Author: NingNing, Twitter: @0xNing0x

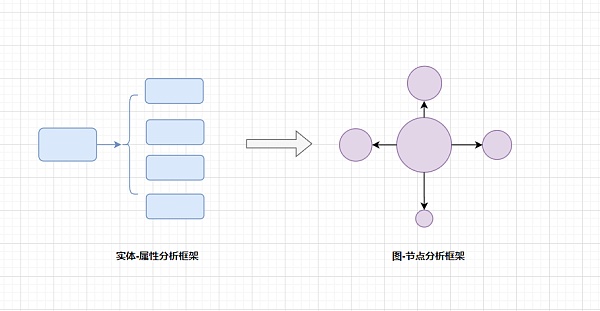

I. Transformation from metaphysical analysis of entity-attribute to graph analysis of node-edge

After large-scale and long-term metaphysical training (here refers to the conceptualized knowledge taught in school) in the modern school system, we have become seriously dependent on the analytical framework of entity-attribute, taking entity-attribute as the essence of things, and forgetting that entity-attribute ≠ thing-in-itself

Take the project rating reports that were popular in the cryptocurrency circle in 2018 and 2019 as an example. Those reports generally adopted the entity-attribute analysis framework:

→ Entity: Project A

→ Attributes: project positioning, market space, vision, technology stack, product architecture, team, roadmap

This analysis framework is the easiest to spread and understand by ordinary investors, but the conclusions drawn using this analysis framework were almost completely falsified in the last bull market

This is because the entity-attribute abstracts a specific project as an isolated existence, ignoring the fact that the value of a single project comes from its connection with the overall web3 network

So, this year I began to learn to use the node-edge analysis framework of graph theory to analyze the value of web3 projects. This made me feel suddenly enlightened, and many confusions were solved.

For example, why did EOS's technology/products, which were ahead of the times, underperform the market in the last bull market?

Under the original entity-attribute analysis framework, EOS scores much higher than Solana/Avalanche/Polygon

However, under the node-edge analysis framework, EOS lacks connection with the Ethereum ecosystem and lacks connection with American capital. It is an isolated node and its score is much lower than Solana/Avalanche/Polygon

And its performance in the last bull market just verified the correctness of the node-edge analysis framework

Node-edge (graph theory) analysis is a serious mathematical subject. I will not expand on it here. Interested students can go to YouTube or Bilibili to study it by themselves

Here I will only demonstrate the centrality analysis in the node-edge analysis framework and its application in judging the value of web3 projects

Centrality analysis is a method for measuring the importance of nodes in a network. It attempts to determine which nodes are more central in the network, thus playing a key role in information dissemination, influence dissemination, connectivity, etc. The following are several common centrality indicators:

Degree Centrality

Degree centrality refers to the number of connections of a node, that is, the number of its edges. The higher the degree centrality of a node, the more connections it has with other nodes

When evaluating a web3 project, the more other web3 projects it connects to, the higher its degree centrality

Currently in the crypto world, the project with the highest degree centrality is Bitcoin, followed by Ethereum, then CEX such as Binance, Coinbase, OKX, and then stablecoin issuers such as USDT

Closeness Centrality

Closeness centrality measures the average distance from a node to other nodes. Nodes with lower average distances are closer to the center of the network because they are able to propagate information to other nodes faster.

When evaluating a web3 project, the shorter its average distance to other web3 projects, the higher its closeness centrality

Currently in the crypto world, the project with the highest degree centrality is Ethereum, followed by CEX such as Binance, Coinbase, and OKX, and then cross-chain bridges such as LayerZero and Orbiter

Betweenness Centrality

Betweenness Centrality measures the frequency of a node acting as an intermediary in all shortest paths

Currently in the crypto world, the project with the highest betweenness centrality is cross-chain bridges such as LayerZero and Orbiter

Eigenvector Centrality

Eigenvector centrality considers the centrality of a node and the nodes connected to it, that is, the sum of the centralities of a node and the nodes connected to it

Currently in the crypto world, the projects with the highest eigenvector centrality are L2 projects such as Arbitrum, Optimistim, Starknet, Zksync,Scroll, Taiko, etc.

Through the above centrality analysis, we can easily evaluate the position and importance of a web3 project in the entire web3 value network

Convert from causal chain analysis to probabilistic correlation analysis

If the entity-attribute metaphysical analysis framework is the ideological stamp implanted in our brains by modern school education, then the A-B-C-D causal chain analysis framework is rooted in the physiological structure and working method of our brain.

To put it simply, the physiological structure and working method of our brain are very similar to the architecture and working method of AI, so AI is also called artificial neural network.

Algorithm, computing power and data are the three elements for AI to learn knowledge, and they are also the three elements for our brain to learn knowledge.

The difference is that the computing power of AI is N times that of our brain. In order to ensure the availability of learning, the brain constantly searches for energy-saving and easy-to-use algorithms in its interaction with the environment, and causal chain analysis is one of them.

Causal chain analysis is already useful enough in daily life, and can help us deal with various affairs in life and work well

But being obsessed with causal chain analysis in financial market transactions will cause big problems

After each market surge or plunge, the media/traders habitually attribute it to one or more reasons. For example, the A-share market attributes the recent plunge to the outflow of northbound funds, and the crypto market attributes the recent plunge to Musk's SpaceX company clearing out Bitcoin.

Then, we try our best to find a certain event and market trend, trying to grasp the causal law to arbitrage, which is a kind of unrealistic behavior in trading thinking.

Trading in the financial market means that we as individuals face the uncertainty of the real world, and we should use probability correlation analysis methods to understand it.

Financial time series methods are also serious subjects. Interested students can go to YouTube or Bilibili to learn.

Introductory financial time series methods include AR and MR. I have explained this analysis method in detail in previous tweets, so I will not repeat it here.

3. From Narrative Maximal Analysis to Epidemiological Analysis

The crypto industry is deeply influenced by the two best-selling books "Animal Spirits" and "Narrative Economics", and generally believes in narrative maximalism. I am one of them

Whenever I see narratives such as decentralization, web3, paradigm revolution, new primitives, stratification, fairness, etc. in white papers, I can't help but get excited. I have a sense of honor and sacredness of participating in a great historical process, and then I begin to equate the narrative of the project with the value of the project

Web3 projects from India are very good at taking advantage of this, such as Polygon's "Internet Value Layer" narrative and ZkSync's "ZK Magna Carta" narrative. They are very good at manipulating the crypto industry's collective unconscious obsession with narratives to start the valuation growth flywheel

Those who believe in narrative maximalism are easily exploited by large, empty projects with no practical utility, such as modular public chains, ZK shared security, etc.

So we have to make up for it with epidemiological analysis methods. In fact, the book "Narrative Economics" also spends a lot of space using epidemiology to analyze how narrative drives the economy.

Epidemiological analysis is also a serious discipline. Students who are interested can go to YouTube or Bilibili to study on their own.

For analyzing the cryptocurrency circle, we only need to understand the SIR model.

The SIR model is an epidemiological model used to describe the spread of infectious diseases in the population. This model divides the population into three main categories: Susceptible, Infectious, and Recovered

These categories represent different states in the population, and people may move from the Susceptible state to the Infectious state and then to the Recovered state over time

Here is an explanation of the three main categories in the SIR model:

Susceptible: This is the individual in the population who has not yet contracted the disease. They are potentially at risk and may become infected after coming into contact with an infected person

Infectious: This is the individual who has already contracted the disease and they can spread the disease to the Susceptible. Over a period of time, the Infectious may spread the disease and then move to the Recovered state

Recovered: This is the individual who has recovered and is no longer able to transmit the disease. Once an individual recovers, they typically gain immunity to the disease, depending on the nature of the specific disease.

The basic differential equation of the SIR model describes the changing trends among susceptible, infected, and recovered individuals.

To analyze crypto investments using the SIR model, we only need to replace susceptible, infected, and recovered individuals with potential investors, existing investors, and exited investors, respectively.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Finbold

Finbold Catherine

Catherine Beincrypto

Beincrypto Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinist

Bitcoinist Nulltx

Nulltx Nulltx

Nulltx