Author: flow, SwissBorg researcher; Translation: Golden Finance xiaozou

This cycle is unusual in terms of the dominance of Bitcoin and altcoins. In the past, the normal sequence of the crypto market was almost always such a process:

1) Bitcoin's dominance rises during the bear market

2) and continues to rise in the early stages of the bull market

3) As the bull market matures, investors begin to allocate funds to high-risk assets ("altcoin hot season").

4) As a result, Bitcoin's dominance begins to decline.

However, this time, we have not seen this complete process so far. Since the last bear market, Bitcoin continues to dominate the market and currently accounts for 57% of the total market value of the crypto market.

There are other possibilities here:

- We are experiencing an atypical market cycle.

- The real bull run has not really started yet.

I have expressed my views on this before, and I do not think we will see a large-scale altcoin boom like in the past: all altcoins are going crazy and Bitcoin's dominance has dropped significantly.

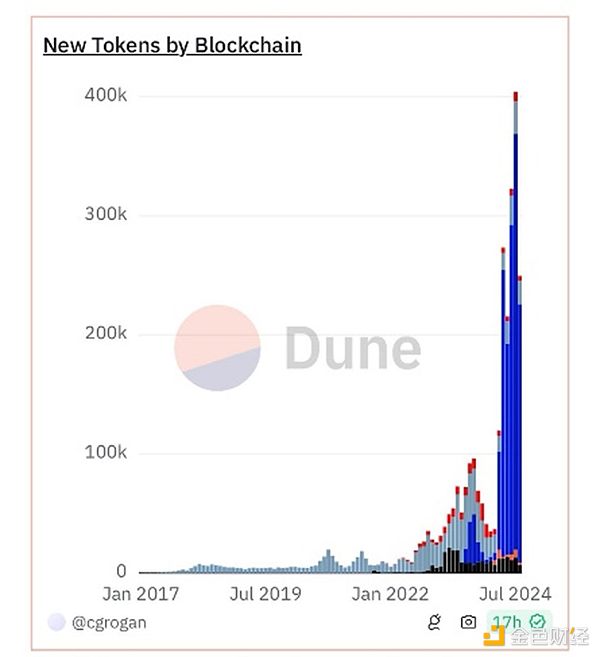

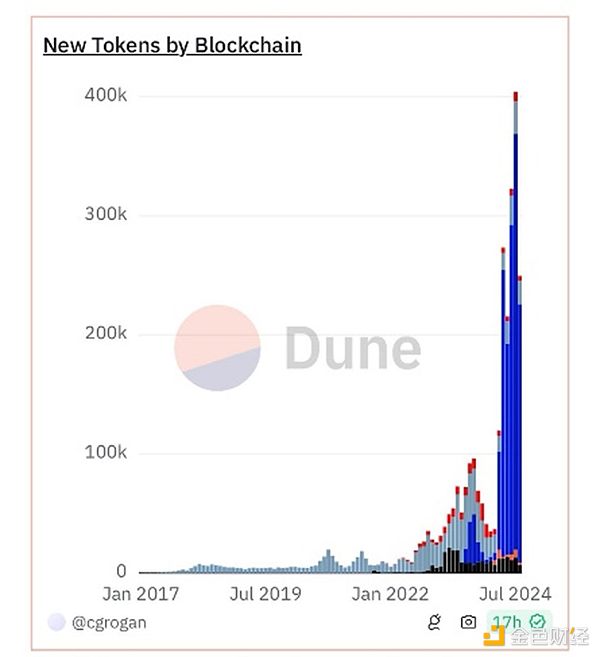

The current altcoin distribution (see the figure below) and market maturity make it more difficult to have a large-scale altcoin season.

Instead, I think the next phase of this bull run is likely to be driven by two or three dominant coins, with occasional special rallies - either stimulated by short-term attention or driven by some killer products or infrastructure that really attract users.

From this perspective, I think it is more cautious to choose altcoins in this cycle than in the past. Don't be naive to think that just holding zombie coins that have no product-market fit and no organic driving force will miraculously make your portfolio multiply by 10 times.

The game is getting harder and harder.

XingChi

XingChi