This article has been slightly edited based on the original text. For the original text, please refer to: https://www.coinbase.com/en-gb/institutional/research-insights/research/monthly-outlook/monthly-outlook-may-2024

The approval of the Bitcoin spot ETF in the United States has strengthened BTC's image as a store of value asset and consolidated its macro asset status. In contrast, Ethereum's fundamental positioning in the crypto space is still unclear. Competitive public chains such as Solana have affected Ethereum's position as the preferred DApp deployment platform. The growth of Ethereum Layer2 and the reduction in ETH destruction also seem to have affected its value accumulation method.

However, we believe that Ethereum's long-term prospects remain optimistic. It has unique advantages among smart contract platforms, including Solidity's strong developer ecosystem, the widespread application of the EVM platform, the importance of ETH as DeFi collateral, and the decentralization and security of the main network. Moreover, as tokenization, the conversion of real-world assets into digital assets on the blockchain, accelerates, ETH may receive a more positive and active boost in the short term than other L1s.

Historical trading data shows that ETH embodies both store value and technological innovation. It is highly linked to BTC, which meets the characteristics of store value, but can perform independently during BTC's long-term rise, following technology-oriented market laws like other crypto assets. ETH is expected to continue to integrate these two characteristics and may reverse its current poor performance and achieve unexpected growth in the second half of 2024.

ETH's Narrative

ETH has a variety of roles, from being called Ultrasound money that controls supply through production cuts to being seen as an Internet bond that provides non-inflationary staking returns. With the rise of Layer2 expansion and re-staking technology, new concepts such as "settlement layer assets" and "universal proof of labor assets" have also emerged.

Translator's Note: Under the PoS mechanism, users can participate in network maintenance and receive rewards by staking ETH, which is similar to buying bonds to get interest, but more decentralized. Since staking rewards come from network transaction fees and newly issued ETH, and the total control strategy limits excessive issuance, ETH's staking return model is regarded as a more inflation-resistant Internet bond compared to traditional inflation.

But in the final analysis, we believe that none of these individual statements can fully reflect the vitality of ETH. In fact, the increase in ETH's uses has made the way to evaluate its value more complicated, and it is difficult to define a single measurement standard. Moreover, the interweaving of these multiple concepts can sometimes cause confusion, and the contradictions between them may distract market participants and obscure the real driving force behind the rise in ETH's value.

Spot ETFs

Spot ETFs are critical for Bitcoin, not only clarifying the regulatory framework, but also attracting new capital inflows. Such ETFs fundamentally reshape the industry landscape, and we believe they disrupt the previous cyclical pattern of capital moving from Bitcoin to Ethereum and then to higher-risk alternative assets.

There is a barrier between funds invested in ETFs and funds on centralized exchanges, which have access to a wider range of crypto assets. Once a spot Ethereum ETF is approved, this barrier will be removed and Ethereum will have access to capital sources that are currently only open to Bitcoin.

In fact, the logic of approving a Bitcoin spot ETF also applies to an Ethereum spot ETF, because the Chicago Mercantile Exchange (CME) futures price is closely linked to the spot price, which can effectively monitor and prevent market misconduct.

The correlation study period for Bitcoin spot ETF approval reference started exactly one month after the launch of Ethereum futures on the Chicago Mercantile Exchange (CME), in March 2021. We speculate that this was intentional so that the same logic can be applied to the Ethereum market in the future. Previous data analysis by Coinbase and Grayscale also showed that the correlation between Ethereum spot and futures prices is similar to that of BTC.

Other Layer1 Challenges

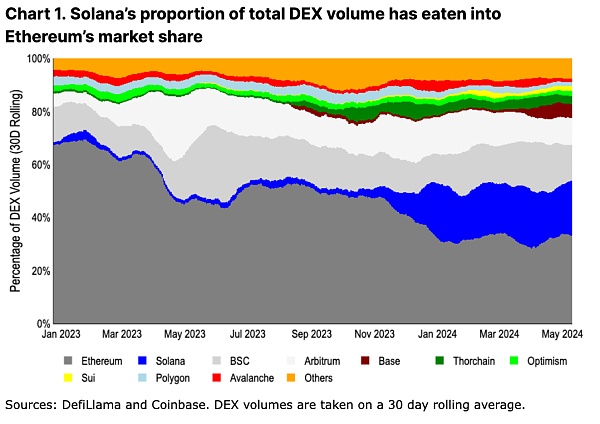

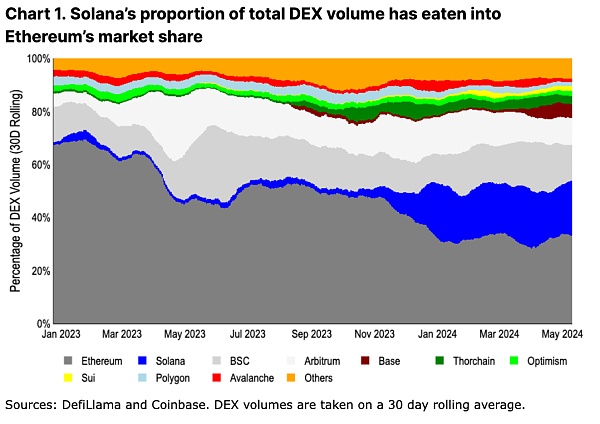

Some high-performance integrated chains, especially Solana, are gradually encroaching on Ethereum's market share. These chains provide high-speed and low-cost transactions, which has led to more and more trading activities being transferred away from the Ethereum mainnet. For example, the share of DEX trading volume in the Solana ecosystem has soared from 2% to 21% in the past year alone.

We observe that these L1s are now more differentiated from Ethereum than in the previous bull cycle. They no longer rely on the Ethereum virtual machine, and DApps are designed from scratch to create their own unique user experience. In addition, the integrated/holistic strategy adopted by these chains enhances the synergy between different applications and solves problems such as poor user experience and dispersed liquidity during the bridging process.

While these unique value propositions are critical, we believe it is too early to judge success based solely on incentive-driven activity indicators. For example, some Ethereum Layer2 user transaction volumes have decreased by more than 80% since the peak of the airdrop. Meanwhile, Solana’s share of total DEX volume has grown from 6% on November 16, 2023, when the Jupiter airdrop announcement was made, to 17% on the first claim date on January 31, 2024 (Jupiter is the main DEX aggregator on Solana).

With three more airdrops to go for Jupiter, expect Solana’s DEX activity to remain high. However, assumptions about long-term activity retention remain speculative in the meantime.

On the other hand, the leading Ethereum Layer2s (Arbitrum, Optimism, and Base) currently account for 17% of total DEX volume, plus 33% for Ethereum itself. This is particularly important when comparing ETH’s demand growth to other Layer1 solutions, as ETH is the base fuel asset in all three Layer2s. Additionally, additional demand drivers for ETH in these networks, such as MEV, are not yet fully developed, leaving room for future demand growth. Therefore, from the perspective of DEX activity, this provides a more proportional comparison of integrated and modular scaling approaches.

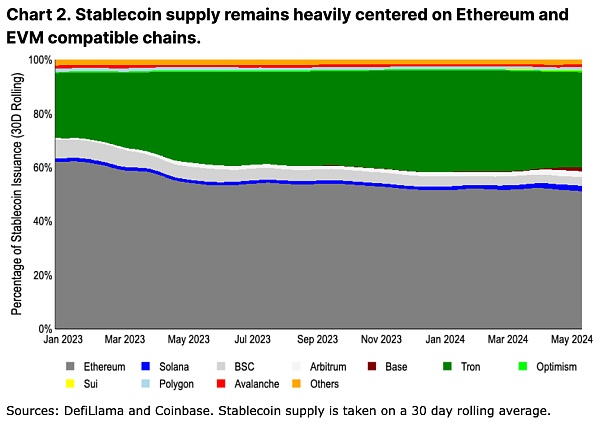

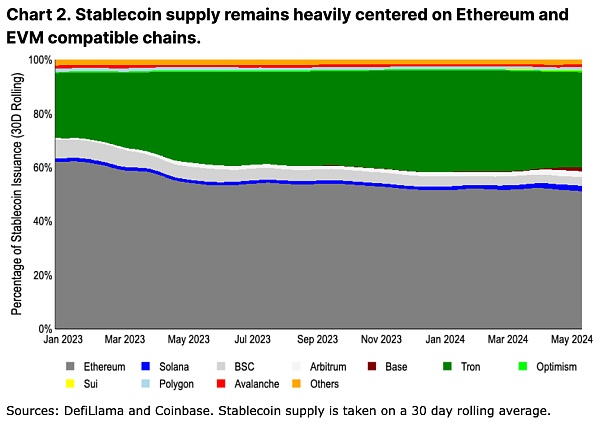

In addition, another more persistent measure of network adoption is stablecoin supply. The circulation and issuance/redemption of stablecoins are subject to bridge restrictions, so they change more slowly.

As measured by stablecoin issuance, activity is still concentrated on Ethereum. We believe that many emerging chains are not yet trustworthy and reliable enough to support large-scale capital, especially capital locked in smart contracts. Large capital holders tend to be less sensitive to Ethereum's higher transaction fees (relative to transaction size) and prefer to reduce risk by reducing liquidity interruption time and minimizing bridge trust.

In fact, stablecoin supply is growing faster on Ethereum Layer2 than Solana. Since the beginning of 2024, Arbitrum has surpassed Solana in stablecoin supply (currently $3.6 billion vs. $3.2 billion in stablecoins, respectively), while Base has grown its stablecoin supply from $160 million to $2.4 billion so far this year.

While the final verdict on the scaling debate is far from clear, early signs of stablecoin growth may actually be more beneficial to Ethereum Layer2 than other Layer1 chains.

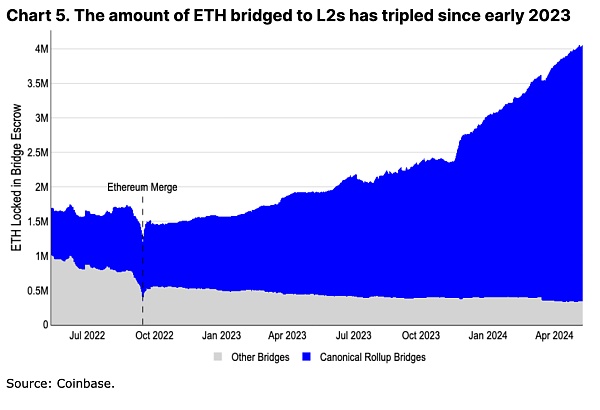

The boom in Layer2 technology has sparked discussion: Layer2 reduces Layer1 block space requirements (thereby reducing ETH burned as transaction fees) and may also support non-ETH gas fees in its ecosystem (further reducing ETH burning).

However, in-depth analysis shows that the impact of this situation on ETH is not negative.

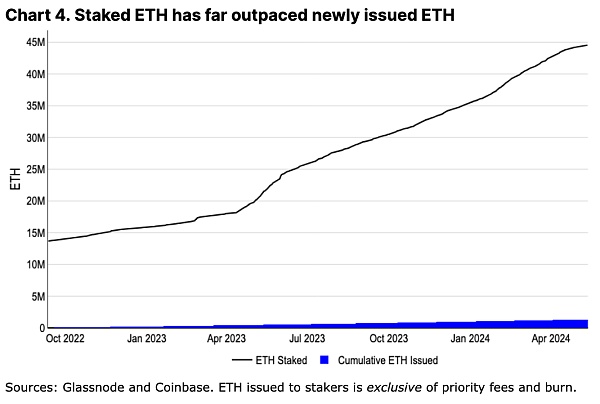

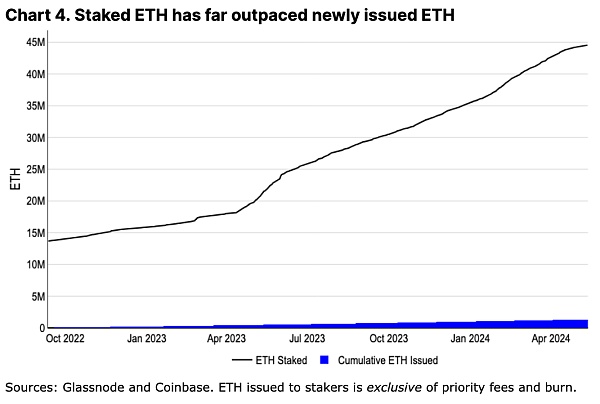

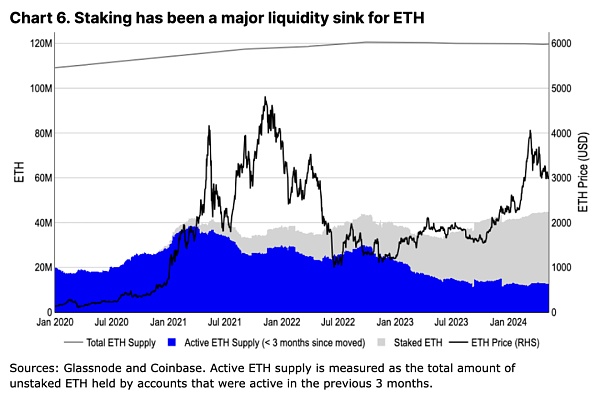

Since Ethereum switched to PoS in 2022, ETH has reached its highest annualized inflation rate. Although inflation is generally considered to be a structurally important component of BTC supply, we do not believe this is true for ETH. In essence, all newly issued ETH is directly allocated to stakers, and their ETH holdings are growing at an astonishing rate, far exceeding the issuance rate. Unlike the Bitcoin mining economy, where miners need to frequently sell BTC to maintain operations, ETH’s low staking cost allows stakers to accumulate ETH for a long time without selling.

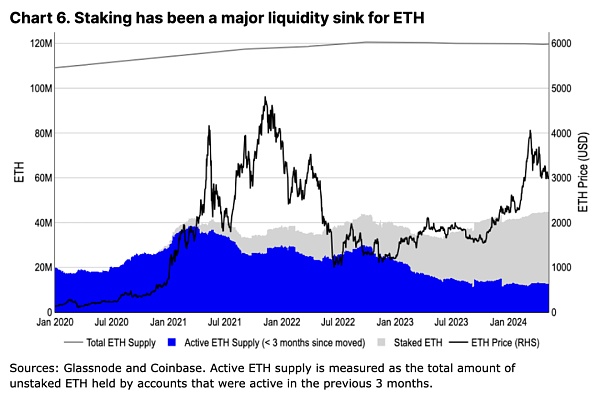

At the same time, staking has become a magnet for ETH liquidity, with the growth rate of staked ETH being more than 20 times the rate of ETH issuance.

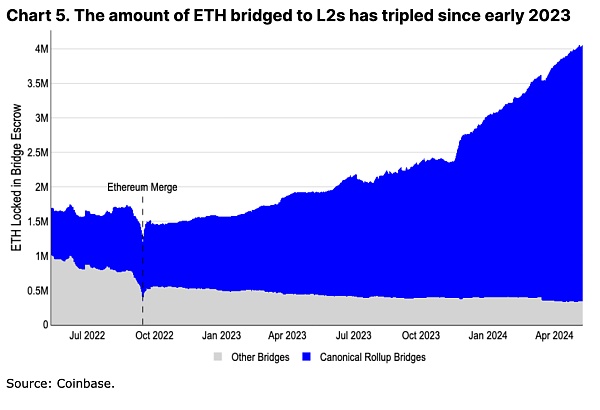

The rise of Layer2 has further exacerbated the liquidity crunch of ETH. More than 3.5 million ETH have migrated to Layer2, which not only directly transferred ETH, but also prompted users to prepare ETH as reserves for Layer2 transactions, which is equivalent to locking ETH in disguise.

Although the Layer2 ecosystem is growing, core financial services and governance activities such as EigenLayer's re-staking, Aave, Maker, Uniswap, etc., still rely on Layer1 to ensure the fundamental demand for ETH. In particular, large fund holders who value security the most prefer to stay in Layer1 before Layer2 fully achieves decentralization and permissionless fraud proof, which also supports the market demand for ETH.

In summary, the development of Layer2 has not weakened ETH, but has promoted the appreciation of ETH in a complex way. It is not only a driver of the growth of ETH demand, but also strengthens the core value of ETH by increasing ETH's application scenarios and its role as the basic unit of Layer1 fees and Layer2 pricing.

Ethereum's Advantages

In addition to the common data-driven narratives, we believe that Ethereum has other advantages that are difficult to quantify but still very important. These may not be short-term tradable narratives, but represent a set of core advantages that can maintain its dominance in the long run.

High-quality collateral assets and pricing benchmarks

ETH plays a core role in the DeFi field. It is widely used in L1 and L2, plays the role of low-risk collateral in lending platforms such as Maker and Aave, and is also the basic trading pair in many DEXs. With the expansion of DeFi applications on L1 and L2, the demand and liquidity of ETH have also increased.

Although BTC is recognized as the primary store of value asset, WBTC, which is used in a packaged form on Ethereum, involves additional trust bridging issues. At present, it seems unlikely that WBTC will replace ETH's position in Ethereum DeFi - the supply of WBTC has been stable for a long time, more than 40% lower than the previous peak. On the contrary, ETH's value and role are becoming increasingly prominent due to its wide applicability in a diverse secondary ecosystem.

The Ethereum community's continued innovation and decentralization are parallel

Ethereum is unique in that it has maintained a strong ability to innovate while continuously advancing decentralization. The outside world sometimes criticizes Ethereum's delays in upgrading plans, but does not fully recognize the difficulty of coordinating many developers from different backgrounds to achieve technical progress.

You know, in order to ensure the uninterrupted operation of the network, teams involving more than five execution clients and four consensus clients must work closely together to promote updates.

For example, since Bitcoin's major upgrade (Taproot) in November 2021, Ethereum has achieved a series of changes: including the introduction of dynamic transaction fee destruction (August 2021), the successful transition to PoS (September 2022), the opening of the deposit withdrawal function (March 2023), and the addition of Blob storage for L2 (March 2024), and many other technical improvement proposals (EIPs) in between. In contrast, some other rapidly developing blockchain platforms, although they iterate quickly, their systems appear more centralized and fragile due to their reliance on a single client.

Decentralization may make the decision-making process more cumbersome and even rigid to a certain extent, but this is also the necessary price to ensure security and fairness. For other ecosystems that may embark on a similar path of decentralization in the future, whether they can establish a development model that is both efficient and inclusive of all parties remains a challenge to be solved.

Rapid Advancement of L2 Innovation

This is not to say that innovation on Ethereum is slower than other ecosystems. On the contrary, we believe that innovation around execution environments and developer tooling is actually outpacing competitors. Ethereum has benefited from rapid centralized development of L2s, all of which pay settlement fees to L1s in the form of ETH. The ability to create diverse platforms with different execution environments (such as WebAssembly, Move, or Solana virtual machines) or other features, such as privacy protection or enhanced staking rewards, means that the slower development timeline of L1 does not hinder the adoption of ETH for more technically comprehensive use cases.

At the same time, the Ethereum community has done a lot of work to clarify the various trust assumptions and definitions when defining concepts such as sidechains, Validium, Rollups, etc., which has enhanced transparency in the industry. In contrast, similar efforts within the Bitcoin L2 ecosystem (such as the L2 Beat project) are less prominent, and the trust models that L2 relies on are diverse and often not clearly understood or well communicated.

Wide Propagation of the EVM

Innovation around new execution environments does not mean that the Solidity language and EVM will become obsolete in the short term. On the contrary, the EVM has been widely spread to other blockchains. For example, research results from Ethereum L2 are being adopted by many Bitcoin L2s. Some of Solidity's shortcomings (such as its susceptibility to reentrancy vulnerabilities) now have static tool checkers to prevent basic attacks. In addition, the popularity of the language has spawned a mature auditing industry, a large number of open source code examples, and detailed best practice guides, which are essential to cultivating a large developer talent pool.

While direct use of EVM does not necessarily increase demand for ETH, improvements to EVM are derived from Ethereum's development process, and other chains will follow suit to maintain compatibility with EVM. We believe that fundamental innovations in EVM will continue to be Ethereum-centric or will soon be absorbed by a certain L2, thereby consolidating the position of the Ethereum ecosystem in the minds of developers.

Tokenization Trend and Cumulative Advantages

We believe that the promotion of tokenization projects and increasingly clear global regulatory policies will first benefit Ethereum (among public chains). Financial products are generally more concerned with technical security rather than extreme optimization, and Ethereum has a natural advantage as the most mature smart contract platform. For many large tokenization projects, relatively high transaction costs (several dollars rather than a few cents) and long confirmation times (several seconds rather than milliseconds) are not major obstacles.

For traditional companies that want to enter the blockchain field, it becomes critical to have a sufficient number of skilled developers. At this point, Solidity, as the most widely used smart contract language, has become the first choice, which further strengthens the popularity of EVM. Blackstone's Ethereum BUIDL Fund and JPMorgan Chase's proposed ODA-FACT standard compatible with ERC-20 are early signals of attention to this developer group.

Ethereum supply dynamics are very different from Bitcoin

ETH's circulating supply changes are fundamentally different from BTC. Even with the sharp price increase from Q4 2023, ETH's three-month liquid supply has not expanded significantly, while BTC's active supply has increased by about 75% during the same period. Unlike the previous Ethereum mining period (2021/2022), when long-term holders increased market supply, more and more ETH is now being used for staking, indicating that staking is an important way for ETH to reduce selling pressure.

Trading Pattern Evolution

Historical data shows that ETH is more closely related to BTC than any other crypto asset. However, during the peak of the bull market or specific Ethereum ecosystem events, ETH will briefly decouple from BTC. This pattern is also reflected in other crypto assets, but to a lesser extent. This reflects that the market makes a relative assessment based on ETH's storage value attributes and the practical value of technological innovation.

During 2023, the correlation between ETH and BTC showed a special phenomenon: when the price of BTC rose, the correlation between ETH and BTC weakened; when the price of BTC fell, the correlation between the two strengthened.

This suggests that BTC price volatility is like a leading signal, foreshadowing ETH's subsequent market correlation changes. The market's enthusiasm for the high price of BTC seems to drive independent trends in other crypto assets (including ETH), especially when the market is rising, the performance of each asset type is diverse; when the market is falling, they tend to perform in line with BTC.

However, this pattern has changed after the US approved the Bitcoin spot ETF. The newly approved ETF attracted different types of investor groups, such as investment advisors and wealth management institutions, who treat BTC differently from traditional investors in the crypto field.

In a pure crypto portfolio, BTC is valued because of its low volatility, but in a traditional portfolio, it is more of a small diversified allocation. This change in capital flow and market structure caused by the change in BTC's role has affected the trading interaction between BTC and ETH. In the future, if the Ethereum spot ETF is approved for listing, ETH is expected to face similar market structural changes, and its trading pattern may be adjusted again.

Summary

We believe that ETH still has potential upside surprises in the coming months. ETH does not seem to have major sources of supply-side excess such as asset unlocking or miner selling pressure. On the contrary, the growth of staking and L2 has proven to be a meaningful and sustained growth point for ETH liquidity. Given the widespread application of EVM and its L2 innovation, ETH's position as the center of DeFi is unlikely to be replaced. At the same time, the importance of the US spot ETH ETF cannot be underestimated.

We believe that the structural demand drivers for ETH, as well as the technological innovation within its ecosystem, will enable ETH to cross multiple narratives and continue to maintain its unique position.

Wilfred

Wilfred