Author: Leon Wankun, Bitcoin Magazine; Compiler: Wuzhu, Golden Finance

Bitcoin skeptics often argue that Bitcoin lacks intrinsic value and claim that real estate, for example, has investment advantages such as tangible cash flow.

In this article, I will debunk the myth of "intrinsic value" and show why cash flow has no direct impact on an asset's ability to serve as a reliable store of value, even in the context of real estate.

The Myth of Intrinsic Value

The idea that value is inherently embedded in something is a misconception. This common belief is influenced by the Labor Theory of Value (LTV), a flawed concept used in classical economics, Marxism, and modern economic theory that holds that value is inherently tied to labor, energy input, or output, misinterpreting how economic value is perceived. This belief extends to real estate, arguing that its ability to generate cash flow through rent or its utility as living and productive space gives it intrinsic value. However, the concept of intrinsic value is fundamentally flawed.

The Subjectivity of Value

In free markets characterized by voluntary transactions, value is clearly subjective. Both parties to a transaction believe that what they receive is more valuable than what they pay, suggesting that value is determined by personal perception rather than intrinsic quality.

Take a Rolex watch: its value not only reflects the extensive labor involved in its craftsmanship, but is also significantly influenced by its scarcity and the individual's desire to own it. This principle of subjective valuation is across the board; the value of assets, including Bitcoin and real estate, is not predetermined but fluctuates based on individual perception. Understanding the subjective nature of value is essential to grasping the true nature of Bitcoin’s value, suggesting that its importance, like a luxury watch or real estate, is deeply rooted in collective demand and limited availability rather than inherent properties. Austrian School of Economics pioneer Carl Menger, arguably the inspiration for the cypherpunks who created Bitcoin, demonstrated as early as the 19th century that prices are a reflection of subjective valuations. Recognizing the importance of subjective valuations is key to understanding Bitcoin’s advantage over real estate as a store of value. Menger noted that value can only exist if humans are aware of the existence of economic goods and their influence has personal (subjective) importance. Subjective theory of value is similar to the perception of beauty, beauty is in the eye of the beholder. Just as beauty standards vary, so too do items like Bitcoin or real estate have different values, and are coveted not because of their intrinsic value, but because of the collective desire or need to own them.

Bitcoin’s Value Proposition

Bitcoin’s value does not come from its difficulty to produce, but from the unparalleled protection that the Bitcoin network gives to the value it stores (productivity) and the network’s final settlement power. This creates demand for Bitcoin, which, aside from time, is the first absolutely scarce commodity we have found in this universe. This scarcity, highlighted by a limited supply and deflationary issuance schedule, and the indestructible nature of the network, is driving demand for Bitcoin.

Real Estate’s Value Proposition

In many real estate transactions, I have found that investors often assume that the majority of profits come from price appreciation rather than direct cash flow. This observation highlights an important insight: Real estate is highly valued not so much because of the direct income it generates, but because of its scarcity and ability to hedge against inflation. This observation is confirmed when we look at the growth data of US house prices and money supply M2.

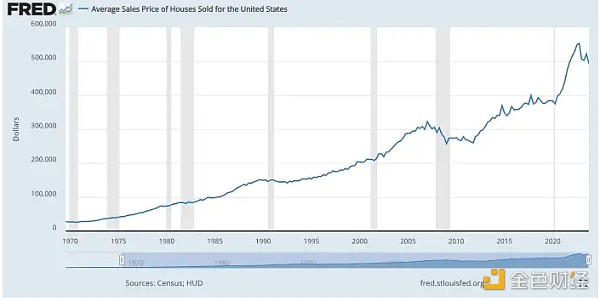

The chart below depicts the average selling price of a US home, showing the dramatic increase in house prices since 1971. The average selling price of a US home rose from approximately $27,000 in 1971 to approximately $492,000 in the third quarter of 2017-2023, indicating a substantial appreciation in real estate values (approximately 1,700%) during this period.

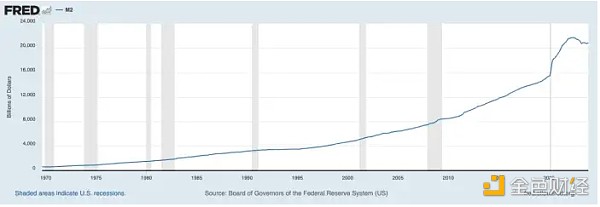

During this period, the Federal Reserve began the transition to a fiat currency system on August 15, 1971, when U.S. President Richard Nixon announced that the United States would end the convertibility of the U.S. dollar to gold. Subsequently, central banks around the world adopted a fiat currency-based monetary system characterized by floating exchange rates and the absence of any monetary standard. As shown in the figure below, the money supply M2 defined by the Federal Reserve includes easily convertible liquid assets such as cash, checking deposits, and certificates of deposit, reflecting the comprehensive range of funds that are easily accessible to people. Spending and investment have continued to grow since the dollar was separated from gold. This vividly illustrates the striking correlation between rising house prices and the simultaneous expansion of the U.S. money supply.

Analyzing the compound annual growth rates (CAGRs) of these two indicators shows a clear link between them. Since 1971, the compound annual growth rate of money supply M2 has been 6.9%, which is closely related to the CAGR of housing prices, which has been 5.7% (see the Appendix for a detailed calculation). Why does this happen?

Increases in money supply force market participants to look for ways to invest to protect against monetary inflation, and one of the most popular investments is real estate.

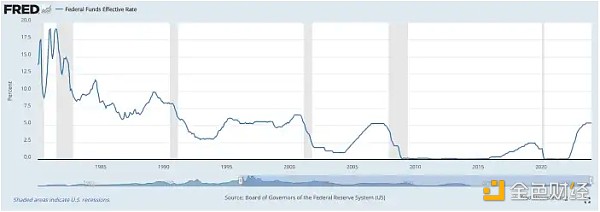

The correlation between money supply expansion and rising housing prices is influenced by a variety of factors, including interest rates, economic growth, and housing supply dynamics. However, since 1971, phases of rapid monetary expansion are usually accompanied by low interest rates and increased borrowing. This is shown in the chart below, which shows the effective federal funds rate.

The availability of affordable financing increases buyers’ purchasing power, which in turn increases demand for real estate, especially since real estate is primarily acquired through loans. The surge in demand, in turn, pushes up real estate prices. The phenomenon of an increase in the supply of monetary units coupled with low interest rates has been a global trend in recent decades. Influenced by the United States’ historical position as a major world power, the precedent of the US dollar as the world’s reserve currency was set.

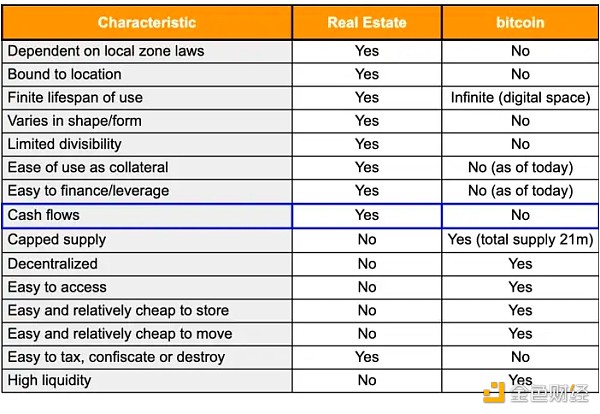

Although there are exceptions to the long-term response of the real estate market, such as Japan, where an aging population coupled with decades of low interest rate policies led to malinvestment, an oversupply of housing, and falling prices. Only in some metropolitan areas, such as Tokyo, is real estate still used to preserve value. Despite these regional differences, a global trend has emerged for real estate to be used as a store of value to counteract the decline in purchasing power caused by monetary expansion. It can be seen that the main attraction of real estate, especially in high-demand areas, lies in its ability to maintain value over time, a feature now challenged by the emergence of Bitcoin. The main role of real estate cash flow is to repay loans, a topic I will explore in more detail later. Real Estate and Bitcoin The data shows that the excessive demand for real estate is due to monetary inflation, which leads people to invest in scarce assets such as real estate to preserve their wealth. The development of real estate prices reflects the financialization of this asset class, a development that was significantly influenced by the departure of central banks around the world from the gold standard, marked by the "Nixon Shock" in 1971. Real estate faces direct competition from Bitcoin - a nearly perfect digital store of value. As a store of value, real estate cannot compete with Bitcoin. The latter is more scarce (fixed supply), cheaper to maintain, more liquid, easier to move, and harder to confiscate, tax, or destroy.

A comparative analysis of Bitcoin and real estate as a store of value reveals Bitcoin's unique advantages. The following table highlights these differences, showing why Bitcoin is increasingly considered a strong contender in the wealth preservation space:

The table further highlights that real estate's popularity as an investment option is largely due to affordable financing options and its ability to generate cash flow, making debt repayment easier, rather than its superior qualities as a store of value. Given that real estate acquisitions are financed primarily through credit, this appears to be a major factor in widespread purchases since 1971, in addition to scarcity. From this perspective, cash flows neither endow real estate with any intrinsic value (which does not exist) nor serve as an extraordinary store of value. This observation can be statistically proven.

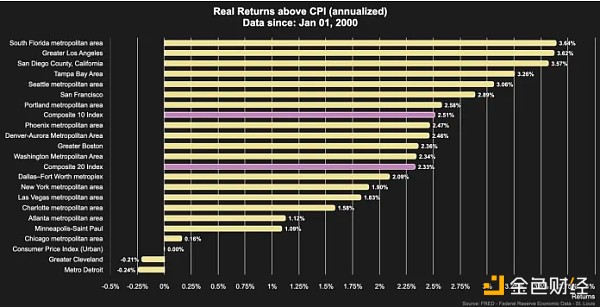

Bitcoin analyst Rapha Zagury, aka Alpha Zeta, found that the composite 20 Case-Shiller House Price Index, which tracks home prices in 20 metropolitan areas in the United States, has increased in value by only 2.3% after adjusting prices for inflation. This is before taxes, transaction costs, and maintenance fees are taken into account. Zagury found that only in some metropolitan areas, such as the South Florida metropolitan area and the greater Los Angeles area, have real property prices increased significantly faster than inflation, with growth rates exceeding inflation by about 3.6%. In contrast, areas such as the greater Cleveland and metropolitan Detroit areas have had negative inflation-adjusted real returns.

Zagury, 2023. From Bricks to Bitcoin, Uncovering Real Estate Investment in the Bitcoin Era. Website: nakamotoportfolio.com

Bitcoin vs. Fiat Currency

It is undeniable that real estate as an asset class has certain advantages over the existing fiat system as it becomes increasingly important to the global financial system.

After all, it is the world’s number one store of value (about 67% of global wealth is stored in real estate) and is also the collateral that banks accept when issuing loans. As a result, many jurisdictions offer stronger financial infrastructure and tax incentives for purchasing real estate and using it as collateral.

However, As Bitcoin’s role as an indestructible and absolutely scarce store of value in the global financial system will become increasingly important, it is expected that this will also have a positive impact on its use as collateral. The two functions of store of value and lending collateral are closely linked.

Why would a bank (or anyone else) accept collateral that depreciates over the long term?

The infrastructure for financial services related to Bitcoin and its use as collateral is still in its infancy. But the possibilities are very promising.

Recalibration of the Cash Flow Investment Theory Based on Fiat Standards

During MicroStrategy’s fourth quarter 2023 earnings call, Chairman Michael Saylor highlighted the increasing difficulty of generating cash flows that exceed the rate of monetary inflation.

He believes that relying on cash flow as an investment metric seems increasingly untenable in the context of widespread inflation in the fiat currency system. He further highlighted Bitcoin’s unique role as a digital scarce asset, combining the value-preserving qualities of real estate without its inherent drawbacks, thus establishing it as an unrivaled store of value in the digital age.

One of Bitcoin’s greatest strengths is that its valuation is not tethered to cash flows, shielding it from the adverse effects of inflation and quarterly financial reporting. Conversely, Bitcoin thrives in an environment of escalating fiat inflation as it becomes a more attractive store of capital.

Bitcoin’s valuation reflects the influx of capital flows, benefiting from the growing desire to protect wealth from the declining purchasing power of traditional fiat currencies.

Revaluing Real Estate According to Bitcoin Standards

While tangible and likely to generate regular cash flows, real estate is subject to regulatory changes and physical degradation, factors that Bitcoin is inherently resistant to. If real estate is not properly cared for, its value will depreciate over time. Bitcoin, on the other hand, offers the ultimate form of transferable value, as it preserves encapsulated wealth. If stored properly, its value increases over time without high maintenance costs. In fact, Bitcoin’s qualities mirror many of the values real estate offers, in addition to being fundamentally more secure, easier to escrow, cheaper to maintain, absolute scarcity, resistance to inflation, and most importantly, the ability to protect, liquidate, or transfer wealth in times of crisis.

I have been grappling with the question of how Bitcoin as a digital store of value can challenge real estate’s dominance as a store of value. This realization initially made me uneasy. However, I have gradually come to see that Bitcoin and real estate can coexist and even thrive together.

In my opinion, Bitcoin enhances the real estate industry by providing a reliable store of value, protecting cash flow from monetary inflation. This advantage is not limited to real estate, but encompasses all industries. As Michael Saylor has argued, Bitcoin represents the digital transformation of capital, marking a critical shift in the way value is preserved across all industries. Bitcoin could therefore attract the monetary premium that real estate currently holds, potentially realigning real estate values closer to their utility value. However, the real estate development sector and the real estate business will continue to remain attractive. People will always need space to live and work. From this perspective, real estate is not just an asset, but a service – providing housing and production space in exchange for rental income. The cash flow generated by this service represents a return on investment, similar to what the famous Austrian economist Ludwig von Mises called “raw interest”, the difference between production costs and expected revenue from the sale of the finished product. However, it is clear that real estate cannot compete with Bitcoin in its ability to preserve value. However, even if the value proposition of real estate as a store of value is changed by the discovery of Bitcoin, the development of real estate will still be economically viable if Bitcoin brings a digital paradigm shift to the financial world.

Summary

In summary, the narratives of cash flow and intrinsic value in investment strategies are being re-evaluated with the advent of Bitcoin. This digital asset, free from the constraints of the traditional monetary system, can offer a glimpse into the future of finance, where value is held not in bricks but in Bitcoins.

As we navigate this paradigm shift, the lessons learned from the comparison of real estate and Bitcoin will undoubtedly shape our approach to investing, wealth preservation, and the structure of the global financial system. While real estate presents opportunities for the foreseeable future, its importance as a store of value should decline over time, while Bitcoin, with its fixed supply and decentralized nature, promises to become an increasingly popular method of preserving wealth, offering unparalleled security and global accessibility, free from the constraints of the traditional financial system.

Aaron

Aaron

Aaron

Aaron Kikyo

Kikyo Catherine

Catherine Catherine

Catherine Brian

Brian Kikyo

Kikyo Hui Xin

Hui Xin Catherine

Catherine Clement

Clement Alex

Alex