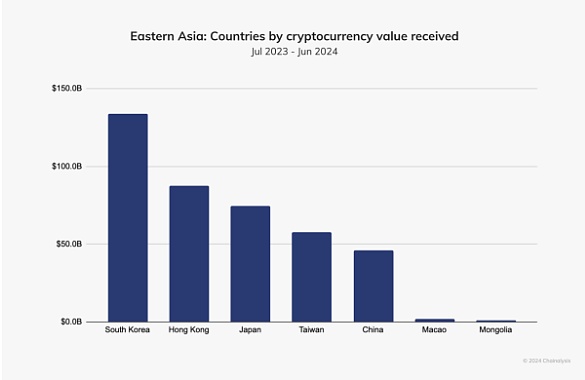

Hong Kong’s Crypto asset trading volume grew an impressive 86% year-over-year. Chainalysis reports that Hong Kong leads the way in East Asia in Crypto asset adoption. The region ranks 30th in digital currency adoption internationally, indicating its potential to become a major player. Several factors are driving this impressive growth. First, Hong Kong’s regulatory environment is unique. For example, Hong Kong has a softer approach to Crypto assets than mainland China, which has strict regulations. This adaptability has fostered financial innovation and attracted the attention of institutional and individual investors looking to enhance their Crypto asset portfolios.

The total value obtained in the market mainly comes from centralized exchanges, accounting for about 64% of the total value obtained in East Asia.

This pattern shows that investors use these centralized platforms to meet their trading needs.

In East Asia, there are profound differences in the landscape of Crypto assets. Centralized trading platforms remain the most popular platforms, accounting for 65% of the market value.

The convenience and reliability of these platforms have attracted retail traders, but behind this lies an unknown truth - more and more institutional players are moving away from these centralized platforms.

Decentralized exchanges (DEXes) and decentralized financial platforms are becoming increasingly popular among institutional investors, even though ordinary traders prefer centralized exchanges.

This change shows that larger players are looking for various investment methods that can take advantage of market inefficiencies, which is often the case with decentralized markets.

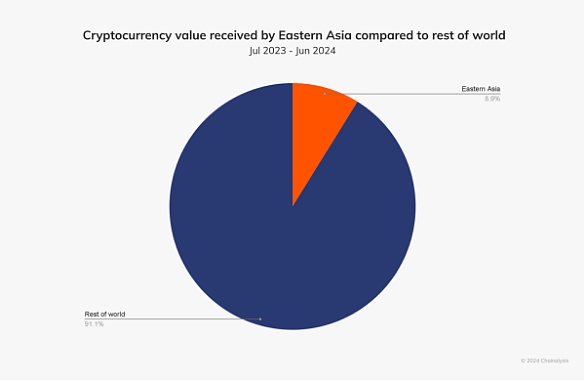

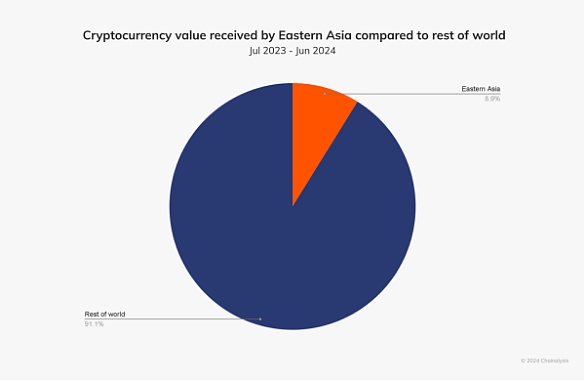

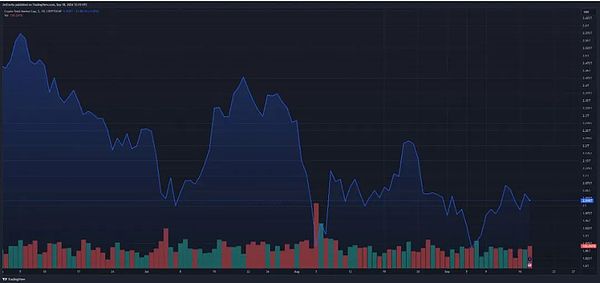

In East Asia,the use of Crypto assets has increased significantly in recent years. Crypto asset trading in the region accounted for approximately 9% of total Crypto asset trading between July 2023 and June 2024.

During this period, more than $400 billion in transactions were executed on the blockchain.

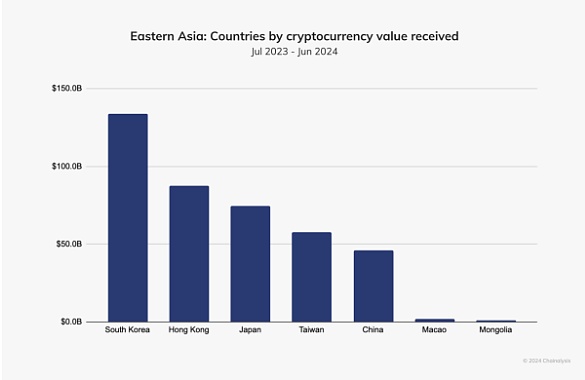

During the research period, South Korea's Crypto assets were worth about $130 billion, maintaining its first place in East Asia.

Although Hong Kong has developed rapidly, it will still face major challenges in the near future.

The recent approval of the Ethereum ETF by the SEC (U.S. Securities and Exchange Commission) has broken some of Hong Kong's competitive advantages over other Crypto asset destinations around the world.

Crypto asset investment will attract more attention from other financial centers, and Hong Kong must continue to innovate in order to continue to be the focus of attention as a top digital currency destination.

Despite the promising prospects, the development prospects of Crypto assets in Hong Kong are still unknown. While consolidating its dominant position in East Asia, the region has had to negotiate changing domestic and offshore policies.

Investors are eagerly watching how the financial district responds and whether it can maintain its steady pace of growth. A supportive regulatory environment and growing institutional interest in and around the region are helping further development.

However, new issues arising from domestic policies and foreign competition will require innovative ideas and clearer laws if the region is to maintain its advantage.

Joy

Joy