Author: Kiki

2024 is already halfway through, and the technology circle has entered an obvious "cooling-off period". We tried to find the real answer to the landing and application of technology in the technology circle that has been excited for more than a year, and squeeze out the bubble. The planning of "Waves and Bubbles" also came from this, and this series includes 4 articles. The first article in the series: "After more than half a year of "price war", "Alibaba Cloud" has come to its senses"; the second article in the series: "After a year of crazy AI, Feishu Dingding "faces destiny"".

This article is the third article in the series: "Uncovering AIGC concept stocks: Who is swimming naked after the tide recedes? "

After more than a year of soaring generative AI technology, the "AIGC concept stocks" in the A-share market are experiencing a collective "de-bubble".

As of the close of September 12, compared with last year's increase, the Wind AIGC Concept Index (8841660.WI) and ChatGPT Concept Index (8841669.WI) have fallen by 30.70% and 30.34% respectively this year. A technology analyst pointed out that the pullback of the artificial intelligence index was mainly due to the excessive short-term increase, and most of the targets did not have impressive performance.

However, global artificial intelligence is still developing rapidly. In the first half of 2024, from the outbreak of Sora at the beginning of the year, the debate between the open source camp and the closed source camp, the parallel development of small and large models to the development of various AI terminals, in order to make the large model land, new competition has begun.

Taking advantage of AI, whether it is a new story written into the financial report and business, or market value management based on concepts, the AI industry, which is still in its early stages of development, seems to have added "milk and honey" to the future of many companies.

The past technology cycles tell us that AI has never lacked hype stories, but after the tide, the naked swimmers will eventually surface. What is the development quality of these AIGC concept companies? Which listed companies are riding on the hot spots and lack fundamental support?

In order to answer the above questions, with the recent disclosure of the 2024 semi-annual reports of A-share listed companies, we have systematically investigated these companies with the 55 constituent stocks related to "Wind AIGC Concept Stocks" as the core targets, combined with their revenue, profit and R&D-related data, and found the following three basic conclusions:

1. AI cannot provide timely assistance, but only icing on the cake. Most of the AI-related businesses have not had a significant impact on the company's current performance.

2. Most of the companies that have achieved short-term results using AI are giants with deep financial resources and companies with clear business models.

3. Most companies emphasize technology investment, but not many are willing to spend money. At the same time, many companies need to consider how to spend money under severe financial performance.

Before reviewing the specific performance of related companies, we first need to clarify the layout of the entire AI industry chain.

In simple terms, the AI industry chain can be divided into three parts: upstream computing power, midstream models and data, and downstream applications and products. The corresponding companies can also be further divided into three industries. In the upstream computing power, there are some computing power concept stocks, which are engaged in AI servers, AI new products and computing power leasing business; in the midstream models and data, there are mainly some AI large model companies and data element related industry chain companies; in the downstream applications, there are more diversified, including some games, media and film and television, and SaaS software development and service companies.

The first round of speculation in artificial intelligence has passed. Today, as the industry gradually moves towards AI disenchantment, the first question that the outside world is concerned about is: Have these companies really made money?

Breaking down the revenue and net profit performance of 55 A-share related AIGC concept stocks in the first half of this year, we found that the profitability of most AIGC concept stocks is worrying.

In the first half of this year, more than 70% of the companies' net profits attributable to their parent companies decreased year-on-year, and some fell by three or four digits. Losses continued to worsen, and it was normal for revenue to increase without profit or neither revenue nor profit to increase.

For example, Kunlun Wanwei (300418.SZ), a star company in the large model industry, turned from profit to loss in the first half of this year, with a net loss of 389 million yuan, a year-on-year decrease of 208.64%; another company on the list, "Wensheng Video" Wave, Chinese Online (300364.SZ), also suffered a worsening loss, with a net loss of 150 million yuan in the first half of the year, a year-on-year increase of 305.03%.

Obviously, most AI-related businesses have not had a significant impact on the company's current financial performance. In the short term, AI cannot provide timely assistance, but only icing on the cake.

Another question also arises: Why is it so difficult for these companies to make money?

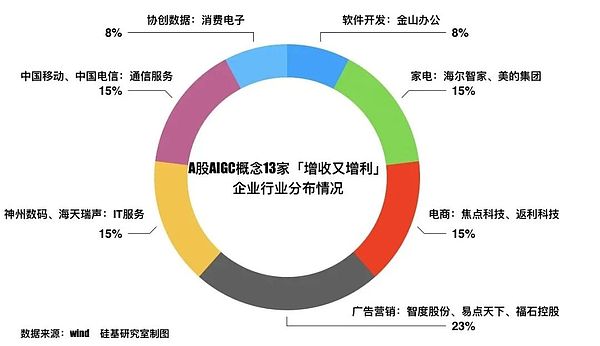

We may be able to find the answer from those companies that "can make money". Among the 55 companies, only about 20%, or 13 companies, have achieved "increased revenue and increased profits". Their "money-making codes" are also on the table -

• One type of company is: the family foundation is strong enough, or the moat of the main business is wide enough.

• One type of company is: the transformation is early or the business model itself is clear enough.

• The first type of enterprise is: small in scale, but has rigid demand for AI, and has strong short-term certainty in the track.

The first type of enterprise with sufficient financial resources, such as China Mobile (600941.SH) and China Telecom (601728.SH), which are listed in the "Zhong" category, and Haier Smart Home (600690.SH) and Midea Group (000333.SZ) in the home appliance track.

AI is inseparable from traffic and entrances, and China Mobile and China Telecom, as domestic operators, have the widest customer base. Haier Smart Home and Midea Group have product and scenario entrances, and can integrate AI technology into the home ecosystem. The stability of their main business is the confidence of these giants to invest in AI.

The second type of companies are those that have transformed early or have a clear business model. From the perspective of AI implementation scenarios, some companies in tracks that are closer to money, such as office software and e-commerce, have also earned the first wave of AIGC dividends. For example, Kingsoft Office (688111.SH), which announced the closure of its advertising business last year, benefited from the "selling memberships", that is, the clarity of the subscription service business model, in the office software track. In the first half of this year, Kingsoft Office's revenue increased by more than 11% year-on-year, and its net profit also increased by more than 20% year-on-year.

Because of its natural data advantages and complex and diverse industrial chain links, e-commerce is also regarded as one of the easiest scenarios for AI to land. Jack Ma once said: "The era of AI e-commerce has just begun. It is an opportunity and a challenge for everyone. "Among the 13 companies that "increased revenue and profits", Focus Technology (002315.SZ), Yidiantianxia (301171.SZ), and Fanli Technology (600228.SZ) are all companies in the e-commerce industry chain. Some of them sell AI tools, some sell marketing plans, some are backed by domestic and foreign e-commerce giants, and some have reaped the benefits of going overseas.

Take Focus Technology, which is oriented towards cross-border e-commerce, as an example. It has launched efficiency tools such as AI customer service. In the form of a paid system, the company's "AI Michael" has lowered the threshold for foreign trade transactions. AI marketing companies like Yidiantianxia have also promoted their own commercialization by getting involved in AI big models at an early stage and trying out applications such as Wensheng videos and digital humans.

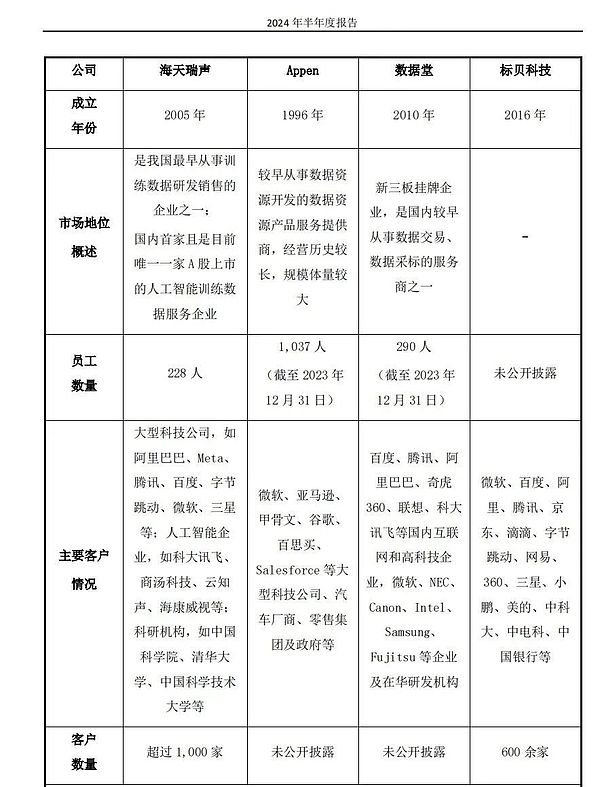

The third type of companies seem to lack the halo of star AI companies, but they have rigid demand for relevance to AI, and the short-term certainty of the track is relatively strong. A typical company is Haitian Ruisheng (688787.SH), which has reaped the dividends of data annotation.

Data is the key core element of the AI era. During the development process of AI, it needs to go through processes such as data collection, cleaning, and annotation to make data a usable data set for AI. Especially under the trend of data moving towards multimodality and customization, the necessity and importance of data annotation are gradually highlighted. However, it should be pointed out that data annotation is not an emerging industry. As an intermediate layer, compared with the construction of the underlying large model, its technical threshold is relatively low, and the market is relatively scattered.

Haitian Ruisheng was established in 2005 and is currently the only A-share listed artificial intelligence training data service company in China. It has a certain accumulation in speech annotation. According to its financial report, the number of its customers has exceeded 1,000, including Alibaba, Meta, Tencent, Microsoft, ByteDance, etc. Although it has achieved a year-on-year turnaround, Haitian Ruisheng has obviously earned hard-earned money, and its net profit attributable to the parent company in the first half of the year was only 416,400 yuan.

Comparison with similar companies of Haitian Ruisheng,

Source: The company's 2024 semi-annual report

In addition to its poor profitability, after more than a year of skyrocketing, the popularity of AIGC concept stocks is fading. Is it a real concept or just a concept? Naked swimmers may have appeared.

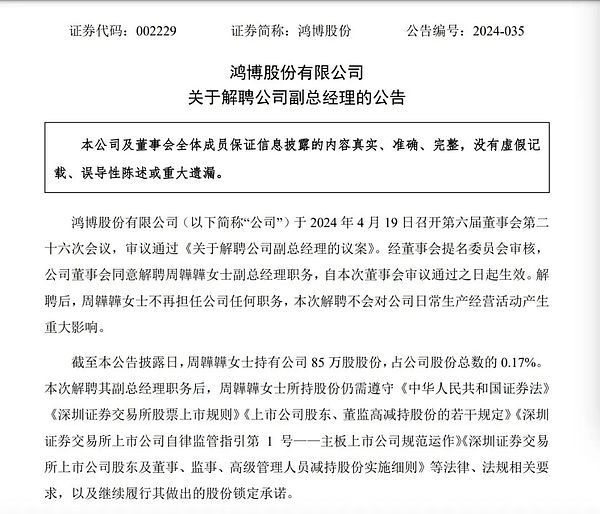

Last year, many companies took advantage of AIGC to become "hot cakes", but this year, as of the close of September 12, we counted the stock price changes of these 55 companies and found that from the beginning of the year to date, only one stock has increased by more than 20%, and most of them are "green", among which the company with the largest stock price drop is a company called Hongbo Co., Ltd. (002229.SZ).

Those who are familiar with AIGC's "shovel-selling business" must be familiar with this company. Because it is close to NVIDIA and has laid out the computing power business, this company whose main business is lottery printing relies on reselling NVIDIA's computing power and chips, and has signed large computing power orders with star large model companies such as Baichuan Intelligence and MiniMax, becoming a phenomenal stock in 2023.

But the good times did not last long. In April 2024, Hongbo Co., Ltd. quickly dismissed Zhou Weiwei, CEO of Yingbo Digital Technology, who was responsible for its computing power business, and several core executives. According to "Sina Technology", the "AI Empowerment Center" jointly planned and built by Hongbo Co., Ltd. and NVIDIA also encountered changes.

Hongbo shares dismissed Zhou Weiwei, former CEO of Yingbo Digital Technology

Source: Company announcement

"I watched him build a tall building, and I watched him collapse", perhaps it can be used to describe the impermanent fate of this cross-border "computing power dark horse".

However, in addition to cross-border players, in the fierce market environment, some star companies in the large model industry are not doing as well as expected.

Typical cases are Wondershare Technology (300624.SZ) and Kunlun Wanwei.

Wondershare Technology, which once benchmarked "Domestic Adobe", had revenue of 705 million yuan in the first half of the year, a year-on-year decrease of 1.8%, and a year-on-year decrease of 43.99% in net profit, turning to losses for the first time in a single quarter. The reasons for the increase in revenue but not in profit point to two points: First, the cost is gradually rising, and second, the competition is more intense.

In terms of cost, the big model is a money-eating beast. During the reporting period, Wondershare Technology's operating costs increased by 32.62% year-on-year, including procurement expenses such as servers and AI software. In terms of market competition, in the first half of this year, affected by the "price war" in the industry, a new traffic competition was also set off. When talking about the external competitive environment, the company pointed out: "external traffic competition is fierce, and it is more difficult to obtain high-quality traffic."

AI products have leapt from early users to the general public. Radical domestic model manufacturers have started a marketing war this year. Kimi, a large model unicorn represented by the Dark Side of the Moon, has also benefited from this. Behind the marketing is the desire for traffic, but it also brings high marketing costs.

In the first half of the year, Wondershare Technology's sales expenses were as high as 365 million yuan, and Kunlun Wanwei's were 934 million yuan, a year-on-year increase of 21%. According to industry insiders, this marketing war of burning money will not stop for now, and players' anxiety about acquiring customers will continue.

In every round of technology cycle, people always seem to overestimate the short-term impact and underestimate the long-term impact. Looking to the future, an industry consensus is that no matter whether the company is well-off or poor, maintaining high-intensity R&D investment is a topic that every company must face.

Firm investment and rapid iteration in related technologies not only determine the short-term technology commercialization capabilities, but also determine how far an AIGC company can go in the long run.

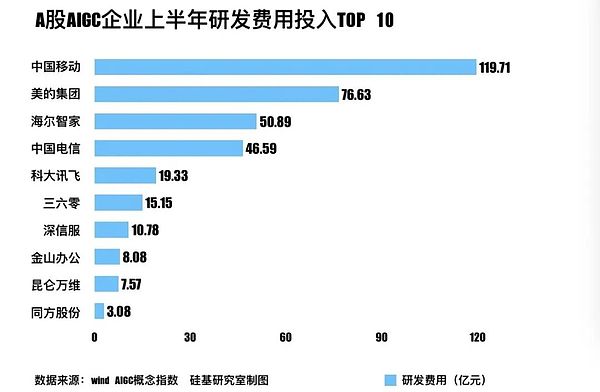

Among the 55 AIGC companies, 16 companies invested more than 100 million yuan in R&D expenses in the first half of this year, accounting for nearly 30%; 7 companies invested more than 1 billion yuan, accounting for about 10%. Only China Mobile invested more than 10 billion yuan, spending nearly 12 billion yuan on R&D in half a year. Home appliance leaders such as Haier Smart Home and Midea Group also invested more than 5 billion yuan in R&D.

From the list of the top 10 companies in terms of R&D expenditure, the speed and breadth of the R&D layout of large models are positively correlated with R&D investment. iFlytek (002230.SZ), 360 (601360.SH), Kingsoft Office, etc. all attach great importance to R&D investment. From the perspective of R&D intensity (the proportion of R&D expenses to revenue), the proportion of R&D expenses of the above companies to total revenue exceeds 20%.

However, R&D investment is one thing. How to further spend the money on R&D depends on the capabilities of AI-related products, services and solutions on the C-end and B-end. Whether R&D can be transformed into actual commercialization requires the subsequent continuous exploration and efforts of these companies.

Some companies are already exploring more cost-effective solutions. For example, the management of iFlytek mentioned that in the next few years, it will not significantly increase the heavy capital computing power investment. iFlytek will use technical means such as model distillation and cutting to form a commercially available large model version, and use the method of "laying eggs along the way" to ensure that it maintains strong market competitiveness in the commercialization process.

This also means that R&D spending is important, but how to spend money is a test of the "art of spending money" of each company.

From the rise of the wind to the disenchantment, reviewing the ups and downs of the above AIGC concept stocks, whether it is hard power or hype, will eventually wait for the test of time. This iron law has been verified in the AI 1.0 era. For more companies that want to ride on the AIGC wind, the time to see the truth has come.

References:

1. Times Finance: AIGC concept stocks have soared for a year: Who is swimming naked and who is sprinting?

2. CITIC Securities: AI is developing rapidly, and the performance of various domestic AI sub-sectors is being tracked

3. Sina Technology: Internal fighting, dismissal, and backlash? Nvidia abandons "nine-fold bull stock" Hongbo Shares

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Coinlive

Coinlive  Yahoo Finance

Yahoo Finance Coinlive

Coinlive  Numen Cyber Labs

Numen Cyber Labs