Source: Jishi Communication

Abstract

As we all know, Bitcoin does not have the smart contract capabilities of Ethereum. Unlike Ethereum's ERC20 contract, connecting to Bitcoin's UTXO is an unavoidable link.Based on the UTXO architecture application, its security is naturally shared with the main chain. This model also brings a lot of expectations to the market. It is possible to build an ecological model different from that of Ethereum L2, which is also the expectation of the market.

Compared with Ethereum, UTXO is the most distinctive data model of Bitcoin, so the Bitcoin Layer2 ecology is expected to present an ecological model different from that of Ethereum.With the intensification of industry competition and the continuous advancement of technology, Ethereum L2 has developed rapidly in recent years. The fees on the Ethereum chain under the prosperous ecology have been controlled as a whole, while the development of the Bitcoin network ecology is still very rudimentary. The recent rise of Ordinals applications such as inscriptions and runes provides a possibility for building applications based on UTXO. The active on-chain transactions brought about by activities such as the 2023 Inscription and this year's Rune have laid the foundation for tapping the potential of UTXO.

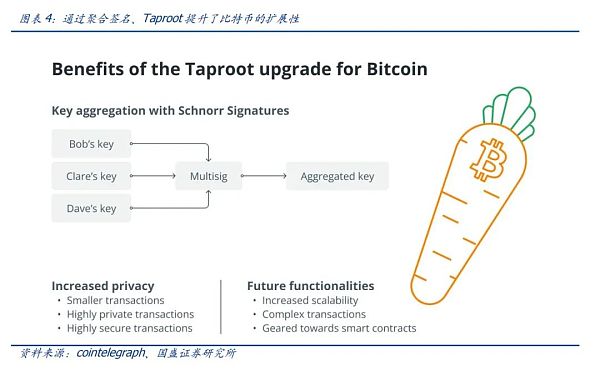

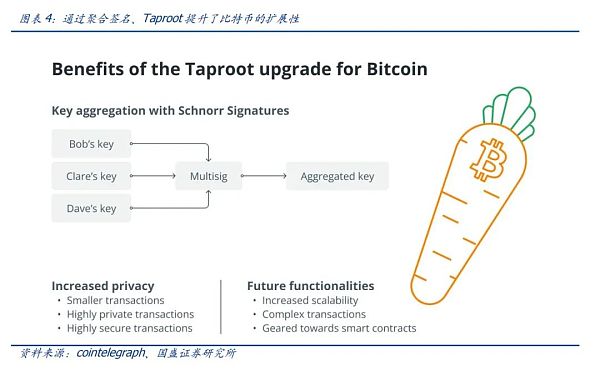

TaprootThe upgrade further enhances the development potential of the Bitcoin ecosystem. We all know that the Bitcoin Taproot upgrade is the most important upgrade since the activation of Segregated Witness (SegWit). Taproot aims to further improve the privacy and efficiency of the network. The most significant change in the Taproot upgrade is that it allows multiple complex signatures (such as multi-signature wallets) to be aggregated and verified together instead of individually. By aggregating signatures, the network performs faster, has lower fees, and saves block space. Taproot provides a new way to perform Bitcoin transactions by enhancing user privacy and flexibility, which will greatly improve the scalability of Bitcoin.

NervosCKB's Cell is similar to a smarter UTXO. Bitcoin UTXO is a box with a paper ledger, while Cell replaces the ledger in the box with an Excel electronic document. Nervos CKB inherits the architecture of Bitcoin UTXO and creates the Cell Model, a universal UTXO model as a state storage that maintains the simplicity and consistency of UTXO. In CKB, all states are stored in Cell, calculations are completed off-chain, and transactions are verified and uploaded to the chain by nodes. Cell represents the basic data storage unit in Nervos. Unlike Bitcoin UTXO, it can contain various data types, such as CKByte, Token, JavaScript code or JSON string and other serialized data. This richer data type broadens the capabilities of Cell and expands UTXO - such as implementing smart contracts (even customized smart contracts, such as issuing NFT tokens, limiting the supply of tokens, and formulating usage conditions that meet unique needs). Will the uniqueness of

UTXO also give birth to a different ecological world? The in-depth mining of Bitcoin UTXO by inscriptions and runes makes it possible to deploy assets based on UTXO, and the upgrade of UTXO by Nervos CKB further liberates computing power. These indicate the different application potential of UTXO, which seems to be more interesting and has become a new expectation of the industry. Looking at the development of Ethereum, from the ERC20 standard that gave birth to ICO, to the development of AMM that provided the source power for DeFi, to the emergence of NFT and the metaverse, its ecological paradigm has gradually become fuller. But this process is not achieved overnight, and there are many twists and turns in the middle. Bitcoin's recent innovations have gained a certain amount of market heat from the beginning, which is a good phenomenon, indicating that the market has great expectations and confidence in the potential of UTXO. But the heat comes quickly and cools down quickly. After the runes appear, the heat of inscriptions naturally decreases. At present, both inscriptions and runes are still in the stage of scrambling for "minting". Minting is just the beginning, and how to develop applications and enrich the ecology later is more important. The situation of Nervos CKB is similar. The current ecological application can be said to be a simple "copy" of the Ethereum ecology.

Risk Warning: Blockchain technology research and development is not as expected; regulatory policy uncertainty; Web3.0 business model implementation is not as expected.

1. Core Views

Bitcoin UTXO itself does not have the ability of smart contracts. At present, Bitcoin has not yet produced a rich ecology like Ethereum. With the exploration of the potential of UTXO by Ordinals protocol, Nervos CKB, etc., new application modes such as inscriptions and runes have emerged, gradually becoming the focus of industry attention. Based on the UTXO architecture application, its security is naturally shared with the main chain. This model also brings a lot of expectations to the market. It is possible to build an ecological model different from Ethereum L2, which is also the expectation of the market.

This article analyzes several typical UTXO application modes and looks forward to the Bitcoin ecology.

2. UTXO’s Spring, BTC Layer2 Ecosystem is Expected to Develop Further

2.1BTC Layer2 Based on UTXO is Expected to Give Birth to a New Ecosystem

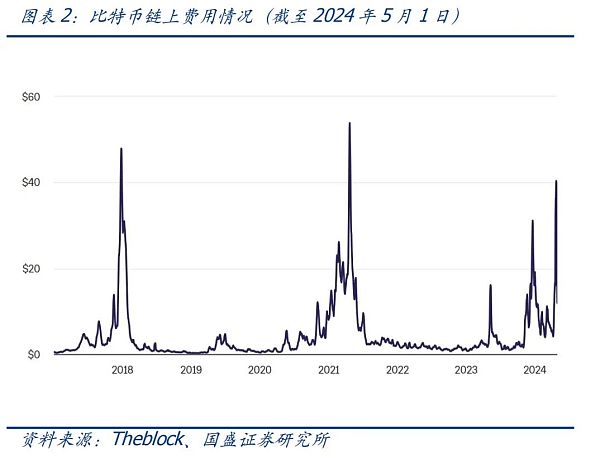

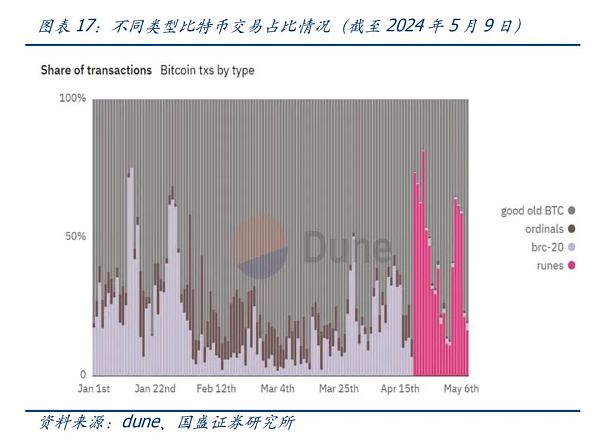

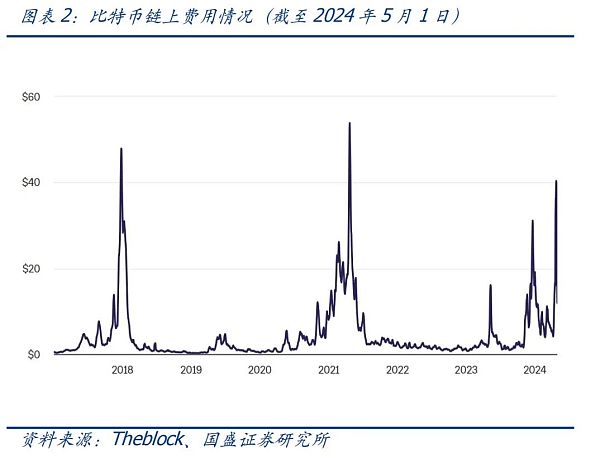

The working principle of blockchain requires decentralized nodes to reach consensus and confirmation, which will inevitably lead to a decrease in efficiency. Therefore, when processing tasks (transferring or executing contract programs), it is naturally not as fast as centralized nodes. This is a typical impossible triangle problem (security, scalability, and decentralization cannot be optimal at the same time). From the perspective of improving scalability, the second-layer network (Layer2, L2) is a widely adopted solution. With the rapid development of Ethereum L2 in recent years, the on-chain fees of Ethereum under the prosperous ecology have been controlled as a whole, while the development of the Bitcoin network ecology is still very rudimentary. The on-chain transactions brought about by the activities such as the inscriptions in 2023 and the runes this year can be seen as a rapid increase in the fees of the Bitcoin network (see Figure 2).

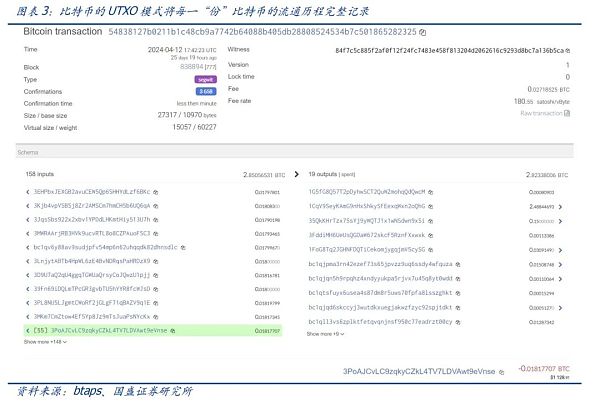

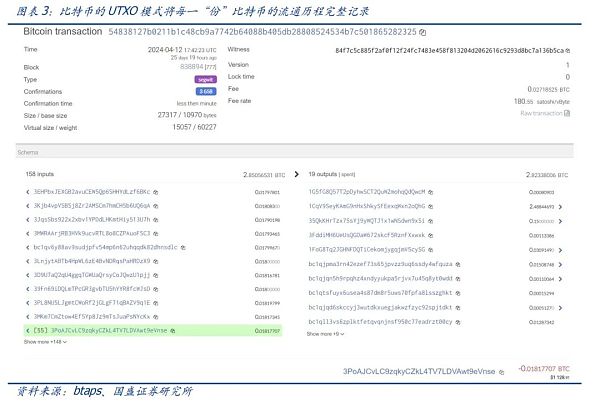

UTXO mechanism makes every satoshi of Bitcoin "non-homogeneous", which is expected to give birth to an ecological model different from Ethereum. Since Bitcoin has no account, the output created by Bitcoin transactions is not actually a simple public key address, but a script. We can understand it this way. In the transaction where Bob pays Alice 1.5 BTC, the output script created by Bob will contain Alice's public key Hash. The meaning of the whole script is that whoever can provide a signature to run the script containing Alice's public key can spend the 1.5 BTC of this transaction. Obviously, only Alice's private key can be used to create a signature, and signatures created by other private keys will not be verified by this script, thus ensuring that others cannot impersonate Alice to spend this output. That is to say, the BTC in UTXO is not recorded in someone's account as a balance - the initiator of each transaction creates a lock for these BTC through a script, and the owner has the key - of course, the input (transfer initiator) and output (transfer recipient) of a certain transfer of Bitcoin may be composed of multiple historical UTXOs, similar to the patchwork of banknotes of different denominations. One of the benefits of this is that all transfer transactions are from the perspective of BTC circulation, and different UTXOs can be traded in parallel because UTXOs are strictly distinguished. It can also be understood in this way: the UTXO mechanism records the circulation of all parts of BTC (the smallest unit is "sats") in full. It can be imagined that each sats is a coin, and a signature is obtained at each circulation to record the rotation process. Compared with Ethereum, UTXO is the most distinctive data model of Bitcoin, so Bitcoin L2 is expected to present an ecological model different from Ethereum.

The upgrade further enhances the development potential of the Bitcoin ecosystem. As we all know, Bitcoin Taproot is the most important upgrade since the activation of Segregated Witness (SegWit). Taproot aims to further improve the privacy and efficiency of the network. The most significant change in the Taproot upgrade is that it allows multiple complex signatures (such as multi-signature wallets) to be aggregated and verified together instead of individually. By aggregating signatures, the network performs faster, has lower fees, and saves block space. Taproot provides a new way to perform Bitcoin transactions by enhancing user privacy and flexibility, which will greatly improve Bitcoin's scalability.

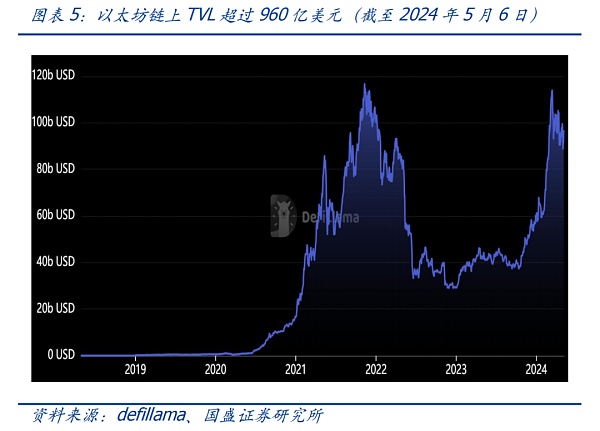

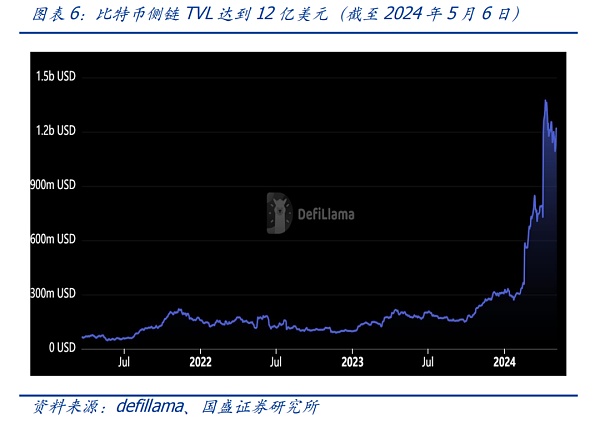

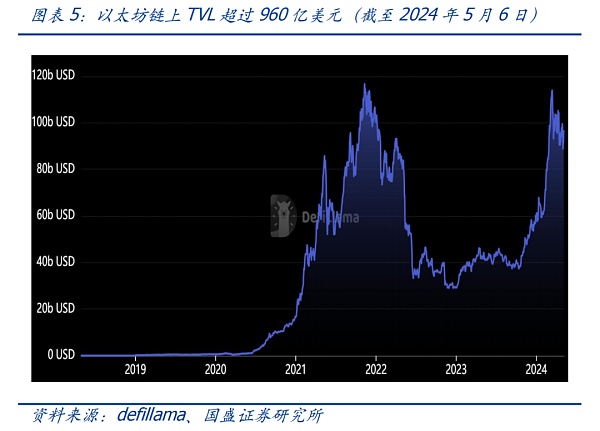

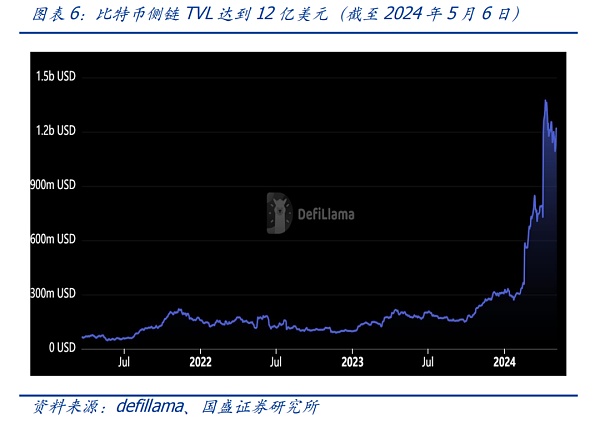

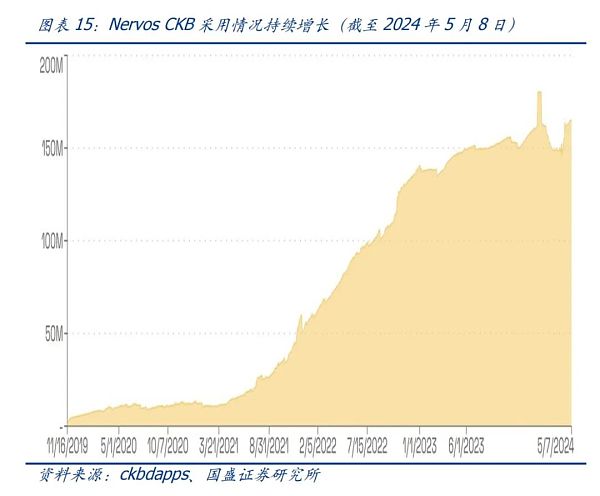

With the Ordinals protocol giving birth to applications such as inscriptions and runes, the development of the Bitcoin ecosystem has been further promoted. As of May 6, the TVL of the Ethereum ecosystem exceeded US$96 billion. The Bitcoin ecosystem has experienced rapid development in the past year, with a TVL of US$1.2 billion. There is no doubt that compared with Ethereum, the development of the Bitcoin ecosystem is still in its early stages.

2.2 Ordinals protocol further explores new possibilities of UTXO

Referring to the development of Ethereum Layer2, Bitcoin L2 also has different technical routes. As we all know, Bitcoin does not have the smart contract capabilities of Ethereum. Therefore, some technical routes of Bitcoin's second-layer network include state channels (such as lightning networks, etc.), side chains, Rollups, etc. Most of these routes rely more on L2 to realize the expansion capabilities of smart contracts, and realize asset cross-connection between the Bitcoin main chain and L2 through cross-chain bridges. This can be said to belong to the category of side chains. A core issue of side chains is how to achieve consensus and shared security between the side chains and the main chain, and how to connect the UTXO of the Bitcoin main chain is an unavoidable link. The recent rise of Ordinals applications such as inscriptions and runes provides a possibility for building applications based on UTXO. Based on the UTXO architecture, the security of the application is naturally shared with the main chain. This model also brings a lot of expectations to the market. It is possible to build an ecological model different from Ethereum L2, which is also the expectation of the market.

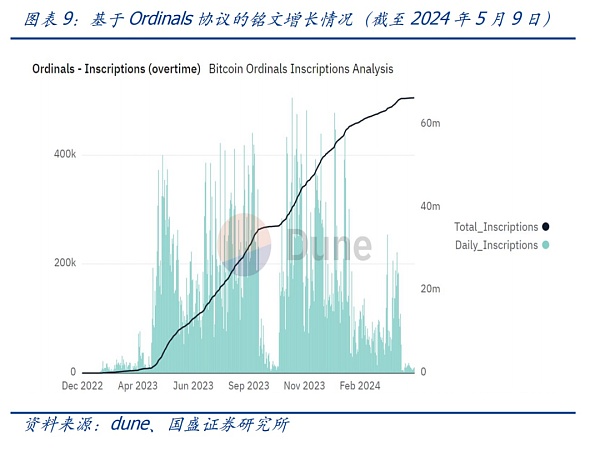

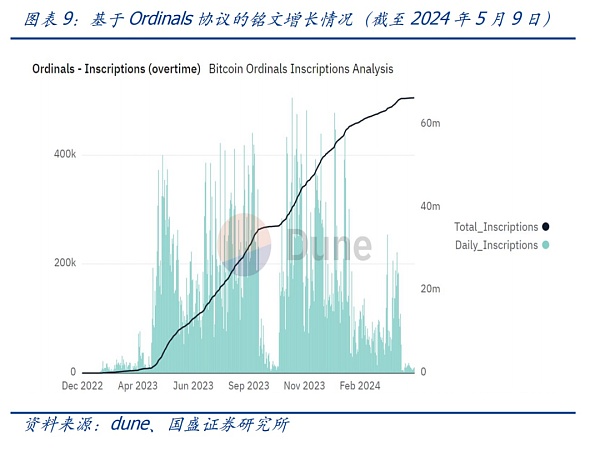

Under the UTXO model, the circulation of each BTC (sats, the smallest unit of Bitcoin) is traceable and non-homogeneous (perhaps this is the earliest NFT), which provides a basis for the development of the Ordinals protocol and the BRC-20 ecosystem. In December 2022, Bitcoin developer Casey Rodarmor released an open source software ORD that runs on the Bitcoin Core full node. Simply put, the software allows users to enter any information on the Bitcoin blockchain, such as a string of text or an image, and then bind the uploaded information to a specific Satoshi, and finally get a Satoshi with some information, which is the so-called Bitcoin NFT. To put it more clearly, the Ordinals protocol is divided into two parts: Ordinals and Inscription. Ordinals are essentially a scheme for numbering the smallest unit of Bitcoin, sats (1 BTC = 100,000,000 sats), and allow individual sats to be tracked and transferred. Here, sats are numbered in the order they are mined, and transferred from transaction inputs to transaction outputs in a first-in, first-out order. Once each sat is numbered, a piece of content can be written into the transaction's "witness quarantine", which will also be assigned to the first sat of the transaction output. This writing process is called inscribe, and the content written is called Inscription. The inscription here can be a picture, text, audio or video, or even code. In theory, as long as the size does not exceed the 4MB upper limit of the Bitcoin block, it can be inscribed. Therefore, Inscription is very similar to NFT in form, and Ordinals is a protocol that allows people to mint NFTs on the Bitcoin network similar to Ethereum.

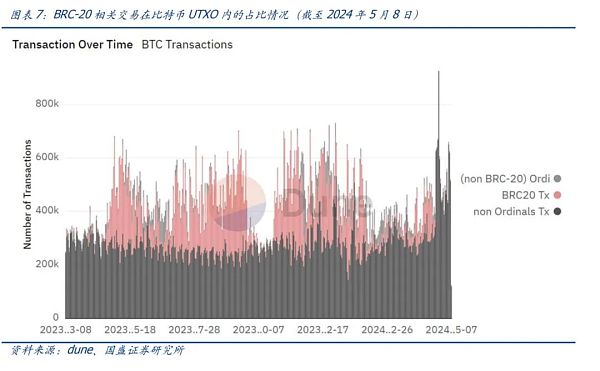

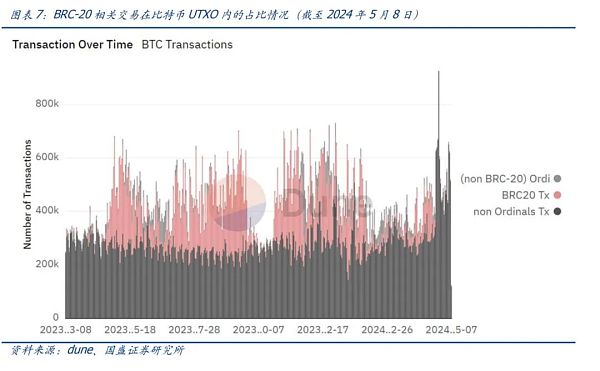

The Ordinals protocol can not only be used to issue NFTs, but also can be used to issue tokens when inscriptions are attached in JSON data format. After further exploring the potential of UTXO, new asset protocols such as BRC-20 were created, which promoted the development of applications such as inscriptions and runes. Since the emergence of BRC-20, transactions on the Bitcoin chain have accounted for a certain proportion, which indicates the development potential of the unique Bitcoin Layer2 ecology.

3. What kind of ecological applications should UTXO produce?

3.1. The Ordinals protocol gave birth to the inscription and rune ecology

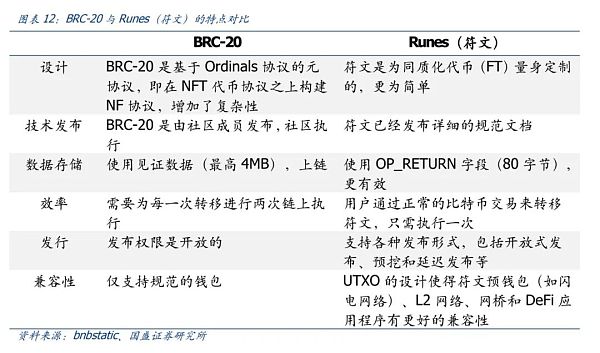

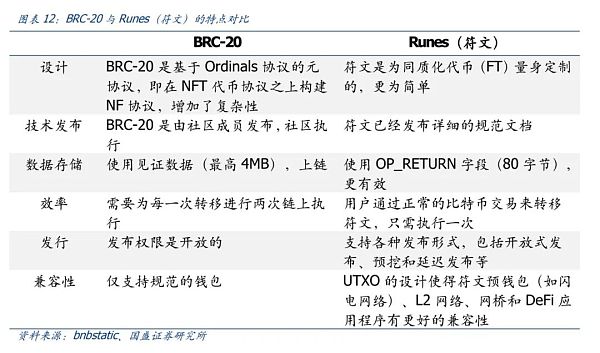

BRC-20 originated from a community experiment and was an attempt at the Bitcoin ecology. On March 9, 2023, Twitter user domodata published the BRC-20 standard on gitbook, which he called an "interesting and experimental standard". It is based on the Ordinals protocol and can set the inscription in JSON data format to deploy, mint and transfer tokens. In short, damodata believes that the Ordinals protocol can not only be used to issue NFTs, but also can be used to issue tokens when the inscription is attached in JSON data format. Therefore, the BRC-20 token can be understood as a variant of the Ordinals NFT. The inscription on the NFT is a picture, but the inscription on the BRC-20 is a unified JSON format text data. BRC-20 mainly provides three standards for the issuance of homogeneous tokens on the Bitcoin network, including the deployment (deploy), minting (Mint) and transfer (Transfer) of the BRC-20 token. Developers can complete the creation and issuance of the BRC-20 token by following this standard. In the gitbook homepage, domodata also gave examples of deployment, minting and transfer.

The BRC-20 standard has promoted the rapid development of inscriptions. After all, the potential of Bitcoin blocks and UTXO is rarely explored in depth. This is an interesting experiment based on Bitcoin UTXO, which has been sought after by the community and users.

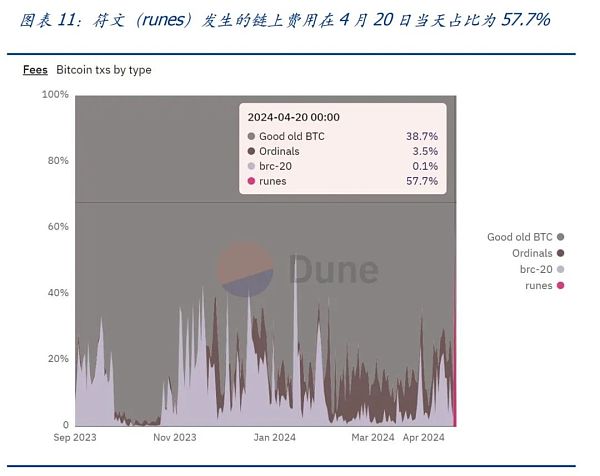

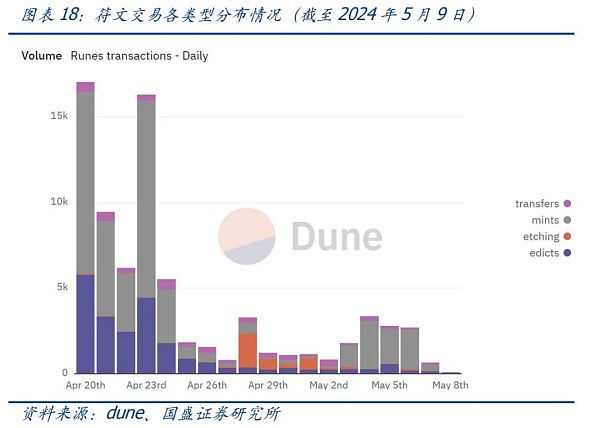

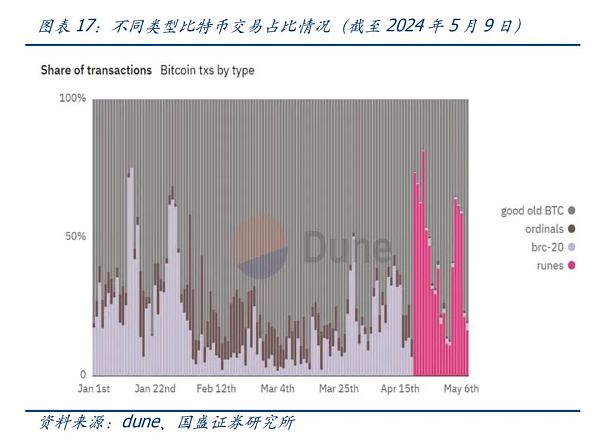

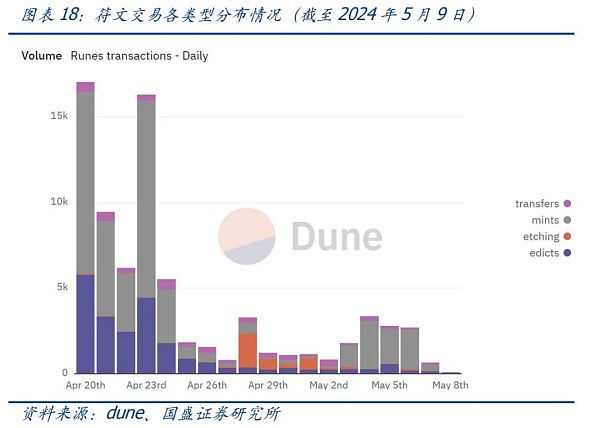

Inscriptions based on BRC-20 are an exploration of the potential of Bitcoin UTXO, focusing on NFT assets. Naturally, the asset protocol of homogeneous tokens (FT) will also become a new direction. At 8:09 on April 20, 2024, BTC successfully completed the fourth halving at block height 840000, and the mining reward of each block of the Bitcoin network was halved from 6.25 BTC to 3.125 BTC. At the same time, Bitcoin Runes was officially launched at the 840,000 block height. Runes are an improvement on inscriptions, which allows assets to be deployed directly in Bitcoin UTXO more flexibly, that is, homogeneous tokens are issued based on UTXO on the Bitcoin network. Figuratively speaking, it is similar to an etching technology, just like the Chinese word "Runes". The token assets deployed by the Runes protocol intuitively record information on the Bitcoin chain: that is, they are written into the OP-RETURN field of Bitcoin UTXO (unspent output).

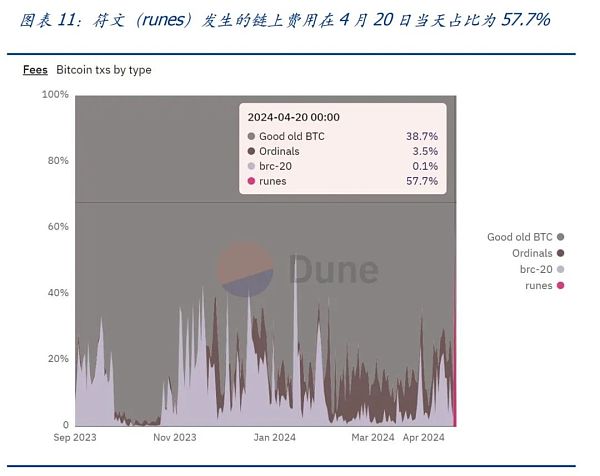

The launch of Runes has led to a rapid increase in Bitcoin chain fees. Since its launch at 8:09 on April 20, the proportion of Bitcoin chain fees generated by Runes activities on that day has been 57.7%, while the Bitcoin chain fees were mainly traditional Bitcoin transfers before. For the 840,000 block, the fees generated were 37.626BTC, which is 10 times more than the mining incentive (3.125BTC)! It is highly sought after by the market.

Rune has obviously gone a step further, with significant improvements in design, issuance and compatibility, and has made sufficient preparations for compatibility with homogeneous tokens, docking bridges, and DeFi applications.

3.2 Evolution of UTXO: Nervos (CKB) Cell Model

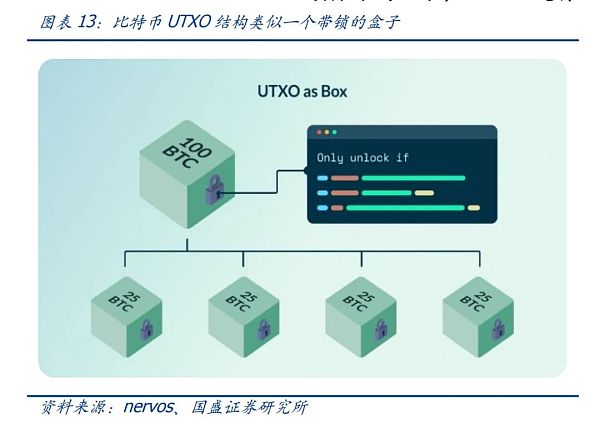

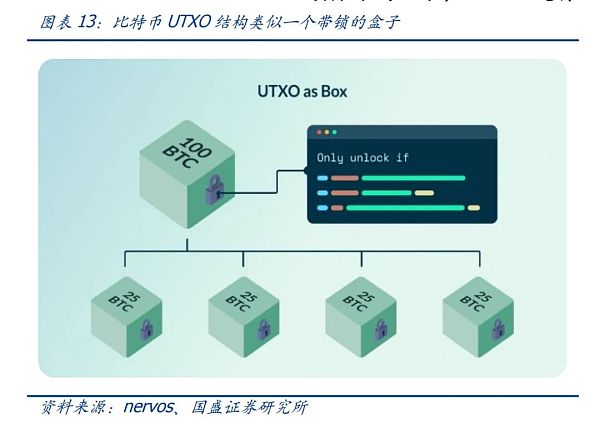

Bitcoin does not have the account balance model we are familiar with, but uses UTXO (Unspent Transaction Output) to express the transaction flow of Bitcoin. For example, when a user receives 100 BTC from someone else, a 100 BTC UTXO is formed, which is equivalent to treating the 100 BTC as a box and adding a lock that can only be unlocked by the user's private key. In fact, the 100 BTC may be composed of several other locked UTXO boxes (for example, 4 25 BTC UTXO boxes, or other combinations), that is, the result of each operation forms an unspent output (UTXO); rather than just updating the (digital) state of the balance like the account balance model. But at the same time, Bitcoin UTXO can only store the value of the Bitcoin it "contains", and cannot store more data, nor does it have more scalability.

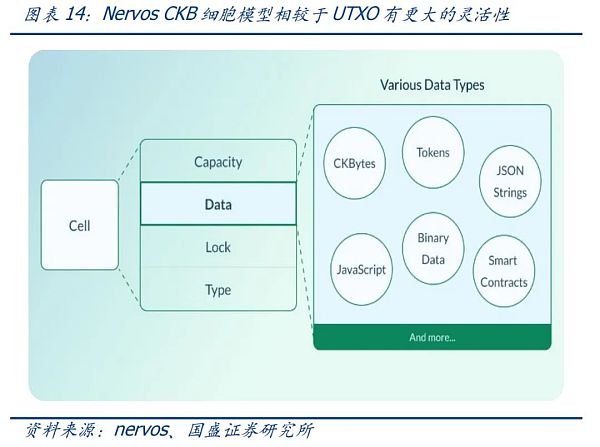

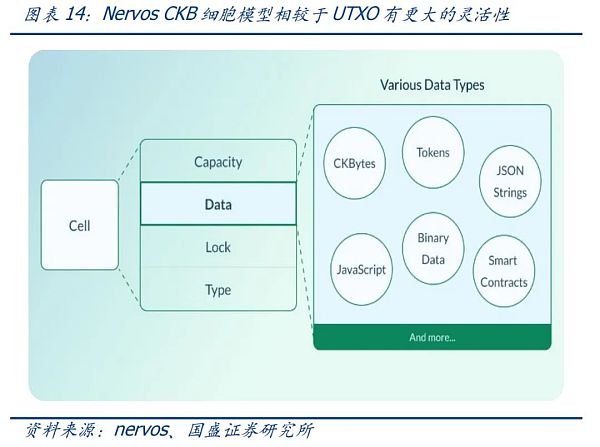

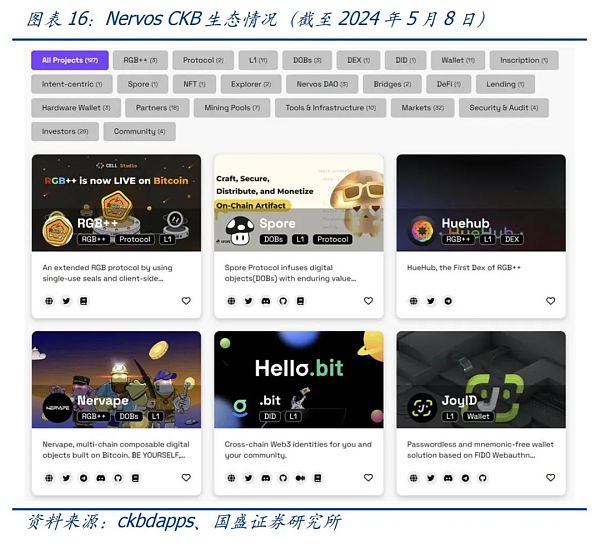

Nervos CKB inherits the architecture of Bitcoin UTXO and creates the Cell Model, which is a universal UTXO model as a state storage, maintaining the simplicity and consistency of UTXO. In CKB, all states are stored in Cell, calculations are completed off-chain, and transactions are verified and uploaded to the chain by nodes. Cell represents the basic data storage unit in Nervos. Unlike Bitcoin UTXO, it can contain various data types, such as serialized data such as CKByte, Token, JavaScript code, or JSON string. This richer data type broadens the capabilities of Cell and expands UTXO - such as implementing smart contracts (even customized smart contracts, such as issuing NFT tokens, limiting the supply of tokens, and formulating usage conditions that meet unique needs).

Also inspired by the Bitcoin UTXO model, the Cell model defines the behavior of each Cell in Nervos CKB and the process of updating the data it contains. Like Bitcoin UTXO, Cell is immutable once formed: once Cells are added to the chain, no changes can be made. Updating the data in a Cell requires a process called "spending" - this is similar to Bitcoin UTXO transfers to achieve "spending". And create a new Cell with the updated data and then add it to the chain - this is similar to the formation of a new Bitcoin UTXO (output for spending). Similarly, each Cell can only be spent once.

In short, we can simply understand that Cell is like a smarter UTXO. Bitcoin UTXO is a box with a paper ledger, and Cell replaces the ledger in the box with an Excel electronic document.

It should be noted that the Cell model separates the calculation and verification of smart contract execution. The calculation occurs off-chain, generating new data, and the updated data is verified on-chain by network nodes. In the cell model, the execution of smart contracts is parallel, that is, each transaction runs independently in its own virtual machine, and multiple virtual machines run simultaneously. Transactions in the cell model are highly flexible and efficient, and multiple smart contract operations can be batched into a single transaction, thereby minimizing transaction and processing fees.

The above-mentioned mode of off-chain calculation and consensus result on-chain is relatively popular. For example, RGB is a popular protocol in the BTC extension protocol, which is to calculate off-chain and submit the results of consensus transactions to the Bitcoin chain. This protocol is essentially similar to the Lightning Network. On this basis, the RGB++ protocol was born, which uses one-time seals and client verification technology to manage state changes and transaction verification. It maps Bitcoin UTXO isomorphic bindings to the Cell of Nervos CKB, and uses script constraints on the CKB chain and the Bitcoin chain to verify the correctness of state calculations and the validity of ownership changes. The advantage of this is that the characteristics of UTXO can be seamlessly connected between Bitcoin and Nervos CKB. RGB++ not only implements enhanced client verification, transaction merging, shared status, etc., but also brings Turing-complete contract extension and performance extension to Bitcoin without cross-chain and security loss.

3.3. Can special UTXO create a special Bitcoin ecosystem?

For a while, there seemed to be a difference between Bitcoin UTXO and Ethereum's ERC20, like classic and modern. UTXO is the root of Bitcoin's security and reliability (anti-double spending, traceability, etc.), but also limits the ecological development of Bitcoin due to scalability issues. It cannot yet achieve the rich ecological scenarios of Ethereum DeFi, NFT and Metaverse.

But if we think about it the other way around, will the uniqueness of UTXO also give birth to a different ecological world? The deep mining of Bitcoin UTXO by inscriptions and runes makes it possible to deploy assets based on UTXO, and the upgrade of UTXO by Nervos CKB further liberates computing power. These indicate the different application potential of UTXO, which seems to be more interesting and has become a new expectation of the industry.

Looking at the development of Ethereum, from the ERC20 standard that gave birth to ICO, to the development of AMM that provided the driving force for DeFi, to the emergence of NFT and the metaverse, its ecological paradigm has gradually become fuller. But this process is not achieved overnight, and there are many twists and turns in the middle.

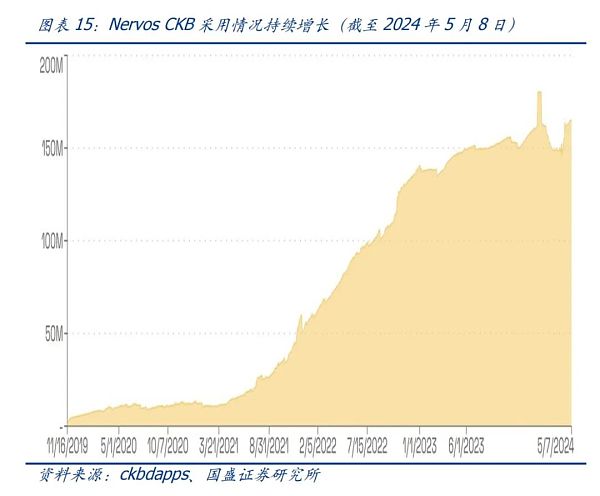

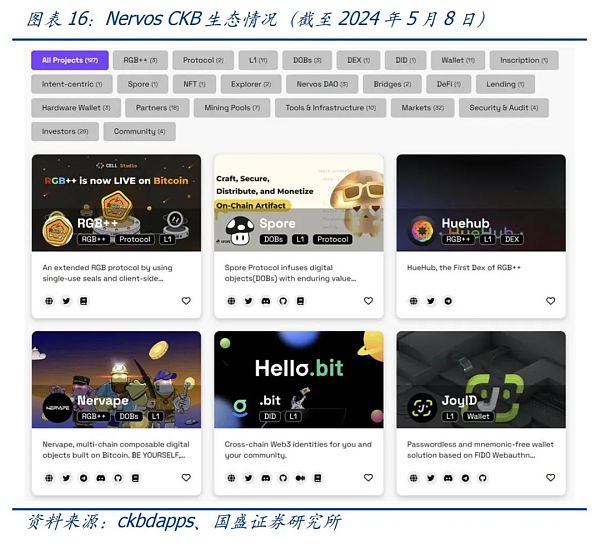

Bitcoin's recent innovations have gained a certain market popularity from the beginning, which is a good phenomenon, indicating that the market has great expectations and confidence in the potential of UTXO. But the heat comes quickly and cools down quickly. After the runes appear, the heat of the inscriptions naturally decreases. At present, both inscriptions and runes are still in the stage of scrambling for "minting" (mints). Minting is just the beginning, and how to develop applications and enrich the ecology later is more important. The situation of Nervos CKB is similar. The current ecological application can be said to be a simple "copy" of the Ethereum ecology.

We believe that the characteristics of UTXO have the potential to inspire different ecological paradigms, and we look forward to the early emergence of such a "stunning" paradigm.

JinseFinance

JinseFinance