Author: Ryan Selkis, founder and CEO of Messari; Translation: Golden Finance xiaozou

Recently, Messari published the Messari Crypto Thesis 2024 report. Below are the report highlights, my 24 thoughts on the crypto industry in 2024.

1. When you have doubts, look at the big picture.

Cryptocurrencies are inevitable, and when you question the long-term development of cryptocurrencies, it’s fascinating to zoom out and see how far we’ve come. helpful.

The following figure shows the performance of cryptocurrency in the past five years:

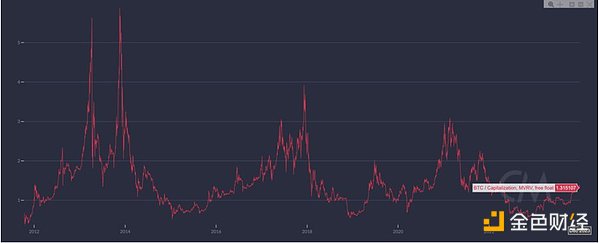

2. Despite the recent increase , but BTC is still the Godzilla of finance.

ETFs are coming, institutional adoption, coupled with geopolitical influences, are far from overheated compared to historical cycles. Looking at the ratio of market value to realized value, it is now 1.3. Wait until it reaches 2.0 or above before making an evaluation.

p>

3. I wrote "ETH has stalled" in late November. Bitcoin is a better digital gold, and Solan et al. have better, faster, and lower-cost execution on "integrated" networks. This may seem reasonable, but due to mean reversion (if nothing else) theory, ETH should be skyrocketing by now.

p>

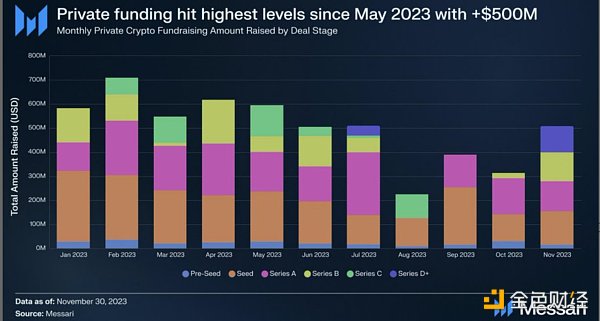

4. Private funds will follow the price trend of public tokens. In terms of crypto venture capital activity, 2024 will crush 2023, and growth companies will continue to attract investment.

The biggest beneficiary:

+ DePIN (storage, computing, wireless)< /p>

+ Rollup & Integrated web ecosystem

+ Any encryptionx ;AI project

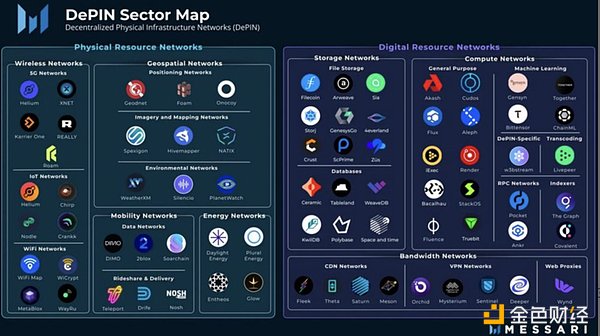

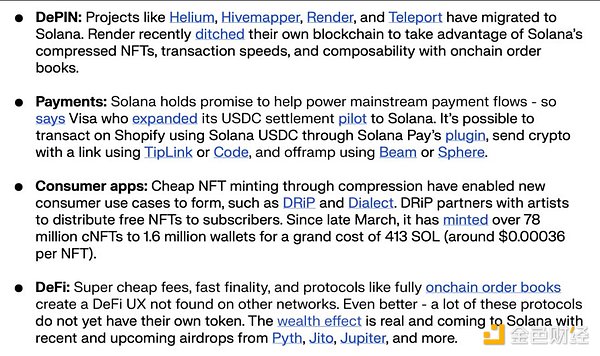

5. DePIN will explode in 2024.

p>

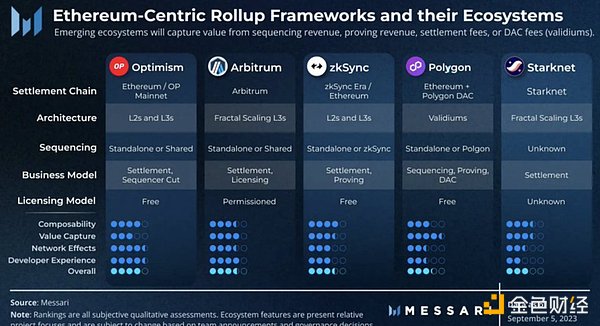

6. The following 10 objects are worthy of attention:

ETF team (Cathie Wood, Larry Fink, Sonnenshein), the Circle team (the most likely IPO candidate), policy leaders (Kristin Smith, Mike Carcaise), our nemesis Satan (Elizabeth Warren), RWA leaders, and DeSoc and DeFi supporter.

7 and 10 types of encryption projects worthy of attention:

(1) Tron USDT

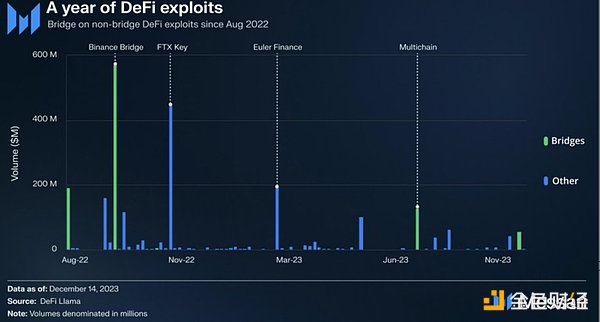

(2) Applications on Base

(3) Celestia

(4)Jupiter & Solana DeFi

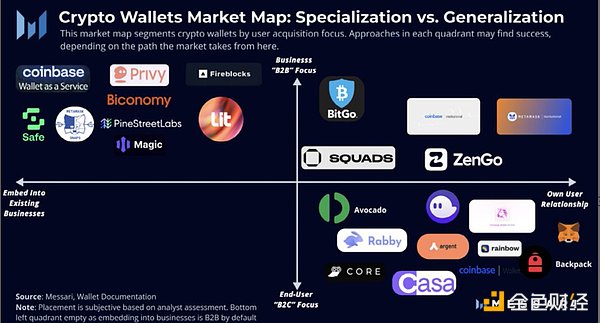

(5)Farcaster / ;Lens

(6)GBTC

(7)Lido & LSTs

(8)CCIP vs. Pyth

(9)Blur & ; Blast

(10) Project Guardian

8. Bitcoin security Model depends on Ordinals. The Bitcoin network needs to be secure in the medium term through:

(1) Fee-based applications.

(2) Introduce permanent low inflation.

(3) Migration to proof of equity.

Otherwise, Bitcoin will eventually fail (slowly).

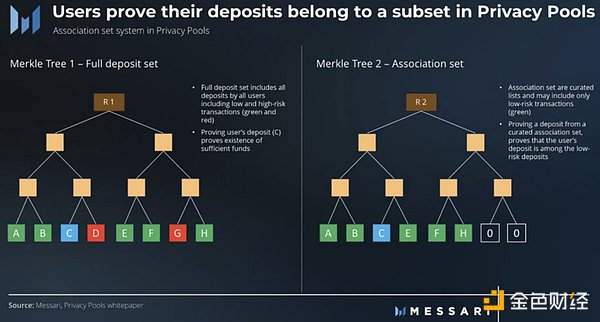

9. The privacy protection projects that I am most interested in are PrivacyPools, SilentProtocol, and ZCash.

We need on-chain privacy, and this is an all-out war to protect our on-chain privacy rights.

p>

10. Concerns about Tether are trivial

The US government likes USDT (monitorable European dollars), even though they secretly pretend to hate it. Continued hostility toward USDC will continue to hurt us unless there is a new president in the White House.

p>

11. If Democrats control both the Senate and the White House, cryptocurrency will have no future in the United States.

We need to get rid of Sherrod Brown, Jon Tester, Katie Porter and several other hostile Senate candidates, or you should move overseas, Choose another industry.

p>

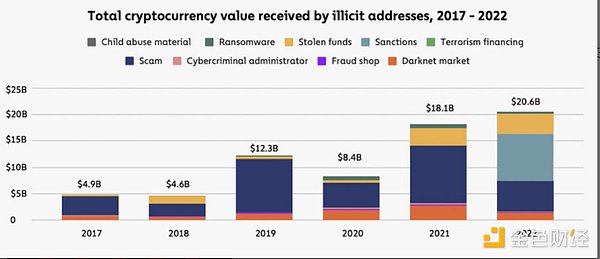

12. Almost everything our political opponents say about us is a lie.

Illegal cryptocurrency use as a percentage of trading volume and market capitalization is near all-time lows, and half of our "illegal financing" is due to half of the world's countries (India + China + other countries) are not even aware of the sanctions.

p>

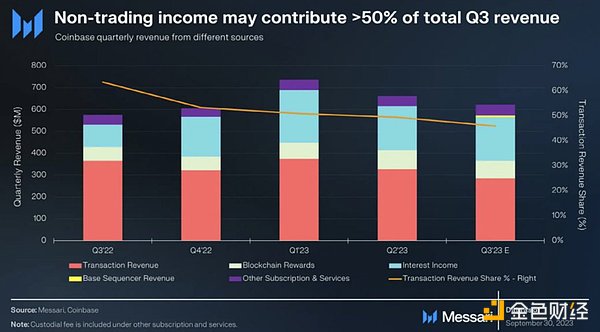

13. Coinbase is a giant and will continue to be so.

The team's excellence in all aspects will promote the development of the encryption field. I expect they will grow through M&A in 2024. Their current profit paths are deposits, transaction volume, and on-chain activity.

p>

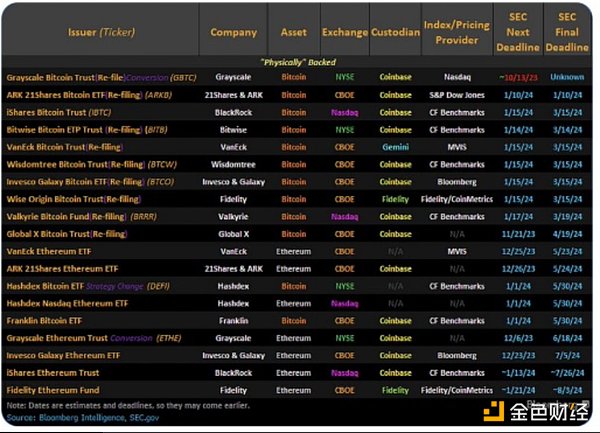

14. You haven’t seen the potential of Bitcoin ETFs yet.

+ Wall Street is interested in cryptocurrencies right now.

+They all have to spend a lot of marketing dollars to compete fiercely with each other.

+ First ETH, then others.

This is a tsunami (earthquakes, tiny corrections, then ruthless capital barriers).

p>

15. Companies such as DCG and Gemini are liquidating each other, their clients, the SEC (U.S. Securities Commission) and the NYAG (New York Attorney General's Office).

+Minimum civil penalties.

+Most creditors settle in U.S. dollars, not cryptocurrencies.

+No jail time for those involved.

If you have any objections, I'm sorry, it's over.

16. Our quarterly report includes dozens of L0/L1/L2 networks. However, the "fat protocol" view still exists and will continue to exist in 2024, even if it is still somewhat ridiculous in the long run. Don't fight trends or memes.

p>

17. Ethereum will still be centered on rollup in the future, and most of the economic value of this year's rebound will be attributed to the tokens and ETH of the rollup chain. Spread trading is a breeze.

p>

18. Solana is a returning player in the crypto industry this year, and it still has room to compete with ETH as the top integrated network. If Bitcoin is Godzilla, then Solana is Pac-Man, capable of eating all killer crypto apps at once.

19. Crypto payments are booming on Ethereum, Tron and Solana. Just not on Bitcoin’s Lightning network. Solana will continue to gain market share, Tron will go or die with Tether, and Ethereum will rely on rollups on it for payment settlement. Lightning will sit quietly in the corner.

p>

20. Currently, spot DEX trading volume is about 15-20% of spot CEX trading volume, but the market share of Perp DEX trading volume is an order of magnitude lower. This gap will narrow significantly in 2024.

The following are potential DeFi leaders:

21. Bridge will continue to be ours The bane of existence. Today, most illegal cryptocurrencies come from on-chain hacks and poor security. Attackers use varying degrees of sophistication, but insecure bridges are and will continue to be a major source of attacks.

p>

22. Elon buys us time, but we need a parallel social media ecosystem. The leaders in the club are Lens, Farcaster, and friend.tech. These agreements are large and involve a lot of money.

p>

23. With the US presidential election approaching, it is predicted that the encryption market may rise 50 times this year, but the most sustainable high-crypto betting opportunities are in the gambling field. Cryptocurrencies have thrived in gray markets and unclear regulatory environments, with huge global demand for gambling bets.

p>

24. The wallet war is the most interesting, riskiest, and least mentioned war in the cryptocurrency field. The ensuing competition will elevate cryptocurrencies from a speculative asset to a safer and easier technology for mainstream consumption by 2024.

p>

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Coinlive

Coinlive  Others

Others