People in the currency circle have their own 618.

After a week of decline, the market shook again on June 18. Just in the early morning, Bitcoin rarely fell below the market support price of $65,000, and Ethereum followed suit, falling below $3,400, with a 24-hour drop of 6.23%. The king of MEME, SOL, also could not hide its decline, falling to 127.22 USDT, a drop of 10.98%.

The mainstream currency is still bleak, and the altcoins are even more difficult to say that they are good. The altcoins generally show a "numb" market, and most of the altcoins have fallen by more than 20%. ZK, which has just been launched, once fell below 0.2USDT, a drop of more than 36%. According to Coinglass data, as of 2 pm yesterday, the entire network had a 24-hour liquidation of US$318 million, mainly long positions, and long orders exceeded US$270 million. Affected by this, the market value of cryptocurrencies has shrunk again, falling to a minimum of $2.46 trillion.

Although Bitcoin has recovered to more than $65,000 today, the market is pessimistic in the face of such a market. Just a few months ago, the general consensus of the market was that Bitcoin would reach $100,000 by the end of the year, and the bull market would take off. This makes people ask, what exactly happened?

It is actually difficult to escape the problem of attribution when reviewing the results, but if we only discuss the decline of Bitcoin this time, it is still insufficient liquidity.

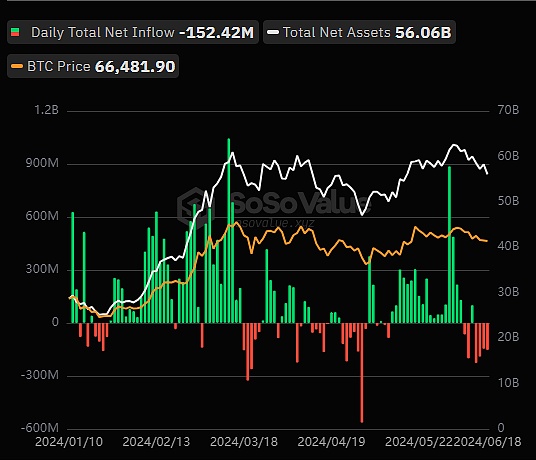

The core factor that boosted the rise of Bitcoin this time is undoubtedly the Bitcoin spot ETF. The rapid influx of institutional funds has led to a surge in demand for Bitcoin, allowing Bitcoin to soar from $40,000 to $73,000, and ultimately giving Bitcoin consensus key support. However, this consensus has also been backfired recently. From June 10 to June 17, Bitcoin ETFs have mostly shown a net outflow, with the outflow reaching $810 million in the past week, and institutional buying momentum has gradually declined.

The turnover rate can also show this sign. The turnover rate on the BTC chain continues to decline, with a 24-hour turnover rate of only 3.91%. The balance of exchange stocks is also decreasing. In the past week, the balance of BTC stocks on exchanges has almost approached the historical lowest level. As of June 19, the balance of BTC exchange wallets was 2.4765 million, reflecting poor selling sentiment.

Behind the data performance is the weakening of macro expectations. At the monetary policy meeting on June 12, the Federal Reserve maintained the target range of the federal funds rate at 5.25% to 5.5%, in line with market expectations. The published rate hike path dot plot shows that Federal Reserve officials predict that the median federal funds rate will drop to 5.1% by the end of 2024, which means that there may be only one rate cut this year, less than the previous forecast of two times. After the remarks came out, the risk market was significantly affected, and the crypto market was the brunt, with more than $600 million in digital asset investment products withdrawn.

On the other hand, the so-called "miner surrender" is also affecting the price trend of Bitcoin. After the halving, in view of the continued increase in mining costs, miners are facing a cash flow crisis in order to ensure operation and expansion. From the performance point of view, the recent mining pool transfer, OTC transaction volume surge, and large listed mining companies have significantly reduced their holdings.On June 11 alone, Marathon Digital, the world's largest Bitcoin mining company, sold 1,200 Bitcoins, setting a record for the largest daily sales by miners since the end of March. From June, the balance of miners' Bitcoin OTC counters exceeded 54,000 BTC, reaching the highest level in a year.

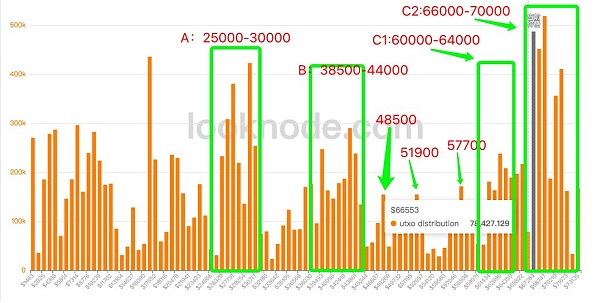

Despite the frequent negative news, from the data, the range of 65,000-69,000 US dollars is still the range where BTC investors enter the market on a large scale. Bitcoin is more likely to be reluctant to sell at this price, so it has gained value support. This is also related to the change in holdings. With the entry of high-net-worth holders, short-term gains will not become the main factor affecting sales. In this sense, this kind of concentrated and slightly boring market will continue.

Bitcoin price range investor distribution, source X platform

Bitcoin has institutional support, but other currencies are not so lucky. In the traditional bull market transmission, the general path is to gradually sink from high-stability assets to low-stability assets, and activate high-yield preferences from low-yield sources, that is, mainstream currencies-altcoins-MEME currencies-other sectors, but this year this path is not as good as before.

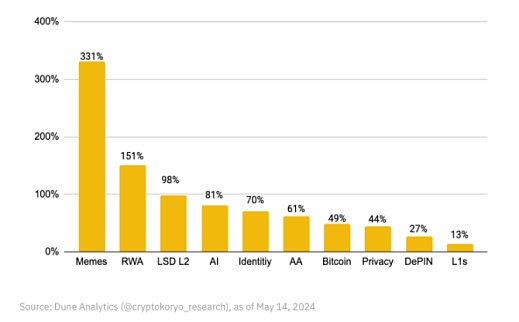

The most notable feature of this round of bull market is the siphon effect of liquidity. Large amounts of liquidity have entered the Bitcoin ecosystem, but the new money of institutions has not overflowed to other fields. There is no strong application emerging in the public chain ecosystem. The value currency performs poorly, but is instead pushed by MEME.

This year's token category growth performance, source: Binance

This year's hotly debated VC tokens have also exacerbated this situation. The linear unlocking of VC tokens has led to a surge in selling pressure. After the unlocking period, a large number of tokens have no one to take over. Retail investors have become victims of liquidity, and token prices have further fallen. According to the Token Unlocks report, it is expected that about $155 billion in tokens will be unlocked from 2024 to 2030, which means that the market needs to increase liquidity by at least $80 billion to absorb it. In the past week, projects such as Aptos, Immutable X, Strike, Sei Network, Arbitrum, and ApeCoin have sold tokens worth $483 million due to large unlocking.

With no innovation in applications, mismatched supply and demand, and limited liquidity, the performance of altcoins has been extremely bleak since March this year. In terms of fair launch and money-making effect, they are not as aggressive as MEME coins, and their value is not as strong as mainstream coins, making them a dilemma in the eyes of investors.Shenyu had said before that there may be no altcoins in this bull market. Affected by the liquidation effect of CRV last week, altcoins were not surprisingly slaughtered again.

In fact, the bull market of market consensus has lasted for more than half a year, but the money-making effect is visibly decreasing. Except for a very small number of retail investors who played MEME, airdrops, and altcoin contracts and were lucky enough to hit the vent, or those who held Bitcoin with diamond hands, looking at the wealth distribution in the market, it is still the top exchanges, CeFi, DeFi and the project parties that previously raised funds to issue coins that have obtained the greatest benefits. The weak money-making effect and value differences have aggravated the current situation of not taking over each other.

Against this background, how to break the deadlock has become the focus of market discussion. From the current situation, the market's gains are all dominated by information. The most direct improvement may be the entry of macro liquidity, which is why everyone is so concerned about the Fed's interest rate cut. In fact, after the European Central Bank announced the interest rate cut, encryption has ushered in a small increase, and the stimulus effect is significant, but whether liquidity can reach other sectors besides mainstream currencies is still in doubt.

From the perspective of the macro industry, another possible positive comes from the US election. As the election approaches, the encryption war between Trump and Biden is intensifying. After accepting cryptocurrency donations and making NFT hot, Trump has made frequent moves, openly standing at the Bitcoin Miners Conference, posting on social platforms that "I hope all remaining Bitcoins are made in the United States", and claiming to become an advocate for Bitcoin miners in the White House, saying that miners can help stabilize the energy supply of the power grid. Biden has also changed his cautious attitude in the past and will participate in the Bitcoin Roundtable for the first time in early July.

The positions of both parties have made cryptocurrencies a political bargaining chip, and thus brought crypto regulation into a new era. Ethereum ETF is a typical example. It has completed a historic reversal in a state of no hope of passing. Consensys recently announced on social media that the SEC has ended its investigation into Ethereum 2.0 and confirmed that ETH has no securities trading charges, which has ushered in a long-awaited rise in the Ethereum ecosystem. According to Bloomberg analysts, the Ethereum spot ETF is expected to be launched before July 2. Compared with the siphoning of Bitcoin, the growth of the Ethereum ETF is more likely to directly stimulate the ecological market, which will also be the most foreseeable positive in the near future.

However, analysts and institutions have different opinions on the analysis of future prices and market conditions.

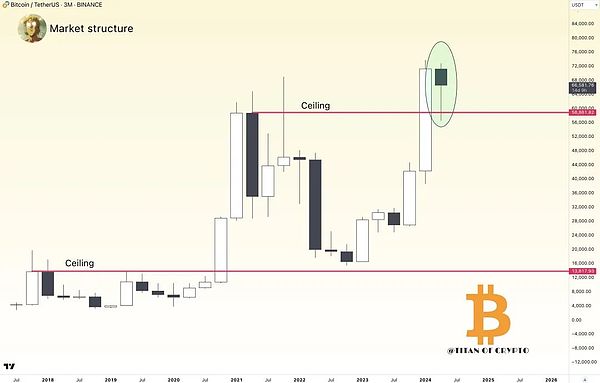

Unlike the previously recognized good singing, after 618, some analysts believe that the decline will continue. According to well-known cryptocurrency analyst Rekt Capital, a BTC price cluster formed near the range high of $71,600, indicating that there is more potential for downside action, and a pullback to below $64,000 may be required for a healthy reset. Trader Titan of Crypto even believes that based on the technical pattern on the monthly chart, Bitcoin may fall below the $60,000 mark on July 1. On-chain analyst Ali also posted on the X platform that historically, Bitcoin generally performs poorly in the third quarter, with an average return of only 6.49% and a median return of -2.57%.

Bitcoin monthly chart, source: Titan of Crypto

But overall, short-term bearish and long-term bullish are the general views of institutions. QCP Capital, Bitfinex, and 10x all emphasized that BTC will continue to rise, and the consensus of 80,000-120,000 by the end of the year is prominent. The whales seem to hold the same view. Lin Chen, head of Asia-Pacific business at Deribit, revealed on social media that a whale sold a call option of 70,000 at the end of July and entered a call option of 70,000 at the end of the year, totaling 100 BTC, paying $883,000, showing that the whales have a relatively negative attitude towards price signals in the short term.

For altcoins, the controversy is even more obvious. Quinn Thompson, founder of crypto hedge fund Lekker Capital, believes that in the current context of high leverage and open interest, lack of panic buying, and stagnant stablecoin supply, the best thing to do is not to buy altcoins.

But Andrei Grachev, co-founder of DWF Labs, believes that as long as Bitcoin remains stable, altcoins will usher in the next few months. Arthur Hayes, the founder of BitMEX, even wrote on June 7 that it is the best time to buy altcoins. Recently, he even said that the Dogecoin ETF will be passed at the end of this cycle, and emphasized on social media that he is increasing his holdings of PENDLE and DOGE.

In any case, the current market does show a rather boring trend. The more such a trend, the more cautious investors should be. After all, whether it is the project party or the big exchange, they are often the most anxious at this time, and rushing to pay money is not a wise move for any user.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance Aaron

Aaron Nell

Nell Tristan

Tristan Cointelegraph

Cointelegraph