Author: Andy, co-founder of The Rollup Co; Translator: Baishui, Golden Finance

Modular blockchains have become the biggest zero-to-one innovation in the crypto space since Ethereum.

Following the highly anticipated launches of Celestia and Dymension, expectations are very high for upcoming modular ecosystem projects. With dozens of tokenless protocols preparing to launch on mainnet this year, and modular narratives seeping into all the cracks of crypto media, I believe we are on the cusp of expansion, similar to what happened after the birth of smart contracts.

We recently released a modular ecosystem map showing more than 100 teams leading modular expansion.

In today’s post, you’ll learn what modular blockchains are, the ins and outs of modular stacks, and my vision for the modular end game.

First, let's answer a seemingly simple question: What is a modular blockchain?

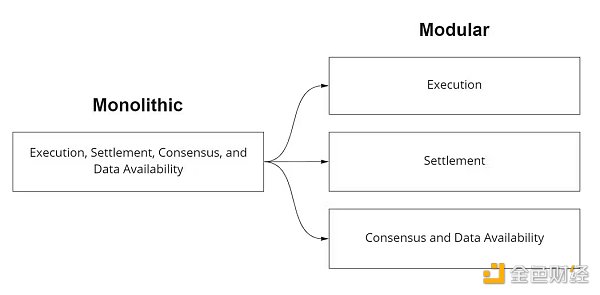

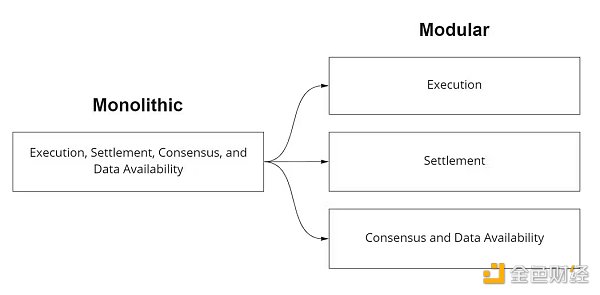

Modular blockchains focus on specific operations rather than striving to complete all core functions at the same time. Their basic principle is to decompose blockchain functions into separate, specialized modules and perform one of the jobs well while outsourcing the rest.

A modular blockchain design separates key functions (data availability and consensus, settlement, and execution) into specialized parts to create the most scalable, most efficient blockchain design.

You can think of a modular blockchain as having specific codebases/chains for each specific function, which together create a greater output than an integrated blockchain that tries to do it all. A lot of what a modular blockchain design tries to achieve is to achieve maximum scalability without sacrificing the core principles on which we build cryptocurrencies.

In the rest of this article, we will explore how each layer of the stack leads to modularity.

Data Availability Layer Decompression

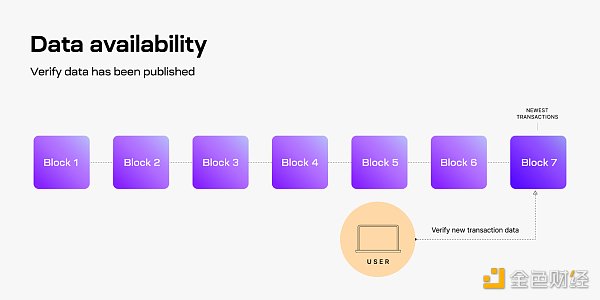

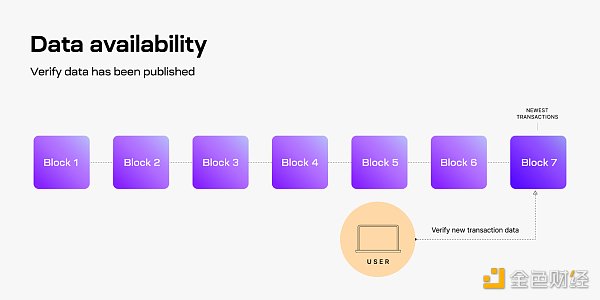

The goal of the Data Availability (DA) layer is to cheaply and securely verify that a given block of data has been successfully published to the network and is accessible to all network participants. Verifiability is a core benefit of using blockchain for any transaction. Data availability is at the heart of verifying that data has been published and is accessible to every node in the network.

The verification process of the DA layer begins when a user makes a transaction and the Rollup sorter batches these transactions into separate blocks. Once the verification is successful, the block is added to the chain.

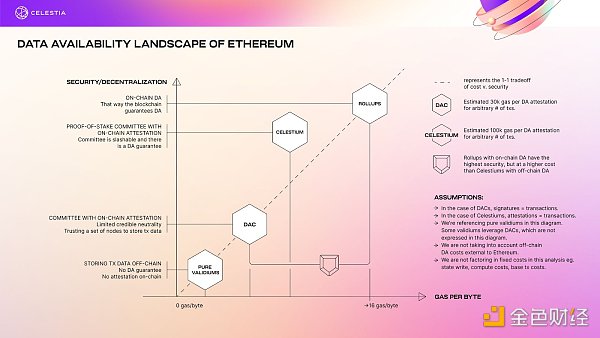

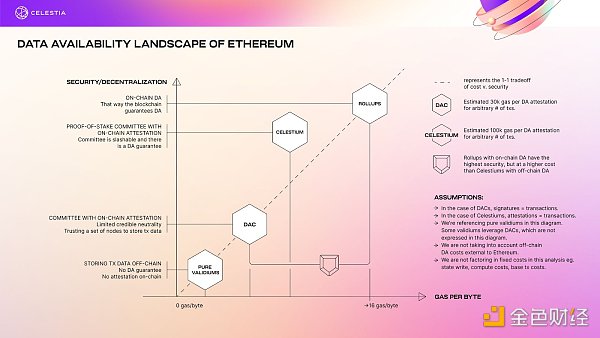

Celestia was launched in November 2023, opening the emergence of alternative data availability (altDA) layers. While the Dencun upgrade recently expanded the scale of Ethereum L2 using Ethereum for DA and blobspace (data storage solutions), the limitations of blobspace are more restrictive than using altDA solutions.

However, it is worth noting that publishing data directly to Ethereum L1 can obtain the highest level of security and decentralization, as shown below.

Celestia focuses only on ordering transactions and providing transaction data. Celestia does not focus on smart contract execution, but outsources it to rollups as part of its focus on providing extremely low costs. This minimalism allows for maximum performance in a specialized way.

Celestia excels in data availability through Data Availability Sampling (DAS), which is done by light nodes verifying data without downloading the entire block.

Avail is an upcoming data availability layer that leverages KZG commitments, erasure codes, and proofs of validity guaranteed by mathematical DA, as well as light client data availability sampling. Avail is also building two other products, Nexus and Fusion, which will address cross-chain communication and liquidity, and shared multi-token security.

Other data availability layers are EigenDA, NEAR, and Zero Gravity.

Execution Layer

The execution layer (also known as the virtual machine layer) is the part of the modular blockchain stack that specializes in processing and executing smart contracts and transactions.

The most notable virtual machine is the EVM, which is the virtual machine that powers Ethereum execution. You can create any type of smart contract or program using the EVM, which was the huge innovation breakthrough that Ethereum ushered in in 2016.

As an Ethereum evangelist, I must say it is hard to have a negative view on the EVM. It dominates the virtual machine space and has become the backbone of countless decentralized applications, and for good reason. It has the best crypto development tools and infrastructure to date.

You can create any type of smart contract and program using the EVM, which has inspired the narrative of "programmable money".

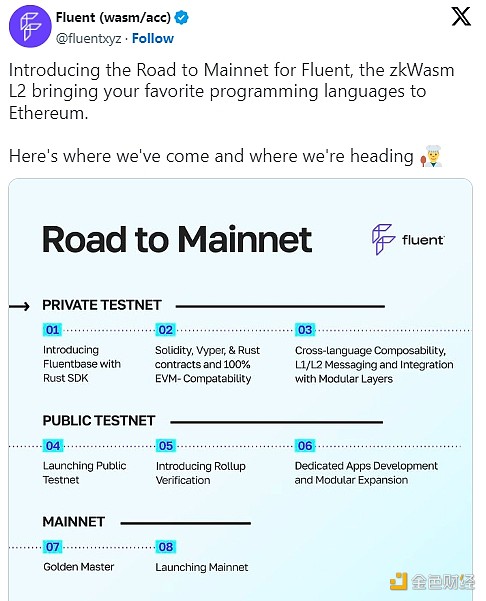

However, I believe that 2024-2025 is the year of the new type of execution layer, known in the modular space as the "altVM" or "next generation VM". High-performance, secure, parallel execution environments will eventually become the standard as Rollups and applications are designed to reduce congestion and run in high-throughput environments.

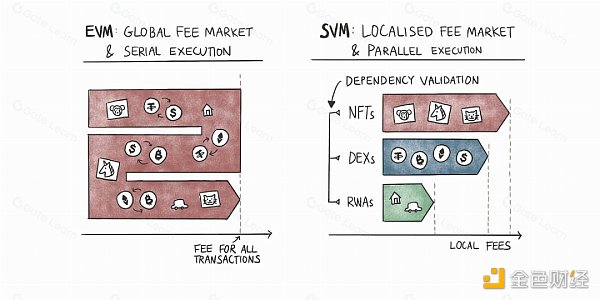

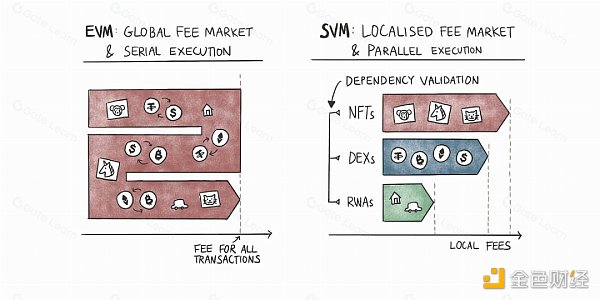

The idea is not to abandon Ethereum, but to embrace diversity and explore new possibilities for user experience and continuous experimentation. One of the altVM’s biggest innovations is the idea of parallel execution, also known as a local fee market.

At any given time on Ethereum, there are a variety of different types of transactions happening simultaneously. People are swapping, buying and selling NFTs, liquidity mining, and doing a ton of other on-chain operations while paying for block space.

There is a global fee market and serial execution within the EVM. This means that all transactions pay a single gas fee, regardless of the transaction type or what blockchain “state” that transaction involves.

Remember the BAYC mint? The gas fee for a single swap was over $2,000.

This is where parallelization comes in. By separating the "state" affected by specific types of transactions, you can have many users running on different applications without seeing massive gas spikes on the chain.

Currently notable execution environments are:

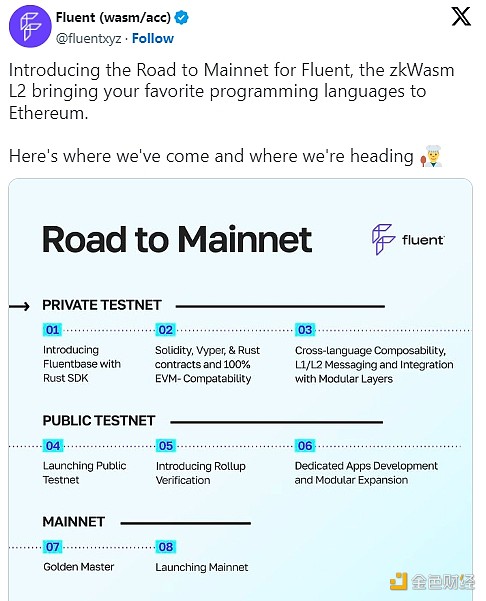

Web Assembly (Wasm) from Fluent Labs

MoveVM from Movement Labs and Lumio

LinuxVM from Cartesi

FuelVM from Fuel Lab

CairoVM from StarkWare

SolanaVM (SVM) from Eclipse

zkVM from RiscZero

These teams are building Rollups using altVM to improve throughput and security at the execution layer. While Q1 2024 is centered around the emergence of data availability, I believe H2 2024 will be dominated by next-generation VM Rollups and parallel EVMs.

Protocol Layer

I see Ethereum as the primary settlement layer for the modular stack. Ethereum is home to dozens of Rollups that rely on the native security properties of Ethereum’s validator set to ensure economic security.

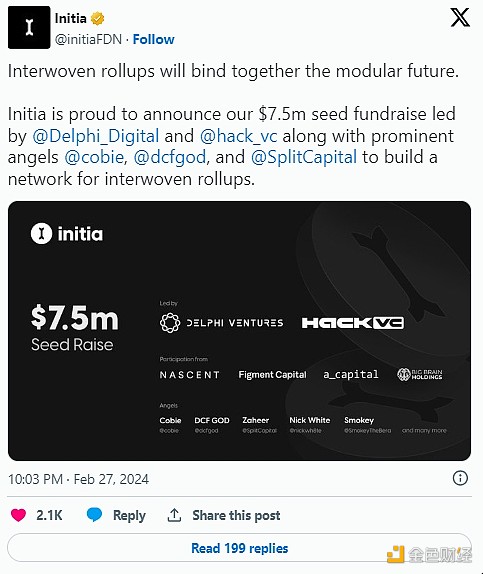

Many of the Rollups mentioned above in the execution section will use Ethereum. However, what is particularly interesting is that we are currently seeing many traditional “monolithic” chains moving towards scaling in a more modular way. Avalanche has subnets. There is discussion about Solana needing to scale via Rollups. Dymension and Initia are their own L1s with Rollups built on top of them.

The settlement layer has been one of the least talked about parts of the modular stack, and for now it looks like Ethereum will continue to dominate as the best settlement layer for Rollups.

However, in the near future I think we will also see sovereign Rollups land directly on Celestia, while other alternative L1s will launch their own Rollup frameworks to fight the gravitational pull of trying to scale single state machines in a decentralized way.

Interoperability is a must

Modular blockchain stack toolkits make it easier than ever to launch and customize blockchains. Notably, Rollup-as-a-Service (RaaS) providers such as Gelato, Caldera, Conduit, and AltLayer, and Rollup frameworks such as Initia and Dymension are facilitating 5-minute Rollup deployments through no-code interfaces.

This has led to an explosion in the launch of new modular chains. However, all of these new chains come with the ultimate tradeoff of fragmentation. Fragmented liquidity leads to more severe slippage on bridges and trades. A fragmented user experience across multiple chains with different wallets, DEXs, and bridges can be overwhelming.

So, how do we unify liquidity and user experience? If blockchains are so easy to launch, shouldn’t it be just as easy to connect them?

Traditional interoperability providers need to be manually deployed on chains one by one and need chains to lobby for them to deploy. This is a huge bottleneck for new chains and hinders their growth.

There are multiple interoperability protocols leading the continued expansion of chains, such as Hyperlane building a permissionless interoperability framework. Union Build focuses on zk-light client interoperability, Omni Network and its open liquidity network standard, Mitosis and its liquidity protocol, and Catalyst and its AMM.

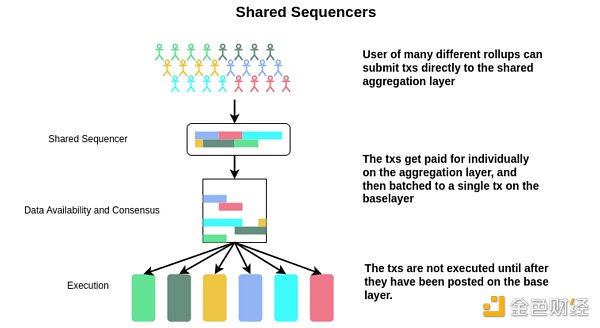

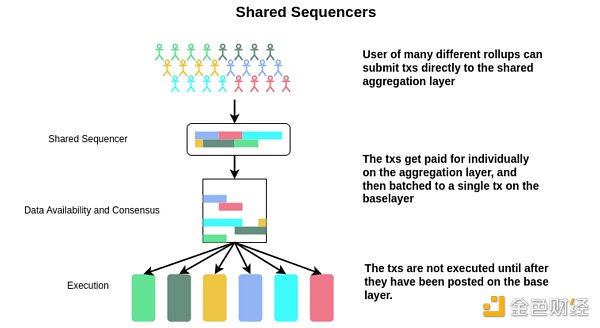

Another interesting area of interoperability is shared ordering, which was recently proposed by Ethereum Foundation researcher Justin Drake.

This is a mechanism to connect Rollups through a shared sequencer for atomic execution. These solutions are currently being tested in production, and I expect leaders in this field to launch this year. Modular interoperability completes the modular stack and unifies the modular ecosystem in a world of over 10,000 Rollups.

The Modular Endgame

In short, modularity is about building a system that is greater than the sum of its parts.

Those who believe in a modular future believe in an alternative future. We believe that providing a more adaptable, less restrictive developer experience will attract more non-crypto native developers and lead to innovation. We also believe in sovereignty. We believe that applications should not have to compete with each other for block space. Applications moving to their own chains will lead to better user experience and greater flexibility for developers.

The days of insufficient block space are coming to an abrupt end. We are in the early stages of a multi-year, massive shift in the way builders operate and build applications on-chain. As we begin to scale modularly, we will continue to see unparalleled innovation and experimentation that will ultimately benefit participants of these networks in ways beyond imagination.

We will soon see a world with 100,000+ chains, a world with many applications on their own sovereign chains, a world with accelerated developer onboarding, and a world with better on-chain user experiences.

I believe this will bring the industry closer to true adoption. I envision a future where users interact with applications in a simplified way, much like how you use the internet everyday. These applications will be their own modular chains, each using a specific part of the modular stack discussed today.

We can't scale our blockspace with more single state machines. We have to modularize and work together.

JinseFinance

JinseFinance