TL,DR;

ZK technology is the main Used to improve scalability, privacy and credibility of various projects such as Starkware, zkSync, Scroll, Mina, Risc0, Giza and EZKL.

ZK technology requires a large amount of computing power, resulting in a computing overhead of 10^4 to 10^6, posing a challenge to the infrastructure team .

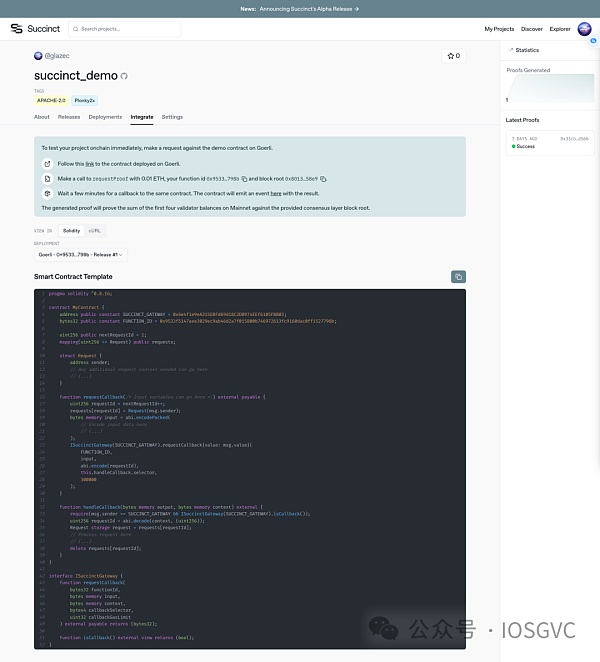

The main methods to generate ZK proofs are Proof Markets and Proof Networks. Proof Markets operates as an open market for trading ZK proofs, while Proof Networks has in-house servers that provide a cloud service-like experience for generating proofs.

The Proof Market approach allows for flexibility and cost-effectiveness as it facilitates the opening of ZK proof transactions without the need for high-end server management market.

The Proof Network approach provides a smooth and developer-friendly experience and provides a way to pay less attention to market mechanisms. Solutions for generating evidence quickly and reliably. In theory, it can produce evidence quickly, because it also takes time to match orders in the proof market.

Challenges include testing and Difficulties in debugging, new security issues emerging, possible vendor lock-in, higher costs in certain usage models, and loss of token utility.

Leading players are likely to be those companies with the greatest demonstrated need for in-house ZK, as they can leverage existing infrastructure and professional teams to maximize hardware utilization.

Emerging applications include ZK Coprocessors, ZK Attestation, ZKML, and ZK Bridges, all of which create greater demand for generating ZK proofs .

Decentralized evidence in ZK is driven by the blockchain industry’s preference for security, censorship resistance, and privacy network, although the inherent security of ZK means that these advantages do not require decentralization as a prerequisite. For Zk, performance is the main concern.

Introduction

Growing demand for ZK

After years of research in the zk field, and in performance After making huge improvements, zk is finally being used in practical applications. Talented engineers apply ZK to:

Scalability

Privacy

Data credit

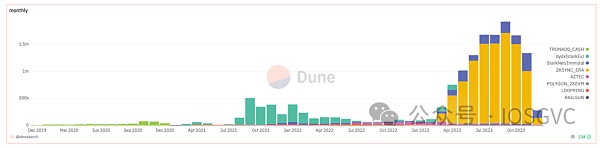

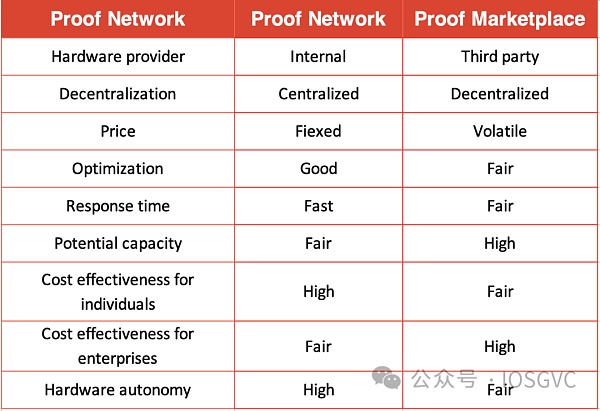

Source: https://dune.com/nebra/zkp-verify-spending A strong increase in ZK verification cost over last year.

This chart produced by the Near team shows the fuel consumption of zkSN(T)ARK on Ethereum and L2s. It includes popular ZK projects like zkSync, Polygon, Aztec, Tornado Cash, Loopring, Worldcoin, Tailgun, Sismo, StarkNet and ImmutableX and dydx.

Compared with zkStark, zkSnark accounts for 80% of the total cost in verification. Among all these projects, Worldcoin has the highest verification cost, followed by zkSync. Verification costs approximately $2 per worldcoin. Verification costs approximately $30 per zkSync.

Prove infrastructure burden

ZK can solve Scalability issues, but at some cost. It requires a lot of computing power. ZK brings a lot of computational overhead, and the Rollup team needs to deal with this problem. @_weidai estimates there is a computational overhead of 10^4 to 10^6 using today's ZK technology. In theory, we could achieve 10x the computational overhead with dedicated circuitry. If you add the virtual machine abstraction layer, there will be 100 times the computational overhead.

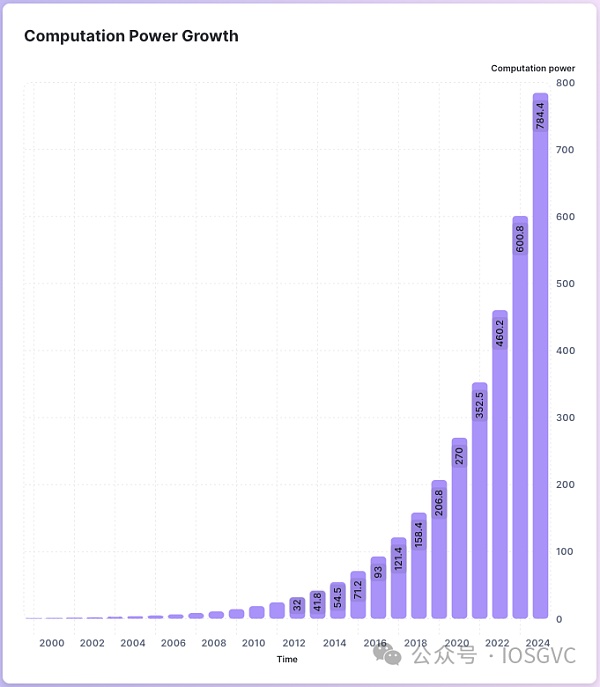

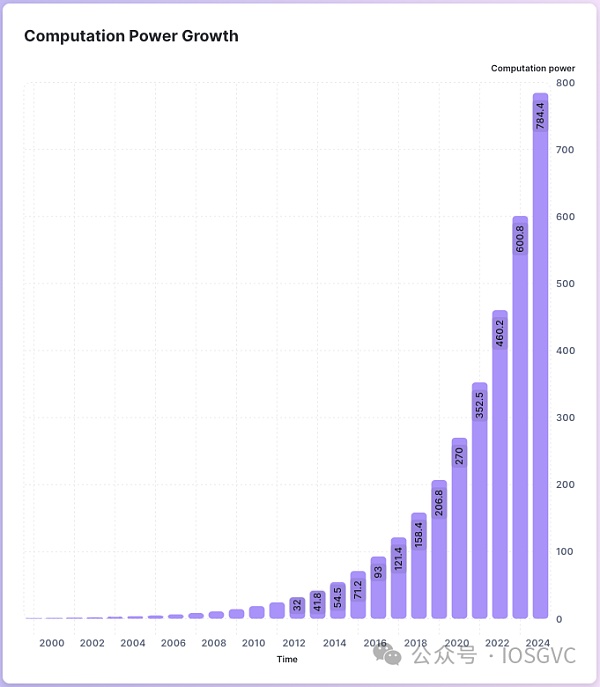

The chart below depicts a graph of computing power based on yearly growth according to Coomery's Law. Chip efficiency increased by a factor of 10 every decade since 2000. If we compare computing power against the year 2000, it will reach 784 times in 2025. This also shows that current ZK calculations are still not on the same order of magnitude as those in 2000.

Source:https://visualize.graphy.app/view/04f82b27-3654-47eb-83e8-3981f6e258be

Please think about it carefully. We are trying to bring a 10x to 100x increase in transaction volume to ZKRU. As the transaction volume increases, we also face a computational overhead of 10^4 to 10^6. These numbers put enormous pressure on the ZKRU infrastructure team. Leading ZKRU teams are using high-end machines with at least 200 GB of memory and have talented operations staff to handle these infrastructure complexities.

So what does it mean for a small team if they want to launch a ZKRU or build a third layer solution with the ZK technology stack? If an independent developer wants to build a ZK Dapps, how do they buy these high-end servers and operate them properly?

Now, starting a ZKRU is not difficult. You can use ZK Stack and follow the instructions in the documentation to deploy a new ZKRU. The hardest part is getting the high-end infrastructure to work. Managing a fleet of servers is much more difficult than day-to-day maintenance of our personal laptops.

In addition, hardware acceleration is not plug-and-play; each team needs to set up different configurations for their servers depending on the zero-knowledge proof system they use.

Ensuring high availability is also a tricky topic. What if tons of users start minting Ordinals on your ZKRU and you suddenly face 1000x throughput? Even an experienced team like Arbitrum was down for several hours due to the surge in Ordinals trading.

Generating a large number of zero-knowledge proofs requires high-end server support. For small and medium-sized teams, setting up and maintaining a fleet of high-end servers can be a heavy burden. To better help groups simply and quickly adopt zero-knowledge technologies, the Emerging Project attempts to help these groups deal with all computing infrastructure complexities.

Prove the market

Source: IOSG Ventues

Proof market and proof network are the two main methods. Prove that the market is like an open market. To generate a proof, a user needs to find a counterparty willing to sell the proof for a certain price. The proof network works like a traditional cloud service, developers submit their circuits and inputs, and a centralized load balancer allocates internal servers within the proof network to generate proofs for users.

Proof markets are a popular approach in ZK proof infrastructure. The proof market is an open market where buyers and sellers trade ZK proofs. The ZK Proof marketing team does not need to care about ZK Proof hardware or own high-end servers, they focus on ZK Proof transactions and verification mechanisms to attract third-party hardware vendors.

Prove that the market is a more open approach. It welcomes third-party hardware vendors. As long as there are sellers with such certificates, buyers can purchase ZK certificates at USD prices. When verifying proofs, everyone in the market does not need to reach consensus, only market operators bear the responsibility for verification. In the proof market, zkDapp developers submit a ZK proof order, including price, generation time, timeout, and public inputs. The third-party hardware vendor will then accept the order and generate a proof.

Proof that the economic structure of the market is simple. Proof generators need to stake. If they generate the wrong certificate or fail to provide it by the deadline, they can be fined. Proof generators with more stake will be able to generate multiple proofs simultaneously.

The main players in the certification market industry are =nil and Marlin.

=nil Foundation

Prove that there are sellers and buyers in the market Home. The buyer is the dApp developer. They pay the seller a fee to generate the certification. There are many factors that influence the price of a certificate. Major factors include circuit size, proof system, generation time, and input size.

The following is the workflow of the =nil proof market:

Prove that the requester sends a request to the market with an expected price of c_r.

The proof market locks the c_r tokens in the buyer's account.

Proof that the producer sends a proposal to the market at price c_p <= c_r.

The proof market matches requests with proposals from proof producers.

Proof producers generate proofs and send them to the market.

The proof market verifies the proof and pays c_r - handling fee tokens to the producer.

Proof requesters get their certificate and use it.

Market design provides a transaction-like experience. Prove that the generated price will change in real time.

The following are =nil product screenshots that prove the market.

Source:https://nil.foundation/

Currently, Proof The Market supports a limited number of claims, with the Mina claim proving to be the most active. Specifically, Proof Market accepts circuits based on their zkLLVM compiler and Placeholder proof system.

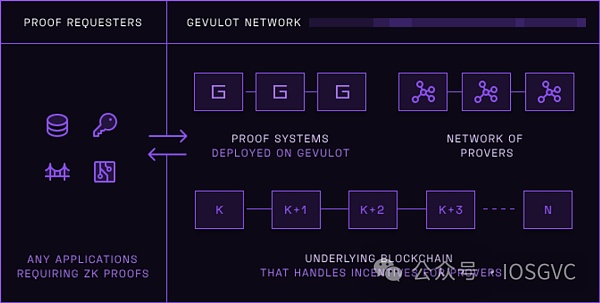

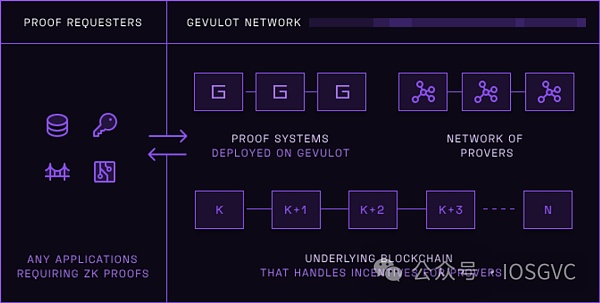

Gevulot

Gevulot is committed to introducing decentralization to the proof market. Gevulot serves as an open and programmable layer 1 blockchain designed for proof-of-market. The first layer of the blockchain handles the distribution, verification and reward distribution of proof requests. The prover network leverages lightweight unikernels to achieve high performance. Gevulot uses verifiable random functions (VRFs) to distribute proof work to a small group of provers, ensuring the reliability of the system.

Source: https://www.gevulot.com/

Users can seamlessly deploy programs with predictable fees, and users can set a maximum fee based on the number of cycles required for program execution.

Provers are rewarded through the Gevulot network and user fees, incentivizing them to generate efficient and competitive proofs. The fastest prover will receive the most network rewards. User fees will be shared equally with all nodes that complete the proof.

Gevulot supports multiple programming languages for program deployment, including C, C++, Go, Java, Node.js, Python, Rust, Ruby, PHP, etc., because Gevulot's underlying VM Nanos support x86_64 Linux ELF binaries.

Gevulot is a general computing platform that supports different languages and proof systems. Gevulot relies on a Nanos single core to ensure that provers can easily run on different machines. All provers need to be compiled into a single single-core image.

Proof Network

Proof Network provides a more Friendly developer experience approach. It operates similarly to Web2's cloud service provider. Developers send payload data via the REST API, and the proof network then returns proofs to the developer. Developers do not need to care about price fluctuations and which party will generate proofs.

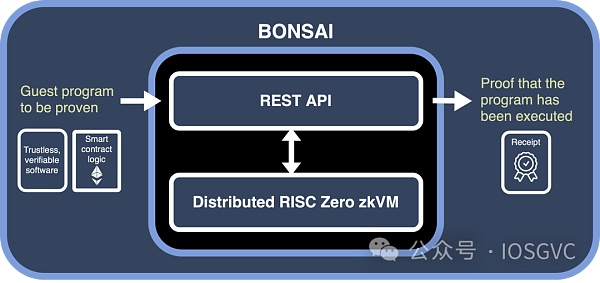

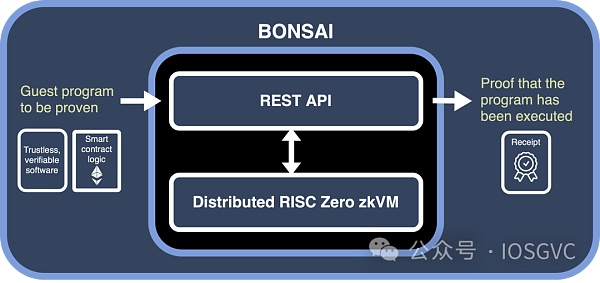

Risc0

Risc Zero started with their zkVM Bonsai. Leveraging the power of zkVM, users can ask Bonsai to generate various claims. For example, Zeth generates proofs for Ethereum blocks, based on Bonsai and Risc0 VMs.

Source: https://www.risczero.com/

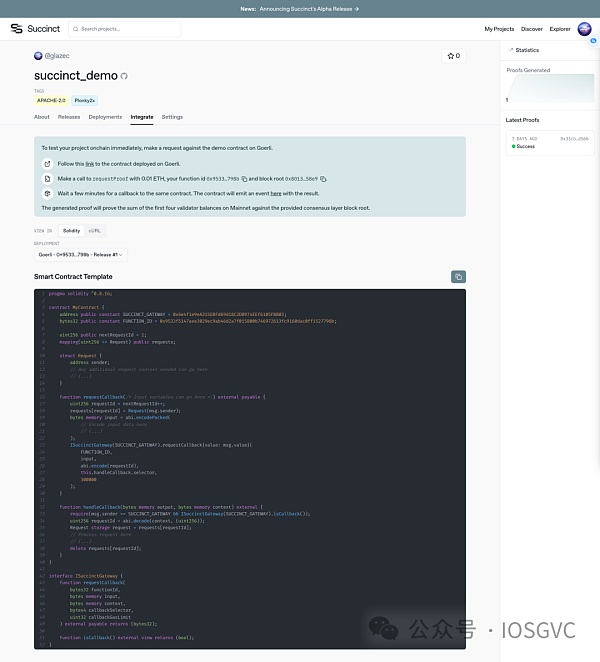

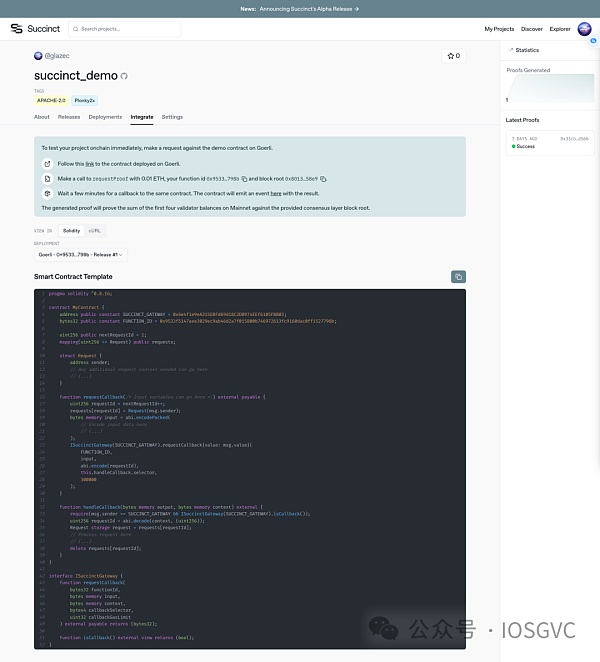

< strong>Succinct

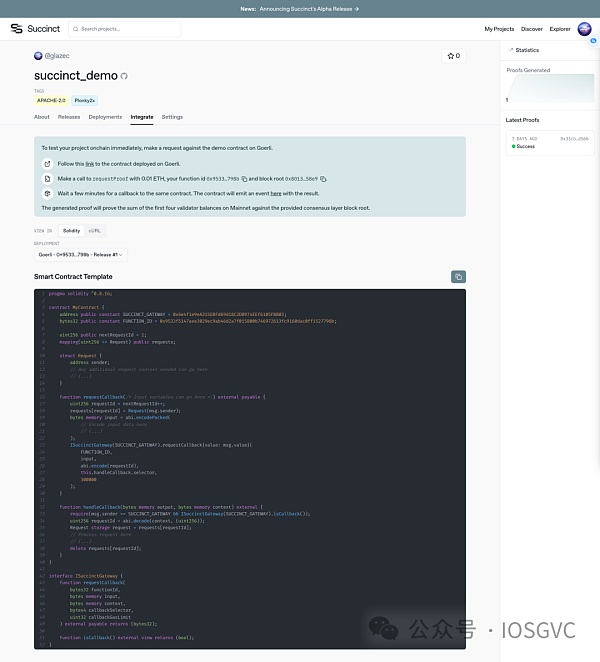

Recently, Succinct has also launched their new products. Rather than providing a REST API circuit, Succinct provides an approach more similar to cloud functions.

The following is the user workflow:

Connect to GitHub account And deploy the circuit

Call the API through REST or smart contract and pass in the circuit input

-

Query results through REST API or smart contract

Source: https ://succinct.xyz/

Compared with BONSAI, Succinct has the following advantages in developer experience:

Managing circuit code libraries is easier

No need to send more times Circuit

One-click deployment of smart contracts for on-chain proof generation and verification

-

Explore popular ZK proofs

View proof generation status on the dashboard

- p>

Supports rustx, gnark, circom, plonky2

Source: https://succinct.xyz/

Proof network or proof market< /p>

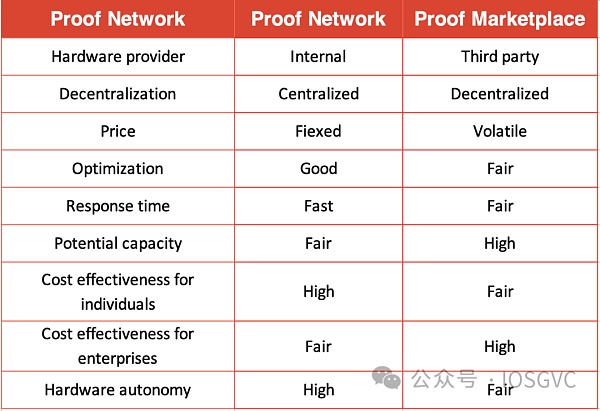

The certification market provides buyers and sellers of certification with greater pricing flexibility. It invites all hardware providers to participate, which helps reduce costs for buyers. But it's worth noting that savings can vary between individuals and businesses. Often, centralized services like Proof Network may offer free services to individuals while charging businesses high fees but providing access to VIP customer support. For example, if an enterprise plans to launch a new event or feature, the enterprise can reserve some computing power on the proof network in advance. A decentralized market may present more balanced and competitive pricing.

In today's market, products based on proof networks seem to provide developers with a smoother experience. It handles all proof generation work and supports major proof systems without introducing any new complex concepts. It provides a consistent user experience. In theory, it provides fast proof generation since order matching in the proof market also takes time. If you are familiar with cloud computing, it turns out that the network is more like a stateless cloud function.

We have the =nil Foundation and Gevulot working on the proof market. Succinct and Risc0 are on the proof network. Hardware companies like Ulvetanna and Cystic have also contributed significantly to improving ZK-proof performance on GPUs and developing the next generation of dedicated ZK chips.

Proof that the market is relatively easy to start. For the ZK infrastructure project, proving the market design can bring more hardware providers online. With its decentralized design, they can easily scale the network to meet future computing needs.

In the future, we foresee the combination of proof network and proof market design. The goal is to provide a seamless experience for developers while integrating a proof market as a backend to facilitate the addition of additional computing resources. This is a direction Succinct plans to pursue in the near future. We are seeing similar shifts in other markets, such as Infura. Infura has its own servers, but it also plans to bring in licensed parties to provide infrastructure.

Source: IOSG Ventures

Who really needs cloud ZK foundation Facilities

We believe developers who want to reduce time to market and build lightweight, flexible applications that can be quickly expanded or updated Those who use it will greatly benefit from these cloud ZK infrastructures.

For applications with large differences in peak and trough usage, cloud ZK infrastructure will reduce costs.

For this type of application, it will be more expensive to purchase a set of servers that are always running and guaranteed to be available at peak times. When the usage is at its lowest, it will cause a lot of waste. Cloud infrastructure can be expanded at any time to improve performance. This excess computing performance can be automatically released outside of peak times.

Who will be the leader?

From our understanding of the Web2 cloud industry, we found that companies with the greatest computing needs tend to have leading cloud infrastructure businesses. They can take advantage of scalability, cost, teams, and innovative products.

This also applies to cloud ZK infrastructure. We believe that those projects with the greatest need for build validation have the potential to have one of the most successful ZK Cloud Infrastructure businesses.

For projects that generate large amounts of ZK proofs in-house, they already have extensive infrastructure, optimizers, and professional teams. They can also maximize hardware utilization by sharing proof resources across applications; when an application does not need to generate proofs immediately, provers can be repurposed for other purposes.

These large projects have their own proof systems to some extent. Third-party proof infrastructure often has difficulty optimizing the various proof systems used by different large-scale projects. By providing fast and easy-to-use cloud provers, large projects can effectively expand their ecosystem of proof systems.

For ZKRU, cloud ZK infrastructure can increase its Fork usage. It is not difficult to spin up a new layer 2 or 3 on these ZKRUs, but maintaining the ZK infrastructure will be costly. Providing out-of-the-box and flexible cloud attesters can help attract more developers. Currently, most developers typically use the OPRU SDK to build new Tier 2 or Tier 3 due to the ease of management of the corresponding infrastructure.

If they do not build their own ZK infrastructure, these huge ZK projects will need to pay high fees to third-party computing providers. They are also limited in the speed of development because they cannot always customize their infrastructure to further improve performance and reduce proof costs.

Who has the greatest need for zero-knowledge proofs?

In addition to ZKRU and layer 1 networks, we have recently seen more emerging applications of zero-knowledge proofs. They all have a huge need for proof generation.

Zero-knowledge coprocessor enables smart contract developers to obtain past blockchain states without trust. A zero-knowledge coprocessor generates zero-knowledge proofs for these past blockchain states. This may be a more secure and less trustless alternative to graphs.

Zero-knowledge authentication helps users bring off-chain data or identity information to the blockchain. After the authenticator verifies this data off-chain, a zero-knowledge proof is generated for it and placed on the blockchain.

Zero-knowledge machine learning makes on-chain reasoning possible. The computation provider performs the ML computation off-chain, generates a zero-knowledge proof for it, and then publishes the proof to the blockchain.

Zero-knowledge bridge is a more secure version of cross-chain bridge. It generates a proof of storage or even a proof of consensus for the source chain and places it on the target chain. This may replace the current cross-chain bridge.

What is special about decentralized proof networks?

In the blockchain industry, decentralization is the most popular narrative. Decentralization brings many benefits:

Security

Censorship resistance

Privacy

< p style="text-align: left;">Zero-knowledge proofs are different from other general calculations. ZK is inherently safe. Anyone can easily and quickly verify a proof, ensuring the prover's honesty. In the ZK space, decentralization is not a prerequisite for security.

Zero-knowledge proofs focus on complex underlying details, built into circuits. While the content within these circuits is extremely difficult to censor, censorship can still be effectively implemented by generating requesters against ZK proofs.

Privacy can be an issue for proof networks because users send private input to the proof network. The ideal solution would be to generate the proof locally to prevent any data leakage. This will challenge local performance. Other solutions might be a new zero-knowledge multi-party computation protocol or generating proofs in a trusted execution environment. A decentralized proof network cannot bring more privacy.

Aside from narrative, censorship resistance is probably the main reason for building a decentralized proof network. Zero-knowledge proof technology is still in its infancy, and so far we have not observed any form of censorship in this space. However, the main challenge hindering the development of zero-knowledge proofs is performance. The introduction of a decentralized proof network may lead to an increase in the computational requirements for generating proofs.

Conclusion

Zero-knowledge proof applications are developing rapidly. Wide range. We expect to see zero-knowledge proofs being integrated into different technology stacks. We've seen ZK layer1, ZK layer 2 networking, ZKML, ZKVM, ZK-Email. Developers are also building ZK oracles, ZK data sources, and ZK databases. We are on the road to “ZKifying everything”. The computational overhead introduced by ZK forces developers to deploy their circuits on high-end servers. As a result, we expect demand for cloud ZK-proof infrastructure to increase to help developers escape the complexities of operating these infrastructures.

In this area, our insights include:

Proof Markets and Proof Networks are two main approaches that can help ZK dApp developers stay away from the complexity of infrastructure.

We anticipate a hybrid approach that combines proof-of-network and proof-of-market mechanisms.

Not all ZK dApp developers are suitable for using cloud ZK infrastructure. Medium-sized projects with stable traffic can self-host servers to reduce costs.

The leaders of cloud ZK infrastructure will be those projects with a need to generate large amounts of ZK proofs, such as the leading ZKRU. They have a financial incentive to do this business.

Decentralization is the dominant narrative in the crypto space because decentralization brings properties such as privacy, censorship resistance, and security. ZK turns out to already have some of these features. Currently, the selling point of the decentralized proof market is censorship resistance.

Cloud ZK proves that the popularity of the infrastructure is in line with the current marketZK dApps The quantity isclosely related. While some projects initially highlight their cloud ZK-proof infrastructure as a key feature, many will eventually pivot to focus on other new narratives.

Part.2 Investment and FinancingEvent

Game NFT DEX and Inscription Protocol EZSwap completed a new round of financing of US$1 million

* Game

According to the official blog of the EOS Network Foundation (ENF), the game NFT DEX and the inscription protocol EZSwap completed the second round of financing of US$1 million last month. The EOS Network Foundation It led the investment of US$500,000, with participation from IOBC Capital and Momentum Capital. The EOS Network Foundation stated that this move not only allows EZSwap to expand its technical capabilities and innovate in the field, but also enriches the entire EOS ecosystem with its gaming solutions and expanded cross-chain functionality.

According to reports, EZSwap is a game NFT DEX and inscription protocol that is setting new standards for game asset transactions and inscription technology by utilizing automated market makers ( AMM) mechanism, EZ Swap provides a seamless and efficient trading environment that is directly integrated with the game. At the end of December, EZSwap was launched on EOS EVM.

Binance Labs announces investment in Memeland’s native token Memecoin (MEME)

* NFT

According to the official blog, Binance Labs announced its investment in Memecoin (MEME), the native ecosystem token of Memeland, an NFT project owned by 9GAG.

It is reported that Memeland’s core focus is to build and invest in SocialFi and the creator economy, aiming to leverage the meme Internet culture and connect creators through its MEME token and NFT and community. In addition to NFT and MEME tokens, Memeland also offers MEME Farming and plans to launch several upcoming features and services. These features are designed to enhance user experience and promote community participation, including an NFT staking mechanism, a social network for community members to collaborate, and liquidity staking of ETH.

DeFi trading platform Bracket Labs completed a $2 million seed round of financing

* DeFi

Bracket Labs, a DeFi options trading platform registered in Panama, completed a $2 million seed round of financing and announced that its volatile market product Passages was officially launched on Arbitrum. The product has been in development for more than a year and a half and has been live on the Arbitrum testnet since mid-October 2023. Passages provides users with a volatility betting platform capable of 2-day prediction markets with a simple design.

Etherscan completes the acquisition of Solana ecological block browser Solscan

*Data

Block explorer developer Etherscan and Solana ecological mainstream block explorer Solscan jointly announced that Etherscan has completed the acquisition of Solscan.

AI startup Perplexity completed $73600,000 in Series B financing at a valuation of $520 million

* AI

Perplexity, an artificial intelligence startup, completed a $73.6 million Series B round of financing at a valuation of $520 million. This financing was led by IVP, whose investment portfolio includes many cryptocurrency and financial technology companies such as Coinbase and Robinhood. Series A investors NEA, Elad Gil, Nat Friedman and Databricks, as well as new investors including Nvidia and Jeff Bezos (through the Bezos Adventure Fund) participated. Perplexity has raised $100 million in total funding to date. The founder and CEO of Perplexity said that this round of financing will help the company continue to develop artificial intelligence technology and accelerate product development.

Part.3 IOSG post-investment Project Progress

Starknet Roadmap: 1 Voting for the v0.13.0 version update will be launched on the main network on the 10th of July

* ZK Infra

Starknet officially updates the 2024 roadmap, which will be released in v0 in the first quarter. The 13.0 test network will reduce transaction fees and will launch a new transaction type v3 transactions. Users can use STRK to pay transaction fees. At the same time, Starknet will open community voting for deploying the above updates on the mainnet on January 10.

In addition, Starknet also plans to use the EIP-4844 upgrade to reduce Ethereum Layer1 data availability costs, and plans to introduce a transaction fee market in the v0.14.0 version to speed up Transaction speed.

Scroll releases 2024 roadmap: plans to reduce cross-chain costs by 50% and be compatible with EIP 1559 transaction types

< p style="text-align: left;">

* Layer2 Sandy Peng, co-founder of Scroll, an Ethereum second-layer network based on ZK Rollup, tweeted that according to Scroll's 2024 roadmap, it plans to reduce cross-chain costs by 50%; it is compatible with EIP 1559 transaction types and SHA256 precompilation; add multiple validators; add decentralized proof; parallel EVM. Additionally, Scroll will be rolling out some fair launch programs this month.

Celer Network Provides cBridge bridging support for BRC-20 tokens

* Infra

Cross-chain interoperability protocol Celer Network announced on the X platform that cBridge is expanding bridging support for BRC-20 tokens to seamlessly connect the Bitcoin network to the EVM ecosystem. This will allow BRC-20 tokens such as ORDI and SATS to participate in the rich DeFi vision on the EVM chain.

Astar Network Plans to release token economic model, zkEVM and other updates in the next two months

* Infra

Sota Watanabe, founder of Astar Network, the Polkadot ecological smart contract platform, said on the X platform that there will be major updates this month and next month including dApp Stake v3, token economic model, Astar zkEVM, etc.

Mina Protocol It is planned to deploy Berkeley upgrade this year

* Infra

According to the official Blog, lightweight blockchain protocol Mina Protocol plans to deploy the Berkeley upgrade this year. The upgrade will bring performance enhancements, leveraging Mina’s design without compromising scalability or decentralization. With the emergence of fully ZK-enabled smart contracts on mainnet, an unlimited number of infrastructure and application improvements are possible, and the Berkeley upgrade also includes performance improvements such as slot time reduction, validator optimization, and more.

Arbitrum’s Orbit platform adds support for custom Gas tokens

* Layer2

Arbitrum’s Orbit platform has added support for custom Gas tokens. The move enables Orbit’s third-layer chain to utilize specific ERC-20 tokens as transaction fees, thereby enhancing the utility of its own tokens and expanding its ecosystem. Xai Gaming, for example, has immediately taken advantage of this feature to reduce barriers to use for end users. Arbitrum said other blockchain projects such as Caldera and Celestia will also take advantage of this feature immediately. In addition, Arbitrum Orbit aims to attract more developers to join the Arbitrum ecosystem and only supports custom Gas token functions on the Orbit AnyTrust chain.

IoTeX plans to launch Layer2 network W3bstream specially designed for DePIN

* DePIN

IoTeX The foundation announced in its official blog that the IoTeX core team is preparing to launch W3bstream, a Layer 2 network designed specifically for DePIN. W3bstream is able to compress (aggregate) large amounts of off-chain data into smaller, verifiable zk-proofs to trigger on-chain transactions. W3bstream contributes to DePIN’s scalability by efficiently managing data preprocessing through its decentralized sequencer network.

IoTeX said: "While W3bstream relies on the IoTeX blockchain for its orchestration, it remains a new DePIN application due to its speed, security and cost-effectiveness. The perfect choice, but W3bstream can support existing DePIN projects on any blockchain."

Synthetix releases Andromeda version on Base network, introducing SNX token buyback and destruction mechanism

* DeFi

< p style="text-align: left;">Synthetix releases the Andromeda version on the Base network, which introduces Core V3 and Perps V3 deployment and uses USDC as a new collateral. A key feature of this version is that 40% of the fees earned on Base is earmarked for the buyback and destruction of SNX tokens. This strategy is designed to efficiently allocate fees in Synthetix multi-chain deployments.

Part.4 Industry Pulse< /strong>

BendDAO: BDIN Launch is online and will last for 24 hours

* NFT

BendDAO stated on the X platform that BDIN Launch is now online and will last for 24 hours.

According to previous news, BDIN tokens total 100 million, of which 60% will be issued on BendDAO, 5% will be allocated to Turtsats Launchpad, and 5% will be allocated to Bakery Launchpad, 30% allocated to the BRC20 ecosystem.

Scallop, the Sui ecological lending protocol, has launched an airdrop point system

* DeFi

Scallop, the Sui ecological lending protocol, announced on the X platform that the Scallop airdrop points system has been launched , and the snapshot has been completed before January 1, 2024. The first phase is designed to support Scallop’s early supporters, including Zealy participants, the verified Sui Scalloper role on Discord, lenders and borrowers on the Scallop platform, and more.

Unibot now launches Solana-specific trading Bot

< em>* Trading Bot

Telegram Bot project Unibot announced the launch of Solana-specific trading Bot "Unibot on Solana". Opening the first phase of access to early adopters. Key features of Unibot on Solana include: support for advanced limit orders, embedded charting and token analysis, advanced routing and trade prioritization strategies, built-in two-way bridge for Ethereum and Solana, and more.

The public beta version of the STEPN development team's new game Gas Hero is now online

* Game

According to official news, Web3 produced by STEPN development team Find Satoshi Lab The public beta version of the game Gas Hero is officially launched.

Sleepless AI: is planning to launch the second batch of NFT

* AI&NFT

Web3+AI game platform Sleepless AI said on the X platform that it is planning Launching the second batch of NFTs.

UniSat: Will follow Ordinals Jubilee upgrade without splitting into isolated protocols, white paper will be released at the end of January

* Inscription

Bitcoin Inscription Wallet UniSat Wallet stated on the X platform that UniSat will follow the Ordinals Jubilee upgrade to confirm that BRC-20 is still on Ordinals and will not split into an isolated protocol. In addition, the UniSat white paper will be released on January 31, 2024.

Bitcoin Inscription Project Rune Alpha is now open to the trading market

* Inscription

Bitcoin Inscription project Rune Alpha announced on social media X, trading market Already started. According to previous news on December 29, Rune Alpha announced that it will open the trading market on January 3, and COOK, PSBTS, GROK, X and GOONFI will be listed in the first phase.

Ethereum Devcon 7 will be held in Bangkok, Thailand from November 12th to 15th

* ETH

The Ethereum Foundation announced that Ethereum development Devcon 7, the developer conference, will be held in Bangkok, Thailand, from November 12th to 15th, 2024. This time Devcon is not only the announcement of the location, but also the expansion of the vision, which will use the entire Southeast Asia region as a stage for community gatherings. Southeast Asia’s Ethereum community plays a key role in the global cryptocurrency scene, with the region’s rapid growth featured prominently in the Global Cryptocurrency Adoption Index. The Devcon team has launched the Go to Devcon (RTD) Grants program to support the development of new Ethereum events, grassroots communities, and education in Southeast Asia.

The proposal to limit inscriptions initiated by Bitcoin Core developer Luke Dashjr failed and has been closed

* Inscription

Initiated by Luke Dashjr, Bitcoin Core client developer The proposal "datacarriersize: Match more datacarrying #28408" discusses whether to limit inscriptions. After discussions among many developers, it was not approved and the proposal is currently closed.

Non-profit organization Better Markets once again asks the SEC to reject the Bitcoin spot ETF application

* ETF

Nonprofit group Better Market said approval of the product would be a Historical mistakes will cause huge losses to investors. Better Market CEO Dennis Kelleher is a representative figure against cryptocurrencies. He has been critical of the virtual asset industry, calling it an "inherently predatory business model." Additionally, Kelleher developed a close relationship with SEC Chairman Gary Gensler while serving on Biden's presidential transition team in 2020. Some analysts say that their relationship may become a variable in whether the Bitcoin spot ETF can pass.

The U.S. SEC may notify issuers of the decision to approve the Bitcoin spot ETF next week

* ETF

According to Reuters, citing people familiar with the matter, If the U.S. Securities and Exchange Commission (SEC) chooses to approve a Bitcoin spot ETF, they could notify issuers as early as next Tuesday or Wednesday.

Eleven Bitcoin spot ETF applicants including BlackRock have submitted revised 19b-4 documents

* ETFs

Includes BlackRock Eleven Bitcoin spot ETF applicants, including , Valkyrie, Ark Invest, Fidelity, Bitwise, Grayscale, Hashdex, Invesco, WisdomTree, Franklin Templeton and VanEck, have submitted revised 19b-4 documents. Document 19b-4 is a proposed change to stock exchange rules to allow ETFs to trade.

JinseFinance

JinseFinance