Original title: The Crypto Theory of Everything; Author: Mippo, Blockworks

“Most technologies tend to automate peripheral workers to perform menial tasks, while blockchain automates Center. Blockchain isn’t putting taxi drivers out of work, it’s putting Uber out of work and letting taxi drivers work directly with customers.” — Vitalik Buterin

If you work in crypto Play around long enough and you'll understand the immense pain of trying to describe to a newbie what crypto is.

After six years of working full-time in crypto, I still cringe when one of my parents asks me to describe what it is.

Usually, I default to the standard Bitcoin-centric answer.

I'll start by describing the problem: central banks printed too much money, so Bitcoin was created as a digital currency that couldn't be devalued by a central entity.

But I'm starting to find this answer unsatisfactory, because while this is true, today's cryptocurrencies are actually Be more inclusive than that.

Today, a large part of the cryptocurrency industry does not interact with Bitcoin and does not care about solving money-related problems.

Cryptocurrency has evolved so rapidly that it is difficult to describe with an overarching theory what the industry is and why it is so important.

I've been struggling with this for a while and finally I think I have a theory that unifies the many seemingly disparate theories about what cryptocurrencies are.

Creation of a new commodity

The fundamental innovation behind cryptocurrency is the creation of a new commodity: block space.

Using an overly simplistic definition, blockspace is storage that exists in cyberspace where any developer can run code or store data.

As far as software is concerned, Blockspace is unique in that it is not affiliated with a centralized owner of hardware.

This is the current state of the software we use today. Companies like Google have created incredibly valuable software that we all use: Google Search, Gmail, Chrome, and more.

But Google can unilaterally change anything if they want to. It turns out that the organization has some, if not many, advantages in this regard.

As a centralized organization, Google can fix errors quickly. They can hire good talent and take advantage of economies of scale. I guess you could also say that the fewer chefs there are in the kitchen, the better the product.

However, there are some software applications that are not suitable for software that can be controlled by a single party.

These are often applications with high social trust and importance.

For example, although we trust Google, we would not trust them to manage our currency.

Why? Because they can change the amount at any time, little oversight is required.

No matter how much we trust Google, we all know that the incentives to cheat are too strong.

This type of high-trust application for which traditional software is not suitable is where blockspace is very useful.

Because it is independently verified by a large number of independent participants around the world, it effectively upends the existing dynamic of subordinating hardware operators to software.

(Note: This is why I think many people in Silicon Valley don’t understand cryptocurrencies. It’s essentially the opposite of their business model.)

Different flavors of block space h2>

It turns out that like any commodity, there are many different ways to perfect the block space.

For example, Bitcoin’s block space has many unique characteristics that make it suitable for currency use cases.

Ironically, The properties of the Bitcoin block space make it particularly suitable for monetary use cases, but its performance suffers Restrictions.

The Bitcoin network generates a block approximately every 10 minutes, with a maximum capacity of 4 Mbytes.

These limitations (and many others) keep Bitcoin out of many use cases - high-frequency trading, gaming, etc.

For monetary use cases, however, these limitations are actually an advantage, as it forces the network to sidestep the complexity required to accommodate these applications.

Other blockspace producers, such as Ethereum, have chosen a different set of trade-offs.

Ethereum’s block space is universal and more suitable for a wider range of applications.

This decision opens Ethereum to a wider range of consumers of the block space it generates. But the complexity it has to deal with as a network has degraded some of its monetary properties.

I could spend multiple paragraphs discussing different flavors of deblocking spaces (application-specific vs. general, blockspaces belonging to sequences on another blockchain, etc.).

The key point to make here is that we are in the early stages of experimenting and refining the block space.

In the future, my expectation is that there will be a large and diverse block space producer suitable for different use cases and consumer markets.

Why do we care that block space is a commodity?

If you are considering investing in related tokens, it is important to understand the commodity nature of block space.

This is important to know about the product. Although there are many commodity investors, almost all of them are traders.

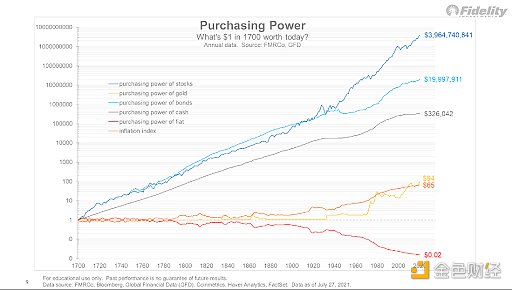

Almost no one buys and holds commodities for 20 years because commodities are socially designed to remain stable, or A more ideal scenario would be a decline.

(Note: when I say "down", I mean actual purchasing power, please don't @ me with oil price charts from 100 years ago.)

< p>The reason is obvious - we use commodities! If the price of oil rises too much, our policymakers will eventually fight tooth and nail to bring it back down.

The same goes for other important commodities such as steel and food.

This is basically the opposite of stocks, which are designed to rise by society. If stocks fall long enough, policymakers will start looking for ways to make them rise again.

I'm being intentionally simplistic, there are other reasons why stocks outperform (compounding, etc.), but this is just an overview.

But crypto investors Being told to HODL

means that almost every newsletter reader strongly dislikes this.

If it is true that L1 block space is a commodity, then all assets we are talking about (Bitcoin, Ethereum, Solana, Atom, etc.) are not long-term investments.

From the perspective we just explained, these are transactions and cannot be held for the long term.

But wait, you say. The data does not support this theory!

I believe in the fat protocol theory.

Other L1 tokens such as Bitcoin and Ethereum are the best-performing assets among cryptocurrencies, far outpacing even the stocks of the most successful companies such as Coinbase.

That's true, but I don't think it will last forever since the incentives for block space are similar to commodities.

For example, if Bitcoin is to become a successful currency, it cannot continue to grow 100% every year.

Similarly, for blockchains that generate block space for applications to use (Ethereum, Solana, etc.), the long-term incentive is for the price to peak at some point.

Some people will point out that the block space market and the token market are not 1:1. I understand that, but they are related because block space is denominated in tokens, so they are intrinsically linked.

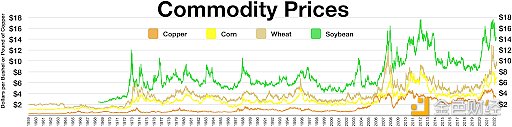

I think the best analogy for cryptocurrencies over the past decade is the commodity boom of the past.

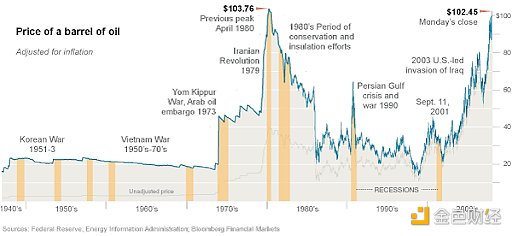

You can look at some examples from recent history, but I think the most relevant is the commodities boom of the 1970s.

Due to similar economic and geopolitical climates, I feel the comparison to the 1970s is most appropriate. The commodities boom was initially triggered by the Arab-Israeli conflict, but underlying inflation made it worse.

At the same time, Nixon suspended the dollar convertibility window into gold, causing the base currency to rapidly expansion, gold prices skyrocketed.

Now, the point I want to emphasize here is not that 1970 The times were exactly the same as today, with currency debasement and inflation being what drove cryptocurrency prices (although that was part of it).

Now, the point I want to emphasize here is not that 1970 The times were exactly the same as today, with currency debasement and inflation being what drove cryptocurrency prices (although that was part of it).

My point is that there have been times in history when investors were deceived into believing that commodities could sustain equity-like returns over the long term.

An interesting comparison that will make the crypto natives in this email laugh is that in the 1970s and 2000s, people also started saying we were going through a commodities super cycle (shout out Su Zhu) .

My mental framework for the current period is, The first phase of cryptocurrency is the world’s first digital commodity Prosperity.

Block space is a novel commodity that can be used in an extremely wide range of applications , which is why it scales exponentially.

But, like all commodity booms that have come before it, financial gravity will be felt. Over time, your favorite L1 will start to trade like corn, steel, or soybeans.

A final comparison between the commodities boom of 1970 and the digital commodities boom of 2010 is their psychological impact on market participants.

There is a very interesting comparison between gold investors in particular and the tribalism in today’s cryptocurrencies.

What’s interesting to me, a gold fan, is that after its spectacular price appreciation in the 1970s, gold underperformed essentially every other asset on the planet.

But 40 years later, the community remains more evangelical than ever. This is incredible if you really think about it.

I think the same underlying dynamics are present in cryptocurrencies. When the price of an asset you own increases 10x or 100x, something happens to most people's brain chemistry that's hard to forget.

In the cryptocurrency space, I believe there are two other underappreciated dynamics that contribute to the prevailing tribalism.

Loneliness in the Internet Age. Young people are increasingly looking for sources of community in a siled world, and large cryptocurrency communities (e.g. Bitcoin, Solana, Ethereum) provide this.

Layer-1 requires large communities to come together to develop roadmaps that have very meaningful technical tradeoffs that only a small group of engineers truly understand. Therefore, the strategy is to create narratives around these trade-offs to build support (think of the block wars).

So while the crypto commodity craze continues, my prediction for the foreseeable future is more tribalism, not less.

Summary of "The Crypto Theory of Everything"

To some, this prediction may sound pessimistic. Not to me.

I think we are still in the early stages of experimentation and expansion in the L1 commodity block space.

So the good news is, Ibelieves we are not close to the end of the blockspace commodities boom. If I had to guess, this trend will continue for another 5 to 10 years.

So If you still like Ethereum, Solana, Celestia or whatever, there is still enough to run Space, I guess the existing and new L1 will be the best venture deal in a decade (not financial advice)! ).

But eventually, I expect the market will adjust to the style of block space it requires and will become commoditized.

To some I will understand that this sounds pessimistic, but I disagree. I think this is a good thing.

My long-term view of cryptocurrency is that it is a foundation that enables new use cases and businesses that were not possible before.

In order to build waves of businesses from generation to generation, we need abundant, cheap, and useful block space. This is exactly what is being built today.

So if you’ve read this far in the newsletter, please read below:

•The fundamental innovation behind cryptocurrencies is the innovation of a new commodity: Blockspace

• The last decade of cryptocurrencies has been a boom in the blockspace commodity, a boom that is likely to continue for the next 5-10 years

• But eventually, this block space will become commoditized, and L1 will start trading horizontally

• This will be the Established first-generation businesses pave the way to cross the chasm into the mainstream

• The equity of these businesses supporting the blockchain space will begin to transcend the underlying L1< /p>

One exception to this theory might be blockchains like Bitcoin, where the use case is not to build businesses on it, but to act as currency.

I think this is a valid exception, although as I pointed out before, if Bitcoin is to function as a currency, its volatility and returns will decline over time.

So ultimately I think the end result is very similar. (Side note: I think the crypto community understands this exception, which is why Ethereum is trying to rebrand itself as a "super-hard currency.")

All in all, this is very frustrating to me excited.

Over the next decade, I expect the Cambrian explosion in block space experiments to Will continue. Investors and users would do well (not financial advice!).

Personally, I'm excited about what's coming next, which is what's going to happen on top of this block space Waves of businesses built from generation to generation.

I think we’ll all be shocked when we look back ten years from now at how much we’ve changed and what we’ve built.

As Bill Gates once famously said: "We overestimate what we can do in a year, but underestimate what we can do in ten years."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Huang Bo

Huang Bo JinseFinance

JinseFinance