Author: Nianqing, ChainCatcher

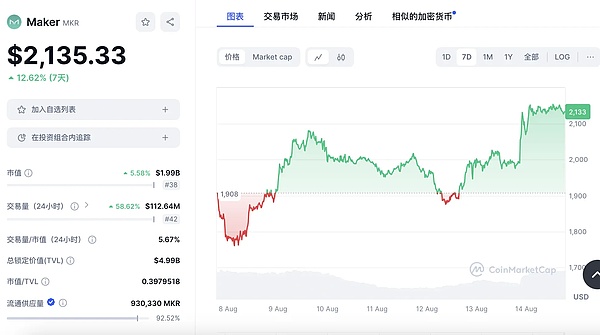

Recently, Grayscale launched Grayscale MakerDAO Trust, a trust fund focusing on MakerDAO governance token MKR. After the announcement, MKR rose by more than 5% in an hour, breaking through $2,100, and rose by 14.7% in the past 7 days.

Last Wednesday, Grayscale also launched Grayscale Bittensor Trust and Grayscale Sui Trust. The two tokens TAO and SUI have been rising for nearly a week in the overall turbulent market. The price of SUI also broke through $1, with a 7-day increase of more than 65%, and it has been on the ChainCatcher project hot search list for several consecutive days.

In July, Grayscale also launched Grayscale Decentralized AI Fund, a fund that invests in a basket of decentralized artificial intelligence tokens, including TAO, FIL, LPT, NEAR and RNDR. After the news was released, the AI sector ushered in a general rise, and the tokens in Grayscale's fund all saw an increase of more than 5% in a short period of time.

The long-lost "Grayscale effect".

As the former Bitcoin whale "Pixiu", Grayscale has become the focus of the entire crypto market due to its massive hoarding of coins. There is even a view that the last round of bull market was the "Grayscale bull", and the continuous hoarding of coins directly promoted the rise in Bitcoin prices.

The glorious years that belonged to Grayscale lasted for two years. After experiencing the liquidity crisis caused by the serial explosions caused by the collapse of FTX in 2022-2023, and the tug-of-war with the US SEC on the conversion of GBTC into a spot ETF, Grayscale's days in front of it seem particularly "peaceful".

After the launch of Bitcoin and Ethereum spot ETFs this year, Grayscale's launch of new funds has accelerated significantly. According to the product page of Grayscale's official website, except for the new funds launched this year, almost all other products were established before 2022. For example, trusts related to other crypto investment products such as Solana, Litecoin, Stellar, Zcash, Chainlink, Decentralized, etc. In addition, Grayscale is also actively recruiting senior assistants for ETF products to support the growth and development of Grayscale's ETF business.

What exactly did the listing of Bitcoin and Ethereum spot ETFs bring to Grayscale?

As an important promoter of the listing of Bitcoin spot ETFs, Grayscale and GBTC have also ushered in a turnaround. However, as the world's largest digital currency asset management company, after GBTC and ETHE, which account for the largest proportion of assets, were converted to ETFs, they also faced challenges from other competitors. Especially traditional asset management giants such as BlackRock and Fidelity.

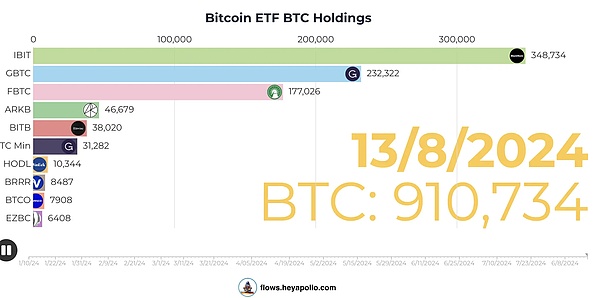

GBTC has accumulated outflows of more than 380,000 BTC since it was listed as an ETF in January, and currently has 232,792 BTC. In contrast, BlackRock already holds 348,165 BTC, surpassing Grayscale as early as May, and Fidelity holds 176,656 BTC, ranking third.

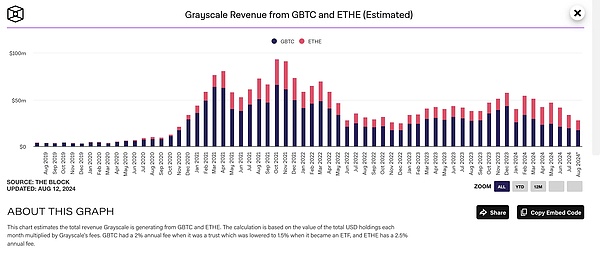

In addition, according to the data of "Grayscale's GBTC and ETHE Income (Estimated)" compiled by The Block, the income of Grayscale's two funds hit a low point during the bear market in 2022, and began to recover after winning the SEC's lawsuit at the end of August 2023, but after GBTC and ETHE were converted into ETFs, the income began to decline again.

Note: This chart estimates Grayscale's total revenue from GBTC and ETHE. The calculation method is the total monthly USD holdings multiplied by Grayscale's fees. GBTC charges an annual fee of 2% when it became a trust fund, which dropped to 1.5% after becoming an ETF, and ETHE's annual fee is 2.5%.

This article will systematically sort out the development history of Grayscale and explore why Grayscale deserves our close attention.

Background and History

Grayscale was founded by Barry Silbert in 2013.

Grayscale only established a Bitcoin Trust at the beginning, and determined the non-redeemable clause in 2014, and listed GBTC on the OTC market in 2015. After 2017, Grayscale began to diversify its products and launched crypto trusts such as Ethereum, Litecoin, ZCash, Solana, and Chainlink.

Barry Silbert began to invest in Bitcoin personally in 2012, and invested in Coinbase, Bitpay, Ripple and other current crypto giants in 2013. In addition, Barry Silbert also founded the prototype department of Genesis Trading, an over-the-counter Bitcoin trading platform. In 2015, Barry Silbert integrated these two businesses with his personal investment business and established DCG (Digital Currency Group).

DCG has gradually developed into a company with asset management companies, mining companies, lending, and media (CoinDesk). Its subsidiaries include asset management company GrayScale, media, and mining company Foundry. DCG has also directly invested in more than 160 projects.

Grayscale Effect

It is generally believed that this round of bull market is driven by institutions. In fact, as early as the last round, the high-profile entry of institutions has begun to take shape. In August 2020, MicroStrategy announced its entry into the Bitcoin market. The SEC and the audit department approved MicroStrategy to include Bitcoin in its balance sheet, which became an important indicator in the market (it is exactly four years away from now).

Under the driving effect of listed companies such as Tesla and MicroStrategy, more and more listed companies in North America have begun to follow suit. Some traditional listed companies have begun to turn to Bitcoin at the business level and asset reserve level.

However, the regulatory process for traditional institutions to hold encrypted assets such as BTC is still relatively complicated, so the compliant crypto trust launched by Grayscale has begun to become an important channel for restricted institutional investors to buy assets such as BTC. It can be said that Grayscale directly introduced institutional investors to the growth momentum of BTC.

In the second half of 2020, Grayscale, which has been generous and has been buying BTC, began to attract attention. The number of new BTCs added by Grayscale GBTC once accounted for 33% of the 100-day output, and tens of thousands of BTC were purchased in a week. Because it only takes in but not out, "when will Grayscale crash the market" once became the "Sword of Damocles" in the currency circle. In addition, Grayscale has also become a weather vane of the market, and the new currency trusts launched often drive up the prices of related currencies. Therefore, Grayscale's purchase even has the "currency listing effect" like Coinbase and Binance.

The direct driving force of the "Grayscale effect" lies in the existence of its premium (the market circulation value of each GBTC> the value of the Bitcoin contained).

Since GBTC is one of the few regulated products in the United States, GBTC was very popular among institutional investors at the time. Coupled with Grayscale Fund's secondary market lock-up policy and the provision that assets cannot be redeemed in the primary market, the market must pay a certain risk premium to investors. Grayscale Fund's premium rate was generally high at the time, with an average asset premium rate of 20%. Therefore, in addition to traditional institutions, Grayscale's GBTC also attracted a large number of arbitrageurs.

Arbitrage Machine

The institutions with the largest GBTC holdings at the time were lending company BlockFi, crypto hedge fund Three Arrows Capital, and Cathie Wood's Ark Investment (AKR).

GBTC has become an important tool for many hedge funds to arbitrage because of its continued high premium. Moreover, large investors such as hedge funds have a way to buy GBTC shares at a price lower than that of ordinary traders. Grayscale allows large investors to directly exchange BTC spot for GBTC shares.

So, these arbitrageurs bought BTC, deposited it in Grayscale, and dumped it to retail investors and institutions in the secondary market at a higher price after the GBTC unlocking period ended. In addition, Three Arrows Capital has long borrowed BTC at ultra-low interest rates without collateral to convert it into GBTC, and then mortgaged it to Genesis, a lending platform also belonging to DCG, to obtain liquidity.

During the peak of the 2020-2021 bull market, the value of GBTC shares exceeded the value of the underlying Bitcoin. But since the end of February 2021, GBTC has begun to show a negative premium. After the premium disappears, the "Grayscale effect" immediately fails.

Subsequently, BlockFi and Three Arrows Capital went bankrupt and fell from the altar. Grayscale's GBTC also quickly became a crusher during the bear market from an accelerator of the bull market.

Related reading: "Success and failure are all arbitrage, how does Grayscale GBTC "pit" Three Arrows Capital, BlockFi and other wronged institutions? 》

Affected by the serial explosions, the DCG Empire once faced the biggest dilemma in history: Genesis announced bankruptcy reorganization; Grayscale's largest trust GBTC was discounted by more than 40%, and the SEC refused to approve the transformation of ETFs. Grayscale continued to try to make an offer to acquire GBTC in the market and liquidate the fund; CoinDesk reported that it was sold for 200 million US dollars.

Spot ETF Core Promoter

In October 2021, under the pressure of a number of competitors applying for Bitcoin spot ETFs, Grayscale submitted an application to the SEC to convert its GBTC into a Bitcoin spot ETF. Subsequently, the decision was postponed by the SEC many times, and finally in June 2022, the deadline, the application was finally rejected. At that time, Grayscale's CEO Michael Sonnenshein immediately issued a statement saying that he would file a lawsuit with the SEC. In October of the same year, Grayscale officially submitted the lawsuit documents for the opening of the court.

In two statements, Grayscale accused the SEC of "arbitrary and capricious" rulings, and even caused "unfair discrimination" between Bitcoin spot ETFs and futures ETFs.

At this time, Grayscale is facing its "darkest moment". If GBTC cannot be converted into a Bitcoin ETF, Grayscale will try to return some investor funds through tender offers and other means.

In January 2023, Grayscale filed the next litigation brief, again questioning the SEC's decision to refuse to convert GBTC into a Bitcoin ETF.

At the end of August 2023, Grayscale won the lawsuit. The U.S. Federal Court of Appeals approved Grayscale's request for review and revoked the SEC's order, requiring the SEC to review Grayscale's ETF request.

On August 29, the trading volume of Grayscale Bitcoin Trust (GBTC) hit a new high since June 2022, and GBTC's stock price rose 18% to nearly $21 on the same day. Grayscale's victory also brought a glimmer of hope to the entire decadent crypto market, and the price of Bitcoin soared 7% to nearly $28,000. In addition, Grayscale's victory in the lawsuit paved the way for ETF applications from giants such as BlackRock and Fidelity.

Accelerated layout

The release of US supervision has allowed Grayscale to turn danger into safety, but it has also introduced more powerful competitors. As mentioned above, since January 11, GBTC's total net asset value has fallen to US$13.87 billion, and the pattern of crypto asset management has undergone tremendous changes due to the entry of traditional asset management companies. Grayscale has to make new layouts and accelerate the launch of new products.

In the past three months, Grayscale has launched 6 new crypto trusts.

Except for the new funds launched this year, almost all other products were established before 2022. For example, trusts related to other crypto investment products such as Solana, Litecoin, Stellar, Zcash, Chainlink, Decentralized, etc. In addition, Grayscale is also actively recruiting senior assistants for ETF products to support the growth and development of Grayscale's ETF business.

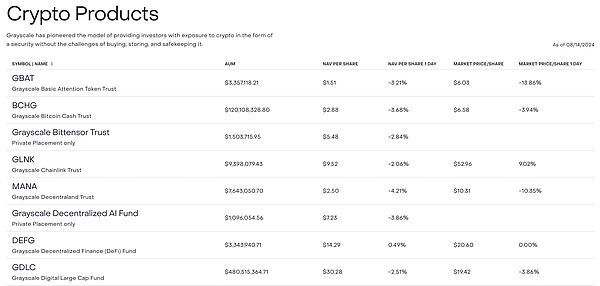

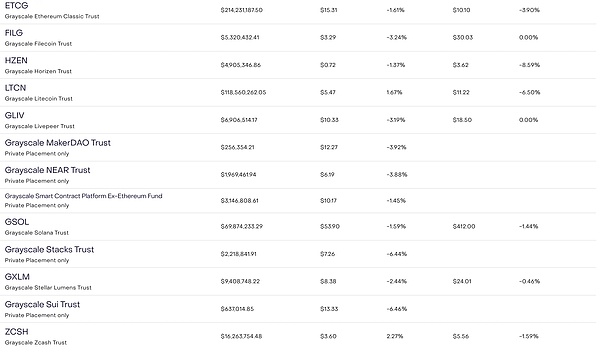

According to Grayscale's official website, Grayscale has currently launched 21 crypto trusts and 5 ETF products. According to Coinglass data, its total holdings are approximately US$21.35 billion. The trust management fee is generally 2.5%, and the fee rate for ETF products is between 0.15% and 2.5%.

In addition to BTC, here is a list of other assets held by Grayscale:

In addition, Grayscale is also considering international markets outside the United States. In April this year, Grayscale disclosed that it plans to expand its crypto fund products to Europe. The company is holding meetings with local partners to discuss how to launch the Grayscale product suite in Europe. When determining the launch of products, Grayscale will consider the impact of investor behavior and local regulations.

Overall, the launch of ETFs has saved Grayscale, which was deeply affected by the FTX incident, and further promoted the entire crypto market. At the same time, for Grayscale, its products still have room for improvement in terms of fees, especially facing a number of powerful competitors, there are more challenges. However, the recent rise in tokens such as MKR and SUI shows that the market is still willing to pay for the "Grayscale effect."

JinseFinance

JinseFinance

JinseFinance

JinseFinance Joy

Joy Coindesk

Coindesk Cointelegraph

Cointelegraph 链向资讯

链向资讯 Ftftx

Ftftx 链向资讯

链向资讯 Ftftx

Ftftx 链向资讯

链向资讯 Cointelegraph

Cointelegraph