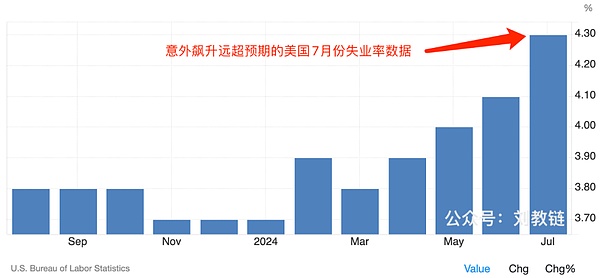

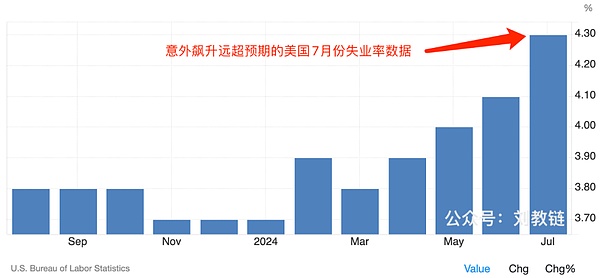

After the release of the US non-farm payrolls data last night, the global financial market was shaken. The increase in non-farm payrolls was 114,000, weaker than the expected 175,000. The key point was that the unemployment rate soared to 4.3%, which was much higher than expected and triggered the so-called "Sahm rule", sending the strongest signal that the US economy was in recession.

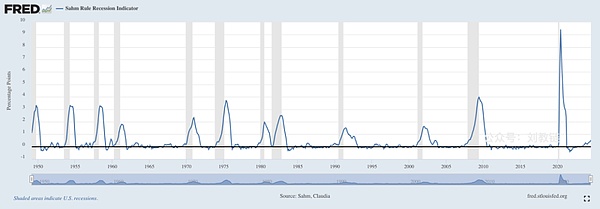

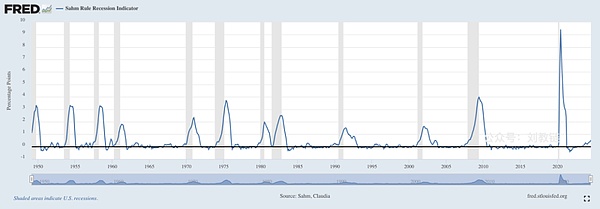

The Sahm rule is an empirical rule: when the average unemployment rate for three consecutive months exceeds the low point of the previous year's unemployment rate by 0.5%, the US economy is bound to fall into recession. How effective is this indicator? It is almost 100% accurate and has never failed. The figure below shows the corresponding relationship between the data of the Sahm rule indicator since 1949 (blue curve) and the US economic recession (gray vertical stripes).

Judging from the reaction of the US stock market and the global market, people's fear of economic recession still overwhelms the joy of the Fed's upcoming interest rate cut. On Friday, US stocks closed down across the board, with the S&P 500 down 1.8%, the Nasdaq down 2.4%, and the Dow Jones down nearly 610 points.

Although Powell raised the white flag at the interest rate meeting at the end of July, he did not make a decision to cut interest rates immediately, but postponed the expectation of a rate cut to September.

Just two days later, the situation changed suddenly. The unexpected employment data perfectly matches Powell's "forecast". However, no matter how the US stock market plummeted across the board, and no matter how it threatened to die, it was impossible to turn back time and let Powell reopen the interest rate meeting at the end of July and announce that interest rates would be cut immediately in August.

The Sino-US financial game, which was jokingly called "hypoglycemia vs. hypertension" by netizens, finally ended up with the eagle collapsing. After 15 years of hard work, the dawn is about to come. The offshore RMB suddenly appreciated against the US dollar, and USD/CNH broke through the 7.2 mark. Indistinctly, the charge has been sounded. The loud horn tore through the thick darkness. The sky in the east was pale.

Last year, Jiaolian wrote a trilogy on this final battle.

The first article, "Artificial Prosperity", points out that the false economic prosperity obtained by the United States due to helicopter money will encounter the exhaustion of excess savings at the end of 2023 and the beginning of 2024. Economic recession is a foregone conclusion. The second article, "Shooting the Cow Across the Mountain", talks about China's countercyclical adjustment of not cooperating with the US interest rate hike, actively puncturing the asset bubble, and resolutely defending the stability of the exchange rate, which will inevitably drain the global capital back to the United States and become a booster to push the United States toward collapse. The third article, "Huashan Sword", focuses on how the US dollar interest rate hike cycle cooperates with the over-issuance of US debt, vacating the cage and replacing the bird, diluting and harvesting the wealth in the hands of people all over the world. China seized the opportunity of the dollar's contraction and lent the dollars it earned to countries on the verge of collapse to repay their debts, agreeing that they would repay in RMB in the future, thus interrupting the performance of the classic script that countries should have leveraged and collapsed and gone bankrupt during the dollar's interest rate hike cycle, and replaced it with a new script in which the people of the world sat and waited for the United States to explode with high interest rates.

What we want is not the real collapse of the United States, but a play of collapse. Once the play of collapse is performed, the U.S. stock market is threatened with death, the U.S. economy is going to decline, and it will "hard land" and fall to pieces. Once the Federal Reserve is afraid, it will withdraw its high interest rate magic and quickly cut interest rates and it will rain.

The curtain opens and the curtain falls, who is the guest?

Seeing the big picture from the small details. In fact, from the fact that many big Vs in the Chinese community in China have been talking about the U.S. stock market rising but not falling all day long, and the comment area is full of comments on the phenomenon of "fixed investment in the Nasdaq", we can foresee that the U.S. stock market is about to reach a local peak. After all, such a huge bubble cannot be filled by these small leeks who brush the comment area to take over. This is the same as when the grandpa and aunt selling vegetables began to rush into the A-share market, it was an indicator that the A-share market had reached its peak.

Remember, the mathematical principle of taking over is that only when funds and players with larger volume enter the market to take over, the market can continue to rise. If a market falls to the point where small shrimps have to take over for large institutions, then the next step can only be a terrible decline and harvest.

Why can BTC continue to rise through cycles? It is because speculators take over for the early veterans, companies take over for speculators, ETFs take over for companies, and sovereign countries will take over for everyone later...

Don't be silly and believe in the nonsense that "the US stock market will collapse as soon as the Federal Reserve cuts interest rates." This is purely confusing cause and effect and reversing black and white. It was obvious that the US stock market was threatening to die, and the Federal Reserve was in a panic and had no choice but to cut interest rates and release money to save the market.

The burning US stock market and the secretive Federal Reserve are like boys and girls who are more than friends but less than lovers, shyly testing each other, and no one dares to take that step. It was the US stock market that took the first step and broke the window paper. Once it was broken, the Federal Reserve would no longer have to hide. The two young and white bodies rolled together.

JinseFinance

JinseFinance