Author: Greg Cipolaro, NYDIG Global Research Director; Compiled by: WEEX Weike Research InstituteAbstract

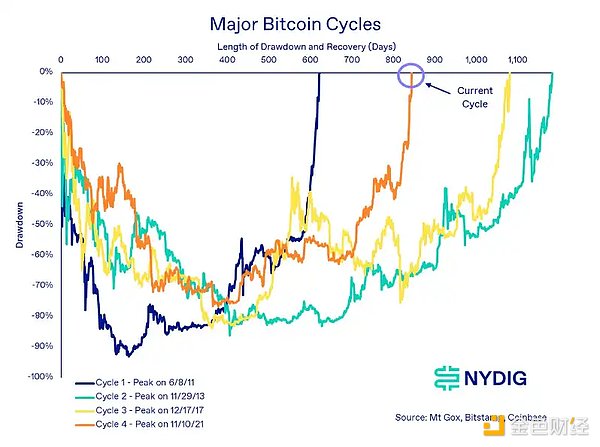

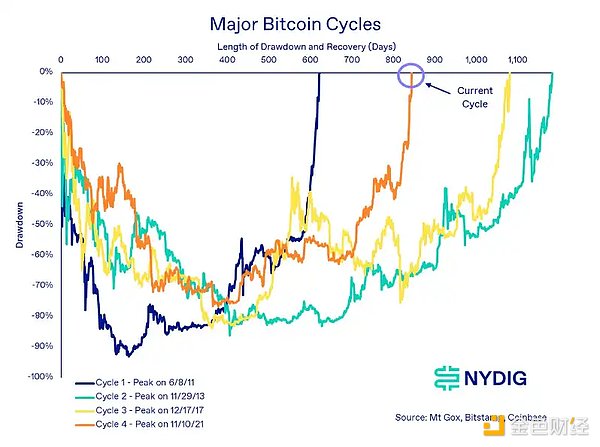

Bitcoin surges to new highs, driven by ETF inflows. Let’s compare it with previous cycles to see how “early” the recovery from the retracement came this time. And an observation of the underlying blockchain data shows that we are still in the early stages of the entire cycle.

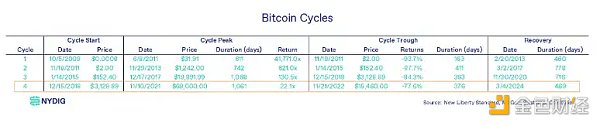

Last Tuesday, Bitcoin once again reached the $69,000 mark after 28 months, recovering from the decline that began at the previous peak in November 2021. , and then continued to refresh historical records. The recovery from the decline and into new highs came against the backdrop of strong U.S. demand for cash ETFs, which attracted $8.9 billion in net inflows in less than 2 months of trading.

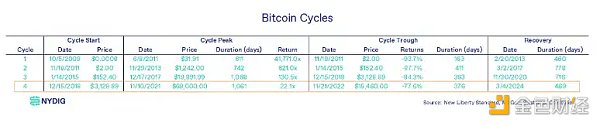

Compared to previous Bitcoin cycles, this recovery is much earlier than the previous two cycles. The recovery in this cycle comes 469 days after Bitcoin hit a low of $15,460 on November 21, 2022 (after the FTX crash), while the previous two cycles took 778 days and 716 days respectively to recover from the price bottom. (WEEX Note: The first cycle can be ignored because Bitcoin did not have a stable price until more than a year after its birth.)

In other words, the first two cycles bottomed out at about the same time as the current cycle, but the current cycle has picked up much faster. Considering the asset class is currently worth around $1.2 trillion, that's truly impressive compared to the recovery's progress from its 2013 peak of just $20.5 billion.

As we celebrate new all-time highs, we want to take a deep dive into the underlying blockchain and understand what it reveals about the network and its usage, without thinking about price impact. While markets and trading activity are often the focus of discussion, especially when hitting new highs, it’s important to focus on what blockchain data reveals about the current cycle.

Ownership

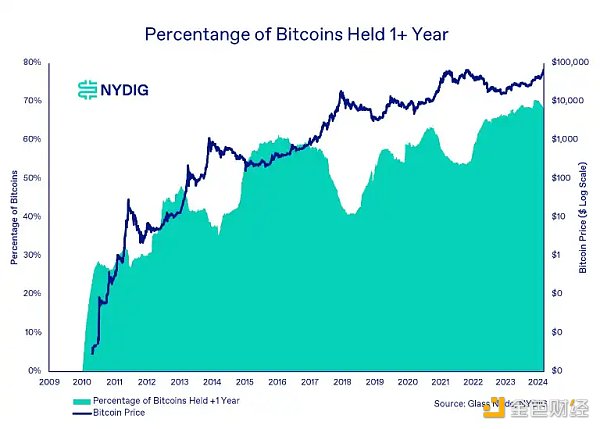

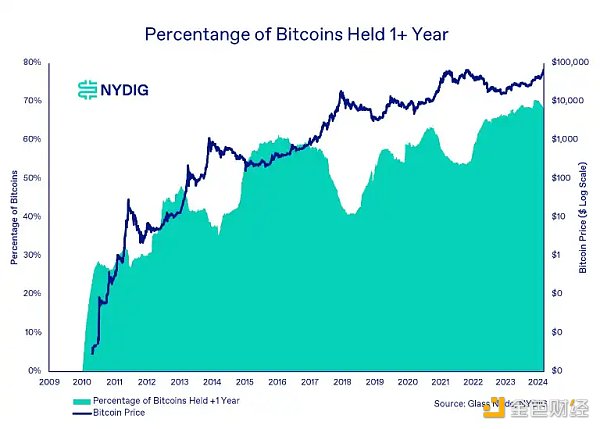

Long-term holders have not yet handed over their chips

Historically, the percentage of coins that haven’t moved in a year has tended to move inversely with Bitcoin’s price trend. Usually as the price of a currency rises, long-term holders sell their coins. However, this expected behavior has yet to materialize, suggesting that long-term holders are currently maintaining their positions.

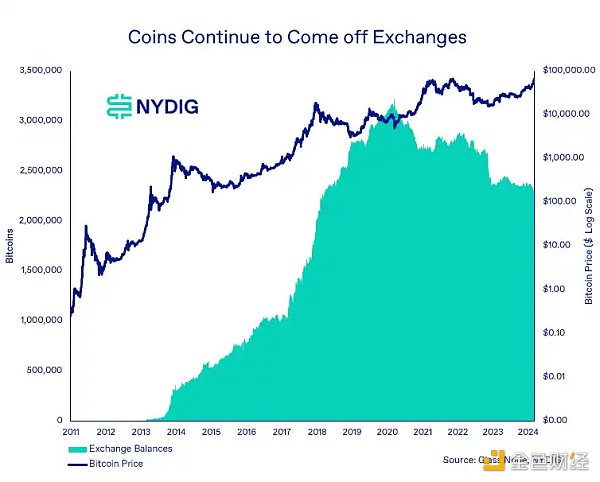

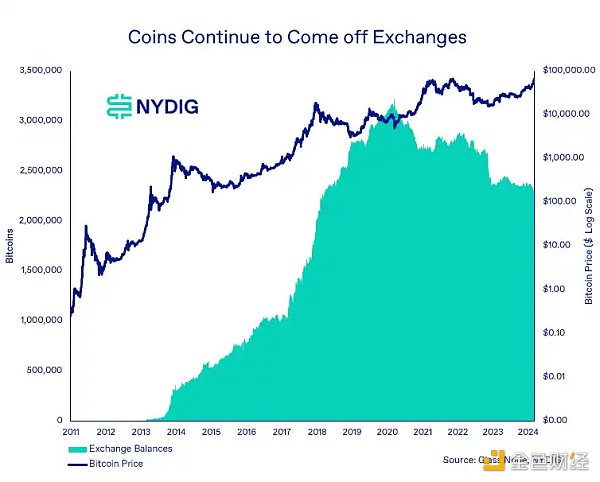

CEX balance continues to decrease

The balance leaving CEX is the main narrative of the last cycle One, and with no sign of changing, investors continue to buy Bitcoin on exchanges and then withdraw it to custodians and self-hosted wallets. Given the disastrous counterparty and platform risks of 2022, continued outflows of investor deposits from exchanges is a good thing in the long run.

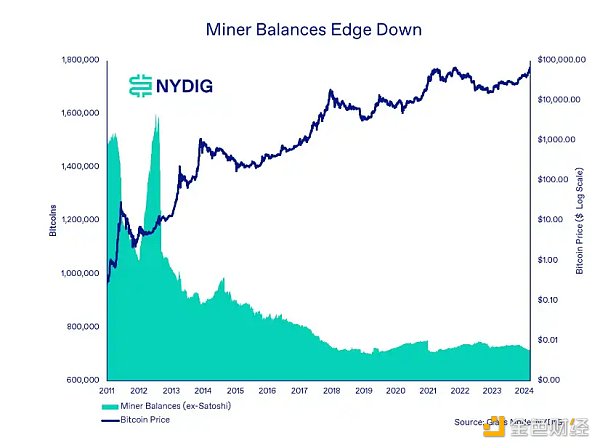

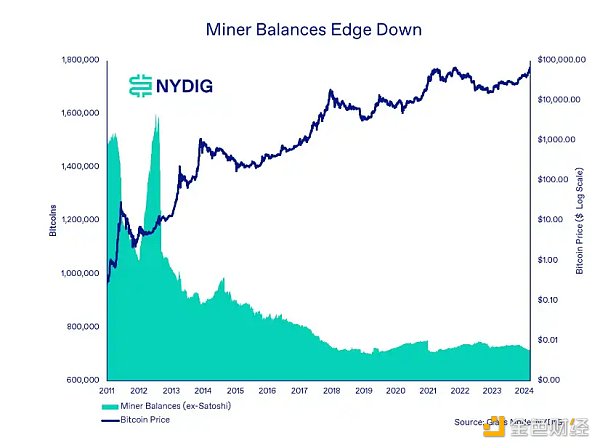

Miners' currency balances have declined slightly

Although the trend is not as obvious as exchange balances, miners' balances have declined slightly recently. This could be related to price increases, capital requirements, or equipment upgrades ahead of the halving in April.

Network usage

User scale represents an indicator that continues to grow

As a proxy for the size of the network, the number of addresses holding non-zero balances recently exceeded 50 million. This indicator has peaked and corrected at the peak of the past two bull markets and is an important indicator of network size and valuation under Metcalfe’s Law. (WEEX Note: Metcalfe's law is an indicator used to describe the relationship between the value of a network and its number of users. The basic point is that the value of a network is proportional to the square of its number of users, because for every additional user in the network, Not only will the user himself gain value from the network, he will also increase the value of the entire network through interactions with other users.)

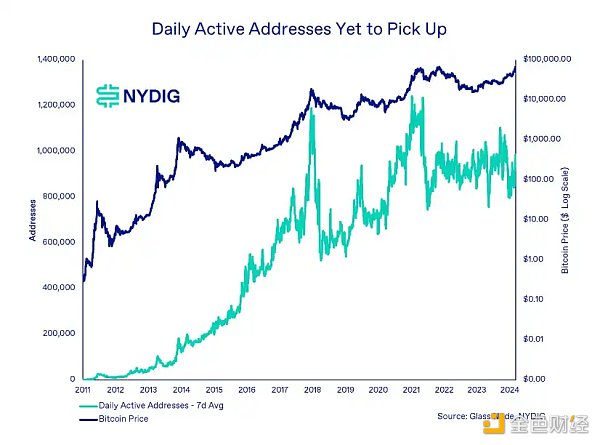

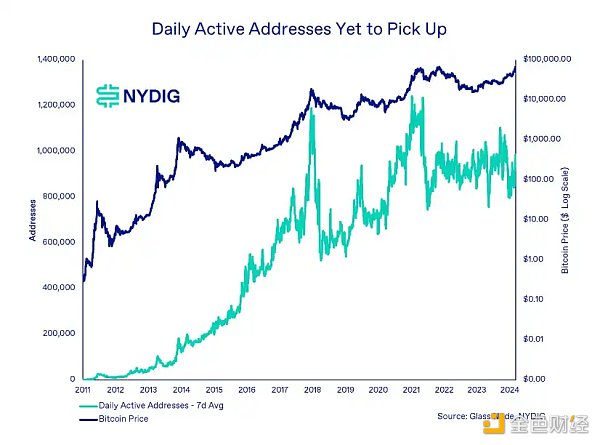

The number of daily interactive independent addresses has not increased significantly

The number of unique addresses interacting on the network every day has not yet increased significantly. This is a positive sign for the current cycle, as this indicator also peaked near the peaks of the previous two bull cycles.

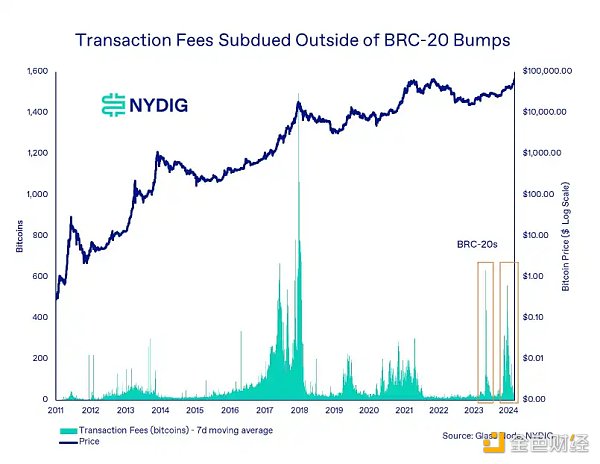

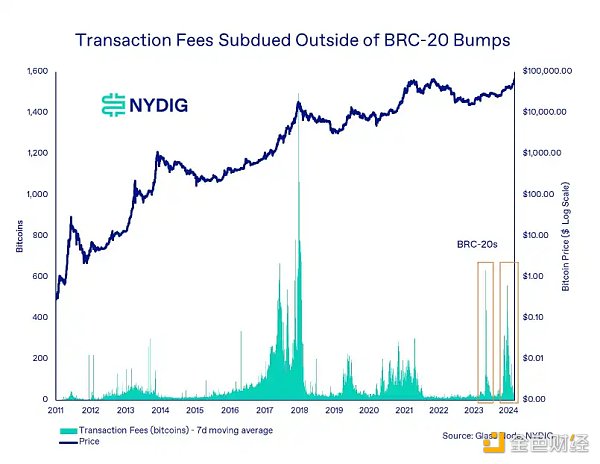

Transaction Fees

Historically, transaction fees exhibit a certain cyclicality: peaking at or near price cycle highs. While there have been two recent transaction fee increases, both were related to BRC-20. Beyond that, we haven't seen the cyclical transaction fee spikes that typically occur around cyclical highs.

Conclusion

Bitcoin has come a long way in just a few months. Just over a year ago, the industry was grappling with the fallout from the collapse of FTX, Genesis, and many other systemically important crypto entities. There is no doubt that ETFs played a significant role in pushing Bitcoin to new all-time highs.

While much of this rally has been driven by financial markets, a study of underlying blockchain data shows that while the current cycle is going strong , but the market may still be far from its peak.

Huang Bo

Huang Bo