What is DeSci / Pump Science? What do the popular tokens mean?

You who hype memes are like civets in a melon field, wandering back and forth between the zoo/AI/DeSci.

JinseFinance

JinseFinance

Author: Ac-Core, YBB Capital researcher; Translation: 0xjs@金财经

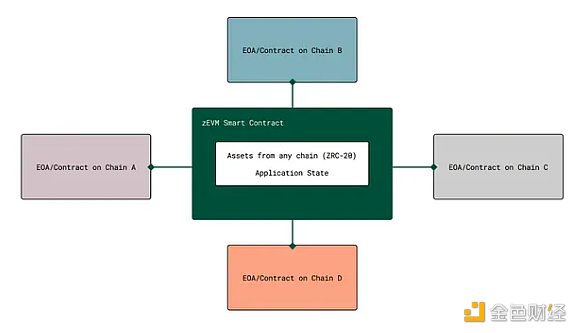

ZetaChain (ZETA) is a layer 1 blockchain designed to bridge various the gap between blockchain networks. Leveraging the Cosmos SDK and Tendermint consensus mechanism, it enables developers to custom build scalable, interoperable applications. The platform allows decentralized applications (DApps) to leverage the capabilities of multiple blockchains to solve current cross-chain protocol issues and achieve full-chain cross-chain functionality. The use of full-chain smart contracts and the ZetaEVM engine promotes interoperability, making ZetaChain a central integration hub.

< /p>

< /p>

Image source: ZetaChain official website

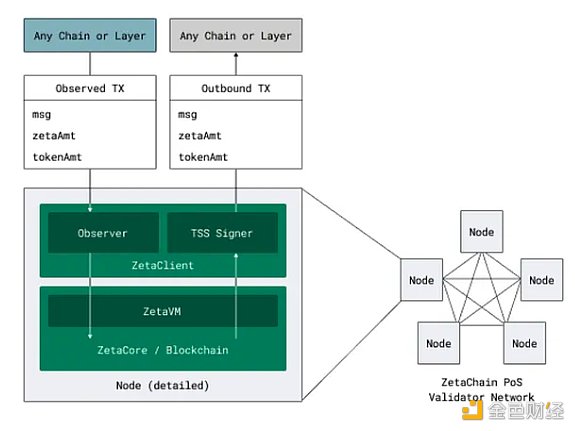

ZetaChain uses Cosmos SDK, Based on the Tendermint consensus engine and Proof of Stake (PoS) model, it demonstrates unique full-chain interoperability capabilities. It uses its own token as Gas fee and has the advantage of extending the full-chain EVM smart contract. As Jed Barker explains, ZetaChain works like this:

Full-chain smart contracts: The core of ZetaChain It is a smart contract that can interact with multiple blockchains. These smart contracts are supported by the ZetaEVM engine, which is compatible with the Ethereum Virtual Machine and allows cross-blockchain data interaction;

Seamless asset transfer: Simplify asset transfers between blockchains without complex bridging. This includes support for blockchains without native smart contract functionality, such as Bitcoin;

Cross-chain messaging: For simpler data exchange ( For example, NFT transmission), ZetaChain provides cross-chain messaging capabilities to promote lightweight data transmission between different networks;

Manage external assets: ZetaChain extends its functionality to manage assets on other blockchains, applying smart contract logic to chains that typically lack this functionality.

Like other architectures, Zeta can provide numerous cross-chain messaging functions, but its unique advantage lies in supporting full-chain EVM Contract, known as "THORChain with smart contracts" or "Axelar with EVM". It uses the Cosmos SDK and CometBFT consensus to create a PoS blockchain, similar to THORChain. Zeta utilizes the ZETA token as a routing token for cross-chain messaging.

The explanation is as follows: ZetaCore is a client that generates blocks and runs Layer1, similar to other PoS blockchains. ZetaClient is responsible for cross-chain operations, and other nodes run ZetaCore and ZetaClient at the same time. Zeta nodes perform three key functions: verification, observation, and signing, each function is operated by a different role within each node. The architecture supports two key functions: full-chain smart contracts and cross-chain messaging.

Image source: Delphi Creative

· Verifier:Standard CometBFT Verifier , like validators on other PoS chains, stake ZETA and vote for blocks;

· Observers: Observers need to run the full nodes of the external chain, which are divided into Sorters and validators. Orderers oversee events on external chains and send them to validators, who vote on events to reach consensus. The role of the sequencer is only to ensure validity; any node can sequence transactions. This makes running a Zeta node more expensive than running a standard chain, similar to THORChain, which is one of the reasons why THORChain did not add Solana support;

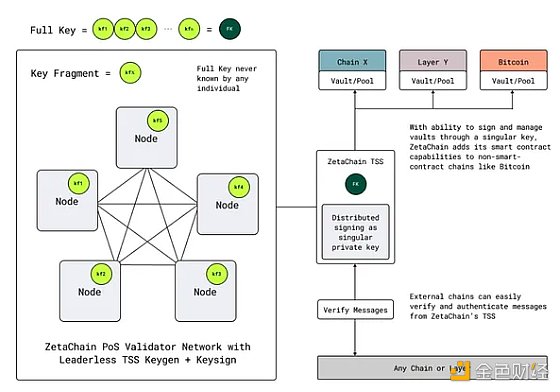

· Signed by:Node Sharing ECDSA/EdDSA keys, only the vast majority (2/3) of nodes can sign transactions on the external chain. Signers are Zeta's method of hosting assets and signing information on external chains. They can be used to interact with smart contracts and custodial assets on smart contract platforms such as Ethereum, as well as custodial assets on non-smart contract chains such as Bitcoin and Dogecoin. The image below in the white paper shows the signature chart.

Image source: Delphi Creative

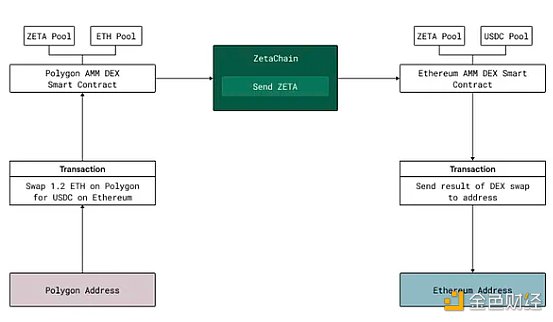

CCMP by using ZetaChain Act as an intermediary to implement information routing between other chains. Other protocols, such as LayerZero, Axelar, IBC, Chainlink CCIP, and to some extent THORChain, are also competing in this direction. For ZetaChain, however, their cross-chain messaging protocol is implemented using its native token ZETA, which fundamentally differentiates it from its competitors. With the exception of THORChain, other competitors do not rely on their native tokens for value transfer. A cross-chain DEX example in the white paper visually demonstrates ZETA’s role in messaging. In this example, if the user wants to exchange 1.2 ETH on Polygon for USDC on Ethereum, the path is:

1. Exchange ETH for ZETA on Polygon AMM;

2. Send ZETA to ZetaChain;

3. Route ZETA from ZetaChain to Ethereum;

4. Exchange ZETA for USDC on Ethereum;

p>

5. The user receives Ethereum USDC.

< span style="font-size: 14px;">Image source: Delphi Creative

< span style="font-size: 14px;">Image source: Delphi Creative

Although logically feasible, this solution requires a lot of funds, which somewhat weakens its relationship with The competitiveness of intent protocols such as Squid and UniswapX, as well as Circle's CCTP, has taken a considerable market share as a settlement track. In addition to capital efficiency, cross-chain messaging is a highly competitive arena.

Deploying cross-chain smart contracts on Zeta provides developers with many benefits beyond just using Zeta and zEVM to facilitate transactions. First, it can interact with assets that do not originally support smart contracts, such as BTC, DOGE, and LTC. Second, by locating application state on Zeta, it minimizes the vulnerability attack surface and does not rely on the liquidity of the ZETA token for value transfer. Among its competitors, apart from Axelar which adopts CosmWasm instead of EVM, no other protocol currently offers such a product and has not seen any adoption to date.

ZetaChain’s cross-chain smart contracts are supported by the TSS protocol, with validators running full nodes on external chains and sharing signatures so they can escrow assets on behalf of ZetaChain and its users. zEVM is then able to manipulate these assets as needed. It is important to note that in this process, for example, BTC is not transferred directly from Bitcoin to Zeta, but to an address hosted by Zeta validators and then represented on ZetaChain, similar to how THORChain escrows BTC for the protocol Add smart contract functionality.

Image source: Delphi Creative

Under this framework, Zeta has the ability to develop many unique protocols, such as :

Cross-chain CDP stablecoin supported by BTC;

BTC, DOGE Money market for , LTC and other non-smart contract assets;

Cross-chain Perp DEX;

Cross-chain revenue aggregator ;

BTC AMM.

Fundamentally, what is unique about the combination of ZetaChain’s zEVM and ZetaClient is its custody and control of on-chain assets that do not directly support smart contracts. While most cross-chain platforms serve as backend infrastructure, ZetaChain helps create your own cryptocurrency economy on ZetaChain.

As the cornerstone of the ZetaChain ecosystem, ZETA plays a vital role in programmability and governance. ZetaChain is known for its interoperability and support for cross-chain dApps, with key network activities relying on ZETA.

Network incentives: ZETA tokens incentivize verification through block rewards Or, transition from fixed pool to variable inflation. This system aligns the interests of validators with the long-term security of the network;

Transaction fees: Transactions within ZetaChain require ZETA to pay Gas fees, which will be distributed to validators and network participants, helping to prevent spam and DDoS attacks;

Cross-chain messaging and value transfer: For cross-chain transactions, ZETA is burned on the source chain and Minted on the target chain, no need to create new packaging assets;

Core Liquidity Pool: ZetaChain’s liquidity pool is composed of ZETA and other assets, promoting user transactions to liquidity Providers pay fees and rewards;

Governance role: ZETA holders participate in network governance and influence key decisions and policy changes to ensure that the network develops with the community.

Overall, ZETA’s multifaceted utility supports ZetaChain’s security, efficiency, and decentralized governance, making it an essential part of the network’s functionality.

The initial total supply of ZETA tokens is set at 2.1 billion, with an annual inflation rate of approximately 2.5% planned after four years. Token allocation (see reference link 1) is strategically allocated to various parts of the ecosystem:

User Growth Pool (10%): Aims to expand the user base through airdrops and community rewards;

Ecosystem Growth Fund (12%): supports ecosystem development and helps partners and dApp developers;

Validator rewards (10%): For block rewards, transition to inflation-based network security rewards after the initial period;

Protocol Vault (24%) : Funding operation, development and ecosystem strengthening;

Core contributors, consultants and buyers (22.5% and 16%): Rewards for contributions to the development and growth of ZetaChain contribute.

Unlike current cross-chain deployments, ZetaChain, as the base layer of the protocol, can achieve liquidity between all different deployments interoperability. For example, users on ZetaChain can deposit margin into a central contract and hold a GMX position. This forms the core premise of Zeta’s cross-chain application (position management is on Zeta), meaning users who want to take advantage of GMX’s full liquidity need to use ZetaChain.

In addition to ensuring execution quality, there are two key advantages:

Similar to the MUX aggregator (please See reference link 2), which allows splitting asset orders across various liquidity sources;

Access to more trading pairs without having to manually connect all relevant chains.

Smart contracts on ZetaChain can directly deposit the required margin amount into the relevant chain, along with instructions on how to use the assets. While this process technically does not require ZetaChain, it can enhance the user experience by:

Facilitate inter-chain interaction;

Allows integrated management rather than isolated management.

UniSwap, the market leader in the DEX space, may shift the center of its operations from Ethereum to any other chain. However, in theory, by deploying on ZetaChain and using the ZRC-20 standard, users can swap in and out of any asset (across any chain) and have said asset hosted on any chain of their choice.

Picture source: LayerZero official website

In the cross-chain transfer market, LayerZero is ZetaChain’s biggest competitor. Although LayerZero does not participate in the competition in the field of full-chain smart contracts, LayerZero's market position in cross-chain transfers is very solid. The main advantage of LayerZero comes from Stargate, followed by LayerZero's promotion of OFT standards (providing new solutions for cross-chain token transfers, making token transfers between different chains simpler and more efficient).

LayerZero Architecture

As a brief introduction, LayerZero is a protocol that allows "user applications" to send information across blockchains. The architecture consists of 4 main parts:

User application: a contract that interacts with the LayerZero Endpoint and sends/receives information (e.g. Stargate) ;

LayerZero Endpoints: a series of smart contracts on different chains (currently supporting more than 40, see reference link 3). Endpoint allows user protocols to send information through the LayerZero backend and consists of 4 modules: Communicator, Verifier, Network and Libraries. The first three modules are standardized on all chains, while Libraries are customized according to different chain logic, allowing LayerZero to quickly add more chains;

Oracle : Responsible for reading block headers from one chain and sending them to another chain. Currently, this role is assumed by Chainlink by default, but as of September 2023, a new partnership with Google Cloud will replace Chainlink as the default role;

Relay : Similar to relays, but they get proofs instead of block headers. Although the application itself can act as a repeater, it is actually handled by LayerZero.

This design essentially boils down to a 2/2 multisig, where the main trust assumption is that Google Cloud and LayerZero are not colluding. Relying on these off-chain components (such as oracles and relayers) can benefit from a lightweight, cheap, and scalable architecture, but also has the disadvantage of relying on two centralized entities, which may expose it to censorship risks.

Image source: Axelar official website

Compared with LayerZero, Axelar’s The structure is more similar to Zeta, but there are significant differences. Like ZetaChain, Axelar is developed using the Cosmos SDK. But it does not directly host the EVM, so it does not support the same type of full-chain smart contracts as Zeta. Therefore, Axelar's target market is cross-chain messaging, similar to LayerZero.

Axelar Architecture

Axelar is a PoS chain with a validator set and a staking token AXL, consisting of the following components and processing information:

Cross-chain GMP request: API that allows applications to send arbitrary data across chains. These message requests are sent to the Axelar gateway (an online platform or digital system that uses blockchain technology to transfer digital currency from one address to another);

Gateway: User / The first stop for application-initiated cross-chain messages routed from the source link to the target chain. For the EVM chain, these are smart contracts, and for Cosmos, these are application logic. The gateway is secured by Axelar validators using MPC, whose shares are weighted by AXL token delegation;

Message processing and relays: Relayers listen for events (gateway information) and Submit it to the Axelar network for processing. Although anyone can run a relay, there is no incentive mechanism and the relay is operated by Axelar;

Information verification: The verifier performs verification on the information received from the relay vote. Each Axelar validator runs a full node for each source chain, thus being able to verify the validity of messages. Compared to a typical Cosmos PoS blockchain, where validators rely on light clients and IBC for messaging, Axelar validators require more resources. In a sense, this model is not as widely scalable as LayerZero, but it offers a higher degree of decentralization. Axelar incentivizes its validators with additional listening rewards; the more chains they support, the more rewards they receive. In the long term, supported chains will need to generate sufficient fees from cross-chain activity, as token rewards for supporting validators running more than 50 full nodes will be exhausted. It may not be feasible to support every chain; instead, they may be concentrated on the main liquidity chain;

Submit information to the target chain: Relayer listens for verification from Axelar Authorization information of the author and pushes it to the gateway of the target chain. Once the target chain receives the approval message, its payload is marked as approved by the Axelar validator. Now, anyone can execute the payload;

Gas and executor services: In the final step, Axelar deploys a contract called "Gas Receiver" on the EVM chain, Used to pay gas fees on the target chain and perform cross-chain loads (sending them to the desired application). Users can pay using the gas tokens of the source chain, and Axelar takes a share of the gas of the target chain.

In general, its structure is similar to ZetaChain, except that it supports EVM on its own chain. In terms of security, Delphi Research considers it more secure than LayerZero's 2/2 model, although it still has some shortcomings. Since applications can run their own relays, the likelihood of collusion between Google and LayerZero is very low.

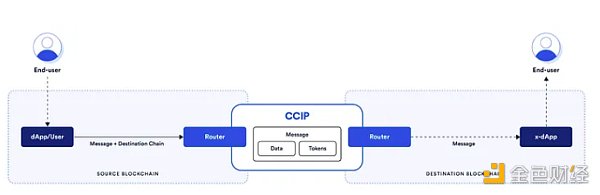

Image source: Chainlink official

Cross-chain interoperability protocol ( CCIP) is not much different from other cross-chain information platforms. Users send information on one chain, the information is forwarded to CCIP, and then CCIP forwards the information to the target chain. What sets CCIP apart is how it leverages Oracle Networks and adds another entity: the Risk Management Network (RMN).

CCIP is divided into two parts: on-chain and off-chain.

On-chain components:

Router: initiates cross-chain transactions. Route the transaction to the destination-specific OnRamp contract, receive the information from the target chain's OffRamp, and route it to the end user/contract;

Commit storage: Submit DON will The Merkle root of the source chain is stored on the target chain. Merkle roots must be "verified" by the risk management network;

OnRamp: one contract per chain (blockchain to blockchain). Verify information and track token transfers/information, manage billing, and more. Monitored by Committing DON;

OffRamp: Similar to OnRamp, one contract per chain. Use the Merkle Root submitted and "verified" to verify the execution of DON, ensure the authenticity of the information, and pass the information to the router;

Token Pool: Tokens can be "locked and minted” or “burned and minted,” depending on the token. For example, since CCIP does not have minting rights, native Gas tokens must be locked and minted. If integrated with CCTP, USDC can be "burned and minted";

Risk Management Network Contract: Contains transactions that can be "verified" (approved) or "invalid" (disapproved) List of risk management network nodes.

Off-chain components:

Committing DON : As mentioned before, Committing DON monitors the OnRamp contract event, waits for the source chain result, and creates the Merkle Root (signed by the legal Committing DON oracle node), and finally writes it into the Commit Store contract of the target chain;

Risk Management Network: A network of nodes that essentially double-checks the Merkle roots of DON submissions. They monitor the OnRamp contract and what Committing DON publishes in the commit store. If the RMN does not "validate" (i.e. verify/confirm) the Merkle Root, the CCIP will freeze;

Perform a DON: similar to commit, but oversees information such as the risk management network. Once the RMN issues a "verification", the executing DON calls the OffRamp contract to complete the destination's CCIP transaction.

In fact, to break the isolation effect between chains, it is crucial to solve the problems of "multi-chain communication" and "cross-chain communication" . Compared with other solutions, the core advantage of the ZetaChain project lies in its cross-chain interoperability, which makes interoperability between different blockchains possible and solves the current problems of blockchain fragmentation and lack of interoperability. Its goal is to enable full-chain dApps to interact directly and natively with different blockchains without wrapping or bridging any assets. However, there are security risks in external chains connected to ZetaChain, which may lead to double spending, censorship, reorganization, hard forks, chain splits, etc.

Currently, LayerZero and Axelar are leading the way in cross-chain information applications. However, it is too early to declare who will be the ultimate leader. While looking forward to ZetaChain’s new solutions, we also look forward to the continuous iteration and innovation of LayerZero, Axelar, Chainlink CCIP, etc.

1. The Future Opportunity for Full-Chain Applications https://members.delphidigital.io/reports/zetachain-part-2-the-opportunity- ahead-for-omnichain-applications#consumer-aggregation-apps--improving-the-on-chain-derivatives-experience-56d5

2. What is ZetaChain? https://www.datawallet .com/crypto/what-is-zetachain

3. The Competitive Landscape of Blockchain Bridging https://members.delphidigital.io/reports/zetachain-part-1-a-competitive-landscape- of-blockchain-bridges#architecture-ed17

Additional Links:

1. Zeta Token Distribution https://www.zetachain.com/docs/about/token-utility/ distribution/

2. MUX Aggregator Whitepaper https://docs.mux.network/protocol/overview/leveraged-trading-aggregator

3. Supported Contracts by LayerZero https: //layerzero.gitbook.io/docs/technical-reference/mainnet/supported-chain-ids

You who hype memes are like civets in a melon field, wandering back and forth between the zoo/AI/DeSci.

JinseFinance

JinseFinanceThe difference between Based Rollup and traditional Rollup.

JinseFinance

JinseFinanceBy using Ethereum for sorting, Taiko aims to be more decentralized than Rollups that use centralized sorters, which describes the situation for most L2s today.

JinseFinance

JinseFinanceETC, the full name of which is “Ethereum Classic”, can be translated into Chinese as “Ethereum Classic”. It is an open source blockchain platform that can be used to write decentralized applications (DApp) run and driven by smart contracts.

JinseFinance

JinseFinanceAOVM is an AI layer protocol built on top of @aoTheComputer, combining AO's hyper-parallelism with AI large models.

JinseFinance

JinseFinanceRecently, the airdrop released by the cross-chain interoperability L1 public chain @zetablockchain has attracted market attention on the "chain abstraction" track. What is chain abstraction, what are the difficulties in full-chain interoperability, and what are the core features of ZetaChain?

JinseFinance

JinseFinanceDencun includes 9 EIPs that enhance everything from security to the staking experience.

JinseFinance

JinseFinanceAs a product of its times, Dogecoin has its own set of problems. DogeLayer is here to fix just that.

Max Ng

Max NgZetaChain is teaming up with Galxe to let users explore the power of omnichain functionality. Check out the guide for instructions to claim these OATs!

Nell

Nell Cointelegraph

Cointelegraph