Polygon, the Ethereum scaling solution, released a new proposal in June 23, intending to upgrade the original main chain Polygon PoS to zkEVM Validium, and proposed a major update towards 2.0 the following month, proposing to upgrade the native token MATIC to POL to support the ecological protocols Polygon PoS, Polygon Supernets and Polygon zkEVM.

On the evening of July 18, Polygon officially announced on the social platform X that the community has agreed to the proposal to upgrade MATIC to POL, and the upgrade is scheduled to be officially launched on the main network on September 4. Polygon officials added that they had launched a testnet upgrade on July 17 to identify and fix potential problems.

On August 28, the official X released 《POL Upgrade | Everything to Know》, officially announcing the details of the upgrade. In the last round of bull market, the Polygon ecosystem performed well in terms of both ecology and TOKEN price, but in this special cycle, I did not see too many eye-catching performances.

How should we view the upgrade and renaming from $MATIC to $POL? 137Labs has made a detailed review of this upgrade based on official documents and AMA, and will take you to understand the details of this upgrade.

First, let’s learn from Polygon’s official “Migration is coming: Matic will migrate to POL on September 4” AMA.

Spokespersons

Sandeep Nailwal - Co-Founder

Mihailo Bjelic - Co-Founder

Marc Boiron - CEO, Polygon Labs

David Silverman - VP of Product, Polygon Labs

Paul Gebheim - Director of Product Team

Q1

Migration to MATIC Is there a deadline to migrate to POL? There is no fixed deadline for migrating MATIC to POL. The migration process began in October last year, and the upgrade on September 4th is an important step in this transition. After this date, all MATIC on the Polygon PoS chain will be automatically converted to POL without user intervention. For users who are staking MATIC, you can continue to stake and the staking contract will handle the transition process. If you choose to stake POL directly, you will benefit from lower gas fees than the migration process. Please note that although there is no deadline, the migration on Ethereum will incur gas fees, while the upgrade for Polygon PoS users will be automatic with no additional fees.

Q2

Why does my wallet still show MATIC instead of POL after the migration?

Your wallet may still show MATIC as the token name needs to be updated. Wrapped MATIC may also continue to show as MATIC until the upgrade is fully processed. Some wallets may update automatically, but you may need to adjust manually.

Q3

Have the POL token and migration contracts been audited?

Yes, the POL token and migration contracts have been thoroughly audited. HEXENS and at least two other teams audited the migration and token contracts. In addition, the staking migration and PoS native token upgrade were audited twice. The Polygon Labs team and external partners such as Stader, Lido, and Coinbase have also contributed to improving the security and reliability of the code. All audit reports can be viewed in the Polygon Token Repository.

Q4

What happens to MATIC held in smart contracts (such as liquidity pools) on Polygon PoS? MATIC in smart contracts (including liquidity pools) will be automatically upgraded to POL. If you are a liquidity provider, your positions (such as MATIC-ETH trading pairs) will be seamlessly switched to POL on the first day without any changes. The process has been thoroughly tested at various levels to ensure that your LP positions continue to work properly. If MATIC is still showing in the application UI, please contact the developer for updates.

Q5

What will happen to existing dApps or protocols on Polygon PoS during the migration process?

The migration is designed to be seamless with minimal impact to existing dApps or protocols. Most applications will not require any changes, but a few may have small utility fixes by the end of September. Some DAOs may propose updates, such as switching oracles from MATIC to POL. Overall, the impact on contracts is minimal, but it is always best to confirm the specific details with your exchange or development team.

Q6

What should I do if I hold MATIC (including staked MATIC) on a centralized exchange? How will the migration work?

If you hold or stake MATIC on a centralized exchange, please follow the specific guidance provided by the exchange. Each exchange may handle the MATIC to POL migration differently, so it is important to follow their instructions. Some exchanges, such as Kraken, have begun sharing FAQs and guides. Remember, the migration is not urgent, take your time to understand the process, and be careful of any possible scams. The best way is to stay updated and follow the instructions of the exchange to ensure a smooth transition.

Q7

What will happen to Wrapped MATIC (wMATIC) during the migration? Do users need to operate other ERC20 tokens on Polygon POS?

Wrapped MATIC (wMATIC) on Polygon POS is similar to Wrapped ETH on Ethereum, as an ERC20 representation of the native MATIC token. During the migration process, wMATIC will also be converted to POL, but the data on the chain will still be called wMATIC until the hard fork updates the wrapper contract. This change will be made later, so users should expect the name to be updated to wPOL after the hard fork. As for other ERC20 tokens on Polygon POS, the migration will not affect them and all applications should continue to function normally.

Q8

What happens if I transfer MATIC to Polygon POS before or after the migration?

If you transfer MATIC to Polygon POS before the migration, it will be automatically converted to POL during the migration process. After the migration, if you transfer MATIC to POS, it will also be converted to POL on the POS side. Regardless of when you make the transfer, you will end up with POL on the POS side. If you decide to withdraw POL later, you will receive POL, but you can use the migration contract to convert it back to MATIC if needed. This setup ensures smooth backward compatibility throughout the process.

Q9

Will my stMATIC tokens automatically migrate to POS on DeFi platforms?

Your stMATIC tokens still represent your staked MATIC, and no major changes are expected as the staking transition is fully backwards compatible. The name and ticker of stMATIC will remain the same, and it will represent the combined balance of MATIC and POL staked in the Lido system. In practice, nothing will change for stMATIC holders - you can continue to stake and use the token. If you have any concerns, it is best to contact the Lido on Polygon team for specific details.

Q10

What happens if I hold MATIC on another Layer 2 (such as zkEVM, Arbitrum, or Optimism)? What steps should I take?

If you find yourself holding MATIC on another Layer 2, you have a few options:

Liquidity Pools:There may be liquidity pools set up on that Layer 2 chain where you can redeem MATIC for POL or other assets. These pools are usually set up on permissionless decentralized exchanges.

Move to Layer 1:You can transfer MATIC from Layer 2 to Layer 1, convert it to POL using the migration contract, and then decide whether to move it back to Layer 2 or explore other options on Polygon POS or zkEVM.

If you use another Layer 2:Make sure it is secure and provides the flexibility you need. Always use other Layer 2s at your own risk!

Q11

How does the community participate in the governance of POL, and what future roles might POL play in the ecosystem? The POL token plays an important role in Polygon's governance and ecosystem, providing several ways for the community to participate?

Governance Participation:

Polygon Improvement Proposals (PIPs):Anyone can submit PIPs to propose changes or improvements to the network. This process is critical to the growth of the Polygon ecosystem, including proposals about POL itself.

Governance Calls:The community can attend Polygon Protocol Governance (PPG) meetings to discuss and provide feedback on proposed changes. This is an opportunity for anyone interested in the governance process to participate.

Protocol Council:

Council Elections:The Protocol Council is a community-elected team that executes protocol upgrades. Discussions are currently underway on how to elect council members using POL and introduce emergency measures if necessary.

Community Finance:

Fiscal Management:POL participates in the management of the Community Finance, a self-sustaining fund that supports various parts of the Polygon ecosystem. In the future, POL may be used for signaling or to elect members of the Community Finance Committee.

Overall, POL enhances community participation in governance and ensures that decisions are driven by the community, establishing multiple mechanisms to integrate POL into the governance and future development of the ecosystem.

The above is the official AMA Q&A on this upgrade. Next, we will learn more about this upgrade from the official release of "POL Upgrade | Everything to Know".

The upcoming migration of MATIC to POL on September 4 marks an important evolution for the Polygon ecosystem, reflecting its broader and ambitious vision. Initially unveiled as Matic Network, Polygon has grown into a multi-faceted ecosystem, known for its popular PoS chain. The migration is the final step since Matic’s rebranding to Polygon in 2020, and is designed to align the network’s token with its expanded multi-chain architecture.

Polygon’s evolution from a single-chain network to a comprehensive multi-chain infrastructure was born out of the realization that a single chain could not support the long-term growth required for global Web3 adoption. The rebrand to Polygon symbolized the shift to the Internet of Blockchains, driving a more scalable and interconnected ecosystem. However, the original MATIC token did not fully reflect the Polygon Network’s expanded vision. The upcoming POL migration is the culmination of this evolution, representing the final implementation of Polygon’s multi-chain roadmap and its promise to support decentralized, community-driven networks.

POL will not only enhance the technical capabilities of the Polygon ecosystem, but will also empower the community through a decentralized decision-making process, especially in funding and network growth initiatives. Through POL, the community will play a greater role in driving ecosystem growth, benefiting from an issuance mechanism that was not possible during the MATIC period. This migration will also diversify the use cases of POL, enabling it to support a variety of networks within the Polygon ecosystem, from PoS chains to AggLayer and zkEVM chains, reducing dependence on a single network and paving the way for continued expansion and innovation of the Polygon ecosystem.

Token Economics of POL

1. From Productive Tokens to Super Productive Tokens

The evolution from Bitcoin's $BTC (mostly non-productive assets) to Ethereum's $ETH (productive tokens) shows how native tokens can enhance protocol functionality and incentivize participants. Polygon’s POL represents the next step in this evolution, introducing the concept of super-productive tokens. POL enhances the utility and role of validators in the network through two key innovations:

Multi-chain Validation:Validators can now participate in and secure multiple Polygon chains, expanding their scope of operation and potential rewards.

Multiple Roles:Within each chain, validators can perform a variety of roles, such as zero-knowledge proof generation and participation in Data Availability Committees (DACs), each of which provides different incentives.

2. Main Advantages

POL introduces several significant advantages to the Polygon ecosystem:

Ecosystem Security:By incentivizing a large number of decentralized PoS validators, POL improves the security and neutrality of each Polygon chain, encouraging validators to protect as many chains as possible.

Unlimited Scalability:POL supports the exponential growth of the Polygon ecosystem, enabling it to scale efficiently and securely while adding new chains.

Ecosystem Support:POL promotes continued support for the network through sustainable protocol mechanisms, including development, research, funding, and adoption incentives.

Avoiding User Friction:POL’s design minimizes friction, eliminating the need for users and developers to hold or stake tokens to access the network, improving the overall user experience.

Community Ownership:POL allows for community governance, reflecting Polygon’s commitment to decentralization and supporting a community-led decision-making process.

POL’s Utility and Incentives

The transition from MATIC to POL is more than just a simple token upgrade — it is a strategic evolution designed to lay the foundation for Polygon’s long-term success and sustainability. POL is designed to be the self-sustaining engine that drives the Polygon network, supporting its mission to become the value layer of the Internet. Here’s how POL drives Polygon’s growth and innovation through its utility and issuance model.

Validator Incentives

A key utility of POL is its role in incentivizing validators. Validators are the backbone of the Polygon network, ensuring its security and scalability. POL's issuance model allocates a portion of POL to validators. Here is how POL drives growth and innovation at Polygon through its utility and issuance model:

Incentivizing Security:A large portion of POL issuance is designated as staking rewards for validators. This ensures that validators always have an incentive to participate and protect the network, maintaining its resilience and integrity.

Supporting Scalability:With a stable supply of rewards, the validator pool can grow efficiently to support an increasing number of chains and transactions. This scalability is critical to maintaining the performance and reliability of Polygon.

Community Treasury

Funded by another portion of POL issuance, the Community Treasury serves as the command center for the Polygon ecosystem. Managed by the Community Treasury Committee, the fund supports several key functions:

Ecosystem Development:The Treasury allocates resources to protocol development, research, funding, and adoption initiatives. This ensures that the network can continue to support its evolution and adaptation as it faces new challenges and opportunities.

Sustainable Growth:By continuously funding development and innovation, the Community Treasury helps Polygon stay at the forefront of blockchain technology. This ongoing investment supports the long-term growth and adaptability of the network.

Continuous Innovation Funding

POL’s issuance model provides a steady stream of funds to drive Polygon’s innovation and growth:

Research and Development:The Community Treasury funds new projects and research, pushing the boundaries of blockchain technology and ensuring Polygon always stays ahead.

Funding and Incentives:By providing funding and incentives, the Treasury attracts new developers and projects, fostering a vibrant innovation ecosystem.

Enhanced Network Security and Stability

POL’s issuance model also contributes to the security and stability of the network:

Reliable Validator Incentives:With guaranteed rewards, validators are more likely to commit to the network in the long term. This stability is critical as Polygon scales and handles increasing transaction volumes.

Decentralization:A well-incentivized validator pool promotes decentralization, maintaining the resilience and reputation of the network.

Flexibility and Community Governance

The issuance model incorporates flexibility and community governance:

Adjustable issuance rate:The community can adjust the issuance rate through the governance mechanism. This flexibility allows Polygon to adapt to changing needs and maintain its efficiency.

Community Participation:By involving the community in decision-making, the network aligns with the priorities of users, fostering a sense of belonging and participation.

Long-term Vision

POL’s issuance model supports Polygon’s long-term vision

Sustainable Ecosystem:Continued funding ensures that key areas such as security and development are fully supported, maintaining Polygon’s competitive advantage for many years to come.

Mainstream Adoption:By ensuring security, scalability, and innovation, the model positions Polygon as a leading platform ready to support a wide range of applications and use cases.

The annual issuance model is more than just a strategy; it is the lifeblood of the Polygon aggregate blockchain network. By providing continuous funding support for validator rewards and the community treasury, POL ensures Polygon’s security, innovation, and resilience. This model acts like a constantly replenishing source of energy, driving the network’s growth and adaptability, and preparing for future challenges and opportunities.

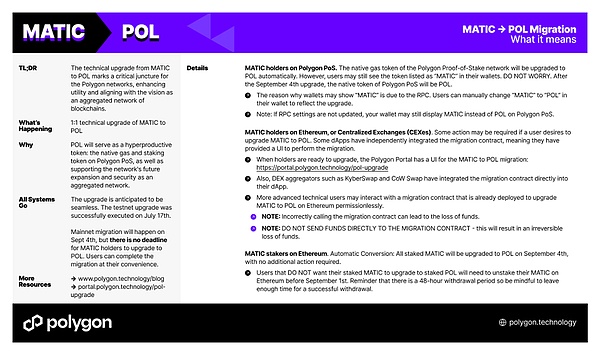

How do I migrate from MATIC to POL?

Automatic Migration:For MATIC holders on Polygon PoS, no action is required. Your MATIC tokens will be automatically converted to POL on September 4th. All liquidity pools, DeFi applications, and NFTs will seamlessly transition to POL, ensuring a smooth experience for you without any action required.

Manual Migration:If you hold MATIC on Ethereum, please use the migration link in the Polygon Portal to upgrade from MATIC to POL. Simply follow the instructions provided to complete the migration process.

CEX Migration:Centralized exchanges will handle the MATIC to POL upgrade according to their own processes. Please check your exchange's official notification for specific details about the migration.

Conclusion

The MATIC to POL migration on September 4th marked a key milestone in the development of the Polygon ecosystem. This transition represents the final step in Polygon's vision to become a comprehensive multi-chain network. Polygon's journey from a single chain to a multi-chain architecture is now about to be completed with the introduction of POL, a token designed to match the network's scaling capabilities and ambitions.

The transition to POL is more than just a token upgrade; it is a strategic evolution that advances Polygon's technical capabilities and decentralizes the decision-making process. With POL, validators will gain new incentives and roles, supporting the security and scalability of the entire network. This efficient token model will enable Polygon to scale infinitely, support diverse use cases, and promote community-driven governance.

POL's utility goes beyond its role as a token; it drives ecosystem growth by providing incentives for validators, establishing a community treasury for development and innovation, and a governance model that promotes community participation. The migration process is designed to be seamless, and MATIC holders on Polygon PoS will be automatically upgraded, while users on Ethereum or centralized exchanges will be given clear migration guidelines.

Overall, POL will drive Polygon to achieve its long-term vision of becoming the value layer of the Internet. This migration represents an important step forward, ensuring that Polygon is at the forefront of blockchain innovation while promoting decentralized and community-driven networks.

It is worth noting that $MATIC faced a heavy regulatory blow from the US SEC as early as mid-June last year, and was repeatedly classified as a security by the SEC, causing the price to collapse at the time. Although the official response stated that Polygon was developed and deployed outside the United States, it is still unknown whether MATIC can escape the pressure of US regulators after upgrading to POL.

Whether this upgrade can bring Polygon ecology back to the forefront and rekindle the market's passion for its ecology, and whether $POL can perform well requires more efforts from the official. What new expectations do you have for the Polygon token after the name change? What new opportunities will $POL have?

JinseFinance

JinseFinance