Source: Culture Horizon

Introduction

The 2024 US presidential election has come to an end. Behind Trump's "quick victory", the latest developments in money politics have received widespread attention. Statistics show that, in sync with Trump's victory in the presidency, 40 of the 58 congressmen funded by the cryptocurrency industry at a cost of $130 million were also declared elected. FairShake Cryptocurrency Group has become the largest Super PAC (Super PAC) in the 2024 election, raising a total of more than 200 million. Some analysts pointed out that Trump, who has shown goodwill to cryptocurrencies, has found new allies in Congress and the government. So, what exactly does the cryptocurrency field want to win in this most "expensive" election?

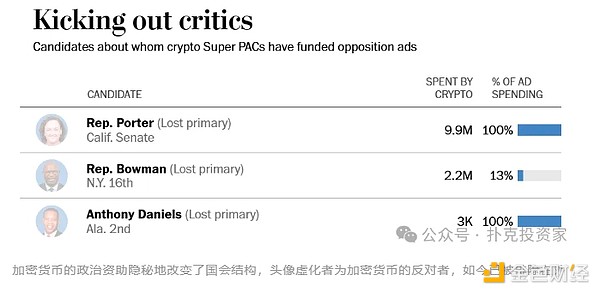

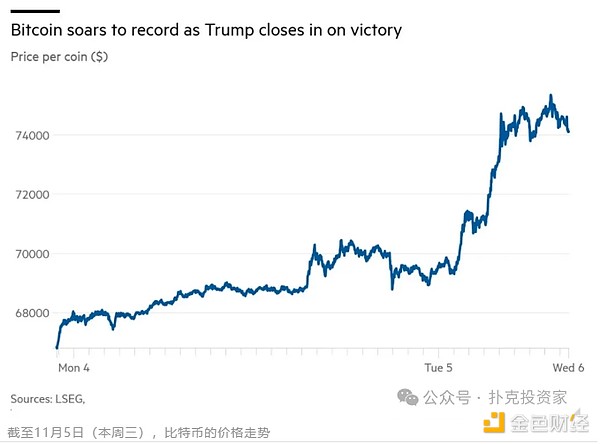

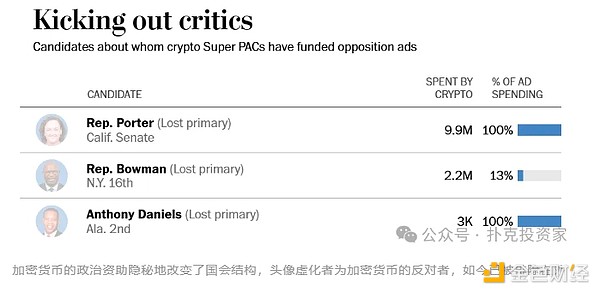

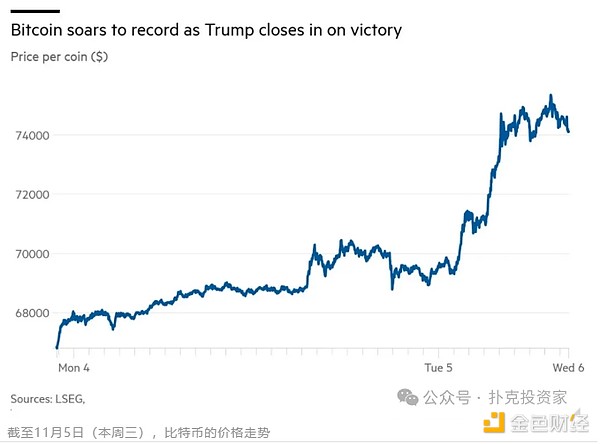

This article points out that Biden's questioning and restrictions on cryptocurrencies during his tenure have caused strong dissatisfaction in the industry. In 2022, FTX, the world's third-largest cryptocurrency exchange, collapsed, and its founder was sentenced to prison for multiple crimes, including misusing customer deposits for high-risk bets and illegal political donations. To combat fraud, the Biden administration has imposed taxes on cryptocurrency investment income, attempted to classify more digital tokens as securities, and initiated regulatory lawsuits through the U.S. Securities and Exchange Commission (SEC). To reshape the regulatory landscape, they turned to Trump and 58 members of Congress. Trump promised to protect crypto assets from excessive regulation during his campaign, proposed an industry-friendly person as the chairman of the SEC, promoted Bitcoin to a "national strategic reserve", and declared that the United States would become a global cryptocurrency center. As soon as Trump won the election, the price of Bitcoin soared to an all-time high of more than $76,000. The political tacit understanding shown by members of Congress is even more intriguing. None of the campaign ads funded by Fairshake mentioned cryptocurrency, but many of the candidates funded by it publicly stated that they would promote the development of cryptocurrency during their term and mentioned it in their 2025 plans, even though voters in the state did not care about cryptocurrency at all.

Many critics of the Democratic Party compare the risks posed by cryptocurrencies to the 2008 financial crisis. With the relaxation of regulations brought about by Trump's election, people are increasingly concerned about global financial stability. At the same time, cryptocurrencies are showing a trend of "mainstreaming" around the world, so much so that some analysts believe that an "arms race" around digital currencies seems to have begun. If Trump fulfills his promise to support cryptocurrencies, the United States may accelerate the popularity of cryptocurrencies. It remains to be seen how digital assets in other countries will be affected and whether this will prompt the adoption of corresponding competitive measures.

Cryptocurrency helps Trump and his allies win the 2024 election

"This election victory highlights the rapidly rising political influence of the cryptocurrency industry."

After the US election, the cryptocurrency industry, executives and investors were particularly happy. They believe that their political funding has not been in vain, and more importantly, they will usher in four years with almost no government regulation and review-and these four years are enough to bring about earth-shaking changes in the cryptocurrency industry.

Over the years, the elites in the cryptocurrency field have been investing political funds, especially Trump. But this does not mean that the elites in the cryptocurrency field have turned to the Republican Party. In fact, they will help run campaign ads for any congressional candidate who supports cryptocurrency.

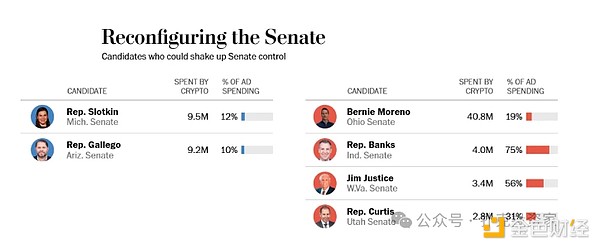

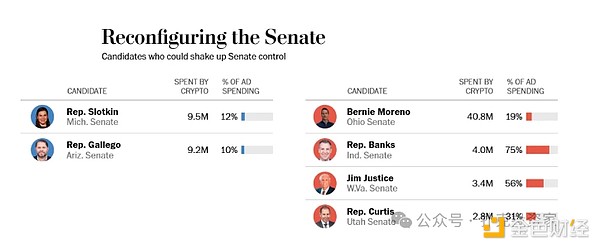

The effect of these efforts is obvious. Trump won the presidency, and 40 of the 58 members of Congress who funded him declared victory. FairShake Cryptocurrency Group has become the largest Super PAC in the 2024 election. Its funds mainly come from cryptocurrency giants such as Coinbase, Andreessen Horowitz and Ripple. It has raised more than 200 million, of which $130 million was used for the campaigns of 58 members of Congress.

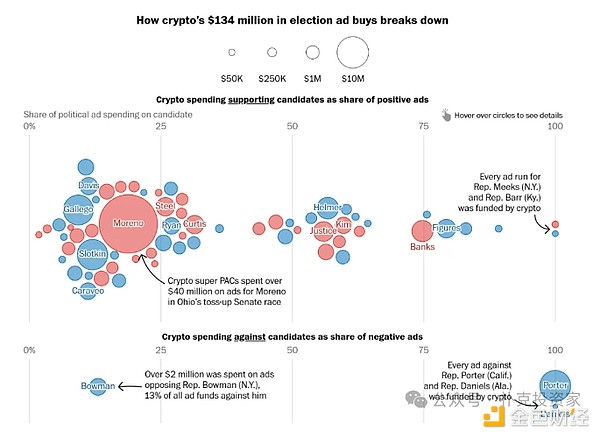

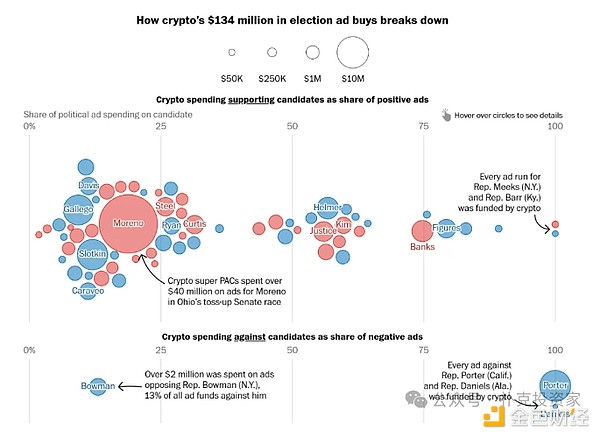

The picture shows the flow of 134 million political funds, and the names of congressmen are in the circle. As can be seen from the above picture, Moreno's expenses accounted for the largest proportion, and cryptocurrency spent a considerable amount of money to promote Brown's defeat; at the same time, they also spent money on "smearing" opposing congressmen, who were skeptical of cryptocurrency.

Despite the huge amount of funding, the operational strategies of cryptocurrency funders are secretive, as exemplified by current Democratic Senator Sherrod Brown of Ohio and Republican Senate candidate Bernie Moreno. Moreno, the incumbent senator Brown is the chairman of the Senate Banking Committee, which regulates digital finance, and has always been skeptical of cryptocurrencies. In order to unseat him, Fairshake funded his challenger Moreno with $41 million to win the election, but did not want voters to see his intentions, so its political ads focused on Moreno's contributions to immigration and employment, without any cryptocurrency propaganda.

After the election, the funders finally got the chance to reap the benefits. They hope that Trump will fulfill his promise to make the United States a "global cryptocurrency center." This expectation alone has pushed the price of Bitcoin to more than $76,000. They believe that Trump will keep his promise. A few months ago, with Trump's help, a cryptocurrency company called World Liberty Financial obtained a business license. After Trump takes office, he can do more.

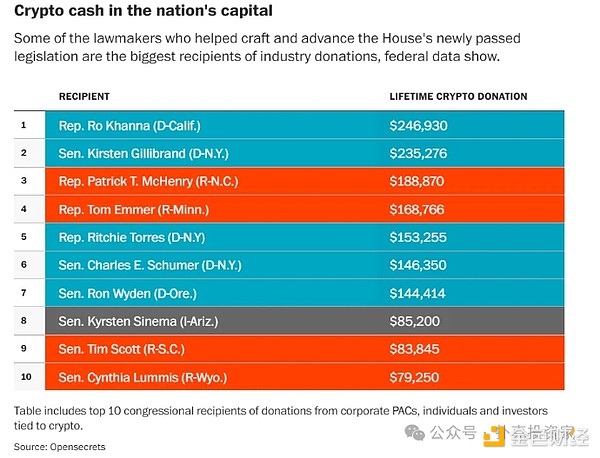

One of these things is the Crypto-Friendly Legislation (FIT21). The bill was drafted and passed in the House earlier this year, but it encountered a lot of resistance in the Senate and has been shelved. This is why Fairshake has been so focused on senators in this year's election. If this legislation is passed, the U.S. Securities and Exchange Commission (SEC) will have less regulatory power over cryptocurrencies and shift more responsibilities to the Commodity Futures Trading Commission (CFTC) - Democratic critics remind that the CFTC will have much less regulatory power than the SEC.

That’s why after the election, Coinbase Chief Legal Officer Paul Grewal announced: “Last night (the election) was groundbreaking for the cryptocurrency industry. All elected officials should recognize that this is an industry committed to long-term development.”

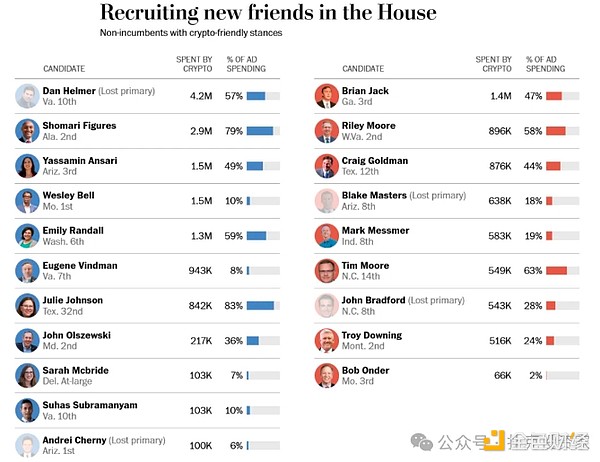

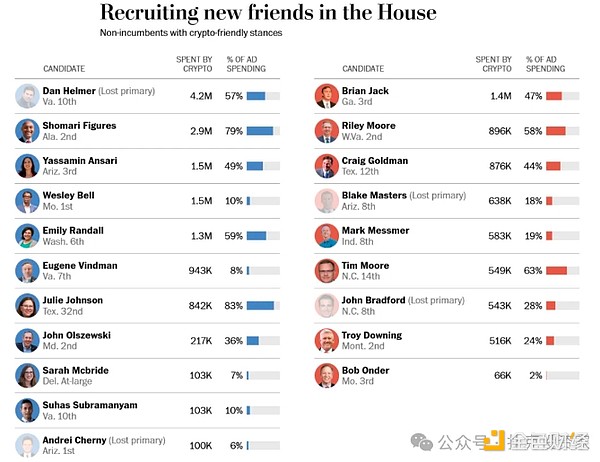

Cryptocurrency’s” new political friends” - new members of Congress, cryptocurrency has invested more than 1,900 in 20 campaigns 10,000 US dollars, hoping to get support after they win the election (those with clear avatars are winners, and those with blurred avatars are losers)

The 2024 election is not the end, but the beginning. Fairshake then announced that they had raised $78 million for the 2026 midterm elections, including funding from Coinbase. Coinbase not only supports candidates, but also extends its tentacles to voters-the organization they fund, "Stand With Crypto", is committed to lobbying voters to accept and support cryptocurrency transactions.

In 2022, the trading platform FTX collapsed, and the Biden administration stepped up its crackdown on cryptocurrencies, causing dissatisfaction among executives and investors in the cryptocurrency field. Since then, federal regulators have been committed to combating fraud, taxing cryptocurrency investment income, and trying to classify more digital tokens as securities for increased supervision.

As a result, the U.S. Securities and Exchange Commission (SEC) is the main regulator, and its chairman Gary Gensler has filed major lawsuits against major platforms such as Coinbase, Ripple and Binance in recent years, accusing them of violating investor protection regulations. All companies have denied the allegations.

They are unwilling to sit still and hope to reshape the regulatory landscape through political intervention, and thus found Trump - they held a fundraiser for the former president in the Bay Area and met with him privately at his Mar-a-Lago estate (where he gave his last victory speech). Sponsors include PayPal co-founders David Sachs and Chamath Palihapitiya, and twin brothers Tyler and Cameron Winklevoss, founders of the trading platform Gemini. With their unremitting efforts, Trump has transformed from an initial skeptic to a strong supporter of cryptocurrency.

At the 2024 Bitcoin Conference in Nashville, Trump promised to set up a committee of industry experts and promote policies that are favorable to cryptocurrencies. He also promised to make Bitcoin a "national strategic reserve" and fire Gensler, chairman of the U.S. Securities and Exchange Commission (SEC). These promises have once again sparked a heated response after Trump's victory.

Cameron Winklevoss wrote passionately on social media: "Imagine if the cryptocurrency industry no longer has to spend billions of dollars fighting the SEC, but instead invests those funds in the future of currency, how much we will achieve in the next four years. Amazing things are coming."

The investment in the cryptocurrency industry is huge, especially if it needs to be a two-sided bet. Fairshake and its two affiliates - focusing on funding the Republican Party's "Defending American Jobs" and supporting the Democratic Party's "Protecting Progress" - have become all aspects of the campaign in their first election funding and are committed to becoming the main funders.

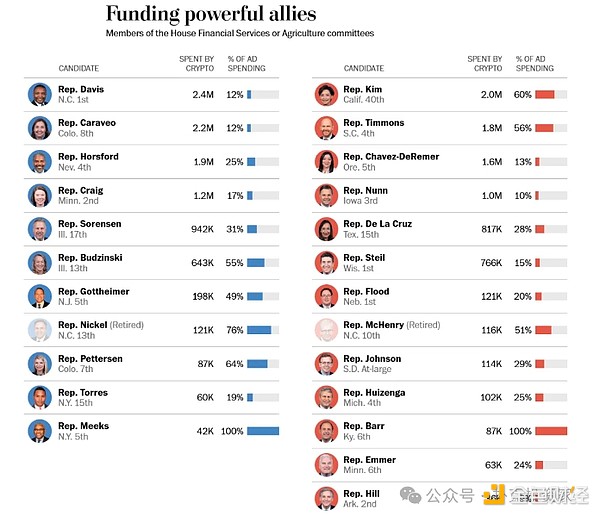

For example, they invested about $3.4 million in the campaign of Jim Justice, the current governor of West Virginia, and nearly $2.9 million in the campaign of Shomari Figures, a Democrat and former Justice Department official in Alabama. They also support current members of Congress who serve on key congressional committees that regulate cryptocurrencies, including Tom Emmer (Republican, Minnesota) and Josh Gottheimer (D-NJ) of the House Financial Services Committee.

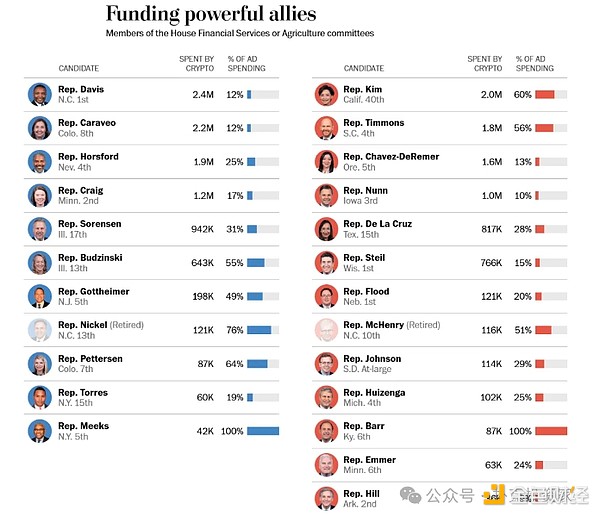

Crypto funded nearly $18.4 million to run passionate ads for 23 members of Congress who hold important positions on key congressional committees that directly regulate cryptocurrency.

Take the example of Moreno in Ohio mentioned above, which proves the determination of cryptocurrency bosses to deregulate. When they funded Moreno, Moreno was 7 percentage points lower than Brown, then chairman of the Senate Banking Committee that regulates digital finance. In order to improve his chances of winning, the political advertising can be described as "crazy". After spending 41 million, Brown was finally driven off the stage. A Fairshake spokesperson firmly stated: "Senator Moreno's reversal victory shows that Ohio voters are looking forward to a leader who values innovation, protects the economic interests of the United States, and ensures the country's technological leadership."

Interestingly, none of the ads funded by Fairshake mentioned cryptocurrency, but many of the funded candidates publicly stated that they would promote rules that would help the cryptocurrency industry during their tenure and mentioned it in their 2025 plans.Kristin Smith, president of the Blockchain Association, a Washington lobbying group, said: "We are celebrating, but we are also planning how to develop and utilize this advantage. The biggest lesson in the past is that it is meaningless to oppose cryptocurrency. Any emerging industry does not want to get too involved in politics, but the "unfair" experience that cryptocurrency has suffered in the past three or four years has forced us to fight back."

Cryptocurrency hot money pours into Washington, and regulation is becoming more moderate - the past and present of FIT21

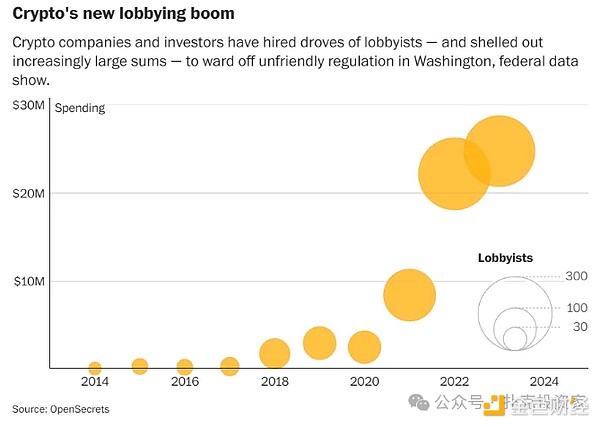

Large cryptocurrency companies are trying to change federal laws through high-cost lobbying, an action that touches multiple levels of American politics. Over the past four years, these companies and investors have spent at least $149 million to prevent strict regulatory measures and support the election of their congressional allies, while attacking lawmakers who are seen as threats.

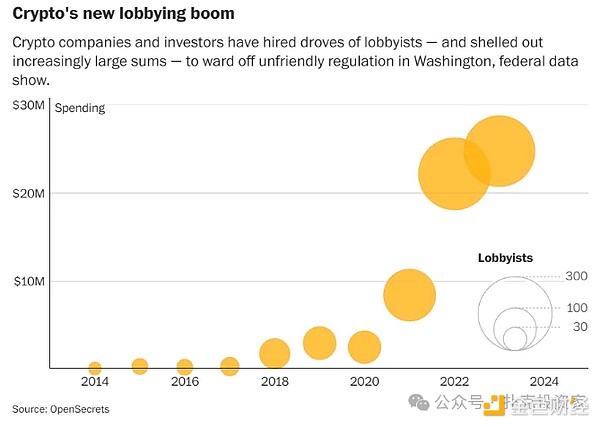

Since 2021, the industry has spent more than $60 million on Capitol Hill to shape federal policy, according to documents analyzed by The Washington Post and data from OpenSecrets and Public Citizen, two organizations that monitor money in politics. The lobbying campaign prompted the House of Representatives to advance the Financial Innovation and Technology Act for the 21st Century (FIT21), the first major legislation on cryptocurrency passed by either chamber of Congress.

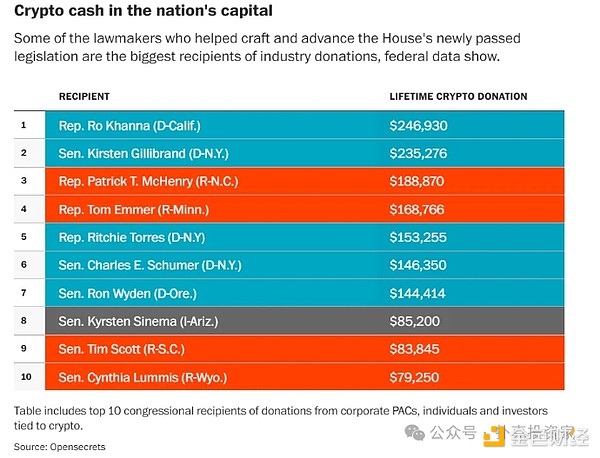

The bill would transfer some federal cryptocurrency regulatory authority from the U.S. Securities and Exchange Commission to the Commodity Futures Trading Commission (CFTC), which is considered less powerful, underfunded and more industry-friendly. Analysis shows that in the past two elections, executives, investors, and even employees in the cryptocurrency field donated as much as $90 million in political funding, and this spending figure may be underestimated (because federal campaign finance laws do not require some non-profit organizations to disclose their sources of income). They support the bill's designers and advocates, including Patrick Timothy McHenry, chairman of the House Financial Services Committee. The day before the House bill passed, McHenry admitted in an interview with reporters that cryptocurrency companies are "mature" in many ways in Washington, and this new "timely" dynamic is an important reference for congressional legislation. Two years ago, FTX, the world's third-largest cryptocurrency trading platform, collapsed. After the collapse, many lawmakers warned that a broader collapse of cryptocurrencies could threaten the entire economy. FTX was once worth $32 billion. In March, former FTX leader Sam Bankman-Fried was sentenced to 25 years in prison by a federal court for abusing customer deposits for high-risk bets and illegal political donations, causing FTX to go bankrupt and customers to demand refunds.

The collapse of FTX has made the cryptocurrency field feel politically "threatened", and the number of political lobbying groups has rapidly increased from 58 in 2020 to more than 270 by the end of 2023.The regulatory agency they requested to transfer, the Commodity Futures Trading Commission (CFTC), not only has little power, but was originally responsible for regulating corn and grain futures. They believe that such "unprofessionalism" will be relatively friendly to the cryptocurrency field.

The political lobbying investment in the field of cryptocurrency has doubled over time

Although FIT21 was proposed by the House of Representatives, cryptocurrency lobbyists and lawyers, mostly from the legal departments of cryptocurrency companies, admitted that they were deeply involved in the drafting of the bill. They simplified or even deliberately ignored many legal procedures for companies in the industry, including the appropriate relaxation of financial disclosures that had to be provided to customers earlier, and shortened the time for investors to appeal to a very short range. These clauses protect the rights and interests of companies, but make investors face greater risks when trading.

The amount of political funding in cryptocurrency received by officials involved in drafting and promoting House legislation

The close ties between the cryptocurrency industry and the government have alarmed consumer regulators, who are concerned about regulatory loopholes and how many opportunities these loopholes provide for financial institutions, including cryptocurrencies. Maxine Waters, the Democratic leader of the House Financial Services Committee, warned that FIT21 places the cryptocurrency field entirely under a "privileged" structure, "which will allow cryptocurrency companies to completely ignore many compliance regulations that other companies must comply with."

Despite the controversy, lawmakers passed the measure by a vote of 279 to 136, marking the latest victory for the industry. Congress also voted this month to restrict other SEC policies and the House of Representatives voted to block the Federal Reserve from issuing a digital dollar.

Many Democratic critics have compared the current situation to the 2008 financial crisis, when Congress failed to prevent several large banks from underwriting risky mortgages. The financial crisis and subsequent recession caused about 6 million people to lose their homes and the U.S. government spent trillions of dollars to help the country out of its difficulties.

Senator Elizabeth Warren said: "Before the 2008 financial crisis, I have always emphasized that we did not have enough regulation on banks. I feel the same way today. If we do not put in place adequate regulatory measures and allow cryptocurrencies to enter our economy more deeply, the final outcome will be terrible."

Crypto companies strongly objected to this comparison, arguing that members of Congress do not understand this new and fast-paced industry.To further consolidate support on Capitol Hill, they set their sights on this year's election. As enumerated in the previous article, more than half of the members of Congress have received political funding from the cryptocurrency field. It is worth mentioning that in West Virginia, state treasurer Riley Moore won the Republican nomination for the House of Representatives and quickly gained support from the cryptocurrency industry - they put an ad for him about how Moore revitalized the manufacturing industry, created jobs and took a "tough" stance on China, and pushed the ad to the televisions and mobile phones of more than 10 million Americans. In order not to deceive voters, he also added a small tofu block on his campaign website about "cultivating the emerging industry of cryptocurrency." West Virginia is one of the poorest states in the United States, and the people there don't care about cryptocurrency at all. Cryptocurrency, another "battlefield" for great power competition? In just over a decade, cryptocurrency has grown from a novelty in the digital field to a trillion-dollar industry with the potential to reshape the global financial landscape. Today, Bitcoin and hundreds of other cryptocurrencies are held as an asset class by a growing number of investors and used to purchase a wide range of goods and services, from software to digital real estate to illegal drugs. Cryptocurrency advocates see it as a democratizing force that takes back the power to issue and control money from central banks and Wall Street. However, critics argue that cryptocurrencies facilitate criminal gangs, terrorist organizations, and lawless states, exacerbate social inequality, trigger wild market fluctuations, and consume a lot of electricity. The regulatory attitudes towards cryptocurrencies vary around the world, with some countries accepting and embracing cryptocurrencies, while others ban or restrict their circulation. As of January 2024, 130 countries around the world, including the United States, are considering issuing their own central bank digital currencies (CBDCs) in response to the rise of cryptocurrencies.

What is cryptocurrency?

Cryptocurrencies get their name from the use of encryption to create and protect virtual currencies. They are traded primarily between virtual wallets owned by users through a decentralized network of computers. These transactions are publicly recorded on a distributed, immutable ledger called the blockchain. This open-source architecture ensures that the currency cannot be copied and that transaction verification does not rely on centralized institutions such as banks. Bitcoin, launched in 2009 by the mysterious software engineer Satoshi Nakamoto, is currently the most well-known cryptocurrency, with a market value of more than $1 trillion. Since then, many other cryptocurrencies have emerged, including Ethereum.

Users transfer funds between digital wallet addresses, and these transactions are packaged into "blocks" and confirmed across the network. The blockchain records transfers between wallet addresses rather than real names or physical addresses, providing users with a degree of anonymity. Some cryptocurrencies, such as Monero, claim to offer higher levels of privacy. But if the identity of the wallet owner is revealed, their transaction history can be traced.

Bitcoin "miners" earn bitcoins by solving complex mathematical puzzles to verify transactions and organize blocks. This process relies on a "proof of work" system. Many cryptocurrencies use this approach, while others, such as Ethereum, use a "proof of stake" mechanism. In the Bitcoin network, a block of transactions is added to the blockchain approximately every ten minutes, along with a reward of new bitcoins (this reward decreases over time). The total supply of bitcoins is limited to 21 million, but not all cryptocurrencies have a supply cap. The price of Bitcoin and many other cryptocurrencies fluctuates as a function of global supply and demand. However, the value of some cryptocurrencies is fixed because they are backed by other assets, known as “stablecoins.” While these currencies often claim to be pegged to fiat currencies, such as $1 per coin, many stablecoins have had their pegs challenged during a series of market turmoil in 2022.

Why are cryptocurrencies so popular?

Once a niche interest for technology enthusiasts, cryptocurrencies, especially Bitcoin, have now leapt into the mainstream, with a trillion-dollar valuation. In November 2021, the price of Bitcoin broke the $60,000 mark for the first time, although it has since fallen back. According to a mid-2023 Pew Research Center survey, about 17% of American adults have invested in, traded or used cryptocurrencies.

Different currencies have different appeals, but the popularity of cryptocurrencies is largely due to their decentralized nature: they can be transferred quickly and anonymously, even across borders, without bank intervention or fees. In some countries, dissidents have used Bitcoin to raise funds to circumvent state controls, including bypassing U.S. sanctions on Russia.

Some analysts believe that digital assets are primarily investment vehicles. Sebastian Mallaby, a senior fellow at the Council on Foreign Relations (CFR), said people buy cryptocurrencies "out of a speculative belief that the value of tokens will rise in the future because a new future is being built on the blockchain." Some Bitcoin supporters see it as a hedge against inflation because its supply is fixed, unlike fiat currencies, whose supply can be increased infinitely by central banks. However, stock market volatility in 2022 caused Bitcoin prices to plummet, and many experts have doubted this argument. The valuations of other cryptocurrencies may be more difficult to explain, although many are related to large projects in the digital asset industry. Some cryptocurrencies, such as Dogecoin, were originally created as a joke, but have retained value and attracted well-known investors.

Bitcoin has been popular with populist leaders in countries with historically unstable currencies, including some in Latin America and Africa. In 2021, El Salvador became the first country to adopt Bitcoin as legal tender, allowing residents to pay taxes and debts with it, though fewer than 15% of people actually used Bitcoin for these activities by 2023, according to a poll by the University of Central America.

Bitcoin and other cryptocurrencies are subject to high price volatility, which some analysts say limits their usefulness as a medium of exchange. (Most buyers and sellers are reluctant to accept a currency whose value can fluctuate wildly from day to day.) Still, some businesses accept Bitcoin payments.

Experts say stablecoins may be more effective as a form of payment than other cryptocurrencies. Stablecoins are relatively stable in value and can be sent instantly, without the transaction fees of credit cards or international money transfer services like Western Union. And because stablecoins can be used by anyone with a smartphone, they offer an opportunity to bring millions of people without traditional bank accounts into the financial system. However, they have come under intense scrutiny from regulators, especially during the market turmoil in 2022, when several stablecoins fell below their $1 pegs.

Decentralized "New" Finance (DeFi)

Cryptocurrencies and blockchains have spawned a new crop of "decentralized finance" (DeFi) businesses and projects. DeFi is essentially a cryptocurrency version of "Wall Street," designed to provide people with financial services (lending and trading) without traditional institutions such as banks and brokerage firms, which often charge high commissions and other fees. Instead, "smart contracts" automatically execute transactions when certain conditions are met.

Most DeFi applications are built on the Ethereum blockchain. Experts say that because blockchain technology is very useful in tracking transactions, it has a range of potential applications beyond cryptocurrencies, such as facilitating international trade.

"You can imagine a new financial system built with blockchain-based tokens that have advantages over the old centralized currencies," said CFR's Mallaby. "If you trust the code, trust the blockchain and the decentralized ledger, this is a new way to organize finance."

What challenges does this bring?

Illegal activities. In recent years, cybercriminals have increasingly carried out ransomware attacks, in which they infiltrate and shut down computer networks and then demand a recovery fee, usually in cryptocurrency. Drug cartels and money launderers have also "increasingly incorporated virtual currencies" into their activities, according to the U.S. Drug Enforcement Administration (DEA). U.S. and European authorities have shut down a number of so-called darknet markets — websites where anonymous people can buy and sell illegal goods and services, mostly drugs, using cryptocurrencies. Critics say those enforcement efforts have fallen short of expectations.

Terrorism and sanctions evasion. The dollar's dominance gives the U.S. unparalleled power to impose tough economic sanctions — and countries including Iran and Russia are increasingly using cryptocurrencies to hedge against the economic impact of sanctions. Meanwhile, the military wing of the Palestinian group Hamas is also trading cryptocurrencies.

Environmental harms. Bitcoin mining is a very energy-intensive process: The network now consumes more electricity than many countries. That has raised concerns about the impact of cryptocurrencies on climate change. Cryptocurrency supporters say the problem can be solved by using renewable energy sources; the president of El Salvador, for example, has pledged to use volcanic energy to mine bitcoins. Ethereum reportedly switched to a proof-of-stake model, which uses less energy, due to environmental concerns.

Volatility and lack of regulation. The rapid rise of cryptocurrencies and DeFi businesses means that billions of dollars in transactions now take place in a relatively unregulated industry, raising concerns about fraud, tax evasion and cybersecurity, as well as broader financial stability. If cryptocurrencies become a dominant form of global payments, they could limit the ability of central banks, especially those in smaller countries, to set monetary policy by controlling the money supply.

In 2022, after high volatility caused several well-known cryptocurrencies to depreciate, a handful of crypto companies were unable to repay their lenders, which were mostly other crypto companies. Many borrowers and lenders declared bankruptcy, including FTX, the world's third-largest cryptocurrency exchange at the time.The collapse of FTX and other companies cost investors tens of billions of dollars and led some experts to call for a full ban on cryptocurrencies, although traditional financial companies have been relatively unscathed.

How are governments responding to the rise of cryptocurrencies?

While many governments initially took a wait-and-see approach to cryptocurrencies, with their rapid growth and the rise of DeFi (decentralized finance), regulators have had to start setting rules for this emerging sector. Regulatory attitudes vary significantly around the world, with some countries accepting or even embracing cryptocurrencies, while others completely ban them. Experts point out that the challenge of regulation lies in how to limit traditional financial risks without suppressing innovation.

In the United States, policymakers have begun to regulate parts of the cryptocurrency and DeFi sectors. In January 2024, the U.S. Securities and Exchange Commission (SEC) approved the first exchange-traded funds (ETFs) containing Bitcoin, marking the official entry of cryptocurrencies into the traditional securities market. However, cryptocurrencies do not fully fit into the existing regulatory framework, creating gray areas that lawmakers may need to resolve. SEC Chairman Gary Gensler likened the cryptocurrency industry to the "Wild West" and urged Congress to give the SEC greater regulatory power. Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen have both called for stronger regulation of stablecoins. But regulators have been cautious about providing cryptocurrency investors with the same protections as in the traditional financial sector, such as deposit insurance. Christopher J. Waller, a member of the Federal Reserve Board of Governors, said in 2023 that if the value of the crypto assets purchased by investors goes to zero, taxpayers should not be expected to bear the losses.

To combat illegal activities, regulators are particularly concerned about exchanges that allow users to exchange cryptocurrencies for U.S. dollars and other national currencies. Under regulatory pressure, major exchanges including Coinbase and Gemini have complied with "know your customer" (KYC) and anti-money laundering regulations. At the same time, law enforcement and intelligence agencies are learning how to use blockchain to analyze and track criminal activities, taking advantage of the traceability of cryptocurrencies. For example, the FBI successfully recovered part of the ransom paid to the Colonial Pipeline hackers. In August 2022, the Treasury Department announced a crackdown on so-called cryptocurrency mixers, tools that allow criminals to trade anonymously on the blockchain, and regarded them as "threats to U.S. national security."

China has cracked down on cryptocurrencies.In September 2021, China announced a complete ban on all cryptocurrency trading and mining, causing some cryptocurrency prices to fall sharply immediately after the ban was enacted. At least eight countries, including Algeria, Bangladesh, Bolivia, Morocco, Nepal, Pakistan, Saudi Arabia and Tunisia, have banned cryptocurrencies, and dozens more have sought to restrict the adoption of digital assets, according to the Atlantic Council. Meanwhile, most other governments have so far taken relatively limited steps.

What is a central bank digital currency (CBDC)?Many central banks around the world, including the Federal Reserve, are considering issuing their own digital currencies, or CBDCs, to safeguard monetary sovereignty. CBDC supporters argue that it can provide the speed and convenience of cryptocurrencies while avoiding some of the risks of cryptocurrencies. Currently, dozens of countries around the world - with a total economic output accounting for more than 98% of the world's total - are studying the feasibility of CBDCs, and 11 of them have fully launched CBDCs, 10 of which are in the Caribbean, with Nigeria being the 11th. In 2023, China began including its pilot digital yuan in the calculation of official currency circulation, although the digital yuan accounts for only 0.1% of central bank cash and reserves. In the United States, there is disagreement within the Federal Reserve on whether a digital dollar is needed.

The implementation of CBDC may allow citizens to open accounts directly at the central bank. This will enable the government to manage the economy more efficiently, for example, by directly depositing stimulus payments and other benefits into citizens' accounts, while the central bank's endorsement will also make CBDC a safe digital asset. However, experts warn that the introduction of CBDC may bring new problems because it concentrates a lot of power, data and risks in the hands of the central bank, which may threaten privacy and cybersecurity.

Some experts also point out that CBDC may replace the role of commercial banks as financial intermediaries, which may bring risks because commercial banks play a key role in the economy by creating and allocating credit (i.e. lending). If people choose to open an account directly at the central bank, the central bank will either need to provide lending services to consumers (which may be beyond the scope of the central bank's functions) or find new ways to inject credit.

Alex

Alex