Author: Eugene Ng Ah Sio, crypto trader, KOL; Translation: 0xjs@黄金财经

TLDR:

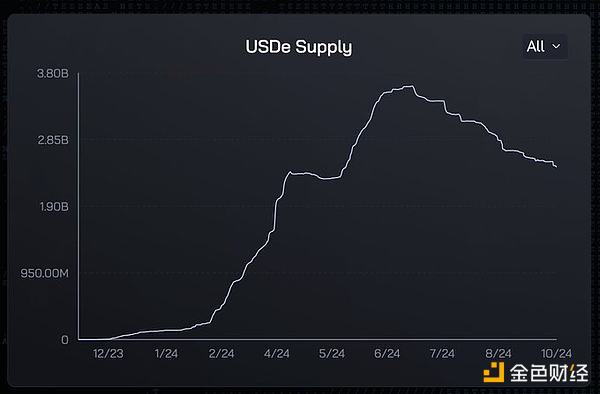

Ethena is the fastest growing DeFi product in history. Its yield-based stablecoin has expanded to $3 billion in just a few months, and no other stablecoin has grown as fast as USDe since its inception. The first chapter of the Ethena story focused on building a safe and superior stablecoin. After successfully withstanding the test of extreme market volatility, it now hopes to chase the biggest prize in the cryptocurrency field - Tether's $160 billion feast.

It is here that Ethena began to transform from a "DeFi native stablecoin" to a fiat stablecoin competitor with a superior value proposition and greatly improved distribution channels. The launch of USTb, the latest participation in Blackrock's treasury products, and the decline in interest rates have brought opportunities to Ethena, and it is now well positioned to make USDe the dominant stablecoin in the cryptocurrency field.

Due to market inefficiencies, you now have the opportunity to buy the strongest new competitor in the largest vertical in crypto for only 1/4 of WIF's market cap.

Market Status

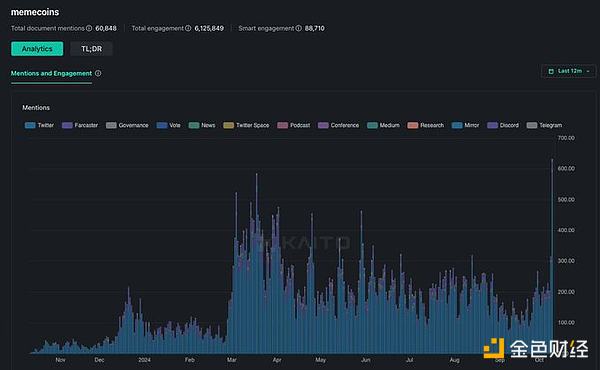

This cycle has been dominated by memecoins. The market has recognized the market manipulation game of buying tokens of relatively unproven VC projects that are trading at ridiculously high valuations that are several times higher than most VC's cost basis. Instead, we have fully embraced the more freewheeling memecoin game. The continued outperformance of memecoins over other altcoins has led to what some consider "financial nihilism" - the disregard of all fundamentals in pursuit of a narrative. While this has been the most profitable trade in crypto over the past 2 years, it has become increasingly common and has even drawn attention to the all-time highs of memecoins.

People's attention to meme reaches an all-time high Source: Kaito

People's attention to meme reaches an all-time high Source: Kaito

As the market became intoxicated with memecoin, it slowly forgot a timeless lesson that all markets teach:

The most powerful speculation is always based on at least a portion of the facts

The rise of memecoin is primarily a crypto-native, retail-led market phenomenon. What these retail participants forget is that the most liquid currencies are always built on parabolic growth at a fundamental level over time. This is because only with fundamentals anchored will the Schelling point for all crypto-native capital pools (retail, hedge funds, proprietary funds, long-only liquid funds) emerge. This is the story of SOL in this cycle, those who focused on developer engagement in early 2023 were able to form a fundamental thesis for the growth of the Solana ecosystem, subsequently enjoying a nearly 10x revaluation within a year.

You may remember Axie Infinity’s 500x liquidity and the millions of players they attracted at the peak of their excitement. Another very familiar reference is Luna’s $40 billion of UST in circulation worldwide, and the 1000x gains you can achieve in 18 months (assuming you bought LUNA off the lows and properly underwrote the spiral risk to get out of it in time).

While financial nihilism is the general trend dominating this cycle, one could argue that it is the lack of strong PMFs in current VC projects that has led to this false consensus view.

However, it only takes one project to get the masses dreaming again.

I believe Ethena is the most qualified candidate for that position in this cycle.

Fundamentals

When considering stablecoins, there are really only two things that matter.

1. Value Proposition - Why should you hold this?

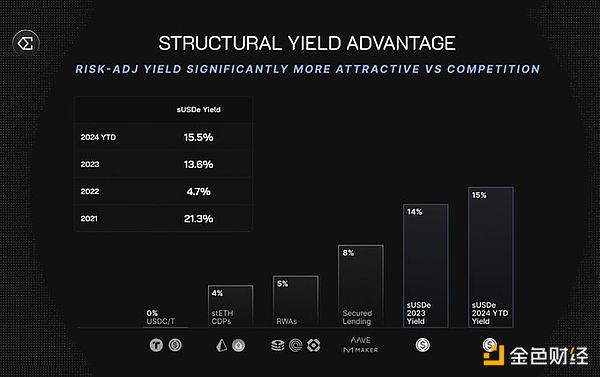

Ethena's product and value proposition is very simple. Deposit $1, get a delta-neutral position between staked ETH and a short ETH position, and earn a yield. Assuming funding rates normalize, sUSDe offers the highest sustainable yield of all stablecoins today (10-13% APY). This substantial value proposition has made Ethena the fastest growing stablecoin in history, reaching a peak TVL of $3.7 billion in 7 months, stabilizing at $2.5 billion after funding rates have dropped.

In terms of yield, USDe is far superior to all other DeFi products

At first glance, it is clear that sUSDe is the undisputed yield king of all cryptocurrencies. Why would you hold Tether today and give up all possible yield on USD? Most likely because it is the most accessible and liquid. Which brings us to…

2. Distribution – How easy is it to get it and use it as a form of money?

When launching any new stablecoin, distribution channels are the most important factor in determining adoption. USDT is the #1 stablecoin today because it is the base currency for any market on every centralized exchange. This in itself is a huge moat and it takes years for new stablecoins to start taking market share.

However, USDe has managed to do something very special. With the support of Bybit, it has been made available to users on the second largest CEX with an automatic yield feature built into the platform. This gives users access to higher quality stablecoin collateral without the added friction. To date, no other decentralized stablecoin has been included on any major CEX, which shows how difficult this feat is. Source: Artemis The current amount of stablecoins on centralized exchanges is about 38.6 billion U.S. dollars, equivalent to 15 times the current supply of USDe. If even 20% of these stablecoins think it is better to earn 5-10% on USDe, it would mean that the service market of USDe will grow nearly 4 times. Now imagine what happens when all major centralized exchanges adopt USDe as collateral?

Catalyst 1: Structural decline in interest rates

Since Ethena was founded, sUSDe's relative yield premium has averaged 5-8% of the federal funds rate. This structural advantage has caused billions of dollars of yield-seeking capital in the cryptocurrency space to flow into Ethena within the first 9 months after its launch.

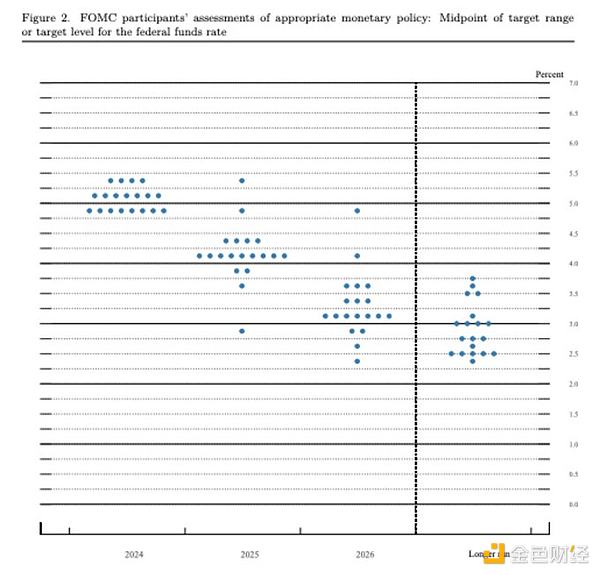

Recent Fed Dot Chart (Sep 2024)

Powell’s 50bp cut in the Fed Funds rate in September marked the beginning of a sustained decline in global risk-free rates. The dot plot currently estimates a steady-state Fed Funds rate of 3 - 3.5%, which implies a ~2% decline in rates over the next 24 months. However, this has nothing to do with Ethena’s revenue stream, and in fact it can be argued that this has a positive indirect trickle-down effect on funding rates (rising markets -> risk-reward -> increased leverage demand -> higher funding rates).

When the two are combined, this potent cocktail sends spreads soaring, and this is the true value proposition of the Ethena product.

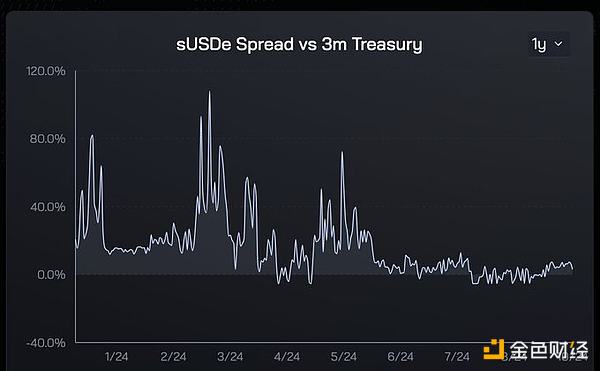

When the funding rate falls, the benchmark yield premium falls from about 10% to 2%

USDe supply is extremely sensitive to the yield differential relative to US Treasuries

USDe supply is extremely sensitive to the yield differential relative to US Treasuries

Referring to the two charts above, it is clear that demand for USDe is highly sensitive to the US Treasury yield premium. In the first 6 months of the increase in the yield premium, USDe supply surged. As the premium declined, demand for USDe naturally tapered off. With this historical data, I believe the return of the yield premium will cause USDe growth to accelerate again. Importantly, this tailwind is both easy to understand and attractive to most market participants.

Over time, I expect this to significantly increase Ethena's share of the market, just as Luna and UST dominated in 2021 as DeFi yields began to decline and UST's 20% collateralization in Anchor became more popular.

Catalyst 2: USTb

USTb was first launched two weeks ago and, in my opinion, is an absolute game-changer that can enhance USDe adoption.

USTb’s main points are as follows:

Stablecoin 100% backed by Blackrock and Securitize

Functionality is exactly the same as other stablecoins, earning yield from US Treasuries but without the added custodian/counterparty risk

Can be a subset of USDe so that when Tradfi yields > crypto yields, sUSDe holders can earn treasury yields

The market is underestimating this as there is little reason to hold any stablecoin in any crypto other than USDe right now, provided you can be confident that exchanges like Binance won’t go bankrupt (and even if they do, USDe won’t go to zero as it’s fully backed by BTC and stETH). In the worst case, you’ll earn similar yields to your competitors, and if not, you’ll earn based on the market’s risk appetite.

With USTb integrated on the backend, sUSDe’s yield volatility is now significantly lower, eliminating the biggest concern that Ethena would not be able to earn a sustainable yield in a bear market. Lower yield volatility also increases the chances of future CEX integration.

With these two catalysts, Ethena has an all-encompassing premium stablecoin that dominates all other competitors today.

Token Economics: The Good, The Bad, and The Opportunities

One of the downsides of VC tokens is that if you hold your tokens long enough, you naturally become exit liquidity for early investors, the team, and other stakeholders who receive token rewards. This alone has caused the entire market to completely abandon the biggest product-market fit crypto of this cycle in favor of pure memecoins.

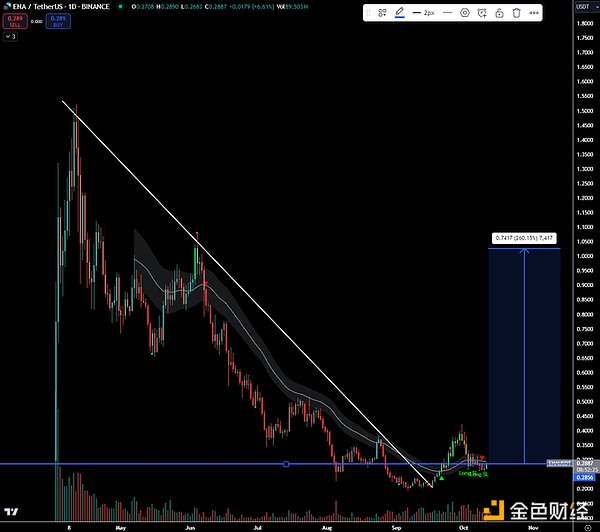

Ethena is no different than your average VC token. Since the high, ENA token price has fallen by ~80% due to the rising valuation of the launch and the airdrop supply entering the market. In these 6 months, the first quarter airdrop has been fully unlocked, and 750 million tokens have entered the market. These unlocks combined with the declining demand for leverage have finally crushed the ENA narrative, which is why no one owns this currency today, and why I strongly suspect that the re-rating will be wildly volatile.

So why should you get exposed to this evil VC token now? The answer is simple - the amount of ENA that will enter the market will decrease dramatically over the next 6 months, greatly suppressing selling pressure. Yesterday, the first batch of tokens was issued, and out of a total of $125 million in new ENA supply, airdroppers claimed only $30 million, choosing to lock up the rest of the tokens. Given that airdroppers have been the main marginal sellers over the past few months, what happens when they stop selling? The price has found a natural bottom at $0.2 and has now formed a historical bottom at $0.26.

Between now and April 2025, the only additional inflation will be the remaining ~$300M airdrop rewards entering the market, but at 28 cents, that equates to ~$450K unlocked daily (less than 1% of daily volume). To put that in perspective, TAO is up 250% in the past month despite $4-5M of inflationary pressure. The point here is that inflationary unlocks rarely have an impact on the re-rating of the token when the stars align. Team/VC unlocks start after April 2025, so that gives us about 6 months to play out the above argument.

How big is the dream?

Even though ENA is the only major new product with a clear PMF in this cycle, ENA is not even in the top 100 on Coingecko. From a technical analysis perspective, ENA's HTF chart looks very clean. Coupled with fundamental drivers + reduced inflationary pressure, I can easily foresee ENA recovering to the $1 level. That wouldn't even get ENA to a market cap equivalent to $WIF, just to the recent high of $1.5 billion reached by POPCAT's circulating supply.

Looking further ahead, Ethena has the foundation to scale USDe to tens of billions, then hundreds of billions. Eventually, as crypto stablecoins gain further market share due to international cross-border payments, a trillion dollars is not out of the question. At this point, it would be surprising if ENA wasn't a top 20 coin given that it's the best product going after the biggest market in crypto.

When we get there is anyone's guess, but I think Ethena is the next big dream for crypto this cycle.

Alex

Alex

Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Hui Xin

Hui Xin