Original title: Crypto's Future is Asia, original author: David C, original source: bankless

Asia could become the growth monster of this cycle as U.S. regulation rages on.

Prominent traders such as GCR and Arthur Hayes have long discussed Asia's long-term impact on cryptocurrencies, with some arguing that investors in the region will be the driving force of the current cycle.

With the brutal regulatory environment in the United States and increasingly positive developments in Hong Kong and mainland China, the case for Asia to lead the crypto industry continues to strengthen.

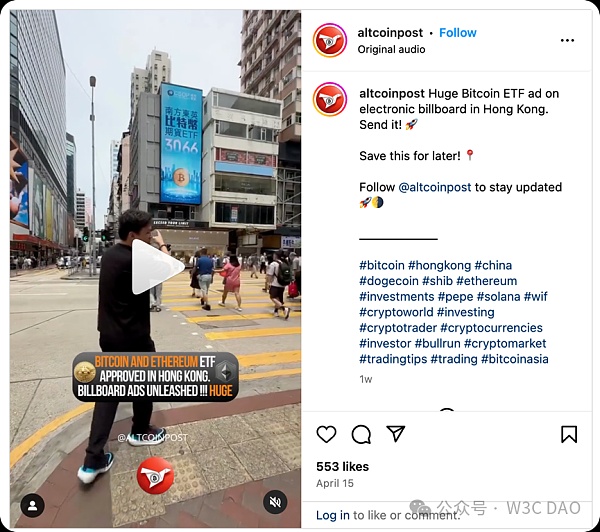

Hong Kong’s new clear crypto regulations and political ties with the mainland suggest that mainland China indirectly supports Hong Kong, positioning the city as a regulated crypto hub. Hong Kong’s recent approval of a crypto ETF further supports this view.

In contrast, the United States presents a different picture, with the SEC’s recent actions against Metamask and Uniswap, which the FBI warned of as a regulatory attack on cryptocurrencies.

These actions reflect the growing scrutiny of crypto businesses within the United States, which could drive a more favorable overseas development environment in Asia and bring industry hubs.

Hong Kong + China

Hong Kong and China are expected to become Asia's hubs for positive influence on cryptocurrencies, thanks to Hong Kong's favorable regulation, China's history with cryptocurrencies, and the interplay between the two regions.

In addition to ETF approvals and transparent regulation, Hong Kong has several other qualities that make it a hotbed for cryptocurrencies in the East. A recent report ranked Hong Kong as a top region for cryptocurrency adoption due to:

1. Zero tax rate on crypto gains attracting traders and investors.

2. Dense network of crypto ATMs for easy fiat-to-crypto conversions.

3. Strong industry influence, with top companies such as Consensys, OKX and Animoca Brands all headquartered or with offices in Hong Kong.

4. Hong Kong’s long-standing status as a trading and financial center makes Hong Kong a nexus for cryptocurrency activity in Asia.

These recent developments did not happen in a vacuum. Greater China, including Hong Kong, has a long history in crypto, pioneering many trading innovations and technological feats such as stablecoins.

These innovations have spurred the growth of Hong Kong’s cryptocurrency market. It can be said that Hong Kong has still managed to carve out a unique regulatory path that could make it a global cryptocurrency center.

In addition, another factor in Hong Kong and mainland China is the capital trend, as mentioned earlier, the desire to invest outside of China.

Hong Kong has long attracted wealthy Chinese to buy luxury goods such as jewelry and high-end brands. This trend, coupled with investors' enthusiasm for investing in non-local assets, has made Hong Kong a channel for mainlanders to invest in alternative assets such as spot ETFs. Although not equivalent to cryptocurrencies, luxury spending reflects the financial trend of wealthy people investing and participating in offshore markets.

To sum up, Hong Kong's crypto adoption, connections with mainland China, and innovation in Greater China make the region an industry powerhouse ready to drive growth in this cycle.

Further Examples of Asian Adoption

Beyond Hong Kong and mainland China, the wider Asian region presents a myriad of regulatory approaches and adoption levels that contrast with U.S. hostility and demonstrate Asia’s willingness to engage with crypto.

India

Despite strict regulations and high taxes, India leads the way in global crypto adoption.

According to Chainalysis, India ranks first in global crypto adoption and second in transaction volume, surpassing many wealthy countries in different crypto uses, including decentralized and centralized exchanges, DeFi, and NFTs. Despite a 30% capital gains tax that favors international platforms, India’s crypto market is thriving. This resilience highlights the strong ongoing demand for cryptocurrencies in the world’s second-largest country, affirming its significant global influence on cryptocurrencies.

Singapore

Singapore is competing with Hong Kong to become Asia’s Web3 hub.

As a leading global financial center, the country takes a sophisticated and thoughtful approach to crypto. It provides a supportive environment for new businesses, including a $150 million Singapore dollar fund to support fintechs such as Web3, and a regulatory sandbox for experimentation. The country balances this with strict, consumer-focused transaction regulation that ensures the safety of its citizens.

Philippines

Finally, the Philippines ranked sixth in Chainalysis’ adoption report, making it one of the countries most influenced by socioeconomic background when it comes to cryptocurrency adoption.

With a large portion of the population unbanked, the country viscerally understands the potential of blockchain not only for financial transactions but also as a comprehensive tool for socioeconomic improvement. As a country dealing with persistent inflationary pressures, cryptocurrencies, especially stablecoins, have become essential in remittances and payments as it offers security, low transaction fees, and fast processing times.

From India’s adoption to Singapore’s framework and the Philippines’ resilience, Asia’s diverse crypto involvement has made it a global heavyweight while showcasing the benefits of blockchain for developing countries.

Finally

As U.S. regulations become more hostile to our industry, Asia’s emerging crypto hubs are poised to attract a significant amount of future investment and innovation, potentially shifting the industry’s economic and technological center of gravity from the West to the East.

The proactive steps taken by Hong Kong and widespread adoption across Asia could make the region a powerful force in this cycle. As the SEC drags its feet and overextends its influence in the U.S., Asia continues to embrace the crypto industry, not only boosting local economies but also potentially guiding global markets toward a new era dominated by Asian technological leadership.

While it’s too early to say the U.S.’s position in the industry has slipped, the winds are blowing in Asia’s favor.

Xu Lin

Xu Lin

Xu Lin

Xu Lin Sanya

Sanya Kikyo

Kikyo Sanya

Sanya Cheng Yuan

Cheng Yuan Catherine

Catherine Catherine

Catherine Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Ftftx

Ftftx