Author: a大桔财经

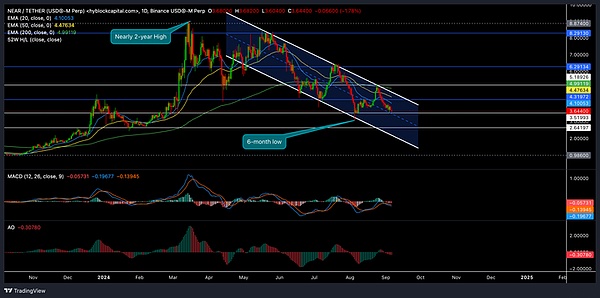

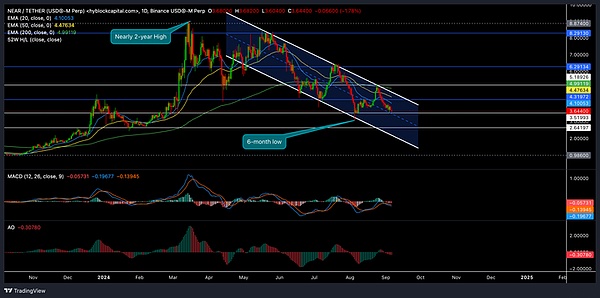

NEAR is hovering around the key $3.5 support level, and bulls need to break through the key EMA to avoid further declines to $2.6.

NEAR Protocol [NEAR] remains bearish after reaching a nearly two-year high in early March. It continues to move within a descending channel and keeps losing important support levels.

Altcoins have struggled to reverse this trend, leaving many investors wondering if a recovery is imminent or if further declines are inevitable.

At the time of writing, NEAR is trading at $3.663, gradually approaching the critical $3.5 support area, which could trigger more selling pressure if the bulls fail to emerge at this level.

Bears continue to apply pressure

NEAR’s price action continues to follow the boundaries of a descending channel, a classic indicator of bearish momentum. This pattern has pushed the coin to a 6-month low, with bulls struggling to break through the key resistance level.

The 20 EMA ($4.1) and the 50 EMA ($4.47) are trending down, suggesting that the short- to medium-term sentiment remains firmly in favor of the sellers. Currently, a major hurdle is the 200-day EMA ($4.99), which has historically acted as a dynamic resistance zone.

If NEAR loses control of the $3.5 support, the bears could easily push the price towards the $2.6 mark, which is a critical support level that could trigger further selling.

Also, the MACD histogram recently crossed below the zero line, suggesting a surge in selling pressure. The recent bearish crossover between the MACD and the signal line reaffirms the bearish advantage.

A decisive crossover above the signal line could ease the concerns of the bulls, but they would need an increase in buying volume to confirm it. Meanwhile, the Awesome Oscillator (AO) also shows negative momentum, further proving that bears are currently in control.

Derivatives Data Show

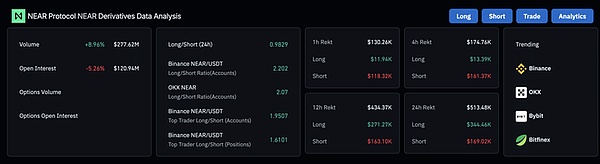

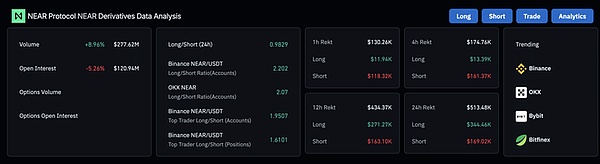

It is worth noting that recent derivatives data reinforces the bearish sentiment. NEAR trading volume increased by 8.96% to a total of $277.62 million, while open interest fell by 5.26% to $120.94 million.

The decline in open interest indicates that traders are closing their positions, signaling that the bearish trend may continue. Binance’s long/short ratio stands at 2.202, with more traders favoring long positions.

However, such an imbalance does not necessarily indicate bullish momentum as long traders could be trapped in a bear market if the key support level is breached.

NEAR bulls will face an uphill battle given the descending channel and bearish EMA placement. A break below $3.5 could open the floodgates for further declines, with $2.6 acting as the next key support.

On the other hand, a breakout above the descending channel’s upper border could pave the way for a retest of the $6.2 resistance level if broader market conditions improve.

Until then, NEAR’s short-term outlook remains bleak. Traders should keep a close eye on Bitcoin’s movements as it could significantly influence NEAR’s trend.

In short

Currently, NEAR has recently broken below the 20, 50, and 200-day EMAs, showing strong selling pressure. Derivatives data show that market sentiment is mixed, with sellers having a slight advantage. The market has been volatile recently, and technical indicators and market sentiment in the short term support a bearish outlook. Despite the positive non-farm data, it is still falling. Looking back at the last rate cut cycle, Bitcoin completed its gains ahead of the rate cut, and began to plummet and fall overall one month before the rate cut. It was not until March 2020 that the liquidity was completely released after the unlimited QE, and the bull market of 2020-2021 was ushered in. I believe that the subsequent liquidity improvement is still unknown. The current priority is to stay alive and wait for this moment to come. I believe that dawn is not far away.

JinseFinance

JinseFinance