Golden Web3.0 Daily | The total value locked in DeFi exceeds 80 billion US dollars

Golden Finance launches "Golden Web3.0 Daily" to provide you with the latest and fastest game, DeFi, DAO, NFT and Metaverse industry news.

JinseFinance

JinseFinance

Author: Mike@Foresight Ventures

You may find that assets drive the wild growth of Web3, which is filled with various asset standards for users to trade. It can even be said that currently Most Web3 applications are based on them.

The most common one is the token standard.

For example, take ERC-20. You can use ERC-20 to issue various coins. These coins can have various narratives and functions, such as equity, bond, and toy. Defi, DAO governance and more. You can also trade these tokens following the AMM curve to complete speculation.

Or ERC-721, you can use this standard to issue NFT. What carries the value of NFT is what everyone calls consensus, speculation, and untapped utility.

For example, in friend.tech, each user is a Ponzi plate based on a key, trading according to the bonding curve. Including the recently popular ordinals ecology, BRC-20 and various inscriptions, as well as the Web3 game engine used to publish various gold mining games... On the surface, it provides new functions, but in essence it is a new asset standard with different carriers .

Just like a person designs a casino game, he makes the rules. He can open his own casino, and others can open their own casinos by accepting his rules. He can use these rules as Provided to other casinos for free as public goods, such as ERC-20 and ERC-721 standards. Rake can also be carried out, for example, Opensea extracts various series of NFT transaction fees, or Uniswap charges protocol fees for transactions and liquidity pools.

We don't trust people, we trust code

The advantage of Web3 over Web2 is that once the model is conceived, the permissionless nature of the blockchain allows the model to be quickly implemented It is deployed into the market in the form of smart contracts, and the effectiveness of the model is verified by market feedback. At the same time, the transparency of smart contracts allows participants to identify risks on their own. Issuing assets is often a simple pump and dump, but sometimes it is also a way to quickly get the product running, starting, expanding, foaming, and converging. The length of this cycle can be greatly shortened. Many project parties relied on disk control and attractive models to quickly complete the cold start, attracting a large number of users and liquidity, and at the same time building infrastructure and networks with their help. Filecoin and Polkadot are classic examples.

Degens are like crows, smart and greedy, attracted by assets, feed on assets, and fight over assets. The Web3 world is like a banquet prepared for crows. The items in it are like plates of dishes, composed of various ingredients. Smart and strong crows can feast, while slow and weak crows will compete for food. You may be defeated and starve, or you may eat poisonous dishes (such as rug pull) and fall into dangerous situations. Project parties play the role of chefs and manipulate the crows to achieve their own goals through asset standard production projects.

We humans are not born with facts and Rather than understanding the world through numbers, we understand the world through narrative

Narrative refers to stories and information conveyed through language, writing, visuals, or other forms. It is an expression used to describe an event, experience, or concept that is intended to convey a specific message, perspective, or value to an audience. BTC is a very attractive narrative: decentralized digital gold, an alternative method of payment and transfer, financial inclusion, and a tool to rebel against the system. BTC has the potential to change the modern financial system, and the breadth and depth of this narrative’s impact is huge. AI, BTC ecology, modularity, etc. are currently popular narratives in Web3. While we are looking for opportunities in these popular narratives, we are also looking for non-consensus narratives. Non-consensus Alpha is often greater than consensus.

Narrative is the carrier of assets, just like a pot, which determines the upper limit of value. As long as the logic cannot be falsified, a sexy enough narrative can theoretically make the market cake bigger. Just like going to a temple to buy incense, or asking a shaman to do something to bring good luck, people will pay for some unproven vision. It is not only the way for a project to communicate its vision, values and goals, but also an important means to attract and maintain the interest of the community, investors and users. The following discusses the importance of narrative in building assets from several dimensions:

Emotional drive: In the capital market, the emotions of participants are a Key factor. An engaging narrative can inspire excitement, confidence, or fear, thereby influencing participant behavior.

The appeal of stories: Human beings are naturally attracted to stories. A good narrative can make complex concepts more understandable and engaging, which is especially important for engaging participants.

Simplify complexity: Web3 gameplay and strategies are often complex and difficult to understand. An effective narrative can simplify complex information into an easy-to-understand story, helping participants quickly grasp key information.

Enhanced communication: A compelling story is more likely to be remembered and spread. In the age of social media and the Internet, the speed and scope of a story’s spread can greatly affect a fund’s popularity and appeal.

Trust building: Through narrative, the fund plate can build a sense of trust. Historical data, success stories, or the leader’s vision included in the story can increase participants’ sense of trust.

Brand Identity: Stories help the fund build a unique brand identity. This not only attracts players but also helps to stand out in a highly competitive market.

Market dynamics: The market is not only driven by data and facts, but also affected by expectations and forecasts. A strong narrative can shape market expectations, which in turn affects capital flows and prices.

Self-fulfilling prophecies: In some cases, strong narratives can even lead to self-fulfilling prophecies, where the market acts because it believes in a narrative, thereby making that narrative come true.

Standing on the wind, even pigs can fly

With a large enough flame, mature and delicious dishes can be cooked quickly. If the flame is too small, the dishes may be raw, or the banquet will break up before the dishes are cooked.

Narrative and market need to match time and space. The key to choosing a market is to meet the needs of existing potential participants. How many people are willing to participate, who are the participants, how much money is there, how the product meets their needs, and their participating behaviors can in turn contribute to the project. What to bring.

Product-Market Fit is the key to the success of the project. It not only determines whether the product can survive in the market, but also is the basis for sustainable growth and development:

Requirement confirmation: Product- Market Fit ensures that your product or service meets an actual need in the market. If the product does not match market demand, then the product itself may fail, even if it is of high quality.

User retention and word-of-mouth: When a product closely matches market demand, user satisfaction is higher and word-of-mouth is more likely to occur. Satisfied users are the best marketers.

More effective marketing: Having product-market fit can make marketing campaigns more effective because you will target those consumers who are most likely to benefit from your product.

The foundation for growth and expansion: Product-Market Fit is the foundation for sustainable growth. Only when the product adapts to the market can the project party effectively expand and grow.

Resource optimization: Understanding market demand can help companies better allocate resources and avoid wasting time and money on functions that do not meet market demand.

Competitive advantage: In a highly competitive market, products that accurately meet consumer needs are more likely to gain a competitive advantage.

Risk reduction: Understanding and meeting market needs reduces the risk of business failure. Product-market fit means that the product is accepted by the market, which reduces the uncertainty of launching a new product in the market.

Attracting investment: For startups seeking funding, being able to demonstrate that they have achieved or are approaching product-market fit will greatly increase the likelihood of attracting investors.

In the Web3 field, an example that shows good product market fit (PMF) is the well-known Uniswap:

Solving the need for decentralized transactions: Uniswap solves the need for decentralized transactions by creating a decentralized A centralized trading platform that allows users to exchange cryptocurrencies directly between each other without the need for traditional intermediaries such as banks or exchanges, and can also issue assets without permission.

Simplify the trading process: Uniswap uses a model called an Automated Market Maker (AMM) to simplify the trading process. Instead of matching transactions to a specific buyer or seller, users interact directly with smart contracts, increasing efficiency.

Provide liquidity incentives: Uniswap encourages users to lock their assets on the platform to provide liquidity and is rewarded through a share of transaction fees. This mechanism attracts a large number of liquidity providers to provide liquidity for newly issued tokens.

Trustless environment: Because it is based on the blockchain, Uniswap allows users to conduct transactions without having to trust each other or third-party intermediaries, reducing transaction risks.

Promotes the development of the DeFi ecosystem: The emergence of Uniswap promotes the development of the entire decentralized financial ecosystem and provides a foundation for the development of other DeFi projects and services.

Okay, there is a pot and fire, it’s time to put in our Ingredients.

The Seven Deadly Sins are a group of sins considered particularly serious in the Christian tradition. They originated from early Christian thinking and teachings on human behavior. The concept of the Seven Deadly Sins was first developed by early Christian thinkers, particularly the 4th-century monk Evagrius of Pontus of Egypt. He listed eight major human sins, known as the "Eight Evil Thoughts." In the 6th century, Pope Gregory I revised and streamlined this list, reducing it to seven, forming what is now known as the "Seven Deadly Sins." The seven deadly sins currently identified include pride, envy, wrath, sloth, greed, gluttony, and lust. These crimes are considered to be the roots of other sins. The Seven Deadly Sins occupy an important place in Christian moral and spiritual teaching and are used to teach believers to identify and avoid these sins in order to promote the health and salvation of the soul.

Avoid? No, we want to exploit people's desires. The wealth code is clearly written in the ancient files. The essence of business is to discover or create needs and satisfy them. Needs are hidden behind desires. Often a good business will eventually lead to two results, or two results exist at the same time: amplifying or satisfying users' desires.

Narrative and market trends may change over time, but people have experienced countless cycles over thousands of years of civilizational evolution and technological progress, but their desires remain the same. Smart people can often manipulate groups through the laws of human nature, meet the needs of the group, and incorporate them into part of their own systems to achieve their own goals. The following lists some mechanisms (business models) and examples that can make crows flock to you. Regardless of Web2 or Web3, they can all play the role of ingredients that stimulate the crows' appetite. However, under the license-free conditions of Web3, their composability and deployment efficiency have been improved, opening up more possibilities.

The existence of trading means that it is speculative. There is the possibility of buying low and selling high. Uncertainty and high return potential together constitute the vision of getting rich quickly. , attracting people to pursue instant and huge wealth growth. Liquidity and volatility are particularly important in trading. In a casino, every change of chips means the dealer's rake. A large part of the reason why tokens have better fundamentals than NFTs is because tokens have better liquidity. Tokens can be divided into countless parts, and everyone can participate, regardless of the amount of funds, and transactions are more flexible. Most NFTs are traded individually. Even if an NFT can be divided into many parts through fragmentation, the total value only corresponds to one value. The transaction threshold is higher and the flexibility is lower. Volatility means the possibility of high profits, providing people with a sense of excitement and instant gratification.

Successful trading brings not only financial returns, but also the psychological satisfaction of victory and achievement. Even if there is actually more luck involved, successful trading is often seen as a reflection of intelligence, analytical and predictive abilities.

Keywords: greed, arrogance

Obtaining endorsements from leading investment institutions or KOLs can also stimulate followers’ desire to participate, but the opposite is true , these investment institutions or KOL can also use their authority and influence to cut their own leeks, DYOR:

1. Trust and credibility

Brand trust: Large institutions often have a strong reputation and brand awareness, which adds trust and credibility to their recommendations or endorsements.

Professional recognition: Large institutions are regarded as experts and authorities in the market, and their decisions are generally considered to be well thought out and based on sufficient information.

2. Sense of security and risk reduction

Reduced perceived risk: Followers tend to believe that if a project or asset is supported by a large institution, then The risk of investing in this project or asset may be low.

Follow the Professionals: Followers tend to imitate the behavior of investors they believe are more knowledgeable and experienced.

3. Social proof and herd mentality

Social proof: The investment decisions of large institutions are regarded as a kind of social proof, that is, “if these professional and Successful institutions are investing, so this must be a good opportunity.”

Group dynamics: Human beings have a natural tendency to follow the herd, especially when faced with complex decisions, and tend to follow the group's choice.

4. Market influence

Market leadership: The investment behavior of large institutions often has a market leadership role and can affect the overall trend of a certain field or asset. .

Demonstration effect: The decisions of these institutions may trigger a demonstration effect, attracting more investors to follow.

Keywords: Lazy

Control refers to the act of manipulating the price and trading volume of assets through a series of means and strategies. In terms of news, pulling up the market, smashing the market, making market decisions, and convincing people with increases are all about controlling the market. Here are a few key reasons why market control attracts participants:

1. The lure of quick profits

The promise of high returns: Control activities are often accompanied by asset The rapid rise in prices has given retail investors the illusion of quick and high returns.

Greed: Human beings have a natural tendency to pursue increased wealth, especially when it appears that it can be obtained easily.

2. Fear of missing out (FOMO)

Following the trend: Retail investors are often afraid when they see others seem to have made huge profits in a short period of time. Missed similar opportunities.

Social proof: The investment behavior of others is regarded as a kind of "proof", implying that the investment decision is correct.

3. Market sentiment and crowd behavior

Market mania: During market manias or bubbles, retail investors tend to be attracted by the general optimism.

Herd mentality: People tend to imitate the behavior of most people around them, especially in situations of information asymmetry.

One of the most common examples is the well-known pump and dump

Pump (hype):

Creating phenomena: Investors or groups use various means (news, statements, social media, community orders) to artificially speculate on assets (usually with low liquidity), creating the illusion that the asset is about to rise, or making early participants rich through pull offers. , create a wealth effect and attract people who have not entered the market.

Raise the price: This hype attracts the attention and interest of other investors, causing them to purchase the asset. As demand increases, asset prices rise.

Dump:

High selling: When the price of an asset reaches a relatively high level, the investors or groups who initially speculated sell it at a high price. out of their assets.

Price Collapse: As a result of heavy selling, asset prices begin to fall sharply, and later investors face losses, especially those who bought at high prices.

Whether it is to make money by pumping and dumping goods, to gain attention, or to quickly attract participants to provide liquidity or build infrastructure, market control is an effective way to achieve one's own goals through user behavior.

Keywords: greed, arrogance

Incentives are the most direct way to attract users: airdrops, invitation rebates, interest generation, mining rewards and transactions Discounts after reaching the volume threshold are all methods with low risk and obvious returns. All these incentive methods provide obvious value propositions, and users can directly see the potential benefits. Incentive methods increase users' participation in the platform or project. degree, promoting the growth of the platform or project and the expansion of the user base. With the participation of more users, the platform or project itself gains added value, further attracting more users. In essence, they are all futures mismatches.

These incentives are often closely related to user participation, and there may also be some exit penalty mechanisms to establish users' sunk costs and bind users to the project.

Tip: The immediate and short-term incentives are highly addictive, which is what we know as nipple fun.

1. Airdrop

Low risk: Users usually do not need to invest funds or only need to hold specific assets to have the opportunity to obtain free tokens or assets. .

Direct rewards: Airdrops provide direct financial incentives, and users can receive valuable tokens immediately.

2. Invitation rebates

Network effect: By inviting new users, existing users can get certain rebates or rewards. This model takes advantage of the network effect, encouraging users to promote products or services.

Win-win situation: Both the inviter and the invitee often benefit, creating a win-win dynamic.

3. Interest earning

Passive income: By staking or investing in specific assets, users can earn passive income, such as interest or other forms of returns.

Relatively low risk: Earning income through interest earning is generally considered a lower risk strategy compared to trading the market directly.

4. Discount after the transaction volume threshold

Encourage active transactions: Provide discounts when the user’s transaction volume reaches a certain threshold to encourage users to trade more frequently trade.

Increase user stickiness: Discounts attract users to continue trading on the same platform, enhancing user loyalty of the platform.

5. Mining rewards

Accelerate construction: Whether it is liquidity mining or node mining, the incentives of tokens will attract people to participate. Come and accelerate the construction of liquidity and node network.

Value binding: Mining activities often have staking and slashing mechanisms to bind the interests of nodes to the value of the network. The withdrawal or evil behavior of nodes will cause economic losses to the nodes to maintain the stability of the network. Safe operation and stability, Bitcoin’s 51% attack and Optimistic’s fraud proof are all good examples: if a node wants to do evil, its costs are often far greater than the benefits.

The recent Blast airdrop directly attracted a large amount of liquidity, obtaining more than 800 million liquidity in just a few weeks. The logic is very simple and crude, which is to put money in the faces of participants. Smash it, and invite points at the same time with the network effect spawned by the Ponzi flywheel. Although cross-chaining with L1 will increase risk exposure, participants are concerned about whether this model can make them profitable. These security issues are reduced in the face of large amounts of money, and there is still a steady stream of people coming to participate.

Keywords: Gluttony

Leverage can leverage gambling, which significantly increases the risk and potential of investment. returns, thereby exacerbating psychological and behavioral patterns similar to gambling:

1. Increased potential returns

Magnified gains: Leverage allows investors to use Less money controls a larger investment, so potential profits are magnified accordingly.

Attraction: This amplification effect attracts investors seeking quick, high returns, similar to the pursuit of big wins in gambling.

2. Increased risk

Amplified losses: Leverage not only magnifies gains but also magnifies losses. Small adverse market movements can result in significant financial losses.

Stress and impulsive decision-making: Faced with higher risks, investors may experience more stress and make impulsive, irrational decisions.

3. Psychological impact

Overconfidence: The use of leverage may cause investors to be overconfident and mistakenly believe that they can control market risks.

Chasing losses: After a loss, investors may increase leverage in an attempt to recover their capital quickly.

4. Invisible “bets”

Invisibility of funds: Unlike physical casinos, in crypto markets, the use of funds is digital , intangible, which may cause investors to have insufficient understanding of the actual investment of funds and risks.

5. Accessibility and Convenience

Ease of use: Web3’s many products make it very easy to use leverage, similar to the universal accessibility of gambling sex.

Perpetual contracts’ 100-fold leverage, Rollbit’s thousand-fold leverage, and Rari Capital’s Defi lending Jenga all attract a large number of users through the stimulation of high leverage, which has become an indispensable charm of these projects.

Keywords: Greed

The lottery mechanism is also an amplifier of gambling. It stimulates and utilizes people's strong reaction to random rewards. Like going to a temple to buy incense or people paying for wishes. :

1. Uncertainty and incentives

Incentive effect: The incentive effect brought about by uncertainty is very powerful. The randomness and potential for big prizes in a lottery draw a sense of excitement and anticipation.

Dopamine Release: When participating in a lottery and anticipating a possible win, the human brain releases dopamine, a neurotransmitter associated with feelings of pleasure and reward.

2. Imbalance between risk and reward

The temptation of high returns: Even if the chance of winning is very low, the huge potential returns can attract people to participate. Ignoring actual risks.

Cost underestimation: Participants tend to underestimate the actual cost of small investments over the long term.

3. Chasing losses

Chasing jackpots: Participants may continue to invest in the hope of eventually winning big prizes, which is different from "chasing losses" in gambling Psychological similarity.

Sunk cost fallacy: Long-term players may continue to participate because of the time and money they have invested, hoping to recoup their capital or make a profit.

4. Illusory sense of control

False sense of control: Participants may mistakenly believe that they can improve their chances of winning through certain strategies or intuition.

Pattern recognition tendency: People tend to look for patterns or patterns in random events, even if these patterns do not exist.

Pooltogether is a well-known lottery project of Web3, which allows users to deposit funds into a common prize pool to earn interest. This interest is then used as prize money, distributed through regular draws to randomly selected participants. All users’ principal remains safe and they will not lose their deposits even if they don’t win a bonus. This mechanism combines the safety of savings with the excitement of lottery, providing a risk-free opportunity to win additional income

Keywords: Greed

The logic of Ponzi that we are familiar with is very simple, that is, the investment of latecomers will make up for the profits of early participants, and at the same time it will have a network multiplier effect.

Projects like Olympus DAO and Anchor Protocol are able to attract large numbers of participants, although they have been criticized by some as Ponzi-like models, because they combine innovative financial mechanisms, the promise of high returns, and the General interest in the decentralized finance (DeFi) space. Here are some of the main reasons why these projects are attractive:

1. Promise of high returns

Attractiveness: These projects usually promise to provide returns higher than those in traditional financial markets, which is very important for It is attractive to investors looking for high yields.

Yield Farm: Participants can earn seemingly substantial interest or token rewards through staking, borrowing, or other means.

2. Innovative financial mechanisms

Unique models: These projects usually operate based on unique and complex financial models, such as algorithmic stablecoins, liquidity mining, bonds, etc. The novel concept attracts those interested in financial innovation.

Technical appeal: Interest in blockchain and decentralized financial technology is also an important factor attracting participants.

Keywords: Greed

The crypto world is like a gold mine, with countless gold waiting for people to mine. , but complex mechanisms and operations make the mining process difficult.

Human nature is lazy, which gave birth to shovels. There are various kinds of shovels on the market, including wooden shovels, iron shovels, stainless steel shovels, and excavators. Efficiency, cost, and application scenarios are all different. What users want is nothing more than to use the least cost: to maximize returns at a certain risk, or to minimize risks within a certain return expectation. Each shovel is a bet, and the shovel itself can make profit through a commission or profit share from the bet. There are two agency methods. One is to provide various betting strategies for users to choose according to their own preferences, such as copy trading and liquidity mining pool aggregators. The other is to directly help users directly host resources.

For example, Clore.ai, which has become quite popular recently, has a mechanism that is very convenient for miners. It helps miners find the mines with the highest yields on the network to mine if they have specific computing power service needs. When the time comes, the tasks assigned by the network are completed; if there is no demand for computing power services, the network finds the cryptocurrency with the highest mining yield at that time and participates in mining. In this way, GPU miners can directly throw the mining machine into the network and automatically maximize their profits.

Various trading robots, ERC-4337, intent-centered applications, and AI agents are all such shovels. They help users avoid complicated steps and achieve their goals as quickly and cost-effectively as possible. This is the key to enhancing user experience (UX).

Compared with giving you a mine directly, compared with giving you a mine and then giving you a shovel, helping you set up sales channels, and then setting up a fully automatic assembly line, which one would you choose?

Keywords: laziness

Although arbitrage sounds like a speculator's game, the arbitrage mechanism exists In fact, sometimes it is a way to ensure the health of the system. Arbitrage of the same assets in different trading markets can stabilize asset prices between each market, and the cost of user purchases will be closer to the actual market. price, thus reducing the user's risk. Or if the project wants to anchor a certain asset, setting up spread arbitrage is a good way. Take the calculation stability of perpetual contracts and Luna/UST as an example:

Perpetual contracts

When the price of the perpetual contract is higher than the spot price (that is, when the contract is overvalued), the long side pays the funding fee to the short side; conversely, the short side pays the long side. Funding rates are usually adjusted at certain intervals (such as every 8 hours). The adjustment of the funding rate reflects the market’s expectations and sentiment for the future price of the asset. Through this payment mechanism, traders are incentivized to trade in a direction that brings the perpetual contract price closer to the spot market price, helping the market self-regulate so that the perpetual contract price does not deviate from the spot price for a long time.

Luna/UST

Basic Concepts

UST: TerraUSD (UST) is an algorithmic stablecoin designed to remain relevant to 1:1 value in US dollars.

Luna: Luna is the native token of the Terra ecosystem and is used to govern and maintain the stablecoin system.

Anchoring Mechanism

Algorithmic adjustment: When the market value of UST deviates from the 1:1 ratio of the US dollar, the system restores balance through an algorithmic adjustment mechanism .

Two-way conversion: Users can freely convert between UST and Luna at a fixed value of $1.

Price-stable operation

When UST > $1:

Mechanism: Users are incentivized to come with 1 USD worth of Luna Mint UST because UST is worth more than $1 in the market.

Result: This increases the supply of UST, thereby lowering its market price.

When UST <$1:

Mechanism: Users can purchase UST for less than $1 and convert it to Luna at a $1 value.

Result: This reduces the circulation of UST, thereby increasing its market price.

While gaining profits, arbitrageurs have unknowingly become a tool for the project side. While arbitrageurs maximize risk-free profits while gaming the market, they in turn maintain the stability of the market. MEV is Another interesting example from the crypto world.

Keywords: greed

Let users game themselves, go up and down, and let the funds flow naturally The ground swelled.

Commonly known as involution, the establishment of winning and losing, levels and rankings makes people in the same scene compete with each other. People at the top want to keep their positions, and people at the bottom want to kick out people at the top and climb up. , to achieve the purpose of the rule creator invisibly.

Examples abound in Web2. There are many games that have ladder lists or rank rankings. Often, many players will spend crazy money to increase their strength or keep improving their rank in order to be at the top of the ladder. play the game. The krypton gold money flows into the pockets of the game companies unknowingly, and when players compete day and night, they unknowingly contribute loyal activity and game time to the game.

Douyin has a pk reward function. Two bloggers pk within a limited time to see who gets more rewards within this time. The bloggers hope that their number of rewards will exceed The other party will try their best to get their fans to reward, and fans will also hope that their favorite blogger wins. Generally, reward activities will be very frequent before the time limit, and there is no need for Douyin's own promotion. The amount of rewards will be raised by bloggers and fans themselves, and a large part of the rewards will become Douyin's profits.

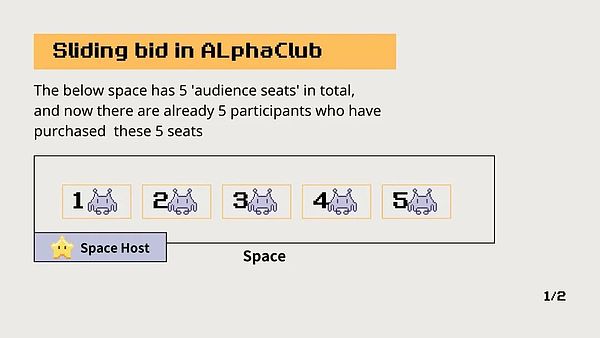

There is a project called Alpha Club, which also uses similar logic:

A successful KOL wanted to share the password of wealth, so he decided to open a space. Information is valuable and space is limited, so space has a price. How is the price determined? Use bonding curve, increasing in sequence.

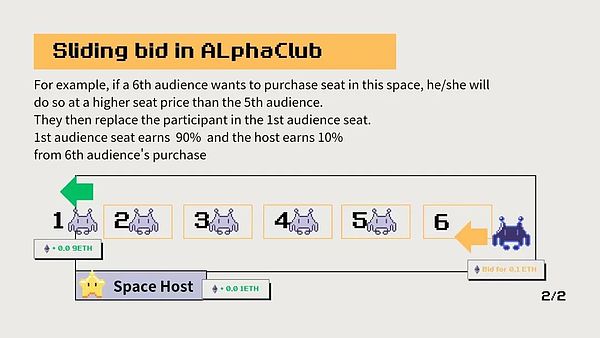

The space is limited, what should I do when the number of people is full? Using sliding bids, the latecomer pays a high price to the first person in the current seat according to the bonding curve, and so on.

The first comer will automatically profit, and the latecomer will continue to increase in value. Everyone has become the market liquidity itself.

Users have two motivations to participate in the auction: one is the need for alpha information and knowledge, and the other is the need for speculation. Serious crypto investors and speculative degens have jointly become participants in market pricing under such a pricing model. Alpha Club's Slogan: You either earn or learn is a true reflection of the first principles of the market.

Keywords: Jealousy

With desire, various ways of playing can be invented, and by combining these modes, And by extending it to different narratives and market scenarios, countless capital market models can be born. When a far-reaching enough narrative, a matching market, and an attractive model reach a state of complementing each other, a delicious dish is born, which does not necessarily require strict matching of supply and demand segments and application scenarios. Please come.

Human nature drives prices, and prices return to value - the game between consumers and speculators, which together constitute the essence of the economic world. In the product mechanism, we may be able to glimpse the truth of games, prices and markets.

In Web3, where chaos and order coexist, you and I are both chefs and crows.

Golden Finance launches "Golden Web3.0 Daily" to provide you with the latest and fastest game, DeFi, DAO, NFT and Metaverse industry news.

JinseFinance

JinseFinanceAfter the Bitcoin ETF craze subsided, investors began to look for the next hot project. Before the Bitcoin halving event triggered market turmoil, many cryptocurrency observers had their eyes on Celestia.

JinseFinance

JinseFinanceBitcoin whales have transferred over $800 million to Coinbase following the SEC's approval of a spot Bitcoin ETF. Notable transactions, totaling 17,291 BTC, raise speculation about potential sell-offs. The price of Bitcoin surged to $47,800 after the ETF approval. While some whales sell, others accumulate Bitcoin at higher prices. Max Keiser acknowledges MicroStrategy's founder, Michael Saylor, for his contributions. The cryptocurrency landscape witnesses significant shifts, prompting attention and scrutiny.

Bernice

BerniceInvestors witness a shift as Bitcoin mining stocks, led by Marathon Digital and Riot Platforms, outperform Bitcoin's growth, marking gains over 800%. Amidst this surge, strategic moves and market predictions underscore the promising trajectory of crypto-related stocks amidst sector challenges.

Joy

JoyThe report differs from the latest redacted version, but BlockFi claims it has always been transparent.

Beincrypto

BeincryptoMore than 800 victims of the collapsed BitConnect crypto Ponzi scheme are set to receive $17 million in restitution, according to the U.S. Department of Justice.

dailyhodl

dailyhodlWhile an ongoing technical divergence between BOND's price and volumes suggests upside exhaustion.

Cointelegraph

CointelegraphThe USTC price rally does not mean it would reclaim its lost U.S. dollar peg in the future.

Cointelegraph

CointelegraphBulls placed too much hope on $32,000 flipping to support, an error that is bound to show by Friday’s $800 million BTC options expiry.

Cointelegraph

CointelegraphWe don't want to let it be. At all costs, we strive to find a technical means to ensure that the village of Yashimura, which has been handed down to us by history, survives into the future. Keep your heart and mind.

Ftftx

Ftftx