Following Bitcoin and Ethereum, Solana has also caught up with the ETF craze.

On July 8, the official announcement showed that Cboe had submitted 19b-4 documents to the US SEC on behalf of VanEck and 21Shares Solana ETF, which means that SOL ETF has officially entered the approval process. As early as June 28, VanEck and 21Shares announced that they had submitted the S-1 application for SolanaETF to the US SEC, and VanEck even issued an open letter to explain the move. Coincidentally, there was a rumor in the market a few days ago that BlackRock may also be applying for SOL ETF.

Whether the rumor is true or false is difficult to distinguish, but it is a fact that some institutions have paid attention to this seemingly impossible ETF. Whether this operation is an attempt by the institution to hype or to capture the market in advance is still inconclusive, but it is certain that whether the application is passed or not, the hype of SOL has already successfully kicked off.

Back in June, when the Ethereum ETF successfully reversed, who would be the next ETF sparked widespread heated discussions in the market. In the discussion at that time, BCH, LTC, DOGE, etc. had all entered the target selection, but among them, SOL was the one with the highest voice.

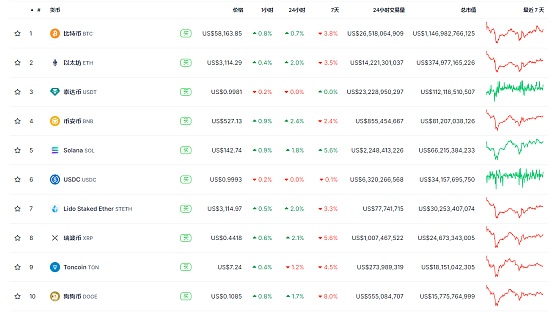

The reason is also quite simple. To realize the ETF application, the currency must have sufficient consensus value and sufficient market depth, otherwise the issuer will face sales problems. SOL's market value has been in the top five cryptocurrencies for many years. USDT, which is above it, obviously does not meet the application conditions, and BNB is entangled in the lawsuit in the United States. In contrast, the feasibility of SOL ETF is particularly prominent.

The second is the closeness of the capital behind it. Although SOL has not deliberately disclosed its capital inclination, due to the high shareholding of FTX and the recognized North American technology circle, almost everyone in the market believes that SOL is backed by Wall Street capital. This can be seen from many projects. Most of the projects based on Solana belong to the Western camp, and SOL can recover from less than $10 to $160 or even $200, and there is no lack of institutional capital behind it.

Against this background, on June 27, asset management giant VanEck took the lead and submitted an S-1 form on "VanEck Solana Trust" to the SEC. The next day, 21Shares followed closely and also submitted an S-1 application. From the documents, both chose Cboe BZX Exchange, with Coinbase as the custodian, and guaranteed that the fund would not participate in the verification or pledge of SOL.

On July 8, the Chicago Board Options Exchange Cboe officially submitted 19b-4 documents for VanEck and 21Shares Solana ETFs. When the US SEC confirms the document, the application will enter the approval period. According to the rules, the SEC will have 240 days to decide whether to approve 19b-4.

Although the issuer has made rapid progress, there are always bearish voices in the market, and the core lies in the historical burden of SOL. The most important problem is the attribute judgment. As we all know, the main reason why the Ethereum ETF was considered unacceptable was that the SEC regarded ETH as a security, but at that time, due to the evasive attitude of the SEC chairman, there was no core evidence for this assertion. However, SOL has been clearly identified as a security.

On June 5, 2023, the SEC listed SOL as a security in the lawsuit against Binance. In the case with Coinbase on June 6 of the same year, SOL was also listed as a security. The SEC's accusations against Binance and Coinbase were also unregistered for securities business. Just in June of this year, the SEC still insisted in its accusations against Kraken that 11 tokens such as SOL, ADA and ALGO were securities, reflecting the consistency of supervision.

Being listed as a security means complying with the SEC's disclosure requirements and regulations, clarifying transparency and KYC, which is obviously difficult for anonymous cryptocurrencies to achieve, and this has become a key obstacle for the SOL ETF. At the same time, because ETFs require a reference spot price, the passage of Bitcoin and Ethereum ETFs requires a leading indicator, which can be traded on the Chicago Mercantile Exchange (CME) in the United States. Currently, except for BTC and ETH, no other currencies meet the requirements.

The second is the issue of decentralization. Not to mention Bitcoin, its existence time and economic model have destined its chips to be relatively decentralized, and Ethereum has also been recognized by regulators after investigation. However, Solana, as a new public chain, has only been around for 5 years. SOL was previously held by FTX for more than 10%, and its decentralization is obviously poor.

In fact, even the issuer is quite hesitant about the above issues. In VanEck's open letter, Matthew, head of digital asset research, mentioned, "We believe that the native token SOL functions similarly to other digital commodities such as Bitcoin and Ethereum. SOL's decentralized nature, high practicality and economic feasibility are consistent with the characteristics of other established digital commodities, which strengthens our belief in SOL as a valuable commodity that can provide use cases for investors, developers and entrepreneurs seeking to replace the duopoly app store."

"We believe" has already demonstrated subjectivity, avoiding the issue of SOL's actual attributes, and to some extent showing lack of confidence. In a recent interview, Matthew even said, "The feasibility of ETFs is not necessarily linked to the futures market. The uranium industry has confirmed this point. As for the crypto futures market, we believe this can be achieved, but it may require a new SEC chairman."

There are many supporters who hold the idea of changing terms. According to Eric Balchunas, senior ETF analyst at Bloomberg, the deadline for Solana ETF is mid-March 2025, and this year's election is in November, which means that the final approval will be decided by the regulatory group after the change of term. He emphasized that "if Biden wins the election, Solana ETF is likely to be "stillborn", but if Trump wins, everything is possible."

Given that both the Republican and Democratic parties are showing goodwill to the cryptocurrency community, the reality may not be reversed. At the recent crypto roundtable, Biden's senior adviser Anita Dunn also rarely attended, demonstrating Biden's easing of his attitude towards crypto. But in other words, even if there is a change of term, can the previous lawsuit be wiped out? It is more likely that the new members will continue in a relatively mild manner, otherwise the function of the SEC may become a joke.

In addition to supervision, commercial feasibility also makes SOL ETF more subtle. Many analysts in the market believe that the inflow of SOL ETF will be far lower than that of Bitcoin or Ethereum ETF, which will undoubtedly cause the profitability of the issuer to decline. Previously, Cathie Wood's Ark Fund had withdrawn the application for Ethereum ETF because of the fierce competition between fees. The management fee of crypto ETFs was significantly lower than that of ordinary ETFs, and the input-output ratio did not match.

0xTodd pointed out that in terms of market share, Ark BTC ETF ranked fourth among 11 ETFs, with an annual management fee of approximately US$7 million, but the final conclusion was that the Ethereum ETF was abandoned due to insufficient profitability, which means that Ark does not believe that ETH can reach this level. Similarly, SOL has a market value of about 66.2 billion US dollars, which is only one-sixth of ETH's market value and 5% of Bitcoin's market value. If the limit is 7 million US dollars, the issuer should manage at least 20 million SOLs, which is about 4.5% of SOL's circulation. In comparison, BlackRock, the top Bitcoin ETF, only manages 1.5% of BTC. A lower market value corresponds to a higher position, which is obviously not cost-effective for the issuer. The current situation is not just SOL. Even Ethereum's ETF has a relatively pessimistic view, believing that the net inflow of funds is only 15% of Bitcoin at most. Of course, some people are optimistic. Market maker GSR believes that if SOL ETF is approved, SOL has a 1.4-fold increase in the background of a bear market, 3.4 times in normal circumstances, and 8.9 times in a bull market.

Compared with SOL, from the perspective of ETF alone, Litecoin and Dogecoin have become the currencies that analysts are more optimistic about. After all, both currencies have no historical burden of securities, and their market capitalization is also among the top ten cryptocurrencies. BitMEX founder Arthur Hayes and Real Vision CEO Raoul Pal mentioned in their blogs that "Dogecoin ETF may be launched at the end of this cycle."

Overall, whether approved or not, SOL ETF has opened the precedent of altcoin ETFs, and more currencies will try to impact this capital crown in the future. If the FIT21 bill is passed, MEME coin ETF may no longer be a dream.

This bill, which has been passed by the House of Representatives, clarifies the CFTC's jurisdiction over cryptocurrencies, grants decentralized judgment criteria, and stipulates that if a currency does not have more than 20% of digital assets or voting rights, it can be regarded as a digital commodity rather than a security, which to some extent clears the way for ETFs. At present, the plan has been handed over to the Senate, but considering that the Senate may decide to redraft the relevant bill, that is, it needs to go through the committee review stage again before being submitted to the Senate, and even if it goes directly to the Senate for a vote, FIT21 will face the amendment and addition of the bill, and then return to the House of Representatives for decision and unification of the text. This critical bill still has a long waiting period.

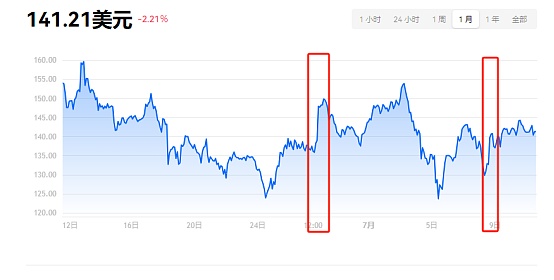

On the other hand, the hype of SOL is immediate. On June 28, when the application news came out, SOL rose 7%, and when the 19b-4 form was submitted on July 8, SOL rose 8%. In recent days, there are even unknown rumors that BlackRock is also planning to apply for this ETF.

From the perspective of price trends, this does make people suspect that it is an ETF speculation by the capital side for SOL. After all, even if it is not approved, the price will inevitably be supported by the continuous promotion of true and false news during the 240-day approval period, and the success or failure of the election will directly affect the market price.

However, judging from the comments of retail investors, it seems that they are still on the sidelines and are not buying into this ETF. There is still a long time to go, and perhaps everyone is also waiting for the next more promising ETF.

WenJun

WenJun

WenJun

WenJun JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo