Author: Socra, Golden Finance

A meme coin called ai16z became a hot topic in the community over the weekend. Not only did its highest market value approach $100 million, but the project was also forwarded and interacted with by Marc Andreessen, co-founder of a16z. Some early investors even received a return of more than 900 times their investment at a cost of 20 SOL.

So what exactly is ai16z, which is hotly discussed in the community? Why can it soar to the sky with its appearance similar to a16z? What new tricks did Daos.fun, which helped shape ai16z, come up with in the meme track?

ai16z successfully took the lead

ai16z self-labeled itself as a VC fund in the AI track, managed by Marc AIndreessen and managed by DAO members. But it is more like an imitation of Marc AIndreessen's own fund investment behavior by using the a16z brand.

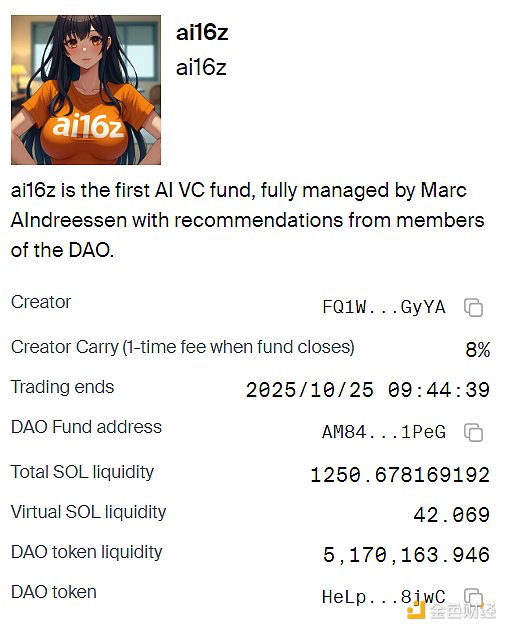

ai16z is actually a fund created by @shawmakesmagic on the Daos.fun platform. It absorbs other users' funds by creating a fund pool. Its essence is still a meme coin project.

According to Shaw, the creator of the ai16z fund, it aims to create an AI replica of Andreessen's transactions, which is based on the suggestions of DAO members and weighted according to their token holdings and transaction quality.

In addition, in order to increase the popularity of the project, Shaw declared that their goal is not to make an artificial intelligence robot that imitates Marc Andreessen, but to beat him in the field where he is best.

On October 25, the ai16z project was established, and the fund's tokens were verified and synchronized on Jupiter and Moonshot (Dexscreener's pump.fun competitor). According to the Daos.fun page information, the fund will expire one year after its establishment, that is, on October 24, 2025.

ai16z's initial performance was mediocre, but with the intervention and publicity of Marc AIndreessen himself, the project took off.

On October 27, Marc AIndreessen posted twice to interact with ai16z. Andreessen first wrote "GAUNTLET THROWNED" in the X post, and attached a screenshot of the project's profile on X. In the Western world, throwing your gloves at the opponent means a duel, and Andreessen regarded ai16z as an opponent in a joking tone.

Andreessen then posted in another post that he had an ai16z T-shirt and attached a screenshot of the ai16z fund avatar.

The release of these posts instantly ignited the community's enthusiasm, causing the Daos.fun website to crash, and also caused the fund's market value to approach $100 million, setting a record high of $96.6 million.

According to the on-chain platform monitoring, an address turned 20 SOL (US$3,500) into US$3.2 million in just two days by buying meme tokens ai16z, with a return rate of up to 914 times.

But as the popularity declined, ai16z was also close to being cut in half, and its current market value has fallen back to US$47 million. However, ai16z is still the top project in terms of growth and market value on the Daos.fun platform.

What is Daos.fun? What are the new tricks?

Daos.fun is a platform that helps ordinary users become fund managers. It allows cryptocurrency users to raise funds for funds in exchange for tokens, and then trade on behalf of investors within a given time period.

If the fund is successful, investors will be able to exchange tokens for the fund's underlying assets, or if the fund's market value is higher than its net asset value, investors can sell tokens.

In essence, Daos.fun is still a copycat project of pump.fun, a Meme token launch platform, but it is still in the Beta testing stage.

At the end of September this year, the Daos.fun team was conducting operational promotions. In the project-related announcement, interested users were invited to create fund projects, and the founders could get RT and LP-level exposure. At the same time, the project promises that higher-level creators can get a high return on their investment, that is, 50% of the transaction fees on the launched DAO tokens + other profits (increase).

If you are able to raise funds and trade memes, please send a private message to invite. I proposed a highly incentivized model for V2 so that you can get 50% of the transaction fees on the launched DAO tokens + any profits

But currently fund creators only accept recommendations, that is, invitation-based.

Daos.fun’s official website lists how the project works:

1. Fundraising

Creators have 1 week to raise the required amount of SOL. This fundraising is a fair issuance of DAO tokens, and everyone can get the same price.

2. Trading (successful financing)

After the fundraising is over, creators will be responsible for SOL investment in their favorite Solana protocol, and the tokens will be public on the virtual AMM. This allows the price of the DAO token to fluctuate according to the trading activity of the fund.

The upward limit of this curve is unlimited, but the downward limit is limited by the market value of the financing. Users can sell their DAO tokens at any time as long as the market value of the token exceeds the original financing amount.

3. Fund Expiration

When the fund expires, the DAO wallet will be frozen and the SOL in the profit will be returned to the token holders. You can destroy your DAO token to redeem the underlying assets of the DAO, or simply sell it on the curve (if its market value is higher than the fundraising amount).

The DAO mentioned in the above terms is a smart wallet funded by the creator, which invests on behalf of DAO token holders.

Summary

Compared with other types of meme launch platforms and tokens, Daos.fun is more novel in form and embeds the narrative concept of AI Meme Coin. Although it itself does not have any practical application functions, at the moment when meme coins are in full swing, the more projects that can attract community attention and superimpose multiple cutting-edge label attributes are more likely to come out. As for how far it can run, it depends on the interest of latecomers.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist