1. Project Introduction

Stargate Finance (STG) is a decentralized finance (DeFi) platform designed to serve as a bridge between blockchains and decentralized applications (DApps).

Stargate Finance is built on the LayerZero protocol, which allows different blockchains to interact with each other. With Stargate, you can exchange USDT on Ethereum for USDC on Arbitrum in one transaction, and support many other chains.

STG tokens are the native tokens of Stargate Finance and are used for various functions and reward mechanisms on the platform. Users can obtain STG tokens by providing liquidity and participating in platform governance. Similarly, users can also participate in platform governance by staking STG tokens and vote on important matters such as platform fees and target asset balance.

2. Core Mechanism

2.1 LayerZero Technology

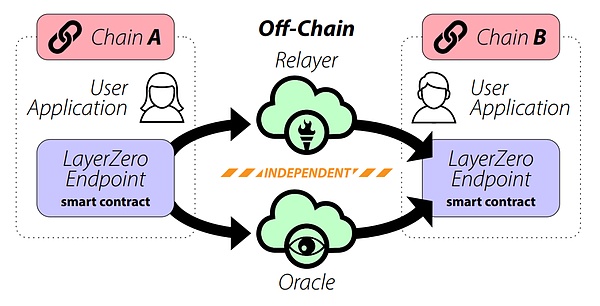

LayerZero technology is the foundation of Stargate Finance, providing a secure and efficient solution for cross-chain communication and asset transfer. The following is a detailed introduction to LayerZero technology:

1. Concept

LayerZero is a cross-chain interoperability protocol that aims to enable direct communication between different blockchains in a decentralized manner. It provides infrastructure for cross-chain asset transfers and solves many problems in traditional cross-chain bridging solutions.

2. Working Principle

LayerZero technology enables cross-chain communication and asset transfer through the following mechanisms:

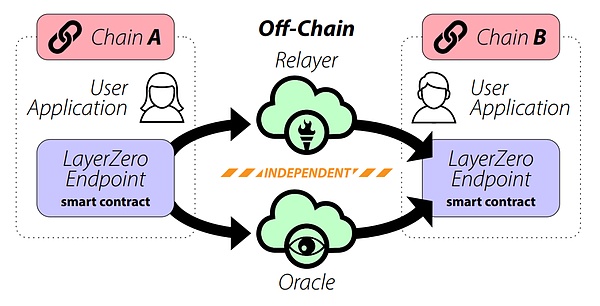

Cross-chain messaging: LayerZero allows direct messaging between different blockchains without the need for intermediaries. This is achieved through lightweight relayers and oracles.

Lightweight relayers and oracles: Relays are responsible for transmitting transaction data, while oracles verify and confirm the validity of this data. The separation design of relayers and oracles ensures high security and decentralization.

User Application (UA): This is a smart contract running on the source and target chains that is responsible for handling the logic of cross-chain transactions. UA ensures the accurate execution of transactions and handles the transfer of user assets.

3. Security and Decentralization

LayerZero technology ensures the security of cross-chain communication through multi-level security mechanisms and decentralized architecture:

Trust Minimization: LayerZero's design philosophy is to minimize trust, that is, to reduce users' trust in intermediaries. Repeaters and oracles are run by independent entities, ensuring the independence of data transmission and verification.

Distributed Verification: The oracle is responsible for verifying the data transmitted by the repeater to ensure the authenticity and accuracy of the transaction data. The distributed oracle network reduces the risk of single point failure.

Anti-fraud mechanism: LayerZero uses an anti-fraud mechanism to ensure the security of cross-chain transactions. If malicious behavior is detected, it can be corrected in time to protect user assets.

4. Cross-chain asset transfer

LayerZero technology supports cross-chain transfer of native assets, providing an efficient and economical solution:

Single transaction to achieve cross-chain transfer: Users can complete asset transfers between different blockchains in one transaction without the complicated process of wrapping tokens.

Instant transaction confirmation: With LayerZero, after the cross-chain transaction is confirmed on the source chain, the assets on the target chain are immediately credited, ensuring the immediacy and reliability of the transaction.

5. Integration with Stargate Finance

LayerZero technology is deeply integrated with Stargate Finance, providing infrastructure for its cross-chain liquidity pool and asset transfer:

Unified liquidity pool: LayerZero technology supports Stargate Finance's unified liquidity pool, realizing liquidity sharing between different blockchains.

Delta algorithm support: LayerZero technology provides cross-chain communication support for the Delta algorithm, ensuring efficient management and rebalancing of the liquidity pool.

6. Advantages

LayerZero technology has several advantages over traditional cross-chain bridging solutions:

Efficient communication: LayerZero achieves efficient cross-chain communication through lightweight relayers and oracles, reducing transaction delays and fees.

Decentralization: LayerZero's decentralized architecture ensures the security and reliability of the system, avoiding single points of failure and centralization risks.

Flexibility: LayerZero supports a variety of blockchains and asset types, providing a wide range of compatibility and applicability.

2.2 Delta Algorithm

Stargate Finance's Delta algorithm is one of its core innovations for achieving efficient and secure cross-chain asset transfer. The following is a detailed introduction to the Delta algorithm:

1.The basis of the Delta algorithm

The Delta algorithm is the core technology of Stargate Finance for managing and optimizing cross-chain liquidity pools. It achieves instant finality of cross-chain asset transfers and ensures the stability of the liquidity pool by programmatically controlling the liquidity pool. 2. Instant Finality The Delta algorithm ensures that after the transaction on the source chain is confirmed, the arrival of assets on the target chain is guaranteed. This means that when users conduct cross-chain transactions, transactions will not fail due to insufficient liquidity or token incompatibility. The specific mechanisms include: Source chain transaction confirmation: When the user submits and confirms the transaction on the source chain, the Delta algorithm immediately locks the corresponding target chain assets. Target chain asset transfer: After the source chain transaction is confirmed, the assets on the target chain are immediately transferred to the user account to ensure the finality of the transaction.

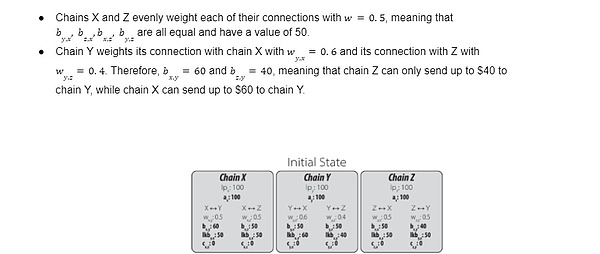

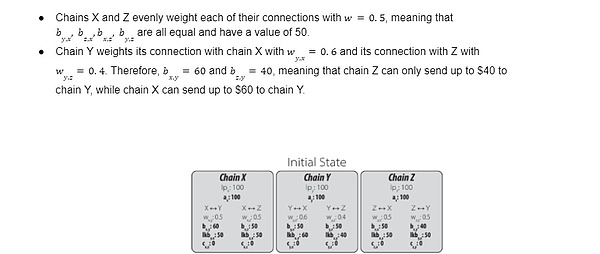

3. Unified Liquidity Pool and Soft Partition

Stargate Finance realizes cross-chain asset transfer through a unified liquidity pool, and the Delta algorithm manages these liquidity pools intelligently:

Unified Liquidity Pool: A unified liquidity pool means that on the Stargate Finance platform, the liquidity of different blockchains is concentrated in a single pool. This structure allows cross-chain assets to flow freely without a complex bridging process, reduces slippage, and significantly improves liquidity and transaction efficiency

Soft Partition: The liquidity pool is dynamically divided into multiple parts (soft partitions). For example, the liquidity pool of the Ethereum network can allocate part of the funds to the BNB chain or the Fantom chain, etc. These partitions can borrow from each other in the event of a liquidity crisis and repay after the transaction is processed.

4. Liquidity Management and Rebalancing Mechanism

In order to prevent the liquidity pool from being exhausted under high concurrent requests, the Delta algorithm introduces a rebalancing mechanism to maintain the stability and efficiency of the liquidity pool:

Rebalancing Fee: The rebalancing fee is part of the transaction fee, which is designed to incentivize users to add or reduce assets in the liquidity pool to maintain the balance of the pool. The rebalancing fee is calculated based on the transaction size and the current pool balance.

Reward Mechanism: The rebalancing fees collected will be accumulated and distributed to users who help rebalance the liquidity pool. The amount of the reward depends on the contribution of the user's transaction to the balance of the pool.

5. Dynamic Liquidity Management

The Delta algorithm dynamically manages the liquidity pool to ensure that the liquidity pool will not be exhausted during large-scale simultaneous transfers between different blockchains:

Liquidity Allocation: Funds in the liquidity pool are dynamically allocated to different blockchains to ensure that each blockchain has sufficient liquidity to process transaction requests.

Liquidity Borrowing: When liquidity is tight, liquidity pools between different blockchains can borrow from each other to ensure smooth transactions.

2.3 Centralized Applications (DApp)

Stargate Finance achieves efficient and secure cross-chain asset management and transactions through its decentralized applications (DApp). The following is a detailed introduction to the Stargate Finance DApp:

1. Core functions of the DApp

Stargate Finance's decentralized application (DApp) provides users with a series of powerful and flexible functions:

Cross-chain asset transfer: Users can seamlessly transfer native assets between different blockchains without the need for a complicated bridging process.

Liquidity provision and mining: Users can provide liquidity to the liquidity pool and receive rewards by participating in liquidity mining.

Cross-chain transactions: Supports instant exchange between tokens on different blockchains, and users can easily conduct cross-chain transactions.

2. Cross-chain asset transfer

One of the main functions of Stargate Finance DApp is cross-chain asset transfer, which is implemented as follows:

Single transaction to complete cross-chain transfer: Users only need to make one transaction to transfer assets between different blockchains. This greatly simplifies the operation process and improves the user experience.

Instant transaction confirmation: Through LayerZero technology, after the cross-chain transaction is confirmed on the source chain, the assets on the target chain are immediately credited, ensuring the immediacy and reliability of the transaction.

Native assets: Users use native assets instead of wrapped tokens during the transfer process, thus avoiding additional fees and complex operations.

3.Liquidity provision and mining

Stargate Finance DApp allows users to provide liquidity to the liquidity pool and obtain stablecoin rewards by participating in liquidity mining:

Unified liquidity pool: Users can deposit assets into a unified liquidity pool and participate in liquidity provision activities on multiple blockchains.

Revenue distribution: Liquidity providers (LPs) are rewarded according to the proportion of liquidity they provide, and the rewards are issued in the form of stablecoins, representing 0.045% of the fees collected in each transfer transaction.

Flexible liquidity management: LP tokens can be redeemed at any time, enabling users to flexibly manage their liquidity provision positions.

4. Cross-chain transactions

Stargate Finance DApp supports instant exchange of tokens on different blockchains, providing convenient cross-chain transaction functions:

One-click exchange: Users can exchange tokens between different blockchains, such as exchanging USDT on the Ethereum network for BUSD on the BNB network.

Reduce slippage: The deep liquidity of the unified liquidity pool reduces slippage during the transaction process, ensuring that users obtain fairer and more accurate transaction prices.

5. User Interface and Experience

Stargate Finance DApp provides a user-friendly interface that simplifies the process of cross-chain asset management and transactions:

Intuitive interface design: The interface design of DApp is simple and intuitive, allowing users to easily conduct cross-chain transactions and liquidity management.

Simplified operation process: Users do not need to understand complex technical details, and can complete cross-chain asset transfers and transactions with simple operations.

3. STG Token

STG token is the native token of the Stargate Finance platform and plays a key role in the entire ecosystem. The following is a detailed introduction to the STG token:

1. Overview of STG Token

STG token is the native token of the Stargate Finance platform and is used for a variety of purposes, including liquidity provision, platform governance, and reward mechanisms. The STG token is designed to support the long-term development of the platform and user participation.

2. Purpose of STG Tokens

Governance and Voting

Staking and Governance: Users can stake STG tokens to obtain vestG (vote-escrowed STG) tokens to participate in platform governance. Users holding vestG tokens can vote on the platform's governance proposals, including key matters such as platform fee adjustments and liquidity pool configuration.

Time-weighted rewards: The longer the STG token is staked, the more vestG tokens the user will receive, thereby increasing their voting power in governance. This mechanism ensures long-term participation and attention to the success of the platform by holders.

Liquidity Provision and Mining

Liquidity Mining: By participating in liquidity mining activities, users can receive additional STG token rewards. Liquidity mining not only improves the liquidity of the platform, but also provides users with an additional source of income.

Transactions and Cross-Chain Transfers

Fee Reduction: Users can enjoy fee reductions when using STG tokens for transactions and cross-chain asset transfers. For example, when using STG tokens for cross-chain transfers, the protocol transfer fee can be waived, while non-STG token transactions will be charged a 0.06% fee.

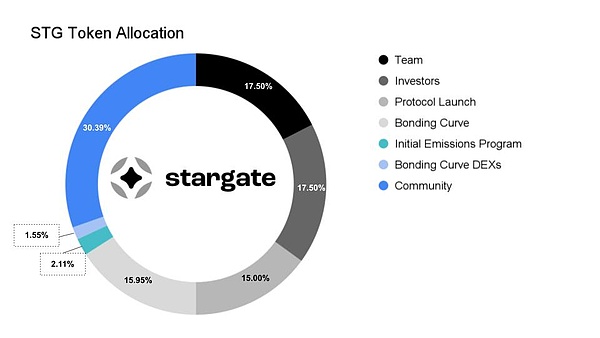

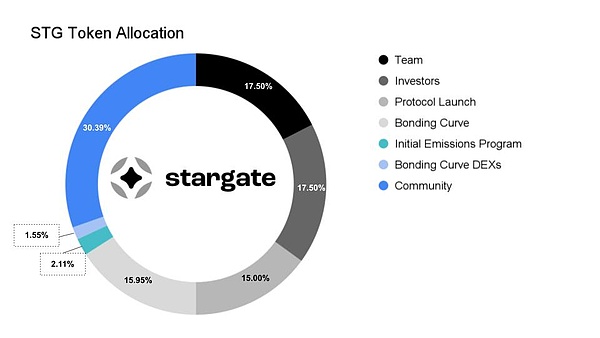

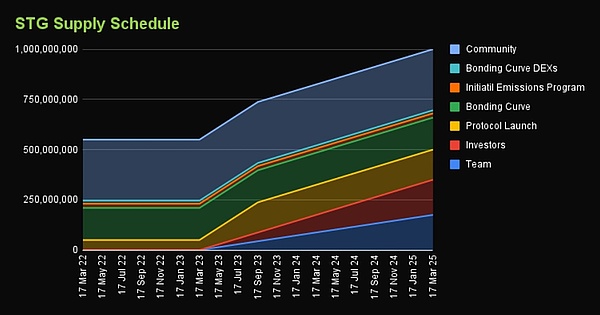

Issuance and distribution of STG tokens

Total supply: The total supply of STG tokens is 1 billion, and the current circulating supply is 205 million, accounting for 20.43% of the total.

Initial Allocation: The initial allocation of STG tokens is as follows:

17.5% allocated to the team

17.5% allocated to investors

15.0% for protocol launch

15.95% for the Bonding Curve

2.11% for the initial release plan

1.55% for the Bonding Curve DEXs

30.39% allocated to the community

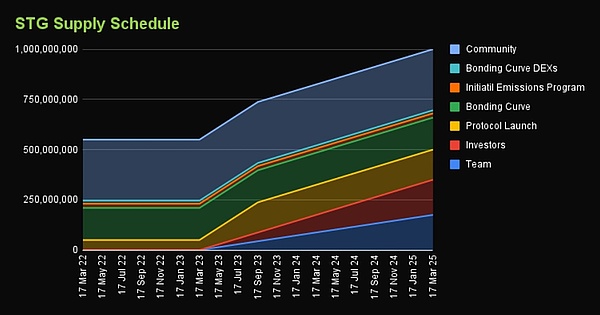

Unlocking schedule

Team and investor allocations: The team and investors' allocation shares are gradually unlocked over 1-2 years to ensure stability in the early stages of the project and control of the circulating supply.

Community allocation: The community allocation portion is unlocked immediately at the launch of the project so that the team and community can effectively allocate funds and promote the development of the protocol.

Economic Model of STG Tokens

The economic model of STG tokens is designed to support the long-term growth and user participation of the platform:

Incentive Mechanism: Through the reward mechanism provided by staking and liquidity, STG tokens incentivize users to actively participate in various activities of the platform and enhance the overall vitality of the platform.

Deflation Mechanism: Part of the transaction fees and rebalancing fees will be used to repurchase and destroy STG tokens, reducing the circulating supply on the market and increasing the scarcity and value of tokens.

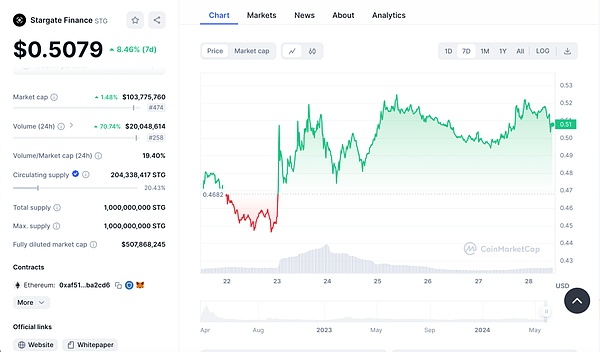

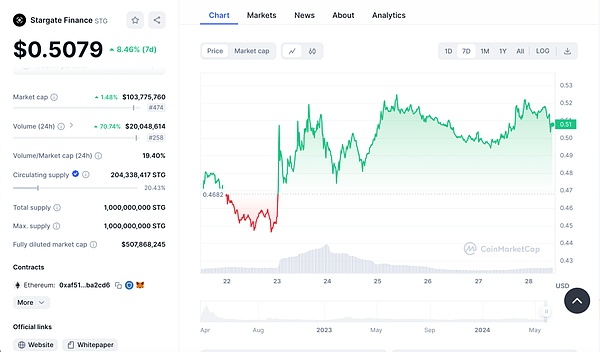

Token Performance

Current Price: $0.5079 (up 8.46% in the past 7 days)

Market Cap: $103,775,760 (up 1.48%)

24 Hour Trading Volume: $20,048,614 (up 70.74%)

Market Cap/Volume Ratio: 19.40%

Fully Diluted Market Value: $507,868,245

Price Trend: The price fluctuated significantly between April 2023 and May 2024. At the beginning of April 2023, the price was around $0.4682, after which it experienced a period of decline before rebounding significantly in late May.

Increased Market Interest: 24-hour trading volume rose by 70.74%, indicating a significant increase in trading activity in a short period of time. This may reflect the market's increased interest and confidence in the Stargate Finance project.

Market Cap Growth: The market cap rose slightly by 1.48%, but compared with the significant increase in trading volume, this may mean a lot of short-term trading activity.

4. Project Evaluation

4.1 Track Analysis

The Stargate Finance project belongs to the decentralized finance (DeFi) field, specifically focusing on cross-chain interoperability and liquidity management. The core goal of the project is to achieve seamless asset transfer and efficient liquidity management between different blockchains through LayerZero technology and Delta algorithm. This makes Stargate Finance one of the indispensable infrastructures in the DeFi ecosystem.

In the DeFi field, there are several projects similar to Stargate Finance that focus on cross-chain interoperability and liquidity management:

1. Polkadot (DOT)

Introduction: Polkadot is a blockchain protocol that supports interoperability of multiple blockchains and aims to achieve cross-chain communication and data sharing. It allows interoperability between different blockchains through relay chain and parallel chain architecture.

Similarities: Similar to Stargate Finance, Polkadot is also committed to solving the interoperability problem between blockchains, but it is mainly achieved by building a multi-chain ecosystem rather than liquidity pools and cross-chain transfers.

2. Cosmos (ATOM)

Introduction: Cosmos is a decentralized network designed to achieve interoperability between blockchains. It uses IBC (Inter-Chain Communication Protocol) and Tendermint consensus mechanism to provide secure and efficient cross-chain communication.

Similarities: Both Cosmos and Stargate Finance focus on cross-chain interoperability. Cosmos provides a framework that enables different blockchains to interoperate, while Stargate Finance enables cross-chain transfer of assets through a unified liquidity pool.

3. Thorchain (RUNE)

Introduction: Thorchain is a decentralized liquidity protocol that allows users to seamlessly exchange crypto assets between different blockchains. It enables cross-chain exchange of assets through inter-chain liquidity pools and RUNE tokens.

Similarities: Thorchain is similar to Stargate Finance in that both provide cross-chain asset exchange and liquidity pool management, but Thorchain mainly achieves this through a decentralized node network and liquidity pool.

4.2 Project Advantages

1. Cross-chain Interoperability

One of the main advantages of Stargate Finance is its strong cross-chain interoperability capabilities. Through LayerZero technology, Stargate Finance realizes direct communication between different blockchains, solves many problems in traditional cross-chain bridging solutions, and provides a safe and efficient cross-chain asset transfer solution. Different blockchains share a unified liquidity pool, which greatly improves liquidity and transaction efficiency, reduces slippage, and improves user experience.

2. Instant transaction confirmation:Once the user submits and confirms the transaction on the source chain, the arrival of the assets on the target chain is guaranteed. This reduces transaction delays and ensures a reliable experience for users in cross-chain transactions.

3. User-friendly operation experience

Simplified cross-chain transfer: Users can complete asset transfers between different blockchains in a single transaction without the need for a complicated bridging process, which greatly simplifies the operation process and improves the user experience.

Intuitive interface design: Stargate Finance provides a user-friendly interface that enables users to easily conduct cross-chain transactions and liquidity management, suitable for all types of user groups.

4. Diverse incentive mechanisms

Liquidity provision and mining: Users can provide liquidity to the liquidity pool and get rewards by participating in liquidity mining. This not only improves the liquidity of the platform, but also provides users with an additional source of income.

Governance and voting: Users can pledge STG tokens to obtain vestG tokens, thereby participating in platform governance and voting on important matters of the platform. This mechanism encourages users to hold and participate in platform development for a long time.

5. Security and Decentralization

Distributed Verification and Anti-Fraud Mechanism: LayerZero technology ensures the security and reliability of cross-chain transactions, verifies transaction data through distributed oracles and relays, and introduces anti-fraud mechanisms to protect user assets.

Decentralized Architecture: Stargate Finance's decentralized architecture reduces the risk of single point failures and enhances the resilience of the overall network.

6. Market Performance

Significant Price Fluctuations and Trading Activities: In the past week, the price of STG tokens has risen by 8.46%, and the 24-hour trading volume has increased significantly, indicating that the market's interest and confidence in the project is growing. 4.3 Project Insufficiency

4.3 Project Insufficiency

1.Rebalancing Fee

Complexity of Fee Mechanism: Although the rebalancing fee mechanism is effective, its calculation method is relatively complex, which may make it difficult for some users to understand and accept it. High-frequency trading users may be highly sensitive to the fee mechanism, which affects their willingness to participate.

2. Market competition

Fierce competition: Competition in the DeFi field is very fierce, and there are many similar projects, such as Polkadot, Cosmos, Thorchain, etc. These projects also have unique advantages in cross-chain interoperability and liquidity management, and Stargate Finance needs to continue to innovate to remain competitive.

3. Ecosystem development

Ecosystem construction: As an emerging project, Stargate Finance needs to continuously expand its ecosystem, including integration with more blockchains and DApps. This requires time and resources, and may affect the rapid development of the project and user coverage.

4. Market and regulatory risks

Crypto market volatility: The high volatility of the crypto market is a risk for any crypto project. Drastic changes in market sentiment may affect the price of STG tokens and users' investment confidence.

Regulatory uncertainty: The regulatory environment for cryptocurrencies and DeFi projects around the world is constantly changing, which may have an impact on project operations and user participation.

5. Conclusion

Stargate Finance is an innovative decentralized finance (DeFi) project that enables efficient and secure cross-chain asset transfer and liquidity management through LayerZero technology and Delta algorithm. Its unified liquidity pool and instant transaction confirmation functions significantly improve user experience and blockchain interoperability.

Despite challenges such as technical complexity, security risks and market competition, Stargate Finance has shown strong development potential in the DeFi field with its technological advantages and innovation capabilities. With the expansion of the ecosystem and the increase in user participation, Stargate Finance is expected to become a leading platform for cross-chain interoperability and liquidity management, and promote the further development of decentralized finance.

JinseFinance

JinseFinance