirana Ventures and other investments The number of investments by institutions in 2023 has dropped significantly, falling by more than 40%.

Web3 investment institutions generally face difficulties in raising funds, only Blockchain Capital, HashKey Capital, CMCC Global, Bitkraft Ventures, No Limit Holdings, etc. The organization announced that it has raised more than $50 million.

At the same time, a small number of investment institutions are also accelerating the frequency of investments to inject momentum into the bleak market. According to statistics, the number of investments from ABCDE Capital, Superscrypt, Foresight Ventures, OKX Ventures, Sora Ventures, No Limit Holdings and other institutions has increased significantly in 2023, rising by more than 50%.

In the Bitcoin ecological craze at the end of the year, institutions such as ABCDE Capital, Sora Ventures, Waterdrip Capital remained active and became Bitcoin Major investor in ecological projects.

3.3. Infrastructure track: The cross-chain direction has the largest financing case of the year, and the enterprise-level infrastructure and wallet direction are subject to capital Sought after

The largest financing case of the year since the birth of the cross-chain track

Wormhole announced the completion of US$225 million in financing in November 2023, becoming the highest-financing project of the year. Cross-chain is also one of the hottest industry trends in 2023. With the widespread emergence of Layer 1, Layer 2 and even Layer 3, users’ cross-chain demand for assets and data is growing rapidly. Wormhole and LayerZero have broken down the barriers between various blockchains through cross-chain communication.

The wallet serves as a traffic portal to receive capital support

As a user Traffic entrance and wallet track are still the targets of capital injection. Both the encrypted hardware wallet Ledger and the social login wallet Magic have received huge amounts of financing, reflecting users' needs for wallet security and convenience respectively. Their development and evolution are the key to the blockchain hosting the next billion users.

Enterprise-level infrastructure has become the focus of the layout

Enterprise-level infrastructure Infrastructure has become the focus of the layout. Digital asset custody and issuance infrastructure Auradine and blockchain development platform QuickNode are mainly targeted at enterprise-level customers, helping companies solve asset issuance, application development and other issues on the asset side, thereby delivering a steady stream of high-quality assets and projects to the market.

3.4. DeFi track: DEX competition continues to intensify, derivatives and RWA have become the focus of the industry

Derivatives agreements have become the focus of capital

Derivatives protocols are the focus of the DeFi field. Focusing on perpetual contracts, synthetic assets, structured products, etc., protocols such as SynFutures, Thetanuts Finance, and Synthetix have received capital support, and their core highlights are It lies in more transparency, permissionless operation mechanism and more user-friendly products.

DEX Competition on the DEX track is intensifying in compliance, order books, cross-chain and other aspects

The decentralized trading track also has many highlights, including Mauve, which focuses on compliance, tanX, which focuses on order book trading, and iZUMi Finance, which focuses on multi-chains. They are using Uniswap through market segmentation and functions. As leading players compete for market share, investment institutions have high hopes.

The market has high expectations for RWA

RWA assets are becoming the most watched direction in the DeFi market. Since real estate, treasury bonds, bills and other assets have stable yields, RWA can provide sustainable and rich types of real yields for the crypto market. Superstate, newly founded by the founder of Compound, is one of the latest major players in the RWA track. The project is committed to purchasing short-term U.S. Treasury bonds and tokenizing them on the chain, which can be directly traded on the chain.

3.5. CeFi Track: The total financing amount has fallen the highest among the major tracks, and the Bitcoin ecological opportunities are sought after by capital

Highest drop among major tracks

In 2023, the total financing amount of the CeFi track will be US$1.18 billion, a decrease of 75.%, which is the highest decline among the major tracks. This is mainly affected by the severe thunderstorm events in CeFi starting in 2022.

Bitcoin-related financial services receive capital bet

Bitcoin-related financial services have attracted the most attention from capital. Swan, Unchained, and River Financial all provide solutions for the Bitcoin ecosystem, providing savings, lending, brokerage and other services. As the most valuable crypto asset, Bitcoin provides its holders with various solutions and creates huge untapped value.

The exchange track has experienced a turning point

Exchange competition After the FTX incident, the vacant market space still attracts the attention of many capitals. Exchanges such as Blockchain.com and One Trading have obtained huge amounts of financing by virtue of their vertical business, regional or license advantages.

3.6. GameFi track: total financing fell by more than 57% , 3A games are still favored by investment institutions

GameFi The overall financing amount of the track fell by more than 57%

Affected by the secondary market conditions, the overall financing amount of the GameFi track has dropped significantly by more than 57% . Large-scale financing is mainly provided by a16z Crypto and Griffin Gaming. Partners, Bitkraft Ventures and other institutions.

Playability has become the mainstream trend

3A games Especially favored by investment institutions, the prospects of Web3 for traditional games such as football, shooting, and adventure are also promising, and playability has become the trend of GameFi; in addition, full-chain games are being placed high hopes by capital and the market.

4. 2023 ROOTDATA LIST

Web3 is becoming a global society An important transformative force that cannot be ignored. In order to more clearly present these contributions to Web3, RootData relies on its leading and rich data advantages and more than 10 million visits and queries from users, and adheres to the principles of professionalism, objectivity, rigor and fairness. , is committed to creating a data-driven list with industry credibility - ROOTDATA LIST, presenting more industry representatives in the Web3 field and helping the high-quality development of the industry.

2023 ROOTDATA LIST list includes "WEB3 Industry TOP 50 Projects", "WEB3 Industry TOP 100 Investment Institutions", "CEFI Track" "TOP 20 Project", "DEFI Track TOP 20 Project", "LAYER 1 Track TOP 20 Project", "LAYER 2 Track TOP 20 Project" "GAMEFI Track TOP 20 Projects”, “SOCIALFi Track TOP 20 Projects”.

Explanation of selection criteria:

Institution selection: core measurement indicators include number of investments, lead investment Number of times, quality of investment projects, media popularity, RootData popularity, etc.

Project selection: core measurement indicators include market value/valuation, media popularity, total lock-up value, financing amount, RootData popularity, investment institution quality, narrative and competition Road card position.

< img alt="RootData: 2023 Web3 Industry Development Research Report and Annual List" src="https://www.chaincatcher.com/upload/image/20240205/1707109062951-541713.png">

Weatherly

Weatherly