Jessy, Golden Finance

On July 5, the crypto market took another plunge, with Bitcoin falling to around $54,000, and more altcoins even falling below the lows of the 2022 bear market.

Bitcoin continued to fall, and altcoins suffered panic selling. According to CoinGecko data, the global cryptocurrency market value has now fallen below $2.1 trillion, a change of -7.81% in the past 24 hours.

The direct cause of this decline may be the massive selling pressure on Bitcoin, and the fundamental reason is the uncertainty of interest rate cuts at the macroeconomic level. When will the market turn around?

Large selling pressure, weak macro expectations

The serial leverage liquidation has begun. Since yesterday, many whales' positions have been liquidated, and the crypto market has been liquidated for about $700 million in the past 24 hours. The decline is rapid and continues to break everyone's bottom line. In fact, from June to now, the major factors affecting the decline in the market have basically not changed, roughly as follows:

1. Mt.Gox began to repay BTC to some creditors

The Mentougou incident was a mine that had been buried for more than ten years, and now it has finally exploded.

On May 28 this year, the cold wallet account of the Mt.Gox exchange, which had been bankrupt for ten years, began to transfer a total of 141,685 bitcoins, which were worth about $98 billion at the time, which triggered a panic in the market. This part of BTC will be released to creditors between July and October.

On July 5, Mt.Gox began to pay creditors. Japanese creditor @VoiceOnFate posted on X today that he had received BTC and BCH compensation from Mt.Gox through a designated exchange platform, and the amount of BTC paid was 13% of the account's holdings that year.

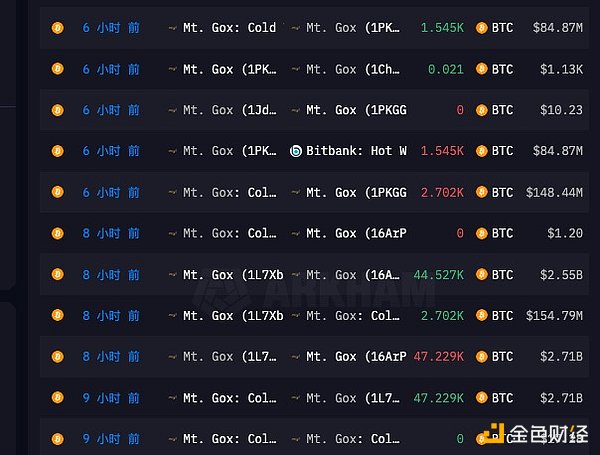

On July 5,Mt.Gox’s transfer records, including transfers to the Bitbank exchange

Mt.Gox lost about 750,000 bitcoins belonging to users at the time, and currently Mt.Gox still holds 141,686 BTC, accounting for 0.72% of the total supply of bitcoin in circulation. If all these coins are paid to creditors, it is believed that it will bring greater selling pressure to Bitcoin. Some analysts pointed out that if most of these bitcoins are sold, the price of Bitcoin will fall to around $47,000.

(For more information on the selling pressure caused by the Mt.Gox compensation, please refer to "Galaxy Research Director: Mt.Gox is about to pay BTC. How much selling pressure will it bring?" )

2. The German and US governments' selling of Bitcoin

The German government holds 45,624 Bitcoins. In less than a week from June 25, it has transferred more than $425 million in Bitcoin to transactions.

In addition to the German government, the governments of the United States, Britain, China, Ukraine and other countries also hold a large number of Bitcoins.

According to the on-chain data, the US government also sent 3,940 bitcoins to the Coinbase Prime wallet on June 26, 2024.

3. Miners sell

After the halving, miners' income dropped sharply. Due to the deterioration of income, many inefficient miners were forced to choose to exit the market, and Bitcoin computing power dropped sharply. OKLink data shows that the computing power of the entire Bitcoin network has dropped by 15% from the peak in the past two months, and has been in a state of continuous decline in the past week.

While the computing power has dropped, the miner group has also increased its selling efforts recently, becoming one of the biggest selling pressures in the market. At present, miners are more focused on short-term interests. IntoTheBlock data shows that Bitcoin miners have sold more than 50,000 bitcoins since 2024, and the Bitcoin reserves held by miners have gradually dropped to the lowest level ever.

4. Institutional purchases slowed down

Current market liquidity is insufficient.

The core factor that boosted the rise of Bitcoin this time is undoubtedly the Bitcoin spot ETF. Matrixport once published that institutional investors including asset management companies, investment consultants, pension funds and sovereign wealth funds are buying Bitcoin spot ETFs. The rapid influx of institutional funds has led to a surge in demand for Bitcoin, and the price has soared.

Recently, this consensus has been challenged. Since June, funds in Bitcoin spot ETFs have been in a state of large outflows most of the time.

5. Macro expectations weakened

At the monetary policy meeting on June 12, the Federal Reserve maintained the target range of the federal funds rate at 5.25% to 5.5%. According to the published dot plot of the interest rate hike path, Federal Reserve officials predicted that the median federal funds rate will drop to 5.1% by the end of 2024, which means that there may be only one interest rate cut this year, which is less than the previous forecast of 2 times.

Will there be another interest rate cut this year? At present, it seems more likely to be negative.

What is the market outlook?

If the market outlook is to rise, the Fed's interest rate cut is definitely fundamental. From the current situation, the market's growth is basically dominated by information, and the most direct improvement is the entry of macro liquidity.

Another thing worth looking forward to is the US election. As the election approaches, the crypto war between Trump and Biden is intensifying. And the "crypto industry" has also become a bargaining chip for politicians to win over voters. First of all, Trump has made frequent moves, choosing crypto figures as his crypto assistants for the election, publicly standing at the Bitcoin Miners Conference, and so on. Biden also participated in the Bitcoin Roundtable meeting and contacted crypto-related people. The game between the two sides is undoubtedly good for the crypto industry. The benefits of the game can be seen from the sudden approval of the Ethereum spot ETF.

In this way, interest rate cuts and the US election are actually long-term positive for the crypto industry.

In the short term, the market has actually reached the bottom of the stage. First of all, Bitcoin has fallen to the shutdown price of some mining machines. Falling to the shutdown coin price generally indicates a stage-by-stage bottom.

Currently, the USDT premium is also high. According to OKX data, the current over-the-counter price of USDT has risen to 7.38 yuan, while the USD/CNH exchange rate is 7.29 yuan. Generally, the USDT premium is caused by a large amount of buying. At present, everyone is in a strong mood to buy at the bottom.

However, it should be noted that there is still great uncertainty in the short-term market. First of all, it takes a certain amount of time to digest the selling pressure. For example, the compensation in Mentougou has just begun. The spot ETF of Ethereum has not yet landed. If the subsequent development of the spot ETF does not meet market expectations, the market will also fall further.

However, in the falling market, it may be possible to build positions in batches in some mainstream currencies with higher certainty, such as Bitcoin and Ethereum.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Edmund

Edmund Huang Bo

Huang Bo Xu Lin

Xu Lin Huang Bo

Huang Bo JinseFinance

JinseFinance Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph 链向资讯

链向资讯