What will the DeFi world be like without the liquidity war?

Since the birth of DeFi, the brutal liquidity war has been going on all the time.

We have seen that many DeFi projects pay a lot of costs or release a lot of tokens in order to obtain liquidity. Some projects have succeeded and gained market dominance, such as Uniswap, while some projects will choose to avoid it and establish liquidity advantages on specific categories of assets to gain survival opportunities, such as Curve for stablecoins and Balancer for LSD. Of course, some projects have exhausted all resources and have no way to continue, and return to dust.

Causes of liquidity war

DeFi liquidity is a field that can easily move towards natural monopoly, that is, liquidity will naturally concentrate on the head protocol.

There is a logical chain like this: DeFi products with more liquidity will have higher availability, so users will concentrate on the product, and the concentration of users will bring more fee income to liquidity providers, so they are more likely to stay. On the contrary, if your product has very little liquidity, then the availability of the product will be relatively poor, the number of users will decrease, the income of liquidity providers will be unsustainable, and they will eventually flee.

This is obviously a Matthew effect logic.

Because of this, the competition for liquidity is very cruel. If you cannot obtain a large amount of liquidity in a short period of time, at least gain a liquidity advantage in a certain segment of assets, then your DeFi project will find it difficult to survive.

If newly created DeFi projects want to compete for liquidity, they need to pay a very tragic price. The cost they pay for obtaining liquidity is far greater than their investment in product development and technological innovation. This short-sighted tendency is actually very unfavorable to the innovation and development of the DeFi field.

We can reflect on this, is it really necessary?

From liquidity war to liquidity sharing

We advocate a new path, namely cross-protocol liquidity sharing. Decentralized finance should be open, which is why it was once called Open Finance in addition to the name DeFi. We believe that cross-protocol liquidity sharing is a matter of course, and an ecosystem should build a unified protocol standard that supports cross-protocol liquidity calls from the beginning.

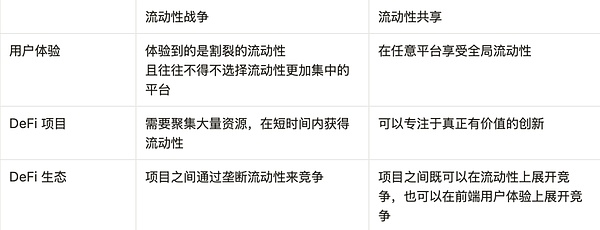

First of all, when liquidity can be shared, DeFi projects do not need to compete for liquidity in order to improve product usability. Even for products with less liquidity, users can enjoy global liquidity on them, and their user experience will not be affected. But the competition for liquidity has not actually disappeared, because projects with more liquidity can still capture more fees. Therefore, we can believe that liquidity sharing actually transforms the brutal liquidity war into a benign liquidity competition.

Secondly, when liquidity can be shared, newly created DeFi projects can survive with only less liquidity. It does not need to spend huge costs to obtain a large amount of liquidity in a short period of time. Then the project can use the funds and team's strength for truly valuable innovations, such as improving capital efficiency and improving matching mechanisms.

Third, when liquidity is shared, it means that liquidity and product front-ends are actually decoupled, which will bring diversified choices in business models to projects. Let's take DEX as an example to illustrate that when users trade on the DEX platform, the income paid to the platform actually includes two parts, namely, front-end usage fees and liquidity usage fees. Among them, the front-end usage fee belongs entirely to the platform, while most of the liquidity usage fee will go to LP, and a small part will go to the platform. In other words, we can understand the income of the DEX platform as having two parts, namely, front-end usage fees and liquidity usage fee commissions. If decoupling is not possible, users can only use the liquidity of the project's front-end. Under the premise of liquidity sharing, users can enjoy global liquidity regardless of which front-end they use. This gives users the freedom to choose the front end, and also gives project parties two choices in business models:

Platforms with traffic, or developers who have the ability to develop a smooth front end experience, can focus on developing the front end and use the front end usage fee as the main income. This looks a bit like the business model of an aggregator, but in the absence of a unified liquidity sharing standard, the aggregator needs to develop a very complex routing protocol, and its core competitiveness is still not the front end, but the intelligence of the routing protocol.

Platforms with LP resources and the ability to aggregate more funds can choose to mainly earn commissions from liquidity usage fees. There is no need to invest too many resources in front-end experience optimization. LPs with financial strength and development capabilities can even choose to build their own liquidity platform, without being charged commissions by anyone, and without having to entrust their funds to any protocol.

LPs with strategy management capabilities can even customize market-making strategies based on their own liquidity platforms, without being restricted by a unified platform.

FusionFi Protocol

Ending the liquidity war and achieving liquidity integration is exactly what the FusionFi Protocol (FFP) that the AO ecosystem is promoting is doing. Through FFP, AO is trying to build a healthier DeFi ecosystem.

So how does FFP achieve liquidity integration?

The core of all financial businesses is actually the circulation and processing of bills. FFP defines a unified bill data structure. This data structure can express spot orders, options, futures and other contract orders, as well as loan orders, so FFP can support a variety of financial transaction scenarios.

Take DEX as an example, anyone can create a spot order ticket, including AMM (when a user initiates a transaction request, AMM can also create a temporary limit order). These tickets will enter a ticket pool, which anyone can see, and extract the tickets that can be matched from the ticket pool and submit them to the settlement process (Settlement Process) for settlement. After the settlement is completed, the status of the ticket changes, and the two parties to the transaction each obtain their own rights and interests.

The settlement behavior is atomic. If the settlement fails, the status of the ticket will not change, and the two parties to the transaction will not have any actual exchange of rights and interests.

This settlement model is very efficient. It can settle a single ticket or multiple tickets together. It can be submitted by the trader himself or by anyone. This brings some superpowers to DEX, such as multi-hop trading and zero-principal arbitrage.

Multi-hop trading means that when a user wants to exchange asset A for asset C, but there is no direct liquidity, the transaction can be completed by exchanging asset A for asset B first, and then for asset C.

Principal-free arbitrage means that arbitrageurs find orders with interest rate spreads in the bill pool and submit them to the settlement center for settlement to obtain the interest rate spread.

Multi-hop trading and principal-free arbitrage are essentially joint settlements of multiple bills.

Image source:

https://x.com/Permaswap/status/1854212032511512992

Through FFP SDK, developers can implement most DeFi protocols with low code. Just as Cosmos SDK greatly reduces the time required for developers to create blockchains, FFP SDK significantly reduces the time required for AO developers to create DeFi protocols.

Summary

The natural monopoly effect of liquidity has led to an extremely fierce liquidity war between DeFi protocols, which has not only led to the dispersion of liquidity and damaged the user experience, but also caused new protocols to invest excessive resources in the competition for liquidity and fail to focus on truly meaningful innovation.

In order to break this situation and accelerate the development of ecological DeFi, AO introduced FFP, a unified protocol for cross-project shared liquidity, at the beginning of the development of the ecosystem, which not only improved the overall liquidity efficiency of the entire ecosystem, but also liberated the creativity of developers. Driven by FFP and FFP SDK, DeFi on the AO ecosystem is expected to emerge faster and form a healthier financial ecosystem.

Others

Others

Others

Others Others

Others decrypt

decrypt Others

Others Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph