Author: ASXN Compiler: Block unicorn

Introduction

Over the past year, as tools, wallets, platforms, and assets continue to improve steadily, the Bitcoin ecosystem has set off a wave of attention every few months.

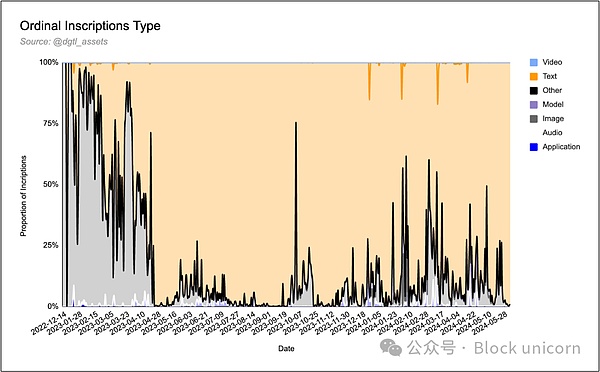

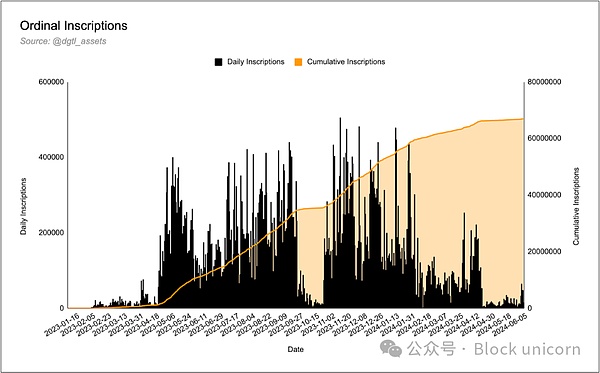

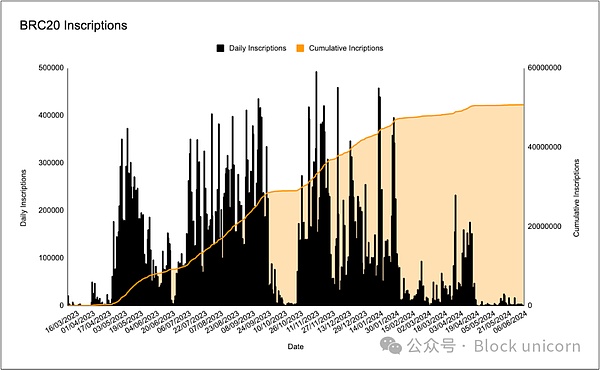

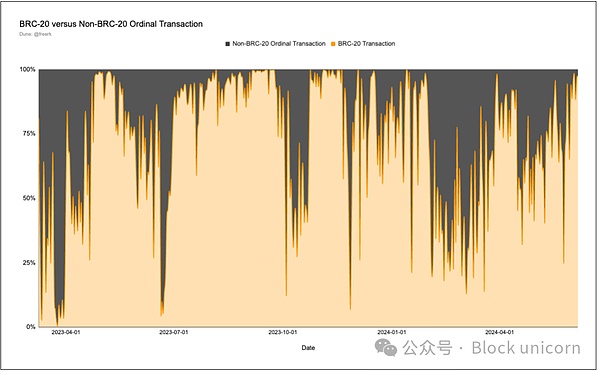

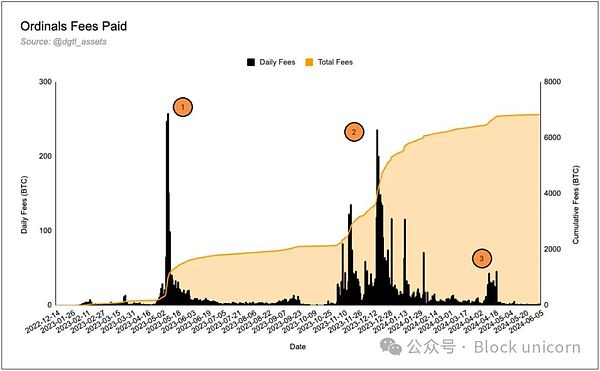

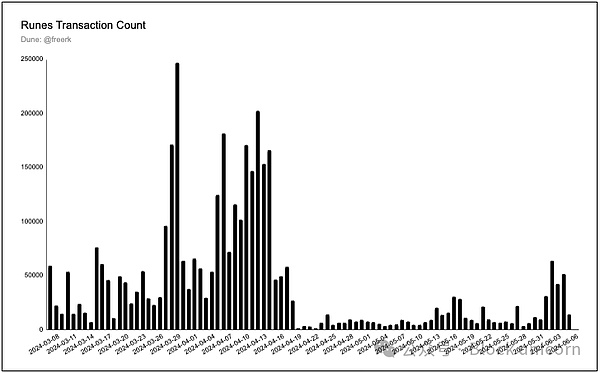

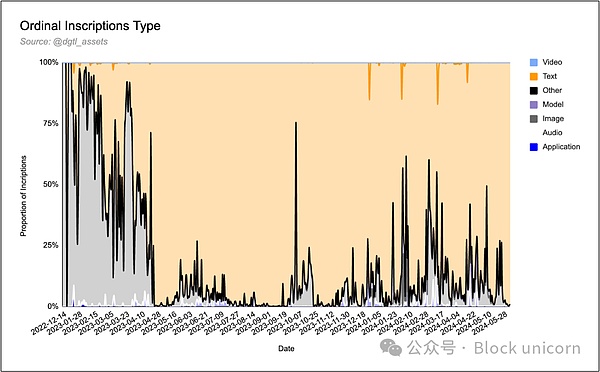

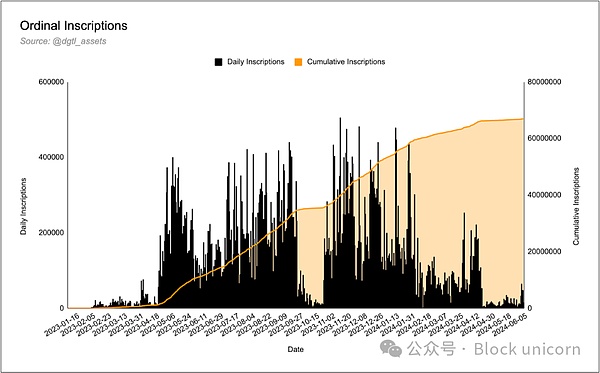

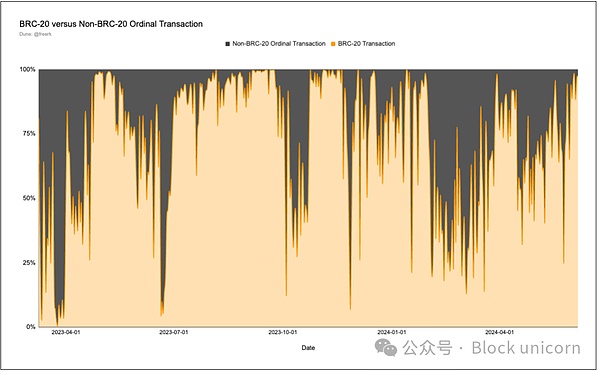

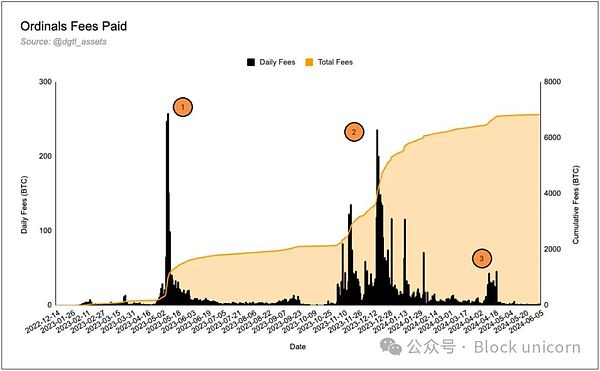

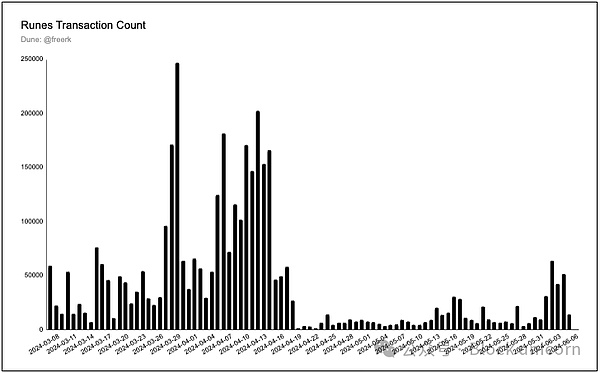

Initially, people scrambled to own less than 10,000 inscriptions to prove their origin, and later new niche communities gradually formed, both memecoin and Ordinals. So far, there are 67 million individual inscriptions, including ordinals, BRC-20, runes, etc. The pattern has also changed dramatically: the hype of ordinals was replaced by the hype of BRC-20 (which lasted for a short time). Since then, BRC-20 has been replaced by runes as a popular "token", and runes are a more concise and simple version of BRC-20.

Unlike interacting with tokens on Ethereum, Solana, and other L1 or L2, interacting with tokens and ordinals on Bitcoin is difficult. But the experience is slowly getting better: in the initial stages, most transactions were conducted through OTC Discords and spreadsheets. Since then, trading has moved to more reputable markets such as MagicEden and OKX, as well as some smaller but purely Bitcoin-native markets such as Unisat. The experience of trading and using non-BTC assets on Bitcoin has improved greatly and become much better. Although certain issues still exist as new asset types and transaction types are added, such as the possibility of burning valuable sats or inscriptions, the experience is now comparable to that of an undeveloped L1.

A natural question when trading and transferring non-BTC assets on Bitcoin is:

We believe this interest stems from three main factors. First, participants have an economic motivation: they believe that if the experience is bad, then they are early adopters, which also means they can profit. Second, there is a lot of capital on the Bitcoin chain, and users expect that capital to flow into other non-BTC assets. Given that Bitcoin users tend to hold their Bitcoin rather than spend it, this reasoning is somewhat untenable. Finally, a less discussed reason is that assets on the Bitcoin chain are unique. Each token and ordinal is engraved on the sat. For example, while NFTs on Ethereum technically live on IPFS (a peer-to-peer distributed network for storing and sharing data), the ordinal is engraved on the sat. This means that while Ethereum or other L1 and L2 require their NFTs to point to the URL of the image associated with it, on Bitcoin, the ordinal encodes the image they represent.

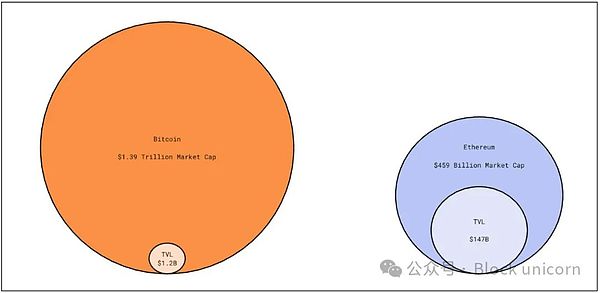

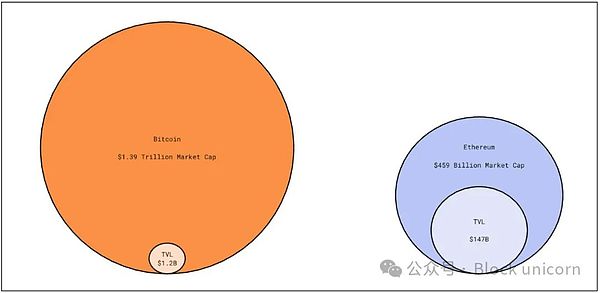

Trillion Dollar Opportunity

Bitcoin is a $1.4 trillion asset and digital natives have been accumulating BTC for years, with TradFi joining the ranks thanks to the ETF approval. The desire to hold BTC stems from its store of value properties and general apathy towards the traditional financial system, but there is more to the story than that. Recent technological developments have brought increased utility and functionality to the chain.

The ideological nature of the Bitcoin community has historically been a barrier to Bitcoin innovation and Bitcoin’s use on other chains. However, the introduction of inscriptions and runes offers a Bitcoin-native solution that aligns with the ethical guidelines that guide the community.

Historically, attempts to add functionality to BTC have come in the form of wBTC (wrapped BTC on Ethereum), while attempts to build protocols that facilitate BTC use on the Bitcoin network have been rare. Much of Bitcoin’s capitalization has been stagnant for years because it has little to no use on-chain; however, Casey Rodarmor has revolutionized this. Inscriptions and runes brought NFTs and memecoins to Bitcoin, which has freed up a lot of capital.

Source: Delphi

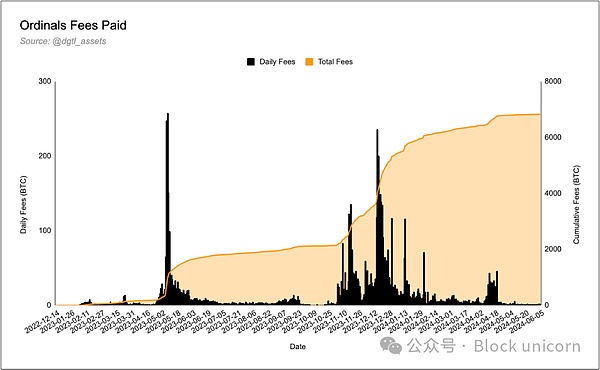

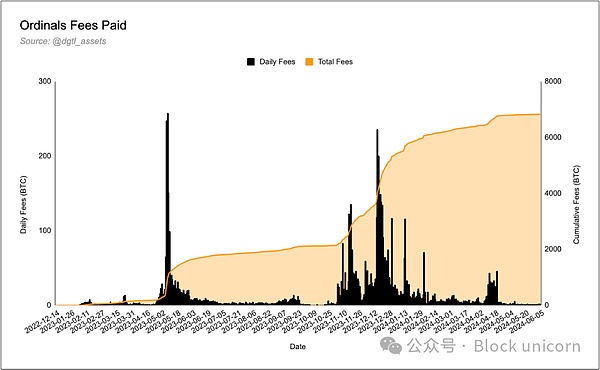

What’s the point of all this? The desire to speculate leads to increased demand for block space, which leads to increased miner fees. If we’re all going to speculate, why not do it on Bitcoin? Any attempt to add additional utility on-chain can only make the base asset, Bitcoin, more valuable and more like money — even if it leads to a short-term backlog in the mempool and unconfirmed transactions. Increased activity builds communities, attracts users, and ultimately becomes a tool to connect users to Bitcoin and its belief system.

Historical context:

To understand the significance of BTCFi (Bitcoin Finance), it’s worth understanding the structures and barriers that have traditionally held it back.

Smart Contract Compatibility:Bitcoin’s scripting language was designed to be intentionally limited in complexity to prioritize security and simplicity. More complex L1s like Ethereum were designed from the outset with Turing-complete programming languages, which enables developers to build DeFi protocols that run on complex code — a level of complexity that Bitcoin’s L1 cannot handle. This complex code is the backbone of DeFi, allowing financial services such as lending, clearing, and trading to be performed automatically and decentralized.

Scalability and transaction speed:Bitcoin is slow to process transactions, processing 3-7 transactions per second, and the 10-minute block time is not suitable for high-performance DeFi applications. In summary, DeFi applications require high throughput and fast confirmation times to run effectively. Ethereum and other L1s have implemented solutions such as L2 or large validators to improve system performance.

Development Community and Ecosystem:The Bitcoin ecosystem lacks a level of development that matches the development frameworks, libraries, and other tools needed to build and deploy DeFi applications. Other L1s have large and active developer communities that are constantly looking to innovate, and this culture is largely missing in Bitcoin.

Core Thesis:There is a fundamental difference between Bitcoin and other L1s, which is the core thesis of their existence. Bitcoin's thesis has been solidified as a store of value, while Ethereum and other L1's thesis is more dynamic.

Design Philosophy:The original intention of Bitcoin was to use it primarily for isolation, although there were small changes later, such as Segregated Witness (SegWit), which subsequently promoted the development of expansion. However, Bitcoin in general is not designed in a way that facilitates building secondary layers and/or applications on top of the base layer. Ethereum, on the other hand, is built as a general purpose smart contract layer - it is designed with the intention that protocols can be built on top of it. This can be seen in the roadmap and the EIPs (Ethereum Improvement Proposals) that drive expansion of the ecosystem.

Prerequisites and Background

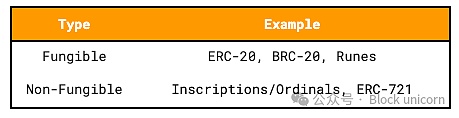

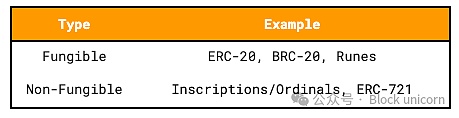

Fungible vs. Non-Fungible Tokens

The concept of fungibility can be boiled down to the ability of 1 unit of a good to be exchanged for another unit of the same good - i.e. are there identical units of the same good? Whether a good should be fungible depends on the nature of the good and the use case for the good.

A good example of a fungible good is a 1 dollar bill, where one dollar can be exchanged for another dollar without any material difference. In the context of traditional finance (TradFi), stocks are fungible - one Tesla stock is exactly the same as another. The same logic can be applied to crypto assets, one BTC is exactly the same as another BTC.

Non-fungible goods, on the other hand, are goods that are similar but not identical. The Last Supper and Salvator Mundi are both paintings by Leonardo da Vinci, but they have different values — a direct exchange would leave one party at a loss. One diamond is not interchangeable with another diamond because they differ in cut, clarity, color, and carat weight, among other things. NFTs are, by definition, non-fungible goods. One NFT will not and should not be identical to another NFT.

Depending on the nature of the protocol being built, developers will need to choose a token standard that defines the fungibility characteristics of a token.

It is worth noting that while Runes are fungible, they are still not as easily traded as Runes on Solana and Ethereum. Trading and DeFi infrastructure on Bitcoin is still limited. Trading with Runes is based on a "batching" system where users have to split the batches. For example, on Solana, selling 1 SPL TOKEN is simple. You just need to enter the number of tokens you want to sell. However, on Bitcoin, tokens come in batches. If I have 10,000 TOKENs and I only want to sell 1, I need to split it first and then list the single TOKEN I want to sell. While this does not make for a great user experience, it is also the initial step in building more complex financial infrastructure on Bitcoin, and both application and wallet developers are actively working on improvements.

Basic AccountModel

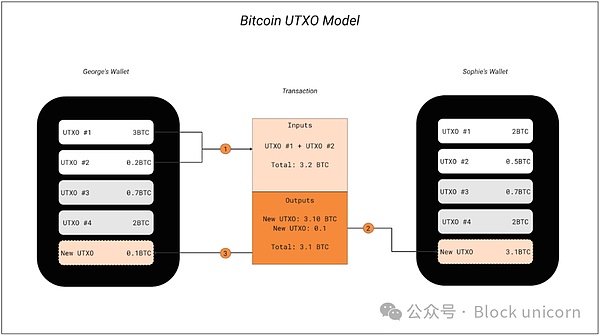

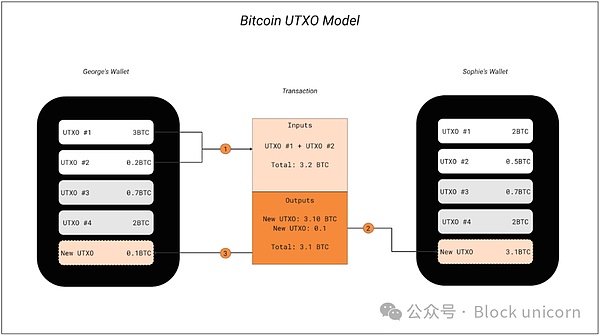

In general, there are only 2 basic account models used by L1 - Bitcoin's UTXO model and Ethereum's account balance model. Similar to double-entry bookkeeping, the purpose of the basic account model is to track balances in a decentralized database.

Account Balance Model (Ethereum) – This is the model we are all familiar with, and it is essentially the exact same as how a bank account works. This model tracks the overall account state (balance) without worrying about the specific details. A transaction is valid if the account balance > the spending transaction. Going back to the bank account analogy: it doesn’t matter how your account gets its value, what matters is that your account balance is greater than the spending transaction.

UTXO Model (Bitcoin) – This underlying account model tracks the specific denominations that bring an account to its total balance. As a mental model, the UTXO system can be likened to how cash payments work. You can’t pay someone $5 by tearing a $10 bill in half; the $10 is the payment and the $5 is the change. You also can’t send $6.50 if you have two $5 bills and four $1 coins; you need to give the seller $7 (a $5 bill and two $1 coins), and you will receive $0.50 in change.

UTXO proceeds in a similar manner - a group of UTXOs are pooled together and sent to the recipient, and then the change is sent back as a new UTXO.

Source: River

Ordinals and Ordinal Theory:

Ordinal Theory is the practice of identifying, numbering, inscribing, tracking, and transacting individual Satoshis. In this world, a single Satoshi is called an ordinal. "Inscribing" is the process of attaching digital content/data to a Satoshi.

Basics and Background:

The backstory is as follows: Casey Rodamor, who had always been fascinated by generative art, observed Ethereum’s NFT season and was attracted to the Art Blocks project. However, he felt that ETH developer UX and centralization issues prevented him from creating and selling his own generative art on ETH. So he challenged himself to bring NFTs to BTC in a way that was culturally acceptable to Bitcoin and its broader community — no tokens, no personal stakes, no changes to BTC, etc. The Ordinals protocol was born, and the rest is history.

Ordinals refers to the fact that in Bitcoin, each individual satoshi has a unique serial number that is assigned based on the order in which the satoshis were mined, and it identifies the satoshi’s position in the total supply. For example, ordinal 1.05 quadrillion is in the middle of the entire supply, as 2.1 quadrillion satoshis will be mined. Ordinals are names given to serial numbers that identify the position of satoshis.

For an NTF to exist on-chain, it needs to be attached to something. This allows the owner to be identified, and enables the NFT to be transferred. The problem is that Bitcoin does not have any stable native identifiers - addresses are temporary, and UTXOs (unspent transaction outputs) are destroyed and created, so there is no stable identifier that can be attached. In Ethereum, the equivalent stable identifiers are smart contract addresses and token IDs. In Bitcoin, this problem is solved with ordinals - individual satoshis can be identified and labeled through the ordinal protocol, which gives us a stable identifier. Given that satoshis will exist forever, this allows anyone to link content to satoshis, and ownership of content transfers with ownership of satoshis.

It is important to note that the ordinal theory is a convention. Participants need to "opt in" to the theory by downloading and running the ORD client. Ordinal theory is a completely "off-chain" phenomenon and a form of social consensus; those not running the ORD client cannot identify individual Satoshis, nor know in what order they were mined. Ordinal theory allows us to rank Satoshis within the block reward, and by extension, every Satoshi that has ever existed.

Valuation

Since ordinals can be tracked and transferred, the natural next step is for people to start collecting specific ordinals that they deem valuable. The idea of value is entirely subjective and is left to the discretion of collectors.

Casey provides subjective guidance for valuing ordinals. He uses the frequency of different events in Bitcoin block production and the associated probabilities of those events occurring (both absolute and conditional) to assign different levels of rarity.

Events and Frequency:

Block Generation: One block is generated approximately every 10 minutes.

Difficulty Adjustment: Once every 2016 blocks.

Halvings: Once every 210,000 blocks.

Cycles: Every 6 halvings, difficulty adjustment and halving occur at the same time, which is called a cycle. The cycle lasts approximately 24 years.

This gives us the following rarity levels:

Common: The first satoshi in a block that is not the first satoshi

Uncommon: The first satoshi in a block

Rare: The first satoshi in each difficulty adjustment cycle

Epic: The first satoshi in each halving cycle

Legendary: The first satoshi in each cycle

Mythic: The first Satoshi in the genesis block

Total supply is as follows:

Common: 2.1 Quadrillion

Uncommon: 6 929 999

Rare: 3 437

Epic: 32

Legendary: 5

Mythic: 1

Value is subjective - other markers of rarity might include who mined BTC (e.g. Satoshi), when it was mined (e.g. BTC Pizza Day), or if they were involved in a famous transaction (e.g. the first Bitcoin transaction between Satoshi and Hal Finney). Value is entirely in the eye of the holder. There is a certain beauty to the laissez-faire nature of the protocol and its valuation methods, with Bitcoin's belief system reflected in every design decision.

Inscriptions

A numbering system and collectible Satoshis are cool, but lack permanence. Things get more interesting once we are able to attach digital content to ordinals. Inscriptions are a way to insert arbitrary data (images, text, audio, or even software) onto a single Satoshi.

The inscription data is published to the Bitcoin blockchain as part of the witness data (the part that contains the transaction signature). The inscription data then goes into the mempool, and once it is confirmed by mining, it becomes a permanent part of the blockchain. Anyone can track these inscription data using custom software, such as Ordinals Explorer.

Unlike regular Bitcoin transactions, creating, minting, and tracking inscriptions requires the holder to run a proprietary ORD client on a fully synced full node. The ORD client is compatible with Bitcoin Core, which allows users to inscribe individual satoshis and track ordinals in UTXO sets. Regular Bitcoin wallets were previously unable to distinguish between inscribed satoshis and regular satoshis, but newer wallets and iterations have adopted different conventions.

Although this is an emerging field, the ecosystem for ordinals and inscriptions is slowly heating up. The construction of liquid markets, trading venues, wallets, etc. is proceeding at a breakneck pace. Some important projects and infrastructure include:

Collectibles: Taproot wizards, ORD Rocks, Bitcoin Puppets, Quantum Cats

Markets: MagicEden, OKX Marketplace, and Unisat Marketplace

Explorers: Ordiscan, OpenOrdex, ord.io, and Ordinals.com provide tools for navigating the inscription ecosystem.

Inscription Services: Outsourcing the complexity of minting ordinals to third parties.

Wallets: MagicEden, OKX, Unisat, and Xverse.

BRC-20 Series

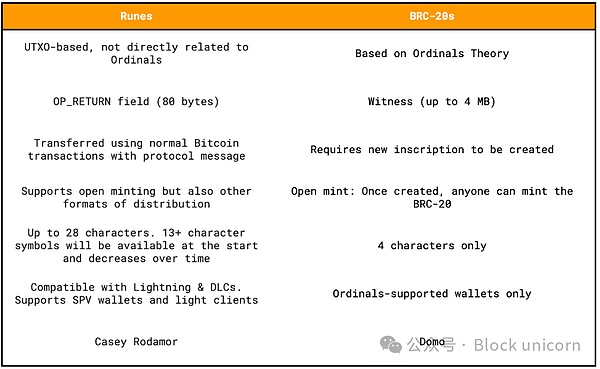

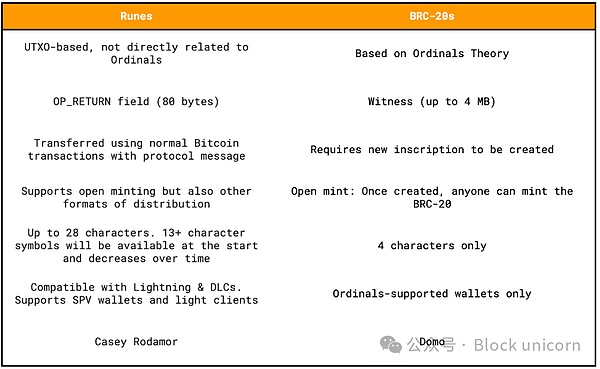

BRC-20 was created using the Ordinal Protocol with the goal of introducing a homogeneous token standard similar to ERC20 on the Ethereum network. With the invention of the BRC-20 token, Bitcoin supports both homogeneous and non-homogeneous tokens.

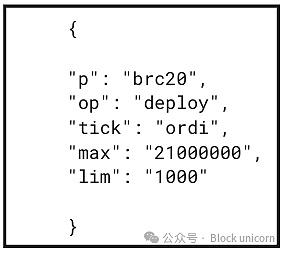

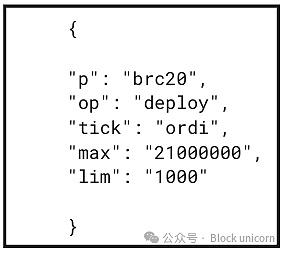

BRC-20 tokens are unique in that they are inscribed directly on the Satoshi using JSON code. In order to create a BRC-20, a script file containing the token parameters needs to be made (as shown in the figure below).

A high-level overview of BRC-20 can be understood as follows:

BRC20 tokens use the Ordinal Protocol to inscribe metadata on the Bitcoin blockchain, creating a decentralized way to mint, transfer, and trade tokens. The process involves creating inscriptions (similar to NFTs) to record minting and transfer events. Ownership is essentially represented by these inscriptions.

Minting, Transfer, and Sale Mechanism:

Minting BRC-20 Tokens – When a BRC-20 token is minted, token parameters such as the token name, limit, and total supply are inscribed in the JSON script.

Transferring BRC-20 Tokens – In order to transfer a BRC-20 token, a new inscription is created. This inscription contains the details of the transfer, such as the amount and the address of the recipient.

Ownership Mechanism – The original script (the mint inscription) remains associated with the original owner, and a new inscription (the transfer inscription) is created for the transaction. Buyers purchase these transfer inscriptions as proof of ownership. Therefore, the concept of buying a BRC-20 token is similar to buying a certificate of proof of ownership.

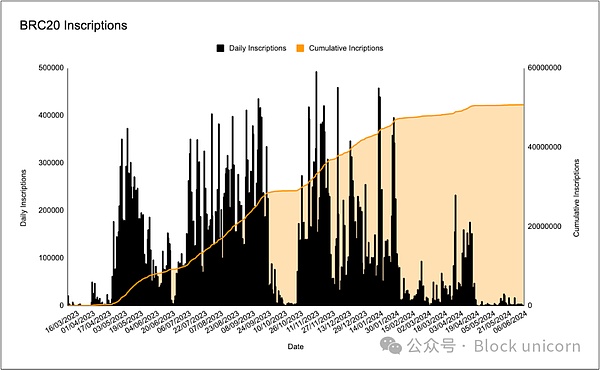

Despite their design flaws, they have become popular – the previous rise in the popularity of inscriptions is largely due to the adoption of BRC-20.

Source: Delphi

BRC-20 vs. ERC-20

BRC-20 tokens exist on the Bitcoin blockchain, while ERC-20 tokens exist on the Ethereum blockchain. Therefore, the inherent properties of L1 are imposed on the tokens - speed and fees are representative of them.

ERC-20 tokens are created using smart contracts on Ethereum, which have a higher degree of programmability and a wider range of execution of various operations and rules than BRC-20. As mentioned earlier, BRC-20 can only perform 3 different operations. The BRC-20 token standard has several drawbacks, including requiring multiple transactions to mint, transfer, or claim tokens, creating too many UTXOs, and only being able to transfer one token at a time.

First Wave of BRC-20

Second and Third Waves from New Innovations

Fourth Wave with Pre-Runes and Halving Speculation

Runes

Runes allow Bitcoin transactions to inscribe, mint, and transfer Bitcoin-native digital goods. While each inscription is unique, every unit of a rune is identical. They are interchangeable tokens that are suitable for a variety of uses.

The Rune Protocol is not a token, but a place for people to create non-BTC tokens on Bitcoin. Tokens created using this token standard are called Runes. Runes were developed to create a cleaner, simpler version of BRC-20. It leverages Bitcoin's underlying UTXO-based account model (outlined earlier), which allows multiple tokens to reside in a single UTXO. The Rune Protocol extends UTXO to allow it to store both Bitcoin and Rune balances, thereby inheriting Bitcoin's security and decentralization properties. Runes are inscribed, minted, and transferred using regular Bitcoin transactions.

Runes is an op_return-based protocol. op_return is a way to create a Bitcoin output that only carries data - this simplifies the process and reduces confusion. During a Bitcoin transaction, Rune balances on input UTXOs are transferred to new UTXOs by default after the UTXO holding the Rune balance is destroyed.

Initially, new token names are required to be at least 13 letters long, and this minimum character limit is reduced by 1 approximately every 4 months. This allows for a slow spread of token names while also continuing to generate interest in the protocol.

Runestones

Runestones do not use witnesses (such as ordinals), but instead use data in the op_return field to contain specific instructions. Users can inscribe (deploy), mint, and transfer Runes by embedding instructions in the op_return field. Runestones can be thought of as protocol messages that store transfer instructions in a UTXO - these instructions determine how Runes are transferred in outputs, such as the destination address and the amount to transfer. Rune balances on UTXO inputs are destroyed when they are transferred to UTXO outputs.

Overall Idea

Rune offers a new avenue for speculation, entertainment, and community building. Similar to Ordinal, Casey has successfully created a protocol that achieves its stated goals without compromising the value system inherent to Bitcoin’s ideology. Likewise, similar to Ordinal, Rune provides a channel to attract liquidity and attention to Bitcoin - the end result is a vibrant speculative ecosystem, all of which pays fees to miners. It is worth considering that if Rune enters the Lightning Network, there may be stablecoins based on Rune. We are ready for another DeFi summer.

Rune and BRC-20

JinseFinance

JinseFinance