What do you think of Avail: Will it be the final narrative of modular public chains?

What do you think of the latest modular project @AvailProject that launched an airdrop? What are its technical architecture and components?

JinseFinance

JinseFinance

Everything They are all modularizing, Ethereum is modularizing itself, and Bitcoin is modularized

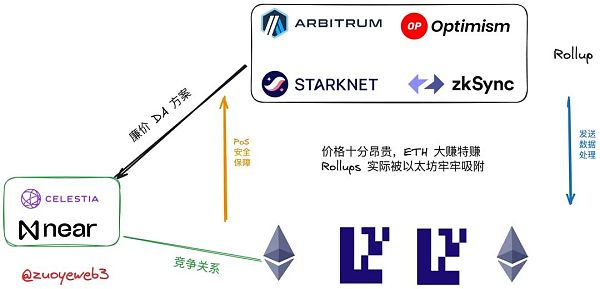

The narrative is suspended after the Rollup currency is issued, and narrative economics Migrating to the DA layer/chain

Legitimacy and versatility have become the main banners. In fact, handling fees and currency issuance are the key< /p>

With the StarkNet airdrop as a symbol, the competition for Ethereum Rollup has come to an end. Next, it’s time to talk about DA. In my opinion , The term Data Availability (DA, Data Availability) is an incomplete expression, lacking an obvious subject and predicate, and only describes the importance of transmitting transaction data beyond the execution layer. Secondly, the DA mechanism involves the basic operating principles of the blockchain. I have elaborated on this part in the Rune article using Bitcoin as an example.

From inscriptions to runes, the paradigm development of asset issuance standards on Bitcoin

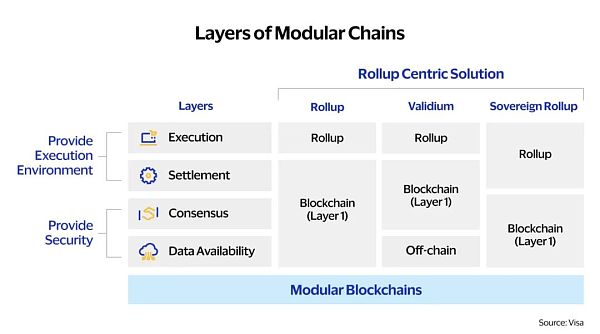

Modularity is the premise of DA. Ethereum’s horizontal modularity is sharding, vertical modularity is layering, and Rollup Responsible for transactions, the main network is responsible for DA and consensus. The popularity of DA means that the concept of layering has become a consensus. Secondly, the Rollup war has ended, and everything after that is tinkering.

The mainnet upgrade plan has become a daily and annual update, which has limited boost to overall market confidence. In this context, the narrative rhythm cannot be adjusted from the latest. The upper layer Rollup and the lowest layer main network are deployed, and DA that can link the two becomes the best choice.

First, let’s supplement the complete expression of DA. Data availability, in a narrow sense, refers to the problem of how light nodes, such as wallets, etc., can efficiently verify full node data. There are two problems here. premise.

Premise 1: Light nodes do not download or cannot download complete full node data, especially when user experience is given priority;

p>

Premise 2: Full node data may be falsified, there is no access mechanism, and there may be malicious nodes in either PoS or PoW.

On single chains such as Bitcoin, this This is not a problem, because the block header already stores rich verifiable information, and the PoW mechanism also ensures that a 51% computing power attack is only a theoretical possibility. However, if you switch to a modular chain, the problem will become complicated, and transactions Execution, settlement, consensus and DA are not on different layers, and may not even be on the same blockchain.

What needs to be noted here is that according to Vitalik, data availability ≠ data retrieval ≠ data storage, but is equivalent to the release of data without being tampered with , as for the storage and retrieval after release, it does not become the focus of DA. The difference between the two is:

Data release: The light nodes on Ethereum can directly prove the validity of transactions without mastering all the data.

Data recovery: For Ethereum, there is no need to worry about security when using Ethereum as DA , so the word release can be covered, but Celestia has to prove: the data stored here is equivalent to being stored in Ethereum, so there will be a retrieval or recovery mechanism.

From Vitalik's perspective, when the data is released to the Ethereum mainnet, the entire process has been completed, and subsequent storage and retrieval are not required. There is a need to worry too much, which actually makes sense. As an existence second only to Bitcoin, the security of Ethereum does not require technical terms to prove.

But! There are exceptions to everything. If transaction data and consensus data are not completely circulated within the Ethereum system, the release, retrieval and even recovery of data need to be carefully considered. This is also a key point for Celestia and Near DA to prove themselves.

DA Special Theory of Relativity: Everything can be modular

Modularity is the direct driving force behind the rise of DA narrative. Ethereum actively chooses to transform itself into a modular public chain. It is currently in a transitional stage of hybrid architecture. Bitcoin can be used as a modular layer. The early OmniLayer practice and the current BTC L2 all have It means something like this.

The modular concept here belongs to my customization, that is, outsourcing or outsourcing the functions of a single chain is considered a type of modularization and is not the same Based on the discourse system of Ethereum.

Or understand it this way, previous blockchains also had light nodes, partial The problem of node and user verification of full nodes is not a large-scale market demand. Only on modular chains, the state synchronization and data storage, release and recovery caused by the separation of each layer have become a huge problem. After all, no one Hope to see a second rollback after The DAO.

First of all, let’s understand modularization. The earliest practice should be the Lightning Network. Modularization like DePIN is another proof of “practice before theory”. Blockchain By outsourcing some functions or modules of the chain, the Lightning Network can be understood as an accounting system with delayed settlement.

For another example, the earliest USDT was issued on Bitcoin's OmniLayer, which also eventually released the data on Bitcoin. This also shows that the blocks of the UTXO model Chains can also be modularized.

Account model blockchains, such as Ethereum, are easier to modularize. Near DA and Celestia also have the same idea. Since everything can be decoupled, Ethereum The main network does not have the extreme sanctity of Bitcoin, so whether it is using Bitcoin as a data release object or "helping" Ethereum process data, it can exist reasonably.

Without modularity, the concept of DA would still be popular, but it would never receive so much attention.

The Ethereum Rollup war is over, BTC L2 is in the ascendant

With modularity, there is a leader. Before the concept of DA, the Rollup route won the expansion war, and even had a tendency to spread to BTC L2. From a crazier perspective, modularity is the expansion. The ultimate solution is that no matter where there is a need for security, scalability or decentralization, it can be extracted from the main network, built separately, and then connected to the main network.

But this also brings about a very interesting problem. In a situation like Bitcoin where almost no expansion plan has been implemented on a large scale, BTC L2 projects have also It started to explode in full swing. For example, B² Network used fraud proof to return data to the Bitcoin main network, which is also an idea of using it as a DA layer. Secondly, Alt L1 entered the DA market with greater efforts. Why is Ethereum’s DA? To monopolize the world, princes, generals and prime ministers, would you rather have the seed? Legitimacy must be struck down with ten thousand feet, says Near DA, and is prepared to do just that.

In a sense, Ethereum is an improvement of Bitcoin, with PoW-->PoS, UTXO-->account model, single entity-- >Modularization, scripting-->The four major differences between smart contracts. The interaction point between the two is exactly modularization, that is, the convergent evolution of the expansion route. The difference is that Bitcoin is passively modular, and more and more L2 Think of Bitcoin as the DA and settlement or consensus layer.

So it must be admitted that "The modular Ethereum first created Rollup's market demand for DA, which in turn led to the DA layer becoming popular

strong>", the implicit premise here is that Rollup is no longer the protagonist, at least for Rollup on Ethereum.

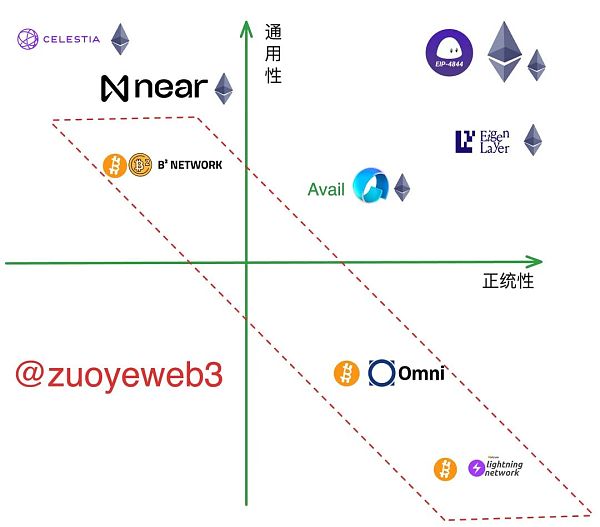

It can be slightly differentiated, at least into Ethereum-based DA solutions, such as Ethereum, EigenLayer, Celestia and Near DA, and Bitcoin as a fact Lightning Network, OmniLayer and B² Network on DA.

The difference here is that for Ethereum, Ethereum itself and EigenLayer's solutions are still centered on ETH and the Ethereum network , the final empowerment is ETH, which is rooted in the economic design of Rollup, that is, Rollup needs to submit "tolls" to the main network to use the security guarantee of the main network based on the ETH PoS network. The tolls here are mainly DA costs, that is Rollup The cost of publishing transaction data to Ethereum for final processing.

It is much simpler for Bitcoin. Bitcoin has no smart contracts and no nodes. For review, you can write whatever you like into the transaction data, as long as you pay the mining fee, but you must note that there is no regret after writing, and you cannot roll back the data or slash any node. BTC L2 has to solve the problem of transaction conflicts by itself.

Words are all about doctrines, but hearts are all about business

Vitalik initiated a debate on the definition and classification of L2 and Rollup, distinguishing the differences between Rollup, Validium and Sovereign Rollups. The main dimension lies in the choice of DA scheme. In the centuries after the end of the Middle Ages, you can still see the familiar "except "You teach" operation.

We just need to remember that the issue of data availability is not a purely technical solution and definition dispute. The core lies in the revenue cost of ETH in the PoS era. This is a matter of real money. The technical dispute is only superficial, so I will only give a brief introduction.

In a narrow sense, data availability is "how the light client verifies the full node data", which can basically be deduced along the following logic, sourced from Vitalik and Celestia founder’s paper:

There is a possibility of fraud in the whole node, that is, there is a problem with the data given;

Among all nodes, at least one node is an honest node and stores complete data or real data;

The core here is the proof mechanism. Taking Celestia as an example, fraud proof is the core of DA operation. Fraud proof is used to ensure timely Bug fixes, and at the same time,verifying fraud proofs is faster than generating fraud proofs, and the light client can quickly complete the verification without affecting user use.

We have an in-depth discussion on fraud proof. For fraud proof, everyone just needs to remember that this is very close to OP's optimistic verification process of Rollup. , that is, assume that it is true first, and then deal with the problematic ones.

Inference logic of fraud proof:

Exists in all nodes At least one honest node;

The broadcast mechanism can operate normally, and the delay is lower than the upper limit of network effectiveness;

There is a certain number of light nodes that can be combined to recover complete data, or equivalent data proof;

Under this logic, it can be concluded that the security and effectiveness oflight nodes are equivalent to those of full nodes.

Since there is OP, there will naturally be imitations of the ZK route. In fact, both Ethereum and EigenLayer are "validity proof" The route is to generate and distribute proof of validity in advance, but the generation itself requires a large amount of computing resources.

To summarize, Celestia and Near DA form an off-chain + fraud proof (OP-like) + cheap + native token DA solution, and Ethereum and EigenLayer form an in-chain + Proof of validity (ZK-like) + More expensive + ETH DA solution lineup.

It is necessary to explain twice that developing a DA solution based entirely on EigenLayer may not be as easy as using Ethereum directly. It is expensive, and EigenLayer may not issue coins, but the central position of ETH will not change.

Second, the fees of each DA are based on Near’s calculations at the end of last year, which cannot represent real-time and fixed prices, and Ethereum will also speed up and reduce fees in the continuous upgrade. , but the overall contrast pattern will not change.

From the perspective of Rollup's interests, increasing revenue and reducing expenditure are two ways to make money. Transaction fees and currency issuance are their own sources of profit, and they must not let go. The only way to increase profits is to reduce expenditures. If you continue to use Ethereum, it is more secure, but the cost is too high. This is the opportunity for Celestia.

EigenLayer is centered on ETH, and Celestia is centered on TIA. From Vitalik's point of view, this is tantamount to a vampire attack, using the ready-made ecosystem of Ethereum , but in the end empowered itself with tokens.

Personally, I think Broken Ethereum has no legitimacy, but the DA layer within the chain still has the highest security. This is true for both Bitcoin and Ethereum. Legitimacy can also be understood as the adaptability to Ethereum, and How dependent the expansion plan is on the Bitcoin mainnet.

In terms of versatility, it is also necessary to deeply consider the design ideas of each DA. Some DA solutions are dedicated L2 or L1 themselves, even BTC L2 and L1 EVM chains such as Near, as well as EigenLayer, all regard EVM compatibility as an important development direction, so EVM compatibility is used as a synonym for compatibility.

The situation of Celestia here is quite special. It introduces an off-chain computing mechanism, so in theory it can actually be compatible with any virtual machine (VM), including EVM naturally, and Celestia is actively expanding its ecosystem, and cross-chain dApp calls are also in its plans.

Of course, the modularity and DA ideas of Bitcoin and Ethereum are not consistent. This is just a happy idea.

Bitcoin DAization

To be precise, Bitcoin is forcibly regarded as the DA layer. Whether it is inscriptions, runes or BTC L2, they all emphasize the importance of storing data in Bitcoin.

At this level, Lightning Network and B² Network represent two extremes. Lightning Network completely relies on the Bitcoin main network for settlement and does not To issue its own tokens, BTC is required for pledge in daily operations. However, as I introduced in the BTC L2 article, the Lightning Network is only a simple payment channel and lacks the ability to support smart contracts. It is extremely orthodox. EVM is a historical product with extremely poor compatibility/versatility.

For comparison, the DA legitimacy of ETH, EIP-4844 ETH and EigenLayer is similar. The only difference is that the latter three natively have smart contract functions, and This indirectly proves that using ETH as the center is not only an economic consideration, but also responsible for the long-term development of the ecosystem. Once ETH's value capture ability is lost, the entire EVM ecosystem is in danger of collapse.

In contrast, OmniLayer has made more progress and uses the Bitcoin mainnet as a data release solution. Although it still requires nodes to download complete data, it also lacks efficient proof. mechanism, and does not support complex operations. This is also the main reason why USDT abandoned OmniLayer and prepared to switch to RGB. It is difficult to call Bitcoin as a DA solution, but it is considered an "ancient" product, and it is purely It is for convenience of comparison and does not have strict requirements for the elderly.

Insert a sentence, RGB++ and CKB are trying to explore new methods for BTC L2 construction. I will publish another article at the right time to systematically sort out BTC For new developments in L2, dig a hole first and leave it to be filled later.

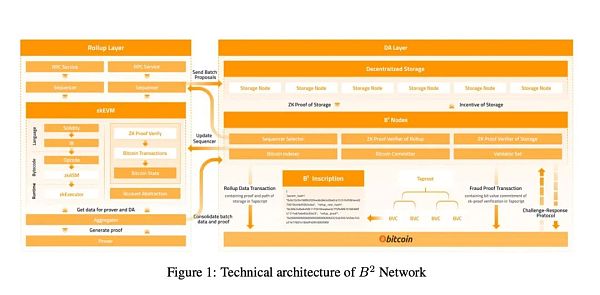

The following uses B² Network as an example to illustrate how the "new era" BTC L2s use Bitcoin as the DA layer, which is different from the unconscious use of Lightning Network and OmniLayer. , B² Network has planned to combine the rollup layer's data return and fraud proof mechanism. The overall idea is highly similar to Celestia.

In terms of design, B² Network partially separates the DA role of Bitcoin, and the Bitcoin main network It plays more of a role as the settlement layer. The data storage of the B² Network DA layer requires B² nodes to provide additional incentive mechanisms to cover the cost of decentralized storage.

B² Network’s EVM compatibility does not need to be overly examined, but there is a high probability that it will issue its own tokens, and how to cheapen the interaction cost of the Bitcoin main network also needs to be Take this into account, after all, the cost of using Bitcoin is very high.

Overall, the DA of Bitcoin is still in its infancy, and the large-scale practicality of its inscriptions, runes and BTC L2 will generate real demand. But basically it will not deviate from the practical path of Ethereum, but there will be differences in the implementation path, and the dual limitations of scripting language and storage cost need to be considered.

Ethereum DA: Containing Celestia

DA Now As we all know, it has a lot to do with Celestia, and it was Vitalik who jointly published a paper titled "Fraud and Data Availability Proofs: Maximizing Light Client Security and Scaling Blockchains with Dishonest Majorities" in 2018 with Celestia founder Mustafa. The action mechanism and implementation principle of DA are derived.

Celestia’s fraud proof mechanism, light client and minimization of the number of honest full nodes were all demonstrated. Subsequently, Mustafa built a project under the name LazyLedger The predecessor of Celestia.

It’s just that I didn’t expect that Celestia would be boycotted by Vitalik after it was actually launched on the market. Economic disputes were the core reason, which has been analyzed in the previous article and will not be repeated.

Celestia naturally does not have much legitimacy. It belongs to the DA layer outside Ethereum. Rollup, which chose Celestia as the DA layer, has also been removed from its name, but in the cheap Under the law of attraction, there are still more and more projects of various types coming to join.

The operating mechanism of Celestia is not complicated. The core is that light nodes use the DAS (data availability sampling) mechanism to efficiently verify full node data.

Celestia’s low cost comes from transferring calculations off-chain, which not only allows the DA layer to run at high speed, but is also effectively compatible with any programming language and VM (virtual machine). The friendliness of developing dApps is also a coup for the rapid development of the ecosystem.

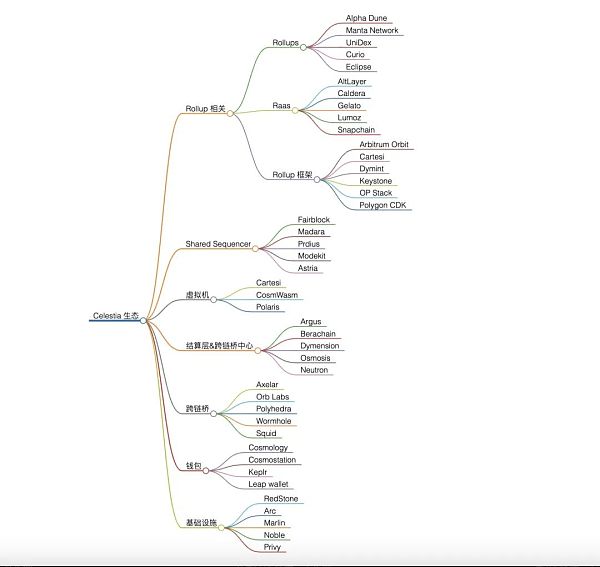

Currently, various Rollup solutions, RaaS, Rollup development architecture, settlement layer, cross-chain bridge and wallet applications can be developed in one stop through Celestia.

Facing the attack of strangers, Ethereum on the one hand emphasizes that it can also assume the DA layer, and in The cost will become lower and lower during continuous upgrades, but due to the existing architecture, it is obviously unwise to engage in a price war with Celestia and Near. EigenLayer has been pushed to the front line of resistance.

Different from Celestia, EigenLayer is essentially a collection of smart contracts on Ethereum. From this perspective, EigenLayer is Ethereum itself, but it can also be regarded as As an abstract virtual chain, this duality allows it to take into account the central role of ETH, and can also extend the role of different dimensions. For example, DA, sequencer, cross-chain bridge and L2 bridge can all be built using EigenLayer. Eigen DA That's it.

In layman's terms, EigenLayer's so-called Liquid Restaking is Lido's matryoshka version. If ETH can be pledged to earn income, it can be redeemed at the same time. If stETH is used as a token, then stETH can continue to be used as a nesting doll. On the one hand, the tokens generated by staking are income certificates, and on the other hand, they can also have full token functions for daily use.

After Ethereum is converted to the PoS mechanism, the amount of ETH pledged is directly related to the health and safety of the network. Currently, there are about 30 million ETH in the pledge network, worth At around $100 billion, the cost of an attack is second only to Bitcoin.

Since staking ensures the security of Ethereum, LSD/LRT can theoretically have unlimited nesting dolls and continue to amplify the token income from staking. According to 1000 The basic price of 100 million is only 1 trillion US dollars when enlarged ten times. The value of Ethereum is enough to support it.

The architecture of Eigen DA is not important. What matters is whether EigenLayer’s economic model can be sustained. Even if EigenLayer fails, there is no problem at all using the Ethereum mainnet.

Due to space limitations, we will no longer provide an in-depth explanation of EigenLayer/ETH/EIP-4844 ETH, Near DA and Avail. Just remember It is to deal with the problem of providing validity proof without full node data.

The Ethereum DA market will continue to compete for some time

The Ethereum DA market has begun, and Celestia has taken the lead in issuing tokens TIA and EigenLayer Although it is centered on ETH, there are not many projects that do not issue coins these days, and the results will depend on the results.

Although there will be new DA solutions emerging, the DA business on Ethereum has basically completed its staking field, and there will be no more new ideas.

Bitcoin DA is still competing incrementally, and we need to wait for BTC L2 to decide the winner

According to my judgment, the possibility of Bitcoin being used as a role similar to Ethereum's DA is not very high. The lack of smart contracts is secondly, and the main reason is that the cost is too expensive. , data compression hundreds or thousands of times is still too expensive. After all, Ethereum is not suitable for data storage, let alone Bitcoin.

References:

Mustafa Al-Bassam: “LazyLedger: A Distributed Data Availability Ledger With Client-Side Smart Contracts”, 2019; arXiv:1905.09274.

Mustafa Al-Bassam, Alberto Sonnino, Vitalik Buterin: “Fraud and Data Availability Proofs: Maximizing Light Client Security and Scaling Blockchains with Dishonest Majorities", 2018; arXiv:1809.09044.

Suwito, M.H., Ueshige, Y., & ; Sakurai, K. (2021). Evolution of Bulletin Board & its application to E-Voting - A Survey. IACR Cryptol. ePrint Arch., 2021, 47.

EigenLayer: The Restaking Collective

Modular Blockchains: A Deep Dive

Monolithic vs. modular blockchain

The Ethereum Off-Chain Data Availability Landscape

On data availability layers

NEAR Foundation Launches NEAR DA to Offer Secure

Why NEAR Data Availability ?

https://docs.eigenlayer.xyz/eigenda/overview/

A comparison between DA layers

What do you think of the latest modular project @AvailProject that launched an airdrop? What are its technical architecture and components?

JinseFinance

JinseFinanceThe AVAIL Claims Portal is now live. You can visit the Avail Claims Portal, agree to the Avail Mainnet Terms and Supplemental Airdrop Terms, and follow the claim process to verify your eligibility for the airdrop.

JinseFinance

JinseFinanceAvail, Web 3.0, seed round financing of US$27 million. The founder personally described Avail's "Trinity" solution and vision. Golden Finance, in-depth discussion of the background and theory of Avail Trinity

JinseFinance

JinseFinanceThis article analyzes the background, ecology and follow-up prospects of the Data Availability War, including DA in the eyes of Buterin, and an inventory and sorting of various DA projects.

JinseFinance

JinseFinance JinseFinance

JinseFinance Nulltx

NulltxHopefully Ethereum becomes a system more like Bitcoin.

链向资讯

链向资讯Hope Ethereum becomes a more Bitcoin-like system

Ftftx

FtftxTo understand the content and imagination of Taproot's upgrade, we must first understand some bitcoins.

Cointelegraph

CointelegraphThe root cause of RBI’s concern appears to be that digital assets could undermine India’s rise as a global power.

Cointelegraph

Cointelegraph